State governments in India fix a rate, below which properties cannot be registered in a particular location at the time of title transfer. This rate is known by various names, including guideline value, circle rate, ready reckoner rate, etc. In Tamil Nadu, the usage of guideline value (GV) is more common. The TNREGINET portal allows you to check the guideline value. It is the official portal of the Tamil Nadu Registration Department.

Prospective buyers must know all about the GV before they make up their mind to buy a property in Tamil Nadu. To help such buyers, we provide a step-by-step process on how to find the guideline value for a property in Tamil Nadu, based on which the stamp duty on property transactions is calculated.

Guideline value definition

Guideline value is the minimum value of a property, as fixed by the state government, at which property can be registered. If the sale of a property takes place at a value higher than the guideline value, the registration will be based on the higher value. However, if you buy a property below the guideline value, you will be required to pay stamp duty and registration charges based on this minimum value.

How to find Tamil Nadu guideline value on TNREGINET?

So far, the guideline value/ guidance value for 2.19 lakh streets and 4.46 billion field numbers / subdivision numbers is available on the department’s website.

Also read all about IGRS market value in Andhra Pradesh (AP)

- Go to the the Registration Department’s TNREGINET portal at https://tnreginet.gov.in/portal/

- The content is available in both Tamil and English. You can change the language as per your preference.

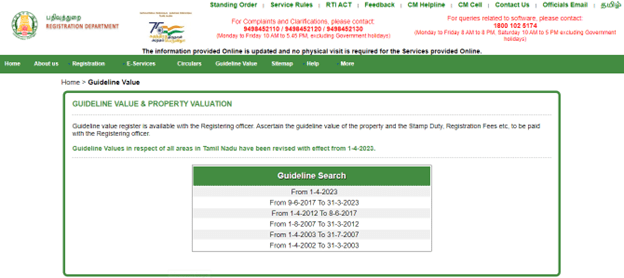

- Click on Guideline Value option from the menu bar.

- On the next page, click on the ‘From 01-04-2023’ link to search for the latest TNREGINET guideline value 2023.

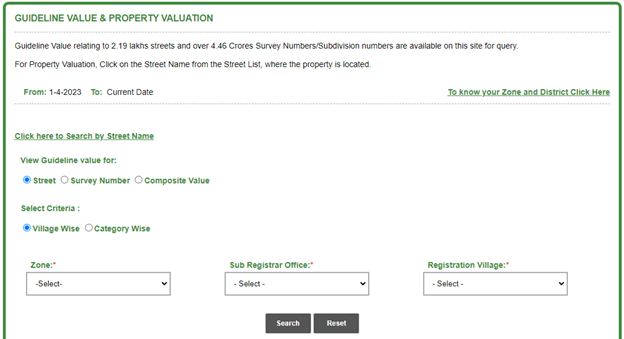

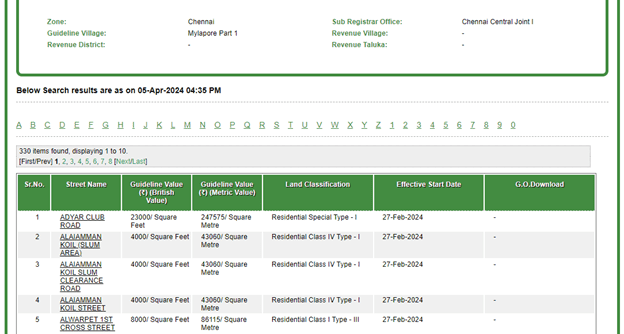

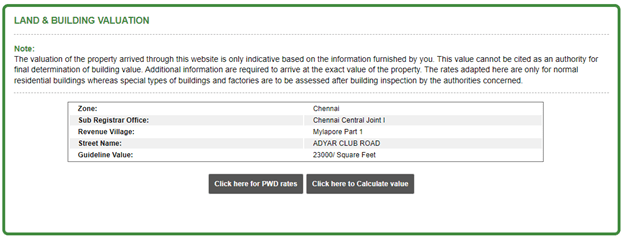

- Users have the option to search for guideline value by street name, survey number or composite value.

Guideline value by street name

- Users can search for guideline value by street name through two options – village wise and category wise.

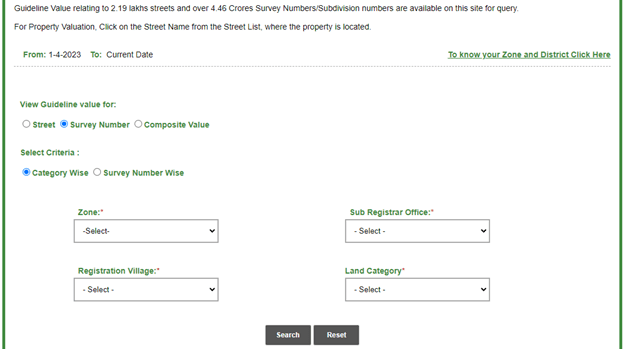

Guideline value by survey number

Users can search for guideline value by survey number through two options – category wise and survey number wise.

