With the Maharashtra government taking the lead and reducing stamp duty charges in the state, property buyers in other states like Gujarat are also looking forward to a similar announcement. Industry body, Confederation of Real Estate Developers’ Association of India (CREDAI) chairman Jaxay Shah, has also said that any reduction would foster demand for property, push allied industries and generate employment. Over the years, the stamp duty Gujarat has come down from 16% to 4.9%. Here’s a look at everything you need to know about stamp duty charges in Gujarat.

Stamp duty and registration charges in Gujarat in 2024

The basic rate of stamp duty in Gujarat is 3.50%, while the total rate is 4.90%. To calculate it, the total price of the property is considered and this includes clubhouse, car park, electric deposit charges, etc.

Registration charges for men and women in Ahmedabad, Gujarat

| Gender | Registration charge |

| For men | 1% |

| For women | No registration charges |

| For joint buyers (male and female)

For joint buyers (male and male) |

1%

1% |

| For joint buyers (female and female) | No registration charges |

The registration fee in Gujarat is 1% for women, men and joint ownership – men and men, women and women and men and women.

See also: How E-Dhara has changed Gujarat land records system

How to calculate stamp duty in Gujarat in 2024?

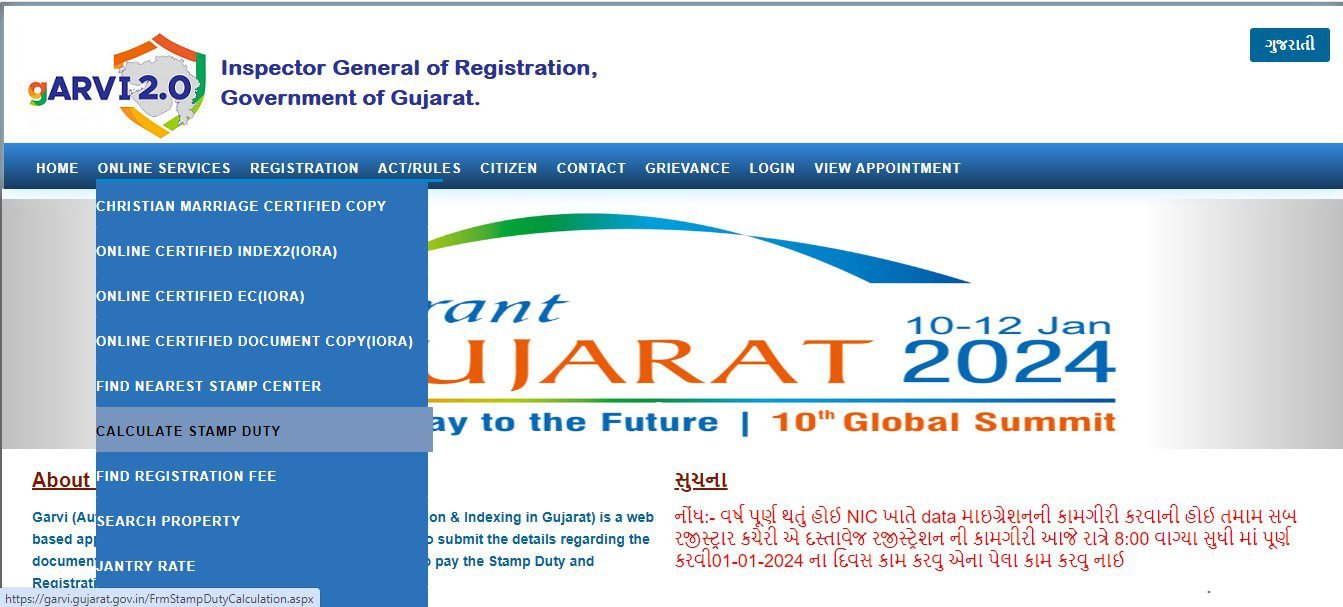

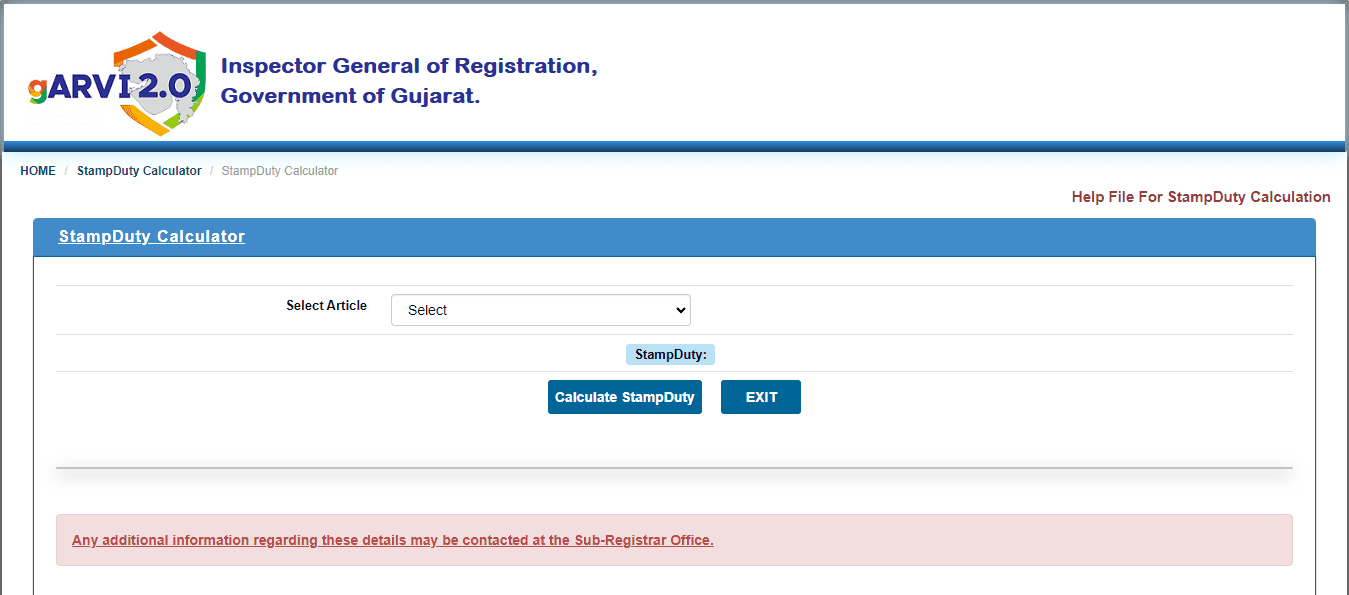

You can use the online stamp duty calculator on the Gujarat online portal. Logon to https://garvi.gujarat.gov.in/ .

Select the article for which stamp duty has to be calculated and click on calculate stamp duty.

Illustrated below an example

Suppose that Anand Patel bought a property for Rs 86.75 lakh in Gujarat. The stamp duty he needs to pay comes to Rs 4,25,075.

Calculation: 86,75,000 x 4.9/100 = Rs 4,25,075.

Stamp duty charges are the same for men and women in Gujarat.

See also: Ahmedabad’s most popular property locations

Additional charges

- Advocate fees

- Folio fees of Rs 10 per page or at the rate as per revisions by the government from time to time

- Index fees of Rs 50 per copy

Now, let us see how to calculate the overall cost of the property. Suppose, Anand Patel and Vidushiben Parikh are buying similar properties at the same price (i.e., Rs 86.75 lakh). Let us see how much each of them has to pay.

Both Patel and Parikh will pay Rs 4,25,075 as stamp duty. However, at the registration stage, Patel will need to pay 1%, that is Rs 86,750.

Rs 86,75,000 x 1/100 = Rs 86,750

Hence, the overall cost for Patel is:

Rs 86,75,000 + 4,25,075 + 86,750 = Rs 91,86,825

In the case of Parikh, only stamp duty charges will apply, since women are exempt from registration charges and therefore, her overall cost comes to Rs 91,00,075.

