Launched in 2015, the Pradhan Mantri Awas Yojana (PMAY) is in Phase 2 now. In this phase, the centre has taken up an aim of constructing 3 crore houses under the PMAY by 2029 with 2 crore houses directed towards PMAY-Gramin and 1 crore directed towards PMAY-Urban 2.0.

What is the Pradhan Mantri Awas Yojana?

The Pradhan Mantri Awas Yojana (PMAY) is a credit-linked subsidy scheme through which the centre and the state governments provide affordable housing for the EWS and the LIG segment.

Under the PMAY scheme, the government helps people living in Kutcha houses in the urban and rural areas of the country buy pucca houses. The scheme also offers financial assistance for the renovation of existing houses and convert them to pucca houses. Under the Pradhan Mantri Awas Yojana- Urban, the Credit Linked Subsidy Scheme (CLSS) is available. There is a cap of Rs 2.67 lakh to avail this subsidy.

Pradhan Mantri Awas Yojana 2025: Key highlights

| PMAY verticals | PMAY-U 2.0 |

| Pradhan Mantri Awas Yojana apply online | PM Awas Yojana Urban 2.0: https://pmaymis.gov.in/

PMAY rural: http://iay.nic.in/ |

| Launch date | June 25, 2015 |

| Address | Pradhan Mantri Awas Yojana (urban) Ministry of Housing and Urban Affairs Nirman Bhawan, New Delhi-110011 |

| PMAY components

|

In-Situ Slum Redevelopment

Credit Linked Subsidy Scheme Affordable Housing in Partnership Beneficiary-led Construction Scheme |

| Toll free number | 1800-11-6163 – HUDCO

1800-11-3377, 1800 11 3388 – NHB |

Find out how to fill Pradhan Mantri Awas Yojana Online Form

PMAY Urban 2.0 and PMAY Gramin

Mentioned are details about the PMAY-U 2.0 and PMAY Gramin.

PMAY Gramin 2025

PMAY-Rural is also known as Pradhan Mantri Awas Yojana-Gramin (PMAY-G). Effective April 1, 2016, the government restructured the Indira Awas Yojana (IAY) into the Pradhan Mantri Awas Yojana-Gramin (PMAY-G). The PMAY Gramin will provide people staying in kuccha houses in villages in India with pucca houses. The Modi 3.0 government announced construction of 2 crore houses under the PMAY-Gramin for five years that is till 2028-29. The total outlay will be of Rs 3,06,137 crore for FY 2024-25 to 2028-29 including the Centre’s share of Rs 2,05,856 crore and the state matching share of Rs 1,00,281 crore. For the PMAY Gramin scheme, Rs 54,500 crore has been allocated for FY 2024-25.

Who are eligible for PMAY Gramin 2025?

The balance households under the existing SECC 2011 based PWL and Awas + 2018 database after updation are eligible. State wise targets for FY24-25 will be allotted shortly. Note that priority will be given to first time beneficiary households during FY24-25 to FY28-29

Here is how to check PMAY status online

PMAY-U 2.0: Pradhan Mantri Awas Yojana-Shehri

PMAY Urban mission was launched on June 25, 2015, to construct pucca houses. Its updated version, the PMAY-U 2.0 with an investment of Rs 10 Lakh Crore will address the housing needs of one crore families. Under this, over 1 Crore urban poor and middle-class families will be aided for construction, purchase, or rent a house at affordable price in urban areas in five years. A government assistance of Rs 2.30 Lakh Crore will be provided under the PMAY-U 2.0 scheme.

What are the benefits of PMAY (U) 2025?

- Subsidised rate of interest: The PMAY (U) provides the Credit Linked Subsidy Scheme (CLSS) that reduces the rate of interest for home loan and makes home buying monetarily easier.

- Inclusive of all categories: The PMAY offers housing units to the Economic Weaker Section (EWS), Low Income Group (LIG), Middle Income Group (MIG) and High Income Group (HIG), thus offering houses across categories.

