The Pimpri-Chinchwad Municipal Corporation (PCMC) is counted as one of the richest civic bodies, owing to a large number of multinational manufacturing units that are functional in the area. The area has also gained prominence as a real estate neighborhood, as the workforce employed in these manufacturing units started buying houses in the region.

PCMC Property Tax 2024

Owing to the development and convenience, a number of housing societies and townships came up in the area, for which the infrastructure is provided by the PCMC. Property owners need to pay half-yearly PCMC Property Tax to the corporation, which can be easily done online. The PCMC was one of the first civic bodies to collect PCMC Property Tax digitally.

Properties exempted from PCMC Property Tax 2024

There are a few types of properties, which are exempted from property tax. This includes space used for religious worship, public burials or cremation and heritage land. Apart from this, any building that is used for charitable, educational, or agricultural purposes, is also exempted from property tax. In addition to this, the PCMC has also exempted residential structures of less than 500 sq ft from property taxes. This move benefits over 1.5 lakh households in the region.

How to calculate PCMC Property Tax 2024?

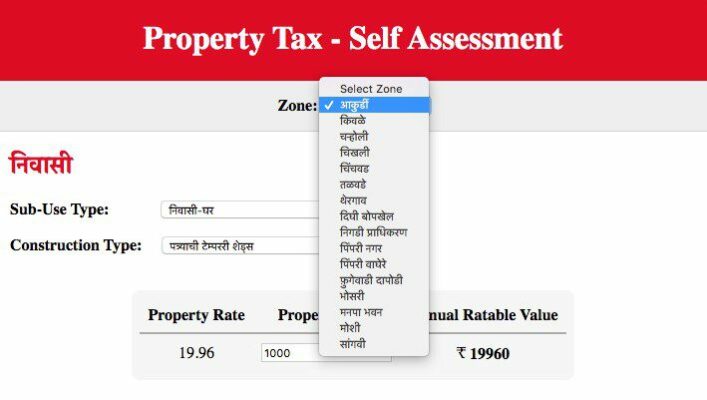

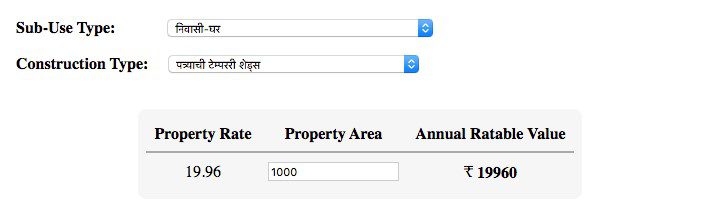

It is easy to self-assess the PCMC property tax online amount for your property in the PCMC area, through a calculator available on the PCMC’s official site. Here is a step-by-step procedure, to calculate your PCMC tax:

Step 1: Visit the PCMC Property Tax-Self Assessment Portal.

Step 2: Choose the zone and scroll down if you want to calculate property tax as a resident or NRI or for commercial property.

Step 3: Select the sub-use type, construction type and type in the property area.

Step 4: Your property tax amount will be calculated.

See also: All about BBMP property tax calculator

What is property id?

Property id is a unique 10 digit number attached to your PCMC property. By feeding this number, all details regarding your property can be accessed.

How to view PCMC Property Tax bill 2024?

