Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of roads, sewer systems, public parks, education, etc. The BBMP property tax is calculated based on the Unit Area Value (UAV) system. It is mandatory for a property owner to pay the property tax every year, even for a vacant property. In this article, we discuss how citizens can pay property tax online in Bangalore.

known about carpet area calculator

See also: Know about posh areas in Bangalore

What is BBMP property tax?

Collected by the Bruhat Bengaluru Mahanagara Palike (BBMP), Bangalore property tax serves as the means to raise revenue from the state’s property owners to improve infrastructure and living conditions for the citizens. Property tax is levied by every state on all tangible assets including residential, commercial, and rented out properties. The property owners are required to pay their share of BBMP house tax before the specified due date each year. Failure to pay can lead to penalties and sometimes even imprisonment.

BBMP property tax: How to calculate property tax?

The BBMP follows a Unit Area Value (UAV) system, for calculating the amount of property tax in Bangalore payable on residential properties. The UAV is based on expected returns from the property, depending upon its location and usage. The calculation is on a per sq ft, per month (unit) basis, for a particular location or street (area) and multiplied by the current property tax rate (value). The jurisdiction of the BBMP is divided into six value zones, based on the guidance value Bangalore published by the Department of Stamps and Registration. The property tax rate will differ, according to the zone in which the property is located.

The formula used to calculate property tax Bangalore is as follows:

Property Tax (K) = (G – I) x 20%

Where,

G = X + Y + Z

and I = G x H/100

G = Gross unit area value

X = Tenanted area of property x Per sq ft rate of property x 10 months

Y = Self-occupied area of property x Per sq ft rate of property x 10 months

Z = Vehicle parking area x Per sq ft rate of vehicle parking area x 10 months

H = Percentage of depreciation rate (depends upon the age of the property).

Check out price trends in Bangalore

Know about: House for sale in Bangalore

BBMP property tax: Property tax rate in Bengaluru

| Zone | For rented out unit (per sq ft) | For self-occupied property (per sq ft) |

| A | Rs 5 | Rs 2.50 |

| B | Rs 4 | Rs 2 |

| C | Rs 3.60 | Rs 1.80 |

| D | Rs 3,20 | Rs 1.60 |

| E | Rs 2.40 | Rs 1.20 |

| F | Rs 2 | Rs 1 |

See also: All about property tax Ludhiana

BBMP property tax calculator

A comprehensive guide to all the values is available on the BBMP website, along with a property tax calculator, which will help citizens make property tax payment online in Bangalore.

The BBMP property tax is computed using three methods as explained below:

- Annual Rental Value System: In this system which is followed in cities like Chennai and Hyderabad, the authority decides gross yearly rent for a property. The tax is levied on the basis of the anticipated value.

- Capital Value System: In this system, the market value of a property is used to determine the applicable property tax. Under this system, the stamp duty department in the region decides the market value of properties.

- Unit Area System: The property tax is levied based on the property’s per unit price of carpet area. To computer the tax applicable, the property value is multiplied by its carpet area. This system is adopted in Bangalore and other cities like New Delhi.

See also: All about NMC property tax

How to pay BBMP property tax online?

The most convenient way for property tax payment in Bangalore, is online on the BBMP website, with your credit or debit card or through internet banking. (Visit https://bbmptax.karnataka.gov.in/)

You can retrieve your property details through your Base Application Number or Property Identifiers (PID). You can make the payment towards your BBMP property tax online, only if you have already paid the property tax at least once, by using your Sas Base Application or PID number.

Step 1: Visit the BBMP Property Tax portal https://bbmptax.karnataka.gov.in/

Step 2: Enter the PID and retrieve the tax bills.

Step 3: Choose the payment method and make the transaction. Download the print receipt and save or print it for your records.

See also: All about Madurai corporation property tax

BBMP property tax: How to get PID online?

Visit BBMP official website and select ‘Citizen Services’. You will be redirected to a new page where you have to choose ‘GIS Enabled Property Tax Information System’. Register through your first number and mobile number. The property mapped on your mobile number will be shown on the map. If your mobile number is not in the records, you can enter your previous payment Application ID, your new PID number will be displayed on the BBMP portal.