- Women empowerment: The PMAY housing gives preference to women ownership thus empowering women.

- Slum decongestion: With the rise in PMAY housing units, the number of slums in the country will reduce. People will move into pucca houses with facilities rather than staying in slums.

- Increased jobs: With the number of housing units growing, the demand for housing increases and this results in job creation.

PMAY: MIG Key features

| Parameters | MIG-I | MIG-II |

| Subsidy on interest | 4% | 3% |

| Maximum loan tenure | 20 years | 20 years |

| Discount NPV calculation | 9% | 9% |

| Maximum interest subsidy amount | 2,35,068 | 2,30,156 |

| Amount for processing fee for all documents | Rs 2,000 | Rs 2,000 |

| Women ownership | Not necessary | Not necessary |

| Building construction | Should have all approvals and be compliant with National Building Code | Should have all approvals and be compliant with National Building Code |

| Basic infrastructure | Mandatory | Mandatory |

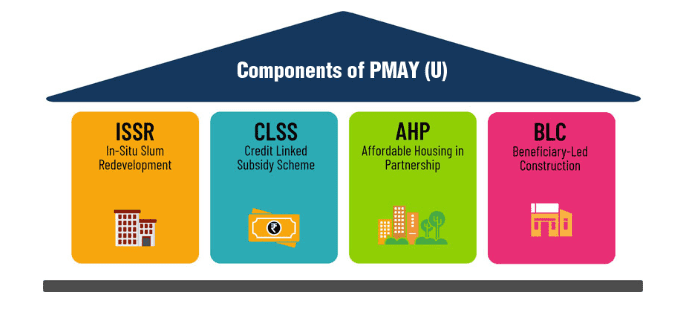

What are the components of PMAY?

Source: PMAY-U.gov.in

PMAY is divided into four components.

In-Situ Slum Redevelopment (ISSR)

This stands for rehabilitation of slums by building houses through private participation for eligible slum dwellers on the land under slums.

Credit-Linked Subsidy Scheme (CLSS)

Source: https://pmay-urban.gov.in/clss

- Any additional loan beyond the subsidised loan amount, will be at non-subsidised rates.

- The loans should either be used for purchase of an under-construction property from the secondary market or construct one’s own house.

- Under the PMAY guidelines, the house bought through loan under this scheme, should be in the name of a woman of the household from the EWS and LIG categories. Ownership by women is not mandatory in case it is being developed using a land parcel.

How to calculate the PMAY subsidy?

Using the PMAY subsidy calculator at the official portal, https://pmayuclap.gov.in/content/html/Subsidy-Calc.html, you can know the exact amount you will receive from the government as the subsidy under the CLSS. To calculate the amount, you will have to key in detail, like your annual income, loan amount, loan tenure, type of units (whether pucca or kuccha), ownership type (women ownership is a must in EWS and LIG houses) and area of the unit.

Apart from displaying the subsidy amount, the page will also display the subsidy category, i.e., EWS, LIG, MIG-1 or MIG-2.

What is affordable housing in partnership (AHP)?

In this, states will build affordable housing projects with central assistance of Rs 1,50,000, either through central agencies or in partnership with the private sector for the EWS category. Projects under the AHP should have minimum of 250 houses with at least 35% houses for EWS category. Under this scheme, preference will be given to physically handicapped persons, senior citizens, SC/ST/OBCs, minorities, single woman, transgender, other weaker and vulnerable sections of the society.

What is beneficiary-led individual house construction/enhancements (BLC)

This provides provisions for people belonging to the EWS category so that they can either construct a new house or enhance the existing house on their own with central assistance of Rs 1,50,000.

This means an addition of minimum of 9 square metre (sqm) carpet area into the existing house with pucca construction of at least one room or room with kitchen and/or bathroom and/or toilet that are compliant with National Building Code (NBC) norms. Note, the total carpet area after the enhancement must not be less than 21 sqm and must not be more than 30 sqm.