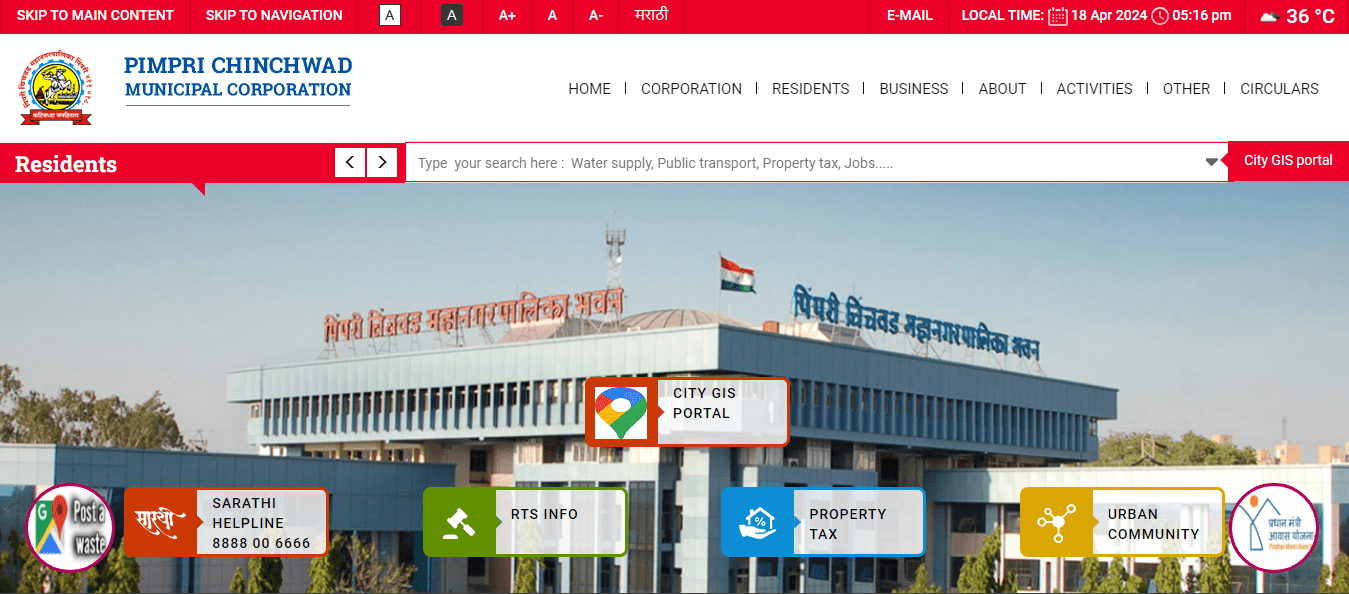

For PCMC Property Tax bill view, visit the PCMC India portal and click on ‘Resident’, from the top menu.

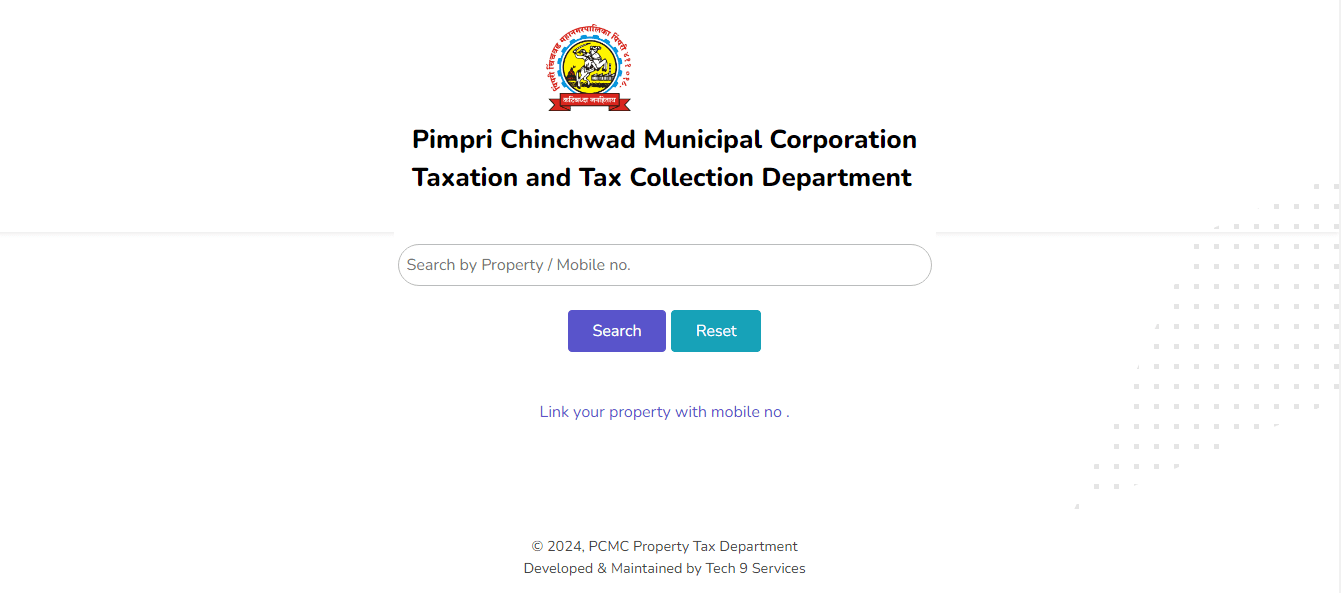

Select ‘Property Tax’ option. You will reach https://publicptax.pcmcindia.gov.in/index.php

- Enter property id number or mobile number and click on search

- You will have to enter property details by entering the zone number, Gat number and owner’s name.

