Property tax, a recurring tax imposed by local government authorities on real estate properties owned by individuals or businesses, is calculated based on factors such as the property’s location, size, usage (residential or commercial), and built-up area, using systems like capital value or unit area valuation. The tax is typically paid annually by the property owner and helps fund essential civic services such as road maintenance, waste management, water supply, and public infrastructure. Rates and rules vary by city or municipality, and non-payment can lead to penalties or legal action.

About Anantapura

Anantapur, a dynamic city steeped in history and brimming with growth opportunities, has become an increasingly appealing destination for property investors and homeowners alike. If you own property in Anantapur, understanding and managing your property tax responsibilities can initially feel overwhelming, however, staying informed can make the entire process straightforward and stress-free. This comprehensive guide is designed to help you navigate the ins and outs of property tax in Anantapur with ease and clarity.

From how property taxes are assessed and calculated to the most convenient methods for making payments, this guide is your helping hand while going through the procedure of filling your property tax in Anantapura. You’ll also find helpful tips and resources for seeking additional support or resolving queries. Whether you’re a first-time homeowner or a seasoned property holder, this guide will equip you with the knowledge and tools needed to handle your property tax obligations confidently and efficiently.

Property tax in Anantapura

Property tax is a yearly responsibility for all property owners in Anantapur, covering both residential and non-residential properties such as homes, shops, offices, and commercial buildings. This tax plays a crucial role in supporting the city’s infrastructure, maintenance, and development initiatives, and is collected by the local municipal authority. Similar to practices across many Indian cities, Anantapur’s property tax is calculated based on several key factors, including the location, size, usage, and age of the property. Among these, the type of property—whether it is used for residential, commercial, or industrial purposes—significantly impacts the tax rate. The revenue generated is reinvested into civic amenities like road repairs, sanitation, water supply, and public health services, making timely payment of property tax essential for both property owners and the city’s well-being.

Property tax rates in Anantapura in 2025

| Tax type | Residential properties | Non-residential properties |

| General tax | 0.0375% | 0.075% |

| Water tax | 0.0105% | 0.021% |

| Drainage tax | 0.0105% | 0.021% |

| Lighting tax | 0.006% | 0.012% |

| Conservancy tax | 0.0105% | 0.021% |

| Total tax | 0.075% | 0.15% |

What is the online procedure for paying property tax in Anantapura?

The Anantapura property tax can be filled online from the comfort of your home as well instead of paying a physical visit to their office.

Here is a step-by-step guide on how to fill your property tax through the online CDMA (Commissioner & Director of Municipal Administration) Portal:

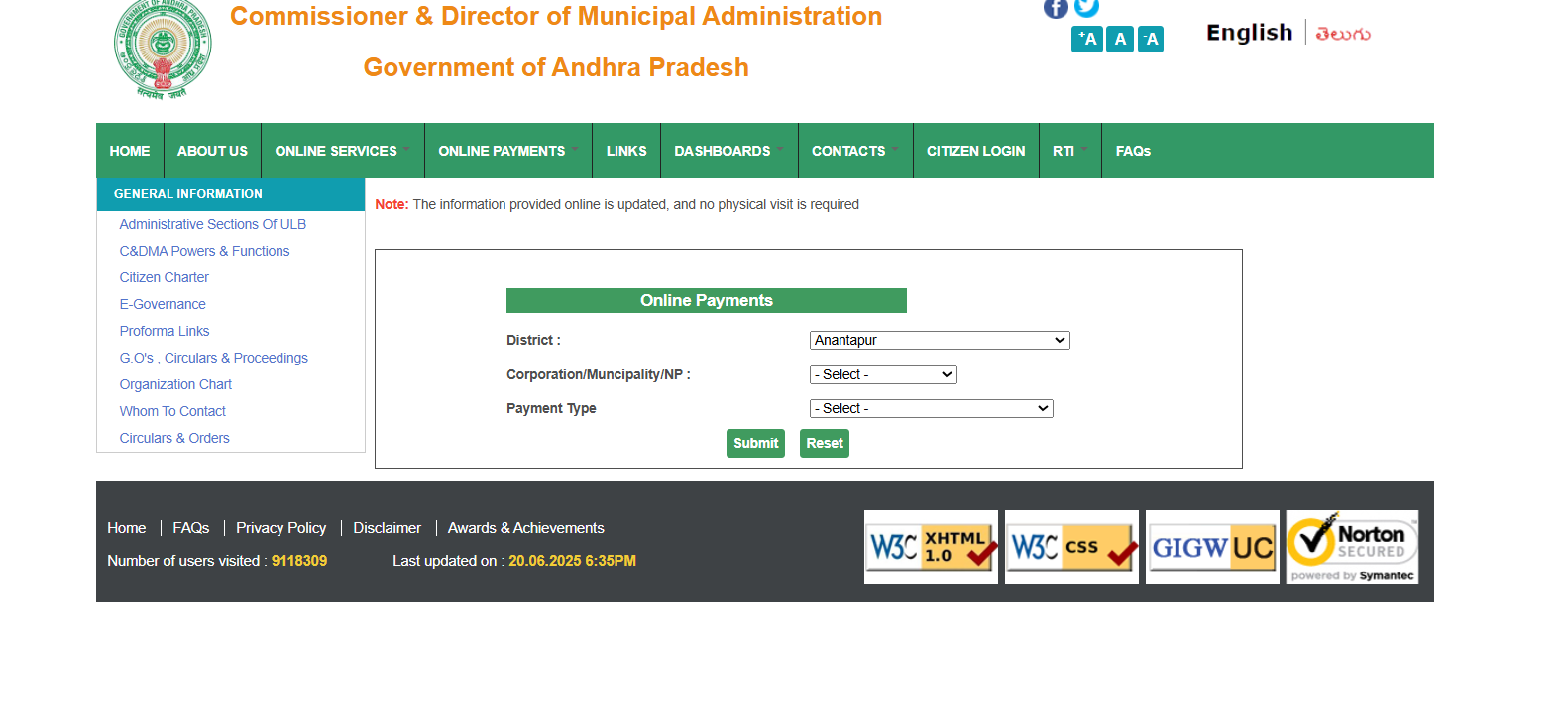

Step 1: Visit the official website of CDMA, Andhra Pradesh https://cdma.ap.gov.in/en .

Step 2: Click on the ‘Online Payments’ tab

Step 3: Click on ‘Property Tax’ from the dropdown menu

Step 4: Once the portal for Property Tax is opened, select the district, corporation, municipality, or NP, and payment type, then click ‘Submit’.

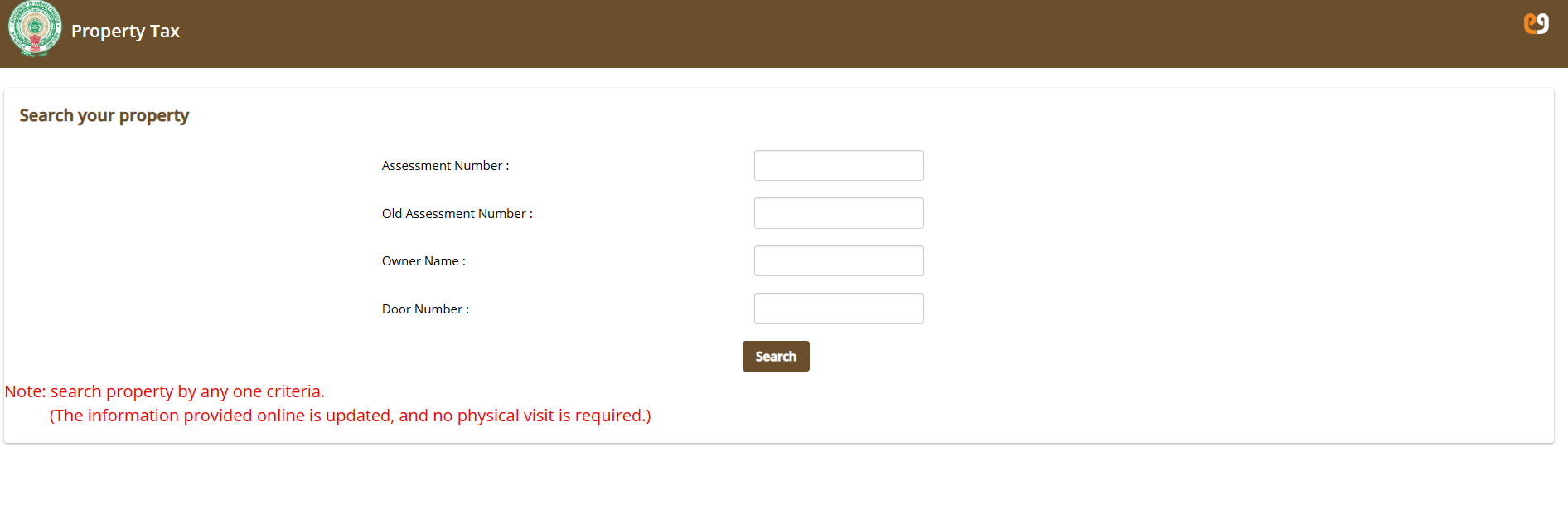

Step 5: Enter the information regarding your property including the assessment number, old assessment number, owner name and door number.

Step 6: Click on ‘search’ and proceed with the available payment methods.

Offline payment procedure

There is still always the option for visiting the nearest Municipal Corporation Office located in your city by following these simple steps:

- Visit the nearest Municipal Corporation office in Anantapur.

- Collect and fill out the property tax form with accurate and complete information.

- Choose your preferred payment method. Options may include cash, Demand Draft (DD), UPI, net banking, credit card, or debit card.

- Carefully review all the entered details to ensure they are correct.