How are beneficiaries chosen for Pradhan Mantri Awas Yojana 2025?

A demand driven approach is followed by the PMAY under which states identify eligible beneficiaries through a demand survey, based on specific criteria.

Among the eligible beneficiaries, priority will be given to the following categories:

- Houseless households.

- Households with zero or fewer rooms (in the case of households with more than one room, priority will be given to those with fewer rooms).

Special prioritisation will also be given based on cumulative deprivation scores. This is calculated using the following socio-economic parameters:

- Households with no adult member aged 16 to 59.

- Female-headed households with no adult male member.

- Households with no literate adult above 25 years.

- Households with a disabled member and no able-bodied adult.

- Landless households dependent on manual casual labour.

Who are not eligible for housing units under PMAY Grahmin 2025?

According to a government letter dated August 12, 2024, there are 10 revised exclusion criteria under which through a survey, eligible rural households for the scheme will be identified. People with

- Motorised three/four wheeler

- Mechanised three/ four wheeler agricultural equipment

- Kisan Credit Card with limit of Rs 50,000 and above

- Households with any member as government employee

- Households with non-agricultural enterprises that are registered with the government.

- Any family member who earns more than Rs 15,000 per month

- Family paying income tax

- Family paying professional tax

- Own 2.5 acre or more of irrigated land

- Own 5 acre or more of unirrigated land

Who are eligible for PMAY 2025?

A family of husband, wife, and unmarried children are considered a household, according to the parameters set under the Pradhan Mantri Awas Yojana.

Family status

A beneficiary should not own a pucca house, either in his name or in the name of any member of his family, in any part of India.

Home ownership

People with a pucca house of less than 21 sqm may be included under enhancement of the existing house.

Age

Adult earning members of a family are considered a separate household and thus, a beneficiary of the scheme, irrespective of their marital status.

Marital status

In the case of married couples, either of the spouses or both together in joint ownership, will be eligible for a house, provided they meet the income eligibility criteria of the household under the scheme.

Category

The beneficiaries from the EWS category are eligible for assistance in all four components of the PMAY mission, whereas the LIG/MIG category is eligible under the CLSS component of the mission. People belonging to SC, ST, and the OBC categories and women belonging to the EWS and the LIG are also eligible to avail the Pradhan Mantri Awas Yojana benefits.

Carpet area limit under PMAY 2025

| Category of applicant | Annual income in Rs | House carpet area in sqm | House carpet area in sq ft |

| EWS | 3 Lakh | 60 | 645.83 |

| LIG | 6 Lakh | 60 | 645.83 |

| MIG-1 | 6-12 Lakh | 160 | 1,722.33 |

| MIG-2 | 12-18 Lakh | 200 | 2,152.78 |

Source: Housing Ministry

To have a clear understanding of the term, read our guide on carpet area.

Reservation under PMAY-G 2025

PMAY-G also ensures targeted assistance for specific disadvantaged groups

- Scheduled Castes and Scheduled Tribes (ST): The scheme reserves minimum 60% of targets for SC/ST households.

- Dharati Aaba Tribal Village Utkarsh Abhiyanwhich focuses on tribal development, covering 63,843 villages, benefiting over 5 crore tribal people across 30 States/UTs.

- 5% of the target is reserved for differently-abled beneficiaries

- 5% prioritises housing for families affected by natural disasters, such as the Fani Cyclone in Odisha

- 15% of the total funds at the national level are earmarked for minority households. The allocation of targets among States/UTs is based on the proportionate rural population of minorities according to the Census 2011 data.

What is the maximum subsidy you can get under PMAY?

The maximum subsidy under the PMAY scheme is Rs 2,67,280 Lakh.

PMAY home loan subsidy benefit timeline

For the EWS and LIG categories, the subsidy benefit is available on home loans that are disbursed on or after June 17, 2015. In case of MIG-1 and MIG-2 categories, the subsidy benefit is available on home loans that are disbursed on or after April 1, 2017.

