People of Bihar can visit the official Bhumi Jankari portal to check land records and Khasra-Khatauni nakal.

Bhumi Jankari: Overview

| Name of the entity | Biharbhumi |

| Owned and operated by | Government of Bihar |

| Website address | http://biharbhumi.bihar.gov.in/ |

| Purpose | Digital medium to offer citizen-centric services, online repository of Bihar land records |

| Services | View Registered Document

View MVR View Web Copy(WC) Book Your Appointment Advance Search Agreement Report Searching By Party Name Searching By Serial No. Digitization Project Tracker Bihar Zonal Tacker 2005-2011 Bihar Zonal Tacker |

| Help Desk numbers | Tel: (0612)-2545654.

Tel: (0612)-2545627. |

| Office address | e-Registration Data Center,

Room No.-222, 2nd Floor, Visheshwaraiya Bhawan Baily Road, Patna Bihar-800015 |

| secy-reg-bihnic.in

igr-bihnic.in |

Check it : All you need to know about Elabharti Bihar

How to Check Land Related Records in Bihar Online?

Step 1: To view Bhulekh Bihar on the Bhumi Jankari portal, go to the official page.

Step 2: On the Services tab on top of the pain, select the Search By Serial Number option.

Step 3: Key in the relevant details and hit View Bhulekh Bihar on Bhumi Jankari Bihar portal.

See also: All about Banglarbhumi

How to Check Bihar Land Records or Bhulekh Bihar by Party Name?

Go to the Bhumi Jankari Bihar portal, and click on the ‘Services‘ button to view Bihar land record by party Name.

On the page that appears, select ‘Search by Party Name’ option.

Fill the relevant information and click the ‘View’ option.

See also: MP Bhu Naksha: How to Check Bhulekh Plot Map Online in Madhya Pradesh?

What is the (MVR) Minimum Value Register in Bhulekh Bihar?

Minimum vale register is the government-decided minimum rates for land and property transactions in Bihar. Land in Bihar can’t be bought and sold below the rate mentioned in the MVR, which is updated periodically.

see also about: state bhulekh

How to one check land MVR online on Bhulekh Bihar?

On Bhulekh Bihar portal, login to Bihar Bhumi Jankari website and click on ‘View Flat MVR’.

You now have to enter details such as town, circle name, local body name, etc., to proceed. Note that MVR is a tool to help you discover how much a plot of land will cost depending upon its location anywhere in Bihar.

See also: How to check Bhu naksha Bihar

How to check flat MVR online on Bhulekh Bihar?

Step 1: On Bhulekh Bihar portal, login to Bihar Bhumi Jankari website and click on ‘View Flat MVR’.

Step 2: You now have to enter details such as town, circle name, local body name, etc., to proceed. Note that MVR is a tool to help you discover how much a plot of land will cost depending upon its location anywhere in Bihar.

see also about: bhulekh uk

How to check Jamabandi Bihar online?

Step 1: Go to the Bihar Bhumi website, and click on the option ‘Jamabandi Panji Dekhein‘.

Step 2: On the page that now appears, fill details like district, village, mauja and halka, before clicking on the ‘Search’ button to view khatauni Bihar.

How to apply for mutation on Bihar Bhumi?

Daakhil Kharij or land mutation in Bihar can be done through the bhumi jankari Bihar portal, by following the below mentioned steps.

Step 1: Go to the bhumi jankari Bihar portal, and click on the ‘Online application for Daakhil Kharij’.

Step 2: Note that only registered users can proceed with online land mutation in Bihar. In case you are a new user, create an account by clicking on the ‘Registration’ option. Those who already have an account, can provide their credentials and proceed by entering their email ID, password and the captcha code and sign in.

Step 3: When new users click on the registration option, the following page will open asking them to provide details like name, address, mobile number, email ID, etc. Click on ‘Register Now’ once you fill all the details to create an account.

Step 4: A registered user can once again go to the main page and apply for land mutation on Bhumi Jankari Bihar portal.

Info. regarding: Motihari pin code

How to find land mutation application on Bihar Bhunaksha website?

Step 1: Enter the following address in your browser: http://biharbhumi.bihar.gov.in/Biharbhumi/

Step 2: Click on the option circled in the screenshot.

Step 3: The mutation application form format will open in a PDF format. You can download it on your machine.

How to check changed mutation case number?

Step 1: On the home screen of the Bihar Bhumi Jankari portal, click on the option बदला हुआ म्युटेशन केस नंबर देखे

Step 2: A detailed PDF file will open showing the changed mutation case numbers for each district. Keep scrolling down to view the changed mutation number for your district.

How to get land possession certificate?

Step 1: Copy paste this link in your browser to visit the official website: http://www.biharbhumi.bihar.gov.in/

Step 2: Click on the ‘ऑनलाइन एल० पी० सी० आवेदन करें’ option.

Step 3: Use you ID and password to log in. Only registered users can perform this task on Bhulekh Bihar. In case you have not yet registered, complete registration to complete this process.