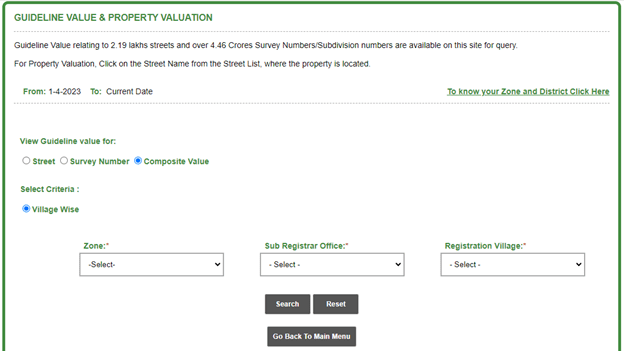

Guideline value by composite value

Users can search for guideline value by composite value village wise option only.

- Provide details such as Zone, Sub-registrar office, registration village, etc.

- Click on Search button to view the guideline value.

- The guideline values for different areas will appear, click on the link to view the details.

- Click on the link to calculate the value of stamp duty based on the document.

See also: All about guideline value in Coimbatore

Guideline value: Why is it important?

- It helps you to estimate and calculate the overall pros and cons of a house purchase decision.

- It plays an important role, when it comes to the payment of stamp duty and registration charges and is a source of revenue. At the same time, it helps both, the authorities and buyers, to understand and detect undervaluation of properties.

- It keeps fraud in check. Those who try to avoid paying the registration charges can be tracked and therefore, this gets rid of corruption and scams with regard to land-related deals, to an extent.

- It is also a good index that helps buyers understand land value as to price their properties competitively.

Know about: Apartments for rent in chennai

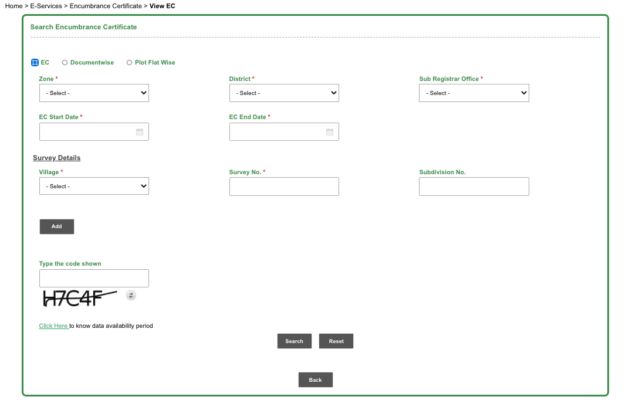

TNREGINET Guideline value: How to view encumbrance certificate?

On the official TNREGINET website, click on the ‘E-Services’ tab and go to ‘View EC’. Input the details, either document-wise or plot/flat-wise and add details of the zone, district, EC start date, its end date, survey details, verification code and then click on submit, to view the encumbrance certificate.

Tamil Nadu registration department hikes fees

Recently, the Tamil Nadu government has revised the registration charges and stamp duty of 20 services provided by the department under Section 78 of the Registration Act 1908, which has come into effect from July 10, 2023. The charges for the transfer of power of attorney to non-family members have been increased by 1% of the property’s market value. The revision comes after a gap of 20 years.

Further, the registration department has also increased the charges for the receipt document for mortgage from Rs 20 to Rs 200. The registration charges for partition, family settlement and release of documents from Rs 4,000 to Rs 10,000. The stamp duty for the same has increased from Rs 25,000 to Rs 40,000. The fee for individual plot registration has been increased from Rs 200 to Rs 1,000.

See also: How to obtain Patta Chitta online in Tamil Nadu

How is property guidance value calculated?

To arrive at the value of property based on the Guideline Value, which is the minimum value of a property in Tamil Nadu at which a property can be registered, the following formula applies:

Property Value = Guideline value (in Rs per sq metre) X Built-up area in sqm

The guideline value can be determined based on the property location and type. The market value of a property is calculated by taking its built-up area and Guideline value into consideration.

For example, property area = 800 sqm

Guideline value = Rs 10,000 per sqm

The property value = 10,000 X 800 = Rs 80 lakh

Impact of difference between property guideline value and market values

Guideline value is the estimated market value of a property as per the government records. In an ideal scenario, it should be the same as the property’s true value in the market. However, guideline values are lower than the market value in most cases. There are some exceptional cases where one may find the guideline value to be more than market value.

There are several land valuation systems to arrive at the true value of land. Nowadays, one can easily estimate the value of a property or land using property value calculator online.

So, it becomes necessary to understand the effects of the difference between property guideline value and market values.

Know about: Tirunelveli (Tamil Nadu)

Encourages black money transactions in the industry

In cases where the property guideline value is lower than the property’s market value, the possibility of black money dealings increases. In such cases buyers and sellers agree to a deal where the guideline value is specified on the sale document and the remaining payment is done in cash.

A lower guideline value compared to the property market value will imply revenue loss for the state government.