- Click on ‘Show’ option, to view your PCMC property tax bill.

- Search for ‘Total Amount to Pay (Amount with Concession-Fajil Amount)’ in the property tax PCMC bill. This is the amount you have to make as PCMC Property Tax payment, for the April-September and October to March period. You can also download the PCMC Property Tax bill.

How to make PCMC Property Tax 2024 online bill payment?

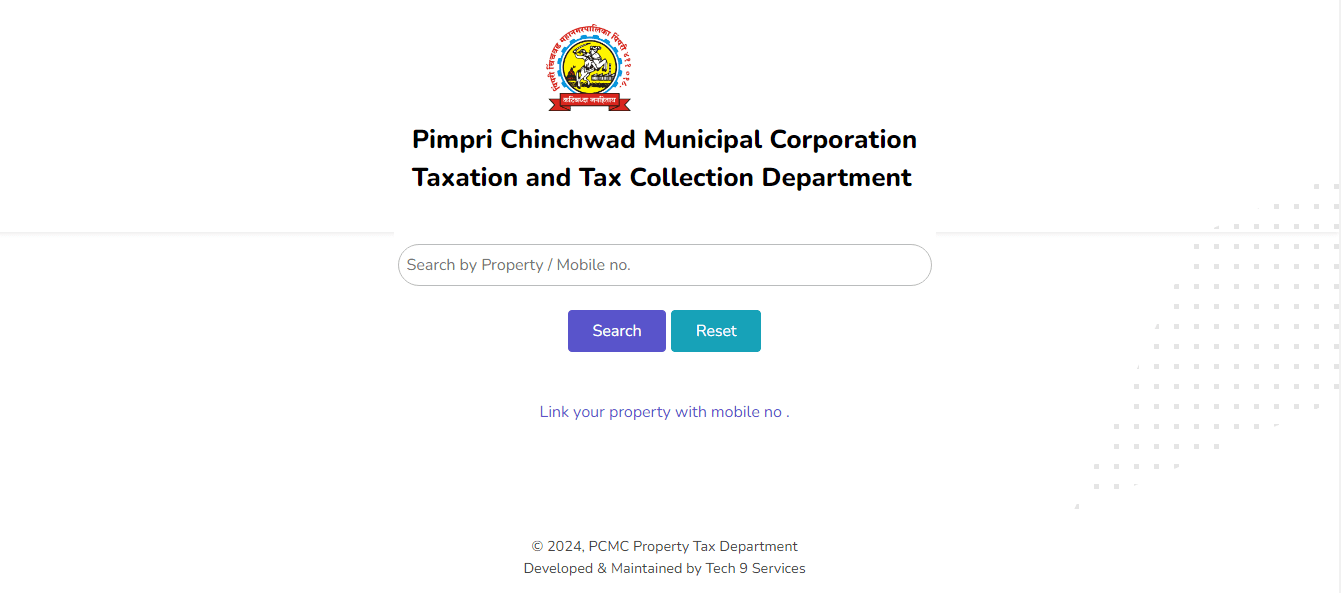

- Visit http://propertytax.pcmcindia.gov.in:8080/pcmc/ . Click on Click here to pay property bill online.

- You will reach the following page. Enter property number or mobile number and click on search.

Once you view your bill, move on to pay the amount using any of the online payment option.

See also: How to use property tax calculator Chennai

See also: Everything about BMC property tax

How to pay PCMC Property Tax 2024 online using Paytm?

Follow these steps, to pay the PCMC property tax bill online via Paytm:

- Select the corporation.

- Fill in the required details such as property ID, name, address, email ID, phone number, etc.

- Click on ‘Get Tax Amount’.

- After checking the payable tax amount, select your preferred mode of transaction – i.e., debit card, credit card, net banking or UPI (UPI is only available with Paytm app).

- Proceed with the payment and you are done with it.

What to do if PCMC Property Tax receipt is not generated?

In case the receipt is not generated on the PCMC website due to some technical problem while making PCMC property tax online payment, check your bank account and pay accordingly.

If money is deducted from your bank account and your property tax receipt is not visible, it will take three working days for the PCMC receipt to be available on the PCMC property tax website.