- Submit the completed form along with the payment using your selected method.

Documents and details required

- Assessment Number: This unique identifier is assigned to your property by the municipal authorities and is crucial for tax purposes.

- Owner Name: Provide your full legal name exactly as it appears on the property records to ensure accurate identification.

- Door Number: Specify the precise door or house number of your property for proper identification.

- Sale Transaction Deed: If there’s a change in ownership or you’re updating details, you may need to present this document as proof.

- Other Relevant Documents: Gather any additional paperwork pertaining to your property, such as occupancy certificates, building plans, etc., depending on the specific requirements.

- Old Assessment Number: If applicable, have the old assessment number on hand for reference or updating purposes.

- Address of the Property: Provide the complete address of the property to ensure accurate tax assessment and record-keeping.

- Aadhaar Card: Your Aadhaar card may be required for identification and verification purposes during the tax payment process.

How to change name in Property tax documents in Anantapura?

- Visit the official website of CDMA Andhra Pradesh: https://cdma.ap.gov.in.

- On the homepage, click on the ‘Online Services’ tab.

- Under the ‘Property Tax’ section, select the ‘File Your Mutation (Transfer of Ownership)’ option.

- You’ll be redirected to a form for submitting name change or ownership transfer requests.

- Fill in all the required details accurately, including your old name, new name, property information (such as door number or assessment number), and contact details.

- Carefully review the information to ensure there are no errors before submission.

- Upload attested copies of supporting documents such as the sale deed, title deed, identity proof, and any legal papers relevant to the name change.

- Submit the completed form and documents as per the website’s instructions.

- After submission, you’ll receive an acknowledgment or reference number for tracking your application.

- The municipal authority will verify your request, and once approved, your name will be updated in the property tax records for Anantapur.

Calculating property tax in Anantapura

To calculate your property tax 2025, follow the given steps:

- Begin by visiting the official website of the Commissioner and Directorate of Municipal Administration (CDMA), Andhra Pradesh at https://cdma.ap.gov.in.

- On the homepage, locate the ‘Online Services’ section and click on it to proceed.

- From the dropdown options, select ‘Anantapur’ as your district.

- Choose the appropriate urban local body (ULB)—this could be a Municipal Corporation, Municipality, or Nagar Panchayat (NP)—based on your property’s location.

- Click the ‘Submit’ button to continue to the property tax calculator.

- In the form that appears, enter all the necessary property details, including:

- Ownership category, such as residential, commercial, or mixed-use

- Site extent (total land area) in square yards

- Building area (constructed area) in square yards

- Apartment or complex details, if the property is part of a larger residential or commercial structure

- IGRS (Integrated Grievance Redressal System) details, if required for cross-verification or additional documentation

- After entering all the relevant information, the property tax calculator will automatically generate an estimated property tax amount based on your inputs.

- Use this estimate to plan your property tax payment or further clarify tax-related queries with the municipal office if needed.

How to check property tax dues in Anantapura?

Here is how you can check your property tax dues in Anantapur for the year 2025:

- Go to the official CDMA, Andhra Pradesh website.

- Click on the ‘Online Services’ tab displayed on the homepage.

- Within the ‘Property Tax’ section, choose the ‘File Your Mutation (Transfer of ownership)’ link.

- Provide the required information and proceed with the process to check your property tax dues.

Few more important things to keep in mind

- Last date to pay the property tax in Anantapura- Apr 30, 2025

- Property Tax rebate in Anantapura- 5 per cent

- Property tax rate in Anantapura in 2025- The property tax rates in Anantapur vary based on the type of property. For instance, residential properties, the general tax rate is 0.075%, while for non-residential properties, it’s 0.15%.

Housing.com POV

Managing property tax in Anantapur is an essential responsibility for every property owner but it does not have to be a complicated process. With both online and offline options available, the process of paying your property tax in Anantapura has now become more accessible and transparent than ever. This guide has walked you through everything, from understanding what property tax is, to calculating dues, making payments, updating ownership details, and checking your outstanding amounts. Staying proactive and informed not only helps you avoid penalties but also supports the city’s infrastructure and public services. As Anantapur continues to grow and evolve, timely payment of property tax ensures you play your part in shaping a better urban future.

FAQs

1. What is the last date to pay property tax in Anantapur for 2025?

The deadline to pay property tax in Anantapur is April 30, 2025. Timely payment helps avoid penalties and ensures eligibility for rebates.

2. Can I pay my property tax online in Anantapur?

Yes, you can pay online through the CDMA Andhra Pradesh portal at https://cdma.ap.gov.in under the ‘Online Payments’ > ‘Property Tax’ section.

3. How is property tax calculated in Anantapur?

It's calculated based on factors like property location, type (residential/commercial), built-up area, and site extent, using the municipal tax rate. You can use the CDMA online calculator for an estimate.

4. Is there any rebate for early payment of property tax?

Yes, a 5% rebate is offered for early payment of property tax in Anantapur.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

Comments 0