Check out properties for sale in Chennai

Income tax implications

If the sale of a property done at a value less than the guideline value, in such case the seller and buyer would incur a loss. This impact is due to the provision of Section 56 (2) (vii) (b) under the Income Tax Act. If the guideline value is higher than the purchase consideration by over Rs 50,000, the difference amount is considered as ‘income from other sources’ under the act. This provision applies in case the assessee obtains the property as Capital Asset and not as stock in trade.

Know about: Hosur

Property registration fees in Tamil Nadu

| Document type | Stamp duty in Tamilnadu | Registration charges in Tamilnadu |

| Conveyance (Sale) | 7% of the market value of the property | 4% of the market value of the property |

| Gift | 7% of the market value of the property | 4% of the market value of the property |

| Exchange | 7% of the market value on the property that has the greater value | 4% of the market value on the property that has the greater value |

| Simple mortgage | 1% on the loan amount, subject to a maximum of Rs 40,000 | 1% on the loan amount, subject to a maximum of Rs 10,000 |

| Mortgage with possession | 4% of the loan amount | 1%, subject to a maximum of Rs 2,00,000 |

| Agreement to sale | Rs 20 | 1% on the money advanced (1% on total consideration if possession is given) |

| Agreement relating to construction of building | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher |

| Cancellation | Rs 50 | Rs 50 |

| Partition among family members | 1% on the market value of the property, subject to a maximum of Rs 40,000 for each share | 1%, subject to a maximum of Rs 10,000 for each share |

| Partition among non-family members | 4% on the market value of the property for separated shares | 1% on the market value of the property for separated shares |

| i) General Power of Attorney to sell the immovable property | Rs 100 | Rs 10,000 |

| ii) General Power of Attorney to sell the immovable property (Power is given to a family member) | Rs 100 | Rs 1,000 |

| iii) General Power of Attorney to sell the movable property and for other purposes | Rs 100 | Rs 50 |

| iv) General Power of Attorney given for consideration | 4% on the consideration | 1% on the consideration or Rs 10,000, whichever is higher |

| Settlement in favour of family members | 1% on the market value of the property but not exceeding Rs 40,000 | 1% on the market value of the property, subject to a maximum of Rs 10,000 |

| Settlement in other cases | 7% on the market value of the property | 4% on the market value of the property |

| Partnership deed where the capital does not exceed Rs 500 | Rs 50 | 1% on the capital invested |

| Partnership deed (other cases) | Rs 300 | 1% on the capital invested |

| Memorandum of Deposit of Title Deeds (MODT) | 0.5% on loan amount, subject to a maximum of Rs 30,000 | 1% on loan amount, subject to a maximum of Rs 6,000 |

| i) Release among family members (coparceners) | 1% on the market value of the property but not exceeding Rs 40,000 | 1% on the market value of the property, subject to a maximum of Rs 10,000 |

| ii) Release among non-family members (co-owner and benami release) | 7% on the market value of the property | 1% on the market value of the property |

| Lease below 30 years | 1% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease up to 99 years | 4% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease above 99 years or perpetual leave | 7% on the total amount of rent, fine, premium of advance, if any, payable. | 1%, subject to a maximum of Rs 20,000 |

| Declaration of trust (if property is there, it would be considered as sale) | Rs 180 | 1% on the amount |

Source: Registration Department, TN

Guideline value Tamilnadu 2023: Latest updates

Tamil Nadu announces new property values for streets, roads

January 4, 2024: The Tamil Nadu government has fixed the composite value for property on more than three lakh roads and streets across the state, according to a TOI report. The composite value of nearly 1.5 lakh streets and roads in Chennai has been announced. The highest value is Rs 28,500 per square foot (sqft) in and around the Boat Club area. The registration charges are 7% of the composite value. For a flat of 1000 sqft area located on St Marys Road in Mylapore, a buyer must pay registration charges of Rs 13 lakh. This will be at 7% composite value which has been fixed at 15,000 per sqft. In north Chennai’s Muthialpet, from Thambu Street to Mooker Nallamuthu Street, the rate has been fixed as Rs 16,500 per sqft. For Bazullah Road in T. Nagar, the composite value is Rs 16,500 per sqft. The composite value is lowest in suburban Tambaram, starting at Rs 3,800 and rising to around Rs 6,000.

Housing.com News Viewpoint

The TNREGINET portal has enabled citizens to access various property-related services online, including checking the guideline value in Tamil Nadu. This helps them get a fair idea of the property rates in their city and plan their property purchase. Moreover, it also provides clarity on the stamp duty and registration charges they will have to pay to the state government. The portal makes various government services available online, eliminating the need to visit the sub-registrar office.

FAQs

When was the Guideline Value in Tamil Nadu last revised?

Guidance Value for properties in Tamil Nadu was last revised in 2017.

What is the impact of guideline value revision on property buyers?

It is believed that any cut in guideline value will bring down property prices. However, property value is also determined by other factors, such as registration charges.

Where can I address queries regarding Guideline Value in Chennai?

You can call on 18001025174 or write to [email protected]

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.