See also: All about KMC property tax bill for 2022-23

BBMP property tax forms

| Forms | Uses |

| Form 1 | Property with Property Identification Number |

| Form 2 | Property with Khata number |

| Form 3 | Property without PID or Khata number |

| Form 4 | In case of no change in the property details such as built-up area, usage or its occupancy |

| Form 5 | If there is a change in the status of the property |

| Form 6 | For the payment of service charge when the property is exempt from payment of property tax |

All tax payers are required to pay their outstanding property tax, either manually or online. For paying the property tax in Bangalore, you need to fill up the forms specified above:

See also: Know how to pay property tax at MCRaipur

BBMP property tax rebate

Property owners paying property tax to BBMP in a single instalment before the due date are eligible to get a rebate of 5%. However, delay in the payment of BBMP property tax will result in an interest rate of 2% per month. Property owners can pay the property tax in two instalments to avoid interest. However, one will not be eligible for a rebate. The deadline for the 5% rebate, which had been extended to May 31 in 2022, has again been extended to June 30 in 2023.

BBMP property tax online: How to download tax receipt?

Once the BBMP tax is paid, the receipt can be obtained online. Visit BBMP Property Tax portal and click ‘Downloads’. Select your option from the drop-down menu. You can print the BBMP tax receipt, Challan or application through this page. You need to enter the assessment year and application ID to view the document you want to print or save. This is the procedure for users to get latest receipt for BBMP property tax online payment 2021-22 and 2020-21.

See also: All about AMC property tax

BBMP property tax: Types of properties that attract property tax

Owners of the following properties are liable for BBMP property tax payment:

- Residential properties, including self-occupied property or rented out properties

- Flats

- Office buildings

- Factory buildings

- Godowns

- Shops

Info. regarding: Sale house in Bangalore

How to pay BBMP property tax offline?

Property owners can pay their property tax for apartments or other properties in Bangalore to the BBMP through offline mode. For this, they must approach the Assistant Revenue Officer office or Bangalore one centre and submit the form. The payment can be done through any mode, including demand draft.

Further, many banks have been authorised to collect the BBMP property tax.

- Axis Bank

- Canara Bank

- ICICI Bank

- HDFC Bank

Those who have a property tax Challan can make the payment to one of the following banks.

- Maharashtra Bank

- SBI

- Corporation Bank

- IDBI

- Indian Overseas Bank

- Indian Bank

- Kotak Mahindra

- IndusInd Bank

Know about: Flats for sale in Bangalore

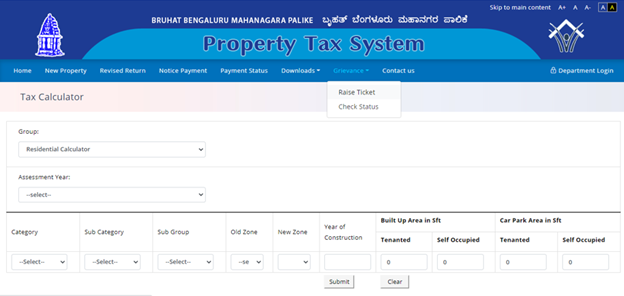

BBMP property tax: How to file a grievance?

Citizens can register their complaints related to property tax online payment and related issues.

Step 1: Visit the official BBMP portal and click on ‘Raise Ticket’ under Grievance

Step 2: Submit details such as mobile number, tax payer name, email ID, message subject, select year and type out the complaint in the message box.

Step 3: Click on Submit.

Users can also check their complaint status online by clicking on Check Status option under grievance and providing Ticket Number to view the details.

How to get your BBMP tax application number?

Follow these steps to get your BBMP tax application number:

- Log on to BBMP’s official website.

- Open the “GIS-based new PID” tab.

- Click on the “Know your PID” option.

- Enter the older application number before clicking on ‘Search’.

- You can check the details on the next page.

- Download or save the information in case you need it in the future.

- Any changes or corrections can be made by heading to the BBMP ward branch.

