Property owners in Ludhiana, Punjab have the responsibility to pay the property tax Ludhiana every year to the Municipal Corporation Ludhiana. Any property tax Ludhiana paid or property tax Ludhiana return filed for a property gets allocated to the Municipal Corporation Ludhiana.

Ludhiana One Time Settlement (OTS) Scheme

Property owners should pay property tax arrears from FY 2013-14 to 2023-24 before December 31, 2023 to avail the One Time Settlement scheme under which no penalty and interest has to be paid. The scheme was announced by the Punjab government in September 2023. All property owners who pay the property tax from January 1, 2024 to March 31, 2024, have to pay an additional penalty of 20% and 18% annual interest for delayed property tax .

MCL Ludhiana is spread across 159 sq km and with the collection of Municipal Corporation Ludhiana property tax, the Municipal Corporation of Ludhiana ensures that the city gets all basic facilities and works for the development of Ludhiana. ‘How do I pay property tax Ludhiana’ is a common question that most people ask for, so we bring you the answer in detail along with other important aspects related to property tax Ludhiana.

See also: All about NMC property tax

Property tax Ludhiana: How to file?

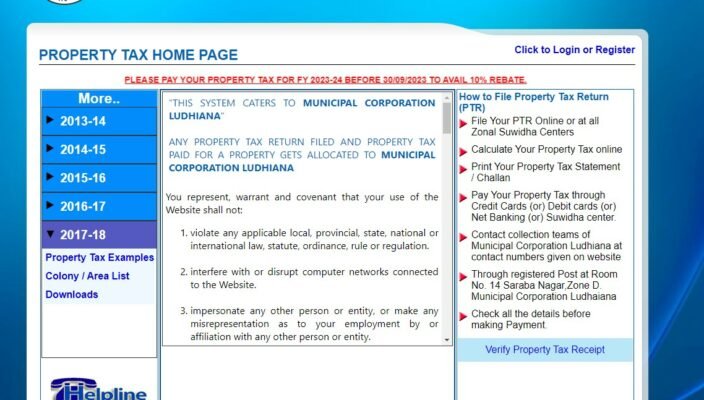

To pay property tax Ludhiana, you can use the online as well as the offline mode. While you can pay the Property tax Ludhiana by visiting any of the zonal suwidha centers in Ludhiana, you can also log on to the Municipal Corporation Ludhiana property tax website at propertytax.mcludhiana.gov.in and pay online.

See also: All about property tax Mumbai

Property tax Ludhiana: Forms for self-assessment

You can download the form for self-assessment for Property tax Ludhiana on the Municipal Corporation Ludhiana property tax website. These forms are available both in Punjabi and English languages.

See also: All about Madurai corporation property tax

Property tax Ludhiana: Area information

To calculate the property tax Ludhiana, click on the colony/area list on the Municipal Corporation Ludhiana property tax homepage.

See also: All about the property tax calculator Delhi

Property tax Ludhiana: How to calculate it?

Property tax Ludhiana depends on factors like value of the land, whether it is self-owned or rented, the property’s age, construction type etc. The interest rate on MC Ludhiana property tax is between 5% and 20%.

The formula used for MCL Ludhiana property tax is category of use x built-up area x age x base value x type of building x floor factor.

For instance, for a residential building under municipal corporation Ludhiana with a total plot area of a unit being 250 square (sq) yard, ground floor being 200 sq yard, vacant land being 50 sq yard, first floor being 100 sq yard, the net property tax Ludhiana will be 200 x Rs 5 per sq yard + 50 x Rs 2.5 per sq yard + 100 x 2.5 per sq yard = Rs 1,375.

(Ground floor considered Rs 5 per sq yard, first floor and vacant land is Rs 2.5 sq yard)

See also: All about BBMP property tax calculator

How to pay municipal corporation Ludhiana property tax return (PTR)?

You can file municipal corporation Ludhiana property tax return online on https://propertytax.mcludhiana.gov.in/Home.aspx using your credit or debit cards, net banking or visiting zonal Suwidha centers.

You can also contact the collection teams of Municipal Corporation Ludhiana or send it through registered post. First, calculate your property tax Ludhiana online. Check all the details before making the Property tax Ludhiana payment. Post this, print your property tax Ludhiana statement/challan.

Note you need to link your UID number for Property tax Ludhiana return and water sewerage ID for a smooth transaction. The UID number for property tax Ludhiana can be obtained from any Suwidha centers of Municipal Corporation Ludhiana by submitting the reference number written on the wall of your house in blue/black colour.

See also: All about KMC property tax bill for 2022-23

To proceed to pay Property tax Ludhiana online, first click on login if you have an account. Otherwise, click on register to create an account with the Property tax Ludhiana website.

Once you login to your e-Seva Punjab account, you will reach the dashboard of the Municipal Corporation Ludhiana where you can see the following services.

Click on ‘Property Tax’ tab where you can assess and pay the property tax Ludhiana. You will reach a page on Municipal Corporation Ludhiana that looks like the picture below.

Click on ‘Pay Property Tax’ on Municipal Corporation Ludhiana page and you will see a pop-up box asking you about the time-period for which the tax has to be paid.

On selecting the time-period, you will reach the next page. For instance, municipal corporation Ludhiana property tax 2021-22 will lead you to a page as shown in the picture below.

See also: Know how to pay property tax at MCRaipur

Enter your municipal corporation Ludhiana property tax return ID 2020-21, that is a computer receipt and press on submit to proceed further. Alternatively, you can input details of manual receipt including book number, receipt number, and receipt date. Note that if you have not filed municipal corporation Ludhiana property tax return for 2020-21 then first file it, then proceed with this transaction.

See also: All about property tax in India

How to link UID number for property tax with PTR ID?