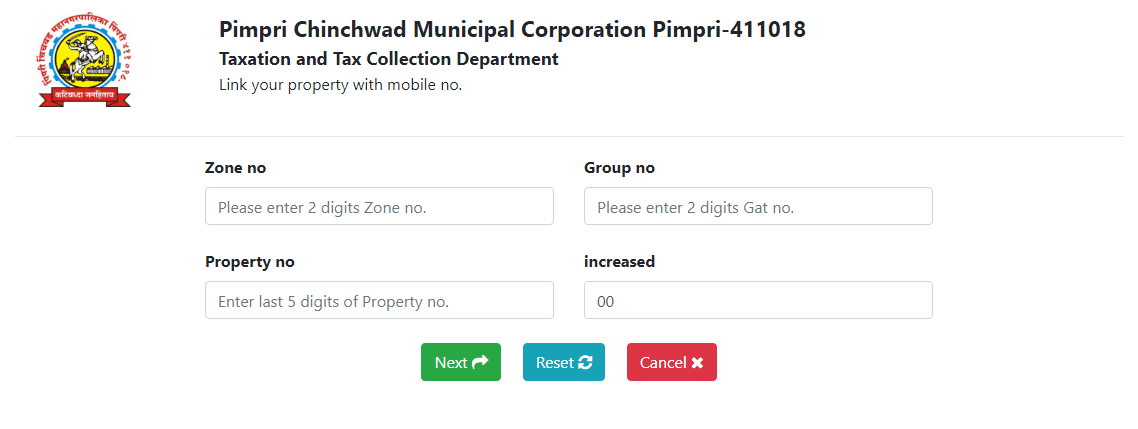

How to link property with mobile number?

On https://publicptax.pcmcindia.gov.in/index.php , click on link your property with mobile number. Enter Zone no, Property No, Group no, increased and click on next and proceed.

See also: All about house tax Delhi

When is the last date to make the PCMC Property Tax 2024 payment?

The PCMC Property Tax can be made in two instalments. The first one for the period (April to September) has to be paid by May 31 and the second one ( October to March) has to be paid by December 31.

Rebate on PCMC Property Tax 2024

If the entire property tax is paid by May 31, the following rebates are available:

| Condition | Rebate |

| For residential properties/ non-residential/open plot specifically registered as residential building | 10% discount on general tax, if the annual rateable value is up to Rs 25,000 or

5% discount, if the annual rateable value is more than Rs 25,000 |

| Residential properties with solar, vermiculture and rain-water harvesting | 5%-10% discount, depending upon the number of projects installed. |

See also: KMC property tax online payment Kolkata

PCMC Property Tax 2024: Illegal construction penalty waiver certificate

Click on Illegal construction penalty waiver certificate on https://publicptax.pcmcindia.gov.in/. You will reach http://103.224.247.135:8081/PropertyTaxService/?wicket:bookmarkablePage=:com.pcmc.propertytax.ptaxservices.IllegalShastiNOCLogin

Enter mobile no., email and click on next and proceed.