How does PMAY subsidy reach beneficiary?

Once your application for subsidy under the PMAY programme is approved, funds are transferred from the central nodal agency (CNA) to the bank (referred to as prime lending institutions or PLI in government documents) from where the beneficiary has borrowed his home loan. In case of PMAY, National Housing Bank (NHB), HUDCO and SBI have been appointed as the CNA.

The bank will then credit this amount to the home loan account of the borrower. This money will be deducted from your outstanding home loan principal. So, if you have received Rs 2 Lakh as the PMAY subsidy and your outstanding loan amount is Rs 35 Lakh, it would reduce to Rs 33 Lakh after the subsidy.

See also: How does the PMAY interest subsidy scheme for EWS and LIG work?

How to apply for PM Awas Yojana online in 2025?

Only a candidate with an Aadhaar card can apply for the benefits of the PMAY scheme. To apply online for PMAY-U 2.0, visit the PMAY portal at https://pmaymis.gov.in and choose PMAY-U website.

Next, check eligibility for participating in PMAY-U 2.0 by filling all details such as If you are applying for the CLSS subsidy, your application must be submitted to your home loan provider.

How to apply for PMAY offline in 2025?

Eligible candidates can obtain and fill in forms in this regard available at common service centres (CSCs). They should pay a fee of Rs 25 plus GST on the purchase of the PMAY subsidy form. CSCs are the access point to avail of essential public utility services in rural parts of India. It takes nearly three-four months for an application to be processed.

Home loan for PMAY 2025: Points to remember

Aadhaar

All home loan accounts under the PMAY scheme will be linked to the Aadhaar numbers of the beneficiary.

Cap on tenure

Tenure of the subsidy is available for a maximum tenure of 20 years.

No interest rate concession

The lender from where you have taken a home loan will charge an interest rate prevailing at the bank.

Loan transfer caveat

If you switch your lender to avail of benefits of low interest rates, even though you have already availed of the interest subvention benefit under the CLSS, you will not be eligible for the interest subvention benefit again.

How to check PMAY subsidy status?

You can check your PMAY application status by following some simple steps. To check your PMAY status online, read our step-by-step guide on how to track your PMAY application status?

How to download PMAY application form?

Visit the official website of PMAY and click on ‘Citizen Assessment’ option. From the drop-down menu, select ‘Track Your Assessment Status’.

Once you click on this option, you will get ‘Track Assessment Form’. Select either ‘By Name, Father’s Name and Mobile Number’ or ‘By Assessment ID’.

Enter the required details and click on ‘Submit’ to access the application form. Once the form appears on screen, click on ‘Print’.

Banks offering home loans under PMAY

- State Bank of India (SBI)