BBMP property tax news

Update on June 2, 2023

The BBMP has extended the deadline for 5% rebate till June 30 for the convenience of Bangalore’s property owners. The BBMP decided on extension on the directions of deputy chief minister and Bengaluru development minister D.K. Shivakumar. The Congress had demanded earlier that the civic body extend the deadline due to the inconvenience experienced by property owners caused by Assembly polls. When the Congress took over, the civic body decided to comply with the demand to extend the date.

Update on November 17, 2022

BBMP forms squads to check property tax payment in Bengaluru

Recently, BBMP formed two revenue intelligence teams to cross-check property tax payment made by owners of residential and commercial properties in select wards. The exercise has been initiated to ascertain the level of pilferage of revenue. Revenue officers will physically verify whether the owners are paying the right tax.

The BBMP has set a target of Rs 4,100 crore from property taxes in 2022-23, an increase of Rs 1,000 crore over the previous year. The municipal body has collected Rs 2,500 crore so far.

Update on May 1, 2022

BBMP extends the rebate period on property tax payment till May 31

The Bruhat Bengaluru Mahanagara Palike (BBMP) has issued a notification stating that is extending the rebate period till May 31, 2022. Thus, property owners in Bangalore can continue to avail 5% rebate against the full payment for 2022-23. As per the BBMP instruction to the taxpayers, in case the property tax return for the previous financial year has been filed, the property tax for the current year will be accompanied with the return and dues for the previous years, if any. If taxpayers have filed revised return for any year, then the return for the current year will be based on the revised return filed. If any tax was paid in advance and if there is a balance after adjusting for the tax for the previous years, the amount will be paid through Cheque or DD after due verification.

If property tax is paid to BBMP in two installments for the existing year, same form is used for second installment. Taxpayers can avail a rebate of 5% on total property tax payable if they are paying full amount in one installment. For arrears payment, one can pay generating challan for each previous year. At present, one can make payment towards property tax if they have already paid the property tax at least once, by using their SAS Base Application Number or PID Number. If one is paying through DD or Cash, the receipt can be generated instantly. However, for payment through cheques, the receipt will be generated only after the realisation of the cheque amount.

Update on January 10, 2022

BBMP to incur loss of Rs 270 crore over property tax blunder

As per a report by Deccan Herald, the Bruhat Bengaluru Mahanagara Palike would lose Rs 270 crore levied as penalty and interest from property owners, owing to a property tax mess.

The issue is related to the Self-Assessment Scheme (SAS) introduced by the civic body in 2016 that enables citizens to choose between various zones based on their nature of property in the city. Due to a technical glitch, citizens selected different zones and ended up paying lesser. On realising this mistake three years later, BBMP started notifying citizens for defaulting on BBMP property tax payment and levied heavy fines of up to five times. It also levied 2% interest per month as per the provision under the Karnataka Municipal Corporation Act. BBMP had identified as many as 78,254 property owners for defaulting on their tax liability and served notices to around 22,000 owners. However, due to strong opposition from the citizens, which was escalated to higher authorities, the civic body refrained from serving further notices. About only 11,000 owners made the payment, amounting to Rs 20.5 crore.

BBMP issues notices

About 78,000 property owners have been served notices for furnishing incorrect details of their properties in the self-assessment scheme. Such defaulters will be asked to pay the difference in the amount and also an added penalty of 2% for a period of two years.

Starting April 1, 2021, the BBMP has decided to roll out an automated system, wherein property details will already be mentioned and owners will simply have to pay the tax.

Extra charges for handling waste

Bengaluru property owners will now have to pay an additional fee in their property tax bill, for doorstep waste pickup service. Residential property owners will have to pay Rs 200 per month, while commercial property owners will be charged Rs 500 per month, for this service. Residential property prices to increase post RERA. This will be in addition to the Solid Waste Management (SWM) cess, which is in range of Rs 200 – Rs 600, currently. There has been a proposal to waive 50% SWM cess for societies that are composting waste but it is yet to be approved.

Double property tax for building plan violations

In 2020, the cabinet decided that property owners who violated the building plans would be penalised and would have to pay double property tax. Law minister JC Madhuswamy said that this proposal was approved and the amendment to the KMC to enable the BBMP to levy this penalty was done.