See also: All about GVMC property tax

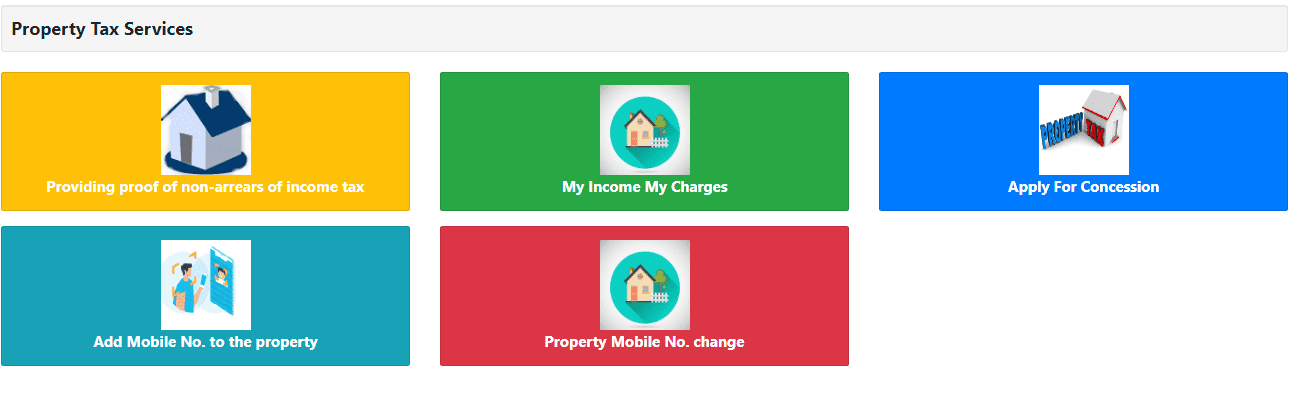

PCMC Property tax 2024: Other services

Property tax services such as providing proof of non-arrears of income tax, My income My charges, Apply for concession, add mobile number to the property and property mobile number change can be used by clicking on the service.

How to change the name in PCMC Property Tax records?

The process of getting your name changed in the official PCMC property tax record is simple and can be done by the applicant if all the necessary documents are in place. Keep these documents handy:

- Latest property tax receipt.

- Attested copy of the sale deed, which should be in the name of the applicant.

- No-objection Certificate from the housing society.

- Application form, which is available from the property tax office

Fill the application form and submit it with above documents to the Commissioner of Revenue at the PCMC office. The application will be verified and the records will be changed in 15-20 working days.

See also: All about GVMC water tax

How to pay PCMC Property Tax offline?

- You can make the PCMC Property Tax payment offline by visiting the local ward office that is near the property.

- Fill the application form and attach supporting documents.

- Pay the bill and get the acknowledgement.

How to register complaint on about PCMC Property Tax?

All citizens can register their complaints related to the Pimpri-Chinchwad Municipal Corporation on the Suvidha platform. Users need to register themselves, to launch a complaint on the platform. The portal can also be used for tracking the status of complaints. All issues related to property tax, water tax, building plan approval, civil works and public establishment systems can be filed on the Suvidha platform.

See also: All you need to know about PCMC Sarathi

How to find Gat/Ward number in PCMC?

Tax payers can find the Gat/Ward number using following table:

| Ward number | Areas |

| 10 | Sant Dnyaneshwar Nagar (MHADA), Morwadi, Laltopi Nagar, Amruteshwar Colony, Indira Nagar, Saraswati University School Campus, Ambedkar Nagar, HDFC Colony, Datt Nagar, Vidya Nagar, Shahu Nagar, Vrindavan Society, Sambhaji Nagar etc. |

| 14 | Chinchwad Station, Mahavir Park, Mohan Nagar, Ram Nagar, Kalbhor Nagar, Aishwaryam Society, Shubhshri Society, Jai Ganesh Vision, Vivek Nagar, Vitthalwadi, Bajaj Auto, Dattawadi, Tuljai Vasti etc. |

| 15 | Aakurdi Gaothan, Ganga Nagar, Vahtuk Nagari, Sector No. 24, 25, 26, 27, 27 A, 28, Sindhu Nagar, Parmar Park, Swapnapurti Society, Central Colony, LIC, Excise, etc. |

| 19 | Vijay Nagar, New SKF Colony, Udyog Nagar, Queen’s Town, Sudarsha Nagar, Sridhara Nagar, Anand Nagar, Bhoir Colony, Gawade Park, Empire Estate, Wisdom Park, Dr. Babasaheb Ambedkar Colony Part, Bhim Nagar, Niradhar Nagar, Emperor Ashok Nagar, Mata Ramabai Ambedkar Nagar, Buddha Nagar, Valmiki Nagar, Sanitary Chal, Bhat Nagar, Bhaji Mandai, Pimpri Camp etc. |

| 16 | Walhekarwadi part, Gurudwara, Nano Home Society, Shinde Vasti, Royal Casa Society, Sector No. 29, Ravet, Nandgiri Society, Vikas Nagar, Crystal City, Mammurdi, Kivale etc. |

| 17 | Dalwi Nagar, Premlok Park, Bhoir Nagar, Giriraj Society, Rail Vihar Society, Shiva Nagari, Nagsen Nagar, Aher Nagar, Valhekarwadi Gaothan, Chinchwade Nagar, Balwant Nagar, Bijli Nagar etc. |

| 18 | S.K.F. Colony, Ruston colony, Pawana Nagar, Vetal Nagar, Chinchwad Gaothan, Keshav Nagar, Tanaji Nagar, Kakade Park, Moraya Raj Park, Darshan Hall, Manik Colony, Lakshmi Nagar, Yashopuram Society etc. |