Step 4: Now search for the Jamabandi for which you need the LPC. To search, click on the “चयन करें” option.

Step 5: Now you can view all the details of the jamabandi nakal. Click on “Proceed for LPC” option. Note that without paying the pending lagaan dues, you can’t apply for LPC.

Step 6: You request for LPC is now registered and an application number will be allocated.

Step 7: Check all the details and click on ‘Final Submit’ option

Step 8: You can check the status of you request by click on the “LPC आवेदन स्थिति” option. Typically, you request will be processed within 10 days of the application.

How to check changed land possession case number?

Step 1: On the home screen of the Bihar Bhumi Jankari portal, click on the option बदला हुआ LPCकेस नंबर देखे

Step 2: Again, a detailed PDF file will open showing the changed LPC case numbers for each district. Keep scrolling down to view the changed mutation number for your district.

How to get encumbrance certificate on Bihar Bhumi?

An encumbrance certificate mentions loans against a land parcel or property. You can download the encumbrance certificate for a land on Bhumi Jankari Bihar by going to the following page:

http://bhumijankari.bihar.gov.in/BiharPortal/Admin/EC/Find_EC.aspx

Select the registration office, circle name, mauza/thana name and type.

You will now be asked to enter khata and plot number to proceed with the encumbrance certificate search.

Check out: Chappra pin code

How can one pay tax online in Bihar using Bhulekh Bihar?

Step 1: Go to the official Bihar Bhumi website, http://www.bhulagan.bihar.gov.in/.

Step 2: From among the many options, select the one that says ‘ऑनलाइन भुगतान करें’’ (pay online).

Step 3: You will now be redirected to a page, where you will have to key in certain details before you can proceed. These include your district name, halka, mauja, anchal, etc. From among the many options, you have the choice to proceed by providing your plot number, or khata number, or raiyat name, etc. Key in these details and click on ‘खोजे’ (search). You can also select ‘समस्त पंजी-२ को नाम के अनुसार देखें’ option and start the search. This will show you a list of the khatas.

Note that a Khata number is an account number allotted to a family and denotes the entire landholding pattern among the members. The Khata number provides you the details of the owners and their total landholding.

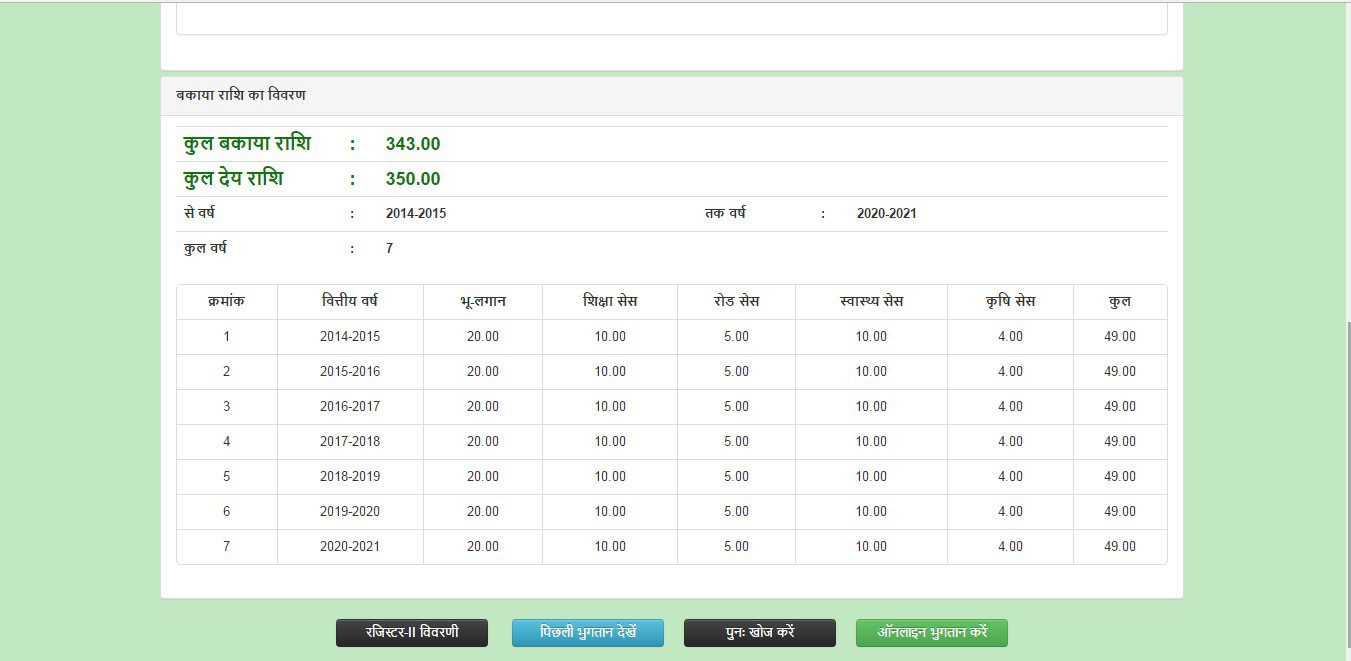

Step 4: You will now be shown all the details about your land and your land tax liability, known as lagan in Hindi.