No hike in BBMP property tax

Plans were on the anvil to hike the property tax in Bangalore by 15%-30% for both, residential and non-residential properties. BBMP special commissioner Basavaraju said that a tax revision was due in 2020 but it could not be carried out due to administrative reasons. As per the Karnataka Municipal Corporation Act (KMC), 1976, the BBMP can revise the property tax in every three years. The move is important, to enable the cash-strapped civic agency to meet its revenue targets.

In 2019-20, the agency’s revenue target was Rs 3,500 crores but it could only earn Rs Rs 2,669 crores. The property tax hike was to be effective from March 2021. However, property owners can heave a sigh of relief as the plan has been shelved for now.

Know about: Apartment for rent in Bangalore

Amendments to KMC Act

An amendment to the KMC Act (Karnataka Municipal Corporations Act) also allows BBMP officials to attach immovable properties of defaulters. The proposal of including the provision of the Land Revenue Act into the KMC Act and thereby, empowering the BBMP officials was made by the commissioner and given its assent by the government. The BBMP expects to meet a revenue target of Rs 5,500 crores in 2020.

Integrated Command and Control Centre (ICCC) and smart city project

A Rs 109-crore project – the Integrated Command and Control Centre – that will be the brain of the smart city project, has been approved. Decisions with respect to the city management and disaster management will take place here and a common helpline number, a dedicated mobile application, as well as a web portal, will also come up. The project, which is funded by the Bengaluru Smart City Ltd, will enable the BBMP, BMTC, BWSSB, BESCOM, City police and Namma Metro, to come under one platform. The command centre will focus on mobility, solid waste management and health. Resultantly, this will improve the livability quotient of the city. Citizens may also be able to find grievance redressal online.

Check out : properties for sale in Bengaluru

BBMP property tax: Contact details

Users can contact on the following numbers for queries related to bbmp property tax online payment and other issues:

- Yelahanka: 080-2363-6671 / 080-2297-5936

- Mahadevapura: 080-2851-2300 / 080-2851-2301

- Dasarahalli: 080-2839-4909 / 080-2839-3688

- Rajarajeshwari Nagar: 080-2860-0954 / 080-2860-1851

- Bommanahalli: 080-2573-2247 / 080-2573-5642

- West: 080-2356-1692 / 080-2346-3366

- South: 080-2656-6362

- East: 080-2297-5803

What are the BBMP property tax zones?

The BBMP tax can vary depending on the zone your property belongs to. There are 8 zones, which are further categorised into non-residential and residential areas. Following is the list of different BBMP property tax zones:

- West

- East

- South

- Mahadevapura

- Yelahanka

- Bommanahalli

- Dasarahalli

- Rajarajeshawri Nagar

Regardless of which zone your property falls into, you can check the status or raise a complaint through the BBMP portal.

FAQs

What is BBMP

BBMP stands for Bruhat Bengaluru Mahanagara Palike and it is the administrative body which looks after the civic amenities and infrastructural needs of of the Greater Bangalore metropolitan area

What is PID number

BBMP has developed a system to establish a GIS based database along with specific applications and update facilities relating to properties, streets with ward and zone boundaries. It provides features to map tax-paying properties with unique PIDs (Property Identifiers) and associate up-to-date Property Tax collection details as layers of information on GIS map.

How to find new PID number on BBMP website

Visit the official BBMP website and find GIS Property Tax Information System option under Citizen Services menu. Search your PID number through your old payment application number or mobile number.

How to get BBMP tax paid receipt online

You can download the receipt from the BBMP property tax portal by submitting the assessment year and application number.

What is the due date for BBMP property tax payment for 2022-23?

The last date for paying BBMP property in Bangalore and get a 5% rebate against the full payment of tax is April 30. However, BBMP has extended the deadline till May 31, 2022.

What is the BBMP property tax late payment penalty?

In case of a delay in paying BBMP property tax, an interest of 2% per month should be paid per month by the taxpayer.

Dhwani is a content management expert with over five years of professional experience. She has authored articles spanning diverse domains, including real estate, finance, business, health, taxation, education and more. Holding a Bachelor’s degree in Journalism and Mass Communication, Dhwani’s interests encompass reading and travelling. She is dedicated to staying updated on the latest real estate advancements in India.

Email: [email protected]