Stamp duty and registration charges in Gujarat 2024: Documents required

- Title deed

- Proof of identity of bures and sellers

- Address proofs

- If document is under Sector 32A of Gujarat Stamps Act, 1958-application from no 1

- Power of attorney

How to pay stamp duty and registration charges in Gujarat 2024?

You can pay the stamp duty and registration charges in Gujarat either offline or online. If you choose offline way, you can visit the nearest franking center and pay the stamp duty and registration charges. You can also visit the SRO and pay the stamp duty and registration charges. Alternatively, you can opt for e-stamping method and pay the stamp duty and registration charges online.

Check out properties for sale in Ahmedabad.

E-stamping in Gujarat

The government has made it possible for everyone to use the e-stamping facility through the Stock Holding Corporation of India Ltd. E-stamping certificates are available immediately, once a person visits the taluka head quarters in any of the districts. Remember that e-stamping is legal.

For a comprehensive list of stamp-selling vendors in Gujarat, click here.

Know about: Anand (Gujarat)

Stamp duty on different deeds in Gujarat in 2024

| Property deeds | Stamp duty on total property |

| On sale deed or gift deed | 6% |

| Transfer of lease right deed | 3% |

| On deed of exchange on property value | 3% |

| On lease deed (1 – 5 years) | 1.5% |

| On lease deed (1- 10 years) | 3% |

| On lease deed (1 – 15 years) | 6% |

| On lease deed (1- 20 years) | 6% |

| On lease deed (above 20 years) | 6% |

| On mortgage deed with possession | 3% |

| On mortgage deed without possession | 1.5% |

| On amendment deed | Rs 5 |

| On GPA | Rs15 |

| On SPA | Rs 5 |

What happens if you don’t pay stamp duty and registration charges in Gujarat?

Under Indian Stamp Act 1899 and Registration Act 1908, it is mandatory to pay stamp duty and registration charges. Failure to pay them will result in 2% month penalties and up to 200% of the deficit amount.

FAQs

What is the difference between stamp duty and registration charges?

Stamp duty is calculated on the market value of a property while registration charges go towards the cost of documenting your ownership of the property and is usually lesser than the stamp duty.

Is e-stamping valid in Gujarat?

Yes, e-stamping is allowed in Gujarat and nationalised and private banks, co-operative banks, stamp vendors, stamp secretaries, chartered accountants, notaries, non-banking finance companies and CSC centres, now facilitate it.

Can I avail of home loan to pay stamp duty?

Stamp duty and registration charges are normally excluded from the home loan sanction.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]