Step 5: Now click on ‘बकाया देखे’, to find out your land tax liability. The page that will now appear, will show your past payments and outstanding lagan liability and also give you an option to pay it online. Click on the pay online button.

Step 6: Now fill in your name, mobile number and address, check the ‘I agree to the terms and conditions’ box and click on ‘भुगतान करें’.

Step 7: You will be redirected to a page, where you will have to use your net banking details, to make the payment. The user must have internet banking credentials to proceed. After filling in the required details, your land tax bill will be paid and an online receipt will be generated.

See also: All about Bihar RERA

Deeds available for download on Bihar Bhumi Jankari

You can download the following deeds from the Bihar Bhumi Jankari portal:

- Arbitration deed

- Adoption Deed

- Award deed

- Cancellation deed

- Exchange deed

- Endowment Deed

- Gift deed

- Lease agreement

- Lease agreement (for a vacant land)

- Lease surrendering deed

- Mortgage deed

- Mortgage deed with a possession

- Mortgage deed

- Power of attorney

- Partnership dissolution deed

- Partnership deed

- Partition deed

- Rectification deed

- Security bond document

- Sale deed

- Sale agreement

- Sale agreement (general)

- Transferring the rights of leasehold by sale (land structure)

- Transferring of the right of leasehold by sale (vacant land)

- Trust deed

- Usufructuary mortgage deed

- Will deed

See also: Commonly used land and revenue record terms in India

Frequently asked questions by Bhulekh Bihar users

What is Bhulekh?

Bhulekh is made of two Hindi terms: bhu (meaning land) and lekh (account). This way, bhulekh stands for land records, also known as record of rights.

See also: All you need to know about IGRSUP

What is Bhulekh Bihar?

Bhulekh Bihar is the online repository of Bihar land records. The Bhumi Jankari Bihar portal provides all the details of the Bihar land record, including Jamabandi Bihar. Launched under the central government’s National Land Record Modernization Program (NLRMP) scheme, Bhulekh Bihar allows users to gain access to a wide variety of information by using serial numbers or party names.

See also: How to check land records online on Bhulekh Odisha website?

Different processes have to be followed to obtain different sort of information through the Bihar land revenue department. Click on the links below to proceed with understanding the process to perform various tasks:

- Process to file mutation.

- Process to view online jamabandi

- Process to pay online bhu-lagan

- Process to file land possession certificate

- Process of parimarjan

- Process to view map

- Process of special survey

- Process of mutation

- Tri-junction identification process

- FAQ of Bihar special survey

- MARBLE (Map and Record Based Land Entitlement)

What is Bihar Bhumi?

The land revenue department of the state oversees various land-related operations in Bihar. The Patna-headquartered department, through the directorate of land records and surveys, maintains and develop land records for the entire state.

See also: All you need to know about Dharitree

How to access Bihar land records?

Among the online services that the Bihar government provides, under its Bhumi Jankari programme, are land and property registration, information about land and property and model deeds. All this and more information can be accessed using the official portal of the department http://bhumijankari.bihar.gov.in/. To provide various types of information through the Bihar Bhumijankari portal, the user must keep handy the details mentioned below:

- Village

- Tehsil

- Mauja

- Owner name

- Khata number

- Khasra number

- Land type

- Land value

- Deed number

Bhumi Jankari Bihar or Bihar Apna Khata

With a view to widen its land record base and provide easy access of these records to the common man, the Revenue and Land Reforms Department in Bihar has launched an online portal, http://lrc.bih.nic.in/ that has a wide variety of data. This portal is also known as Bihar Apna Khata portal.

The functions of this department include:

- Collection of land revenue, along with road cess, education cess, health cess, etc.

- Maintenance and updating of land records.

- Acquisition of land for public purposes.

- Conservation of government lands.

- Lease of government lands.

- Transfer of government lands to various departments of the state government and institutions.

- Survey and demarcation of land.

- Management and control of natural resources.

The Bihar Apna Khata portal provides information about the above-mentioned records.

Check out : Know all about SSPMIS Bihar portal

Also read all about IGRS Bihar

What is parimarjan?

Parimarjan is the Hindi term for correction. Using the parimarjan facility on the Bihar Bhumijankari portal, landowners in the state can correct the mistakes in their old records. You can make an application for correction in your land records in Bihar online on this portal and can track your application using the application ID generated on the portal, after the application is successfully made. Staff from the land revenue department may get in touch with you and ask you to furnish supporting documents, to correct the mistakes.

See also: All you need to know about Punjab land records

Read about : Elabharthi Bihar

Contact information of Bhulekh Bihar

Department of Revenue and Land Reforms

Old Secretariat, Bailey Road, Patna – 800015

Help Line No: 06122280012

Email: [email protected]

See also: Dharani land records portal in Telangana

FAQs

What is land tax