To link the UID number for property tax with the PTR ID, click on ‘Link UID’ and you will reach the page as shown below. Here, enter your Property tax Ludhiana return ID and select the financial year and click on get details.

You will get the following details. If everything is right, click on validate and generate OTP and proceed to link UID with PTR ID.

See also: All about AMC property tax

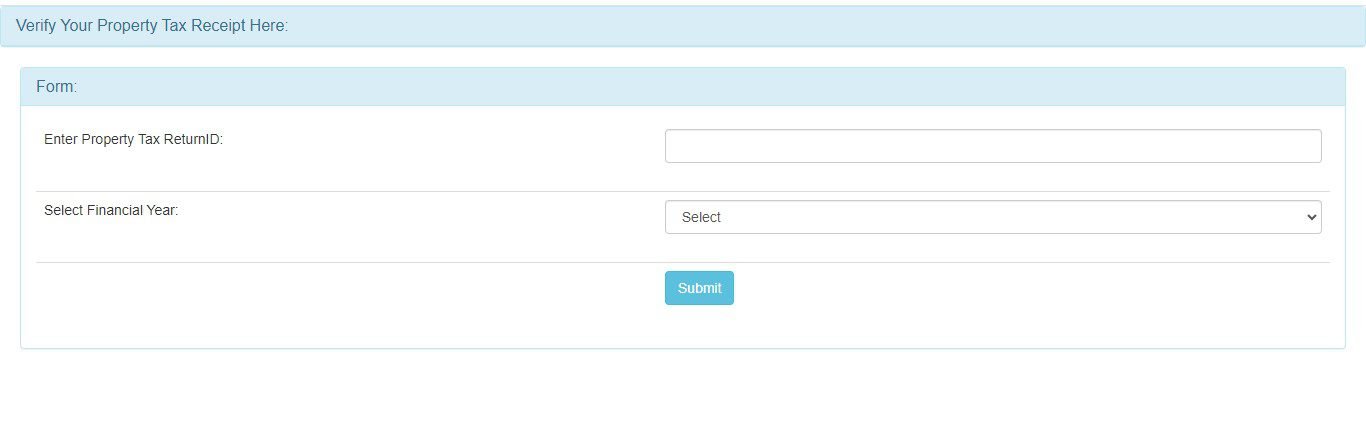

Property tax Ludhiana: How to verify property tax receipt?

To verify the property tax receipt, click on verify property tax receipt on the property tax Ludhiana home page. You will reach

Enter property tax return Id, select financial year from the drop down box and click on submit.

Property tax Ludhiana: Print tax receipt

To print tax receipt reports, go to reports section on the Ludhiana property tax page and click on ‘Print Assessment Reports’. You will reach the page like shown below.

Fill in the details in the property tax Ludhiana page including house number and select the financial year and you will get all the details.

See also: GWMC House Tax: Know all about paying property tax in Warangal

Property tax Ludhiana: Verify transaction

Click on ‘Verify Transaction’ on property tax Ludhiana and you will reach the page as shown below.

Here enter the transaction number, select the financial year and click on verify transaction and generate receipt for property tax Ludhiana.

Property tax Ludhiana history

You can check the property tax Ludhiana history by clicking on ‘Tax history’. You will have to enter the property tax Ludhiana return ID and you can see the complete details like mentioned below.

Property tax Ludhiana: What happens if not paid on time?

As Property tax Ludhiana is collected for the development of the city, it is imperative that citizens pay their Property tax Ludhiana on time. According to the Property tax Ludhiana official portal, all residents need to necessarily pay the municipal corporation Ludhiana property tax for FY 2021-22 before December 31, 2021, to avoid the penalty of 10%.

Property tax Ludhiana: Refund and cancellation policy

If you have made an excess of payment of your property tax Ludhiana, then you can request for a refund only through a manual way via Account Payee cheque. The Ludhiana Municipal Corporation will not transfer any amount online as refund. Once the applicant has submitted the refund application form, the concerned authority will process the form. The Property tax Ludhiana refund will be initiated only after the confirmation that the service has not been rendered for which the extra payment has been made.

Note that no interest on excess of payment for Property tax Ludhiana will be applicable to the applicant. For any dispute in transaction with respect to Ludhiana property tax, the applicant is supposed to contact the Municipal Corporation Ludhiana within 15 days of transaction date.

Ludhiana property tax: Digital payment feedback

If you want to give any feedback or lodge comments regarding property tax Ludhiana, click on feedback and key in all details and press submit.

Expert tips for Ludhiana property tax reduction

- Pay Ludhiana property tax on time or before the deadline to avail of the incentive granted by the government. Also, by paying the property tax for the entire year at once can get you a discount.

- If there are any exemptions that can be claimed on your property, do claim it while filing the Ludhiana property tax

- To avail offers like rebate or amnesty scheme offered by the Ludhiana Municipal Corporation, pay the Ludhiana property tax before the deadline mentioned.

Property tax Ludhiana: Helpline

For any query, contact 84375-35700 between 9:30 am and 5:00 pm

see also about: Punjab land records

FAQs

Under which department does Ludhiana property tax fall?

The Ludhiana property tax falls under the Municipal Corporation Ludhiana.

Till when is the One Time Settlement Scheme from the Punjab government valid?

The One Time Settlement Scheme is valid till December 31, 2023.

Where can you pay the Ludhiana Property Tax online?

You can pay the Ludhiana Property Tax on the Ludhiana Municipal Corporation portal.

Is paying property tax necessary in Ludhiana?

Yes, paying property tax is mandatory as this money is used by the municipal corporation to develop the city.

What happens if the property owner doesn't pay property tax?

Property owners who don't pay property tax will be penalised. Failure to pay the penalty may also result in sealing and auction of the property.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]