- Punjab National Bank

- Bank of Baroda

- HDFC Bank

- ICICI Bank

- Axis Bank

- IDFC First Bank

- Bandhan Bank

- Bank of India

- IDBI Bank

- Canara Bank

Top public banks that offer PMAY subsidy

| Bank | Website | Associated central nodal agency |

| State Bank of India | www.sbi.co.in | NHB |

| Punjab National Bank | www.pnbindia.in | NHB |

| Allahabad Bank | www.allahabadbank.in | NHB |

| Bank of Baroda | www.bankofbaroda.co.in | NHB |

| Bank of India | www.bankofindia.com | NHB |

| Bank of Maharashtra | www.bankofmaharashtra.in | NHB |

| Canara Bank | www.canarabank.in | NHB |

| Central Bank of India | www.centralbankofindia.co.in | HUDCO |

| Corporation Bank | www.corpbank.com | NHB |

| Dena Bank | www.denabank.co.in | NHB |

| IDBI Bank | www.idbi.com | NHB |

| Indian Bank | www.indian-bank.com | NHB |

| Indian Overseas Bank | www.iob.in | NHB |

| Oriental Bank of Commerce | www.obcindia.co.in | NHB |

| Punjab & Sind Bank | www.psbindia.com | NHB |

| Syndicate Bank | www.syndicatebank.in | NHB |

| UCO Bank | www.ucobank.com | NHB |

| Union Bank of India | www.unionbankonline.co.in | NHB |

| United Bank of India | www.unitedbankofindia.com | NHB |

| Vijaya Bank | www.vijayabank.com | HUDCO |

Top private banks that offer PMAY subsidy

| Bank | Website | Associated central nodal agency |

| Axis Bank | www.axisbank.com | NHB |

| ICICI Bank | www.icicibank.com | NHB |

| HDFC Bank | www.HDFC.com | NHB |

| Kotak Mahindra Bank | www.kotak.com | NHB |

| LIC Housing Finance | www.lichousing.com | NHB |

| Karnataka Bank | www.karnatakabank.com | NHB |

| Karur Vysya Bank | www.kvb.co.in | NHB |

| IDFC Bank | www.idfcbank.com | NHB |

| Jammu & Kashmir Bank | www.jkbank.net | HUDCO |

| Bandhan Bank | www.bandhanbank.com | NHB |

| Dhanlaxmi Bank | www.dhanbank.com | HUDCO |

| Deutsche Bank AG | www.deutschebank.co.in | NHB |

| South Indian Bank | www.southindianbank.com | HUDCO |

| Lakshmi Vilas Bank | www.lvbank.com | NHB |

| Aadhar Housing Finance | www.aadharhousing.com | NHB |

| Aditya Birla Housing Finance | www.adityabirlahomeloans.com | NHB |

| Bajaj Housing Finance | www.bajajfinserv.in | NHB |

| PNB Housing Finance | www.pnbhousing.com | NHB |

List of state-level PMAY-U nodal agencies

| State | Organisation | Address | Email ID |

| Andaman & Nicobar Islands | UT of Andaman & Nicobar Islands | Municipal Council, Port Blair – 744101 | jspwdud@gmail.com |

| Andhra Pradesh | Andhra Pradesh Township Infrastructure Development Corporation Limited | Flat no. 502, Vijaya Lakshmi Residency, Gunadhala, Vijayawada – 520004 | aptsidco@gmail.com |

| Andhra Pradesh | Andhra Pradesh State Housing Corporation Limited | AP State Housing Corporation Ltd, Himayatnagar, Hyderabad – 500029 | apshcl.ed@gmail.com |

| Arunachal Pradesh | Government of Arunachal Pradesh | Department of Urban Development and Housing, Mob-II, Itanagar | chiefengineercumdir2009@yahoo.com |

| Assam | Government of Assam | Block A, Room no. 219, Assam Secretariat, Dispur, Guwahati – 781006 | directortcpassam@gmail.com |

| Bihar | Government of Bihar | Urban Development and Housing Department, Vikash Bhavan, Bailey Road, New Secretariat, Patna – 15, Bihar | sltcraybihar@gmail.com |

| Chandigarh | Chandigarh Housing Board | Sec-9D, Chandigarh, 160017 | chb_chd@yahoo.com |

| Chhattisgarh | Government of Chhattisgarh | Mahanadi Bhawan, Mantralaya D Naya Raipur, Chhattisgarh, Room no. S-1/4 | pmay.cg@gmail.com |

| Dadra & Nagar Haveli and Daman & Diu | UT of Dadra & Nagar Haveli and Daman & Diu | Secretariat, Silvassa, 396220 | devcom-dd@nic.in |

| Dadra & Nagar Haveli | UT of Dadra & Nagar Haveli | Secretariat, Silvassa, 396220 | pp_parmar@yahoo.com |

| Goa | Goa government | GSUDA 6th Floor, Shramshakti Bhavan, Patto – Panaji | gsuda.gsuda@yahoo.com |