| 22 | Kalewadi, Vijay Nagar, Nirmal Nagar, Adarsh Nagar, Pawana Nagar, Jyotiba Nagar part, Nadhe Nagar etc. |

| Ward Number | Areas |

| 2 | Chikhali gaothan part, river residency, crystal city, swaraj residency, Gandharva excellence, bankar Vasti, borhadewadi, woods villa, jadhavwadi, raje shivaji Nagar, kudalwadi part etc. |

| 6 | Dhavde Vasti, Bhagat Vasti, Gulve Vasti, Chakrapani vasahat part, Pandav Nagar, Roshal garden premises, Sadguru Nagar etc. |

| 8 | Jai Ganesh Empire, Jalvayu Vihar, Central Vihar, Maharashtra Colony, Indrayani Nagar, Khande Vasti, Gavali Matha, Balajiniguri etc. |

| 9 | Tata Motors, Yashwant Nagar, Vitthal Nagar, Udyam Nagar, Swapna Nagari, Antariksha Society, Ajmera Society, Vastu Udyog, Masulkar Colony, Mahindra Royal, Kharalwadi, Gandhi Nagar, Nehru Nagar etc. |

| 25 | Malwadi, Punawale, Pandhare Vasti, Kate Vasti, Navale Vasti, Tathawade, Ashoka Nagar, Nimbalkar Nagar, Bhumakar Vasti, Wakad Kala-Khadak, Munjoba Nagar, ManeVasti, Bhujbal Vasti, Wakadkar Vasti, Kemse Vasti, Rohan Tarang Society, Pristine Society, Swara Pride Residency etc. . |

| 26 | Pimpale Nilakh, Vishal Nagar, Parkstreet, KaspateVasti, Anmol Residency, Dhanraj Park, Dattamandir, Annabhau Sathe Nagar, Venu Nagar Part, Rakshak Society, Bharat Electronics etc. |

| 28 | Five garden, Shivar Garden, Planet Millennium, Kapse Lawns, Ram Nagar, Pimple Saudagar, Kunal Icon, Rose Land, Govind Garden etc. |

| 29 | Kalpataru Estate, Kranti Nagar, Kashid Park, Gagangiri Park, Jawalkar Nagar, Shivneri Colony, Gulmohar Colony, Onkar Colony, Gokul Nagari, Bhalekar Nagar, Pimple Gurav, Sudarshan Nagar, VaiduVasti etc. |

| 3 | Moshi Gaothan, Gandharva Nagari, Sant Dnyaneshwar Nagar Part, Sai Temple, Gokhle mala, Alankapuram Society, Vadmukhwadi, Kaljewadi, Tajnemala, Chovisawadi, Charholi, Dudulgaon etc. |

| 4 | Part-1 Dighi, Gajanan Maharaj Nagar, Bharatmata Nagar, Gaikwad Nagar, Bhandari Skyline, Samarth Nagar, Krishna Nagar Part II V.S.N.L. Ganesh Nagar, Ram Nagar, Bopkhel Gaothan etc. |

| 5 | Ram Nagar, Sant Tukaram Nagar, Gurudatta Colony, Gangotri Park, Sawant Nagar, Mahadev Nagar, Gawli Nagar, Shriram Colony, Sant Dnyaneshwar Nagar, Chakrapani Vasahat Part etc. |

| 7 | Shitalbagh, Century Enka Colony, Suvidha Park, Apte Colony, Sandvik Colony, Khandoba Mal, Gawhane Vasti, Bhosari Gaothan, Landewadi, Shanti Nagar etc. |

| 1 | Chikhli Gaothan Bhag, Patil Nagar, Ganesh Nagar, More Vasti Area, Sonwavne Vasti, etc. |

| 11 | Nevale Vasti, Hargude Vasti, Kudalwadi Part, Krishna Nagar, Sharad Nagar, Koyana Nagar, Mahatma Phule Nagar, Purna Nagar, Gharkul Project, Ajantha Nagar, Durga Nagar etc. |

| 12 | Talwade Gaothan, MIDC, IT Park, Jyotiba Temple, Sahyog Nagar, Rupi Nagar, Triveni Nagar, Mhetre Vasti Part, Tamhane Vasti Part etc. |

