States in India have been empowered to levy taxes on property transactions, which happens to be the leading sources of revenue generation for local governments in the country. This tax is primarily imposed in the form of stamp duty. The Registration Act, 1908, makes it mandatory for homebuyers to pay stamp duty at the time of property registration.

Stamp duty in Delhi 2024

| Buyer type | Stamp duty in Delhi | Stamp duty in NDMC area | Stamp duty in Delhi Cantonment Board Area |

| Male | 6% | 5.5% | 3% |

| Female | 5% | 3.5% | 3% |

| Joint | 5% | 4.5% | 3# |

Source: revenue.delhi.gov.in

Registration fee in Delhi 2024

| Buyer type | Registration charges in Delhi | Registration charges in NDMC area | Stamp duty in Delhi Cantonment Board Area |

| Male | 1% | 1% | 1% |

| Female | 1% | 1% | 1% |

| Joint | 1% | 1% | 1# |

Source: revenue.delhi.gov.in

Irrespective of their gender, all buyers in Delhi have to pay 1% of the deal value as the registration charge along with the stamp duty at the time of registration of the sale deed. So, effectively, a man buying and registering a property in the national capital will have to pay 7% of the property cost during the registration while a woman will pay 5% of the value. In case a house is being registered jointly in the name of a man and a woman, they will pay 6% of the property cost during the time of registration in Delhi.

See also: How to register property online in Delhi

How to calculate stamp duty in Delhi?

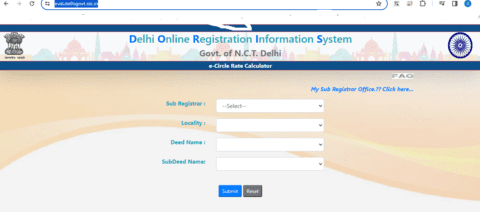

Step 1: Copy and paste the following official link in your browser: https://eval.delhigovt.nic.in/

Step 2: Once the page opens, you will be asked to provide the following details:

- Gender of the owner

- Property location

- Property plight area

- Property type

- Availability of parking

- Parking area in sqm

- Consideration value

- Type of flat (DDA or private)

- Number of floors in the building

Step 3: Once you provide all the details, the stamp duty payable on the transaction will be visible on your screen.

How to pay stamp duty in Delhi?

With the government introducing e-stamping, stamp duty has to be paid through e-stamping in Delhi. So, there are no offline channels through which this duty could be paid. As the Centre has appointed the Stock Holding Corporation of India Limited (SHCIL) as the agency responsible for all e-stamps in India, buyers will have to visit its official portal, www.shcilestamp.com and make the payment there. SHCIL has authorised collection centres called ACC, which act as the intermediary between the SHCIL and the buyer.

In case you are acting through an ACC, you could pay the stamp duty in cash, as well. You could also pay the fund through cheque/demand draft/pay order/RTGS/NEFT/account to account transfer.

After making the payments, the buyer can book an online appointment with the sub-registrar’s office, by logging on to srams.delhi.gov.in to initiate the registration process.

Documents for Delhi property registration

- Sale deed

- Identity proofs of the buyer, seller and witnesses

- Address proofs of the buyer, seller and witnesses

- Two passport-sized photographs of the buyers and sellers on two copies of documents

- e-Stamp paper with correct value of stamp duty

- e-Registration fee receipt of registration fee with undertaking/affidavit

- Self-attested copy of PAN card or Form 60

- No-objection certificate (NOC), in case of plot or land

- All original documents with one set of copies

- Identity and address proof of two witnesses

- Proof of TDS payment

Check out: properties for sale in Delhi.

Transfer charge on property registration in Delhi 2024

Transfer fee is a fee homebuyers in the capital have to pay over and above the stamp duty and registration charges at the time of property registration on gift deed, sale deed and other conveyance deeds. The transfer fee is calculated based on the registration value of the asset.

The Delhi government on July 10, 2023, approved a proposal to hike transfer duty by one percentage point. According to a circular issued on July 10, the new rates are applicable on properties worth over Rs 25 lakh. Properties worth less than that will continue to attract the old rate.

As the new rates kick in, women and transgender homebuyers in Delhi will have to pay 3% transfer duty on property registration as against the previous 2%. Similarly, men buyers will pay 4% transfer duty as against 3%. Authorities have been directed to facilitate the implementation of the hike with immediate effect.

Read full coverage here.

FAQs

How much stamp duty do women have to pay in Delhi?

Women buyers have to pay only 4% of the property value as stamp duty in Delhi.

Can I pay stamp duty offline in Delhi?

Buyers have to make the stamp duty payment online in Delhi.

Where do I go for property registration in Delhi?

Book an appointment and visit the sub-registrar’s office which governs the area in which the property is located. Since there are several such offices, be sure you visit the right one.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]