| Gujarat

|

Gujarat government | Affordable Housing Mission, New Sachivalya, Block no. 14/7, 7th floor, Gandhinagar – 382010 | gujarat.ahm@gmail.com |

| Haryana

|

State Urban Development Agency | Bays 11-14, Palika Bhavan, Sector 4, Panchkula – 134112, Haryana | suda.haryana@yahoo.co.in |

| Himachal Pradesh | Directorate of Urban Development | Palika Bhavan, Talland, Shimla | ud-hp@nic.in |

| Jammu & Kashmir | J&K Housing Board | Jkhousingboard@yahoo.com | |

| Jharkhand | Urban Development Department | 3rd floor, Room No. 326, FFP Building, Dhurwa, Ranchi, Jharkhand, 834004 | jhsltcray@gmail.com |

| Kerala | State Poverty Eradication Mission | TRIDA Building, JN Medical College, PO Thiruvananthapuram | uhmkerala@gmail.com |

| Madhya Pradesh | Urban Administration and Development | GoMP Palika Bhawan, Shivaji Nagar, Bhopal, 462016 | addlcommuad@mpurban.gov.in |

| Maharashtra

|

Maharashtra government | Griha Nirman Bhawan, 4th Floor, Kalanagar, Bandra (East), Mumbai 400051 | mhdirhfa@gmail.com |

| Manipur | Government of Manipur | Town Planning Department, Government of Manipur, Directorate Complex, North AOC, Imphal – 795001 | hfamanipur@gmail.com |

| Meghalaya | Government of Meghalaya | Raitong Building, Meghalaya Civil Secretariat, Shillong, 793001 | duashillong@yahoo.co.in |

| Mizoram | Urban Development & Poverty Alleviation | Directorate of Urban Development and Poverty Alleviation, Thakthing Tlang, Aizawl, Mizoram, Pin: 796005 | hvlzara@gmail.com |

| Nagaland

|

Nagaland government | Municipal Affairs Cell, AG Colony, Kohima – 797001 | zanbe07@yahoo.in |

| Odisha | Housing & Urban Development Department | 1st Floor, State Secretariat, Annex – B, Bhubaneswar – 751001 | ouhmodisha@gmail.com |

| Puducherry | Government of Puducherry | Town & Country Planning Department, Jawahar Nagar, Boomianpet, Puducherry – 605005 | tcppondy@gmail.com |

| Punjab | Punjab Urban Development Authority | PUDA Bhavan, Sector-62, SAS Nagar, Mohali, Punjab | office@puda.gov.in |

| Rajasthan | Rajasthan Urban Drinking Water, Sewerage & Infrastructure Corporation Ltd (RUDSICO)

|

4-SA-24, Jawahar Nagar, Jaipur | hfarajasthan2015@gmail.com |

| Sikkim | Government of Sikkim | Department of UD & Housing, Government of Sikkim, NH 31A, Gangtok, 737102 | gurungdinker@gmail.com |

| Tamil Nadu | Government of Tamil Nadu | Tamil Nadu Slum Clearance Board, No 5 Kamarajar Salai, Chennai – 600005 | raytnscb@gmail.com |

| Telangana | Government of Telangana | Commissioner and Director of Municipal Administration, 3rd Floor, Ac Guards Public Health, Lakdikapool, Hyderabad | tsmepma@gmail.com |

| Tripura | Government of Tripura | Directorate Of Urban Development, Government of Tripura, Pt. Nehru Complex, Gorakha Basti, 3rd Floor, Khadya Bhawan, Agartala Pin: 799006 | sipmiutripura@gmail.com |

| Uttarakhand | Directorate of Urban Development | State Urban Development Authority, 85A, Motharawala Road, Ajabpur kalan, Dehradun | pmayurbanuk@gmail.com |

| Karnataka | Government of Karnataka | 9th Floor, Vishweshwaraiah Towers, Dr Ambedkar Veedhi, Bangalore, 560001 | dmaray2012@gmail.com |

| West Bengal | State Urban Development Authority | ILGUS Bhaban, Block HC Block, Sector 3, Bidhan Nagar, Kolkata – 700106 | wbsuda.hfa@gmail.com |

| Uttar Pradesh | State Urban Development Agency (SUDA) | Navchetna Kendra, 10, Ashoka Marg, Lucknow 226002 | hfaup1@gmail.com |