| 13 | Nigdi Gaothan, Sector 22- Ota-skim, Yamuna Nagar, Mata Amritanandamayi Math Campus, Srikrishna Temple Area, Sainath Nagar etc. |

| 21 | Milind Nagar, Subhash Nagar, Gautam Nagar, Adarash Nagar, Indira Nagar, Shastri Nagar, Baldev Nagar, Ganesh Nagar, Jijamata Hospital, Sanjay Gandhi Nagar, Vaibhav Nagar, Ashok Theater, Vaishno Devi Temple, Masulkar Park, Pimprigaon, Tapovan Temple, Balmal Chal, Kailas Nagar, Dnyaneshwar Nagar, Dr. Babasaheb Ambedkar Colony part etc. |

| 23 | Prasun Dham, Ganga Ashiyana, Kunal Residency, Swiss County,Thergaon Gavthan, Padwalnagar part, Ashoka Socitey, Sainath nagar, Samarth colony etc. |

| 24 | Prasundhham, Ganga Ashiana, Kunal Residency, Swiss County, Thergaon Gaothan, Padwal Nagar Part, Asoka Society, Sainath Nagar, Samarth Colony etc. |

| 27 | Tapkir Nagar, Shri Nagar, Shivtirth Nagar, Baliram Garden, Rahatini Gaothan, Tambe Shala Area, Sinhagad Colony, Raigad Colony, Laxmibai Tapakir School, SNPP School, Royal Orange County, Galaxy Society etc |

| 20 | Vishal Theater Area, H.A. Colony, Mahesh Nagar, Sant Tukaram Nagar, Mahatma Phule Nagar, Vallabh Nagar, Landewadi slum, CIRT, Parshvnath Society, Kasarwadi part, Agrasen Nagar, Kundan Nagar part etc. |

| 30 | Shankarwadi Part, Sarita Sangam Society, Shastri Nagar, Keshv Nagar, Kasarwadi part, Kundan Nagar part, Phugewadi, Sanjay Nagar, Dapodi, Siddharth Nagar, Ganesh Nagar, Sunderbagh Colony, ST Workshop etc. |

| 31 | Part-1 Rajiv Gandhi Nagar, Gajanan Maharaj Nagar, Kirti Nagar, Vinayak Nagar, Ganesh Nagar, Kavde Nagar, Gagarde Nagar part, Vidya Nagar part Part II Uro Hospital, etc. |

| 32 | Sangavi Gaothan, Madhuban Society, Dhore Nagar, Jaymala Nagar, Sangam Nagar, PWD Colony, ST Colony, Krishna Nagar, Sairaj Residency, Shivdatt Nagar, etc. |

Know about: Room rent in Indore

PCMC Property Tax: Contact details

While the PCMC property tax payment process is simple and user-friendly, the payee can reach out to the civic body, in case of problems.

PCMC Sarathi Helpline Number: 8888 00 6666

PCMC Sarathi website: Portal Link

Housing.com POV

Property tax is one of the most important revenues for the local municipal body. The PCMC has put in place a very easy and efficient system to make the PCMC Property Tax payment. It is always recommended for property owners to pay the property tax bill before the deadline. This way, they may be able to avail of the rebate (if any) offered by the municipal body. Failure to pay the property tax on time will unnecessarily lead to complexities such penalty for the time period that the property tax has not been paid for. Ignoring payment of the property tax PCMC for a long time will lead to problems such as attachment of property and eventually its auction.

FAQs

How do I fill my PCMC property tax online?

Visit the PCMC website and follow the above given procedure, to pay your property tax.

How to check PCMC property tax bill online?

You can view the property tax bill on the PCMC property tax website.

Is Ravet under PCMC?

Yes, Ravet falls under the PCMC's jurisdiction.

What is meant by PCMC?

PCMC stands for Pimpri-Chinchwad Municipal Corporation.

Is property tax applicable to vacant land?

Property tax is applicable on all kinds of properties, including the vacant land.

In case of joint ownership who is responsible to pay property tax?

All owners of a property are responsible for paying property tax.

How do I find my PCMC property tax?

Go on https://www.pcmcindia.gov.in/ to find the exact property tax that you have to pay for the property that you own in the PCMC jurisdiction.

How do I change my name on my property tax in PCMC?

You can change the name by submitting the following documents along with the filled application form-Paid e-receipt of the latest property tax, copy of sales deed in the applicant’s name that is duly attested by the official department, NOC from the housing society .

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]