(Source: PMAY website)

Contact number

NHB toll-free number

1800-11-3377

1800-11-3388

HUDCO toll-free number

1800-11-6163

Housing.com POV

PMAY is a mass scale program that uses the digital platform effectively for a transparent process that can be tracked easily. With many benefits offered by the PMAY, such as the CLSS, homeownership for people from various categories has been made more affordable. Also, with the scheme giving preference to women beneficiaries, the PMAY champions women empowerment. Before applying for a house under PMAY, it is recommended to check the beneficiary list on people who are not eligible for PMAY schemes.

FAQs

Who is eligible for the PMAY?

People from the Economically Weaker Sections (EWS), Low-Income Group (LIG), Middle-Income Group I (MIG I) and Middle-Income Group II (MIG II) are eligible for the PMAY.

How to apply for the PMAY?

You can apply for the PMAY by visiting the PMAY official website or by visiting a Common Service Centre.

What documents are required to apply for the PMAY?

Documents required for applying for the PMAY are identity proof, address proof, income proof and property papers.

Is home ownership affordable in India?

It is difficult to say that housing is affordable in India. However, easier access to mortgage finance, longer loan tenures, higher loan-to-value ratios and tax incentives have made home ownership slightly more affordable.

Did India have a low-cost housing scheme for its poor prior to PMAY?

While efforts to provide low cost housing have been made for many years (National Housing Policy, 1994; Jawaharlal Nehru National Urban Renewal Mission, 2005; Rajiv Awas Yojana 2013), the Pradhan Mantri Awas Yojana (PMAY) launched in 2015, with the aim to provide ‘Housing for All by 2022’, provided a fresh impetus to the segment. It has two components – the PMAY Urban (PMAY-U) and the PMAY-Gramin (PMAY-G).

Is Jawaharlal Nehru National Urban Renewal Mission, 2005 still active?

No, the PMAY-U, launched in 2015, subsumes all the previous urban housing schemes and aims to address the urban housing shortage of 20 million by 2022.

What is EWS category under PMAY?

Those with income of up to Rs 3 lakh fall under the EWS category of buyers as defined under the PMAY and get an interest subsidy of 6.5% on a loan amount of up to Rs 6 lakh.

What is LIG category under PMAY?

Those with income between Rs 3 lakh and Rs 6 lakh fall under the LIG category of buyers as defined by the PMAY and get an interest subsidy of 6.5% on a loan amount of up to Rs 6 lakh.

What is MIG-1 category under PMAY?

Those with income between Rs 6 lakh and Rs 12 lakh fall under the MIG-1 category of buyers as defined by the PMAY and get an interest subsidy of 4% on a loan amount of up to Rs 9 lakh.

What is MIG-2 category under PMAY?

Those with annual income between Rs 12 lakh and Rs 18 lakh fall under the MIG-2 category of buyers as defined by the PMAY and get an interest subsidy of 3% on a loan amount of up to Rs 12 lakh.

Who is eligible for PMAY-U 2.0?

People from the Economically Weaker Section (EWS), Low-Income Group (LIG), Middle-Income Group I (MIG I) and Middle-Income Group II (MIG II) are eligible for the PMAY-U 2.0.

How to apply for PMAY-U 2.0?

You can apply for PMAY-U 2.0 by visiting the PMAY official website or by visiting a Common Service Centre.

What documents are required to apply for PMAY-U 2.0?

Documents required to apply for PMAY-U 2.0 are identity proof, address proof, income proof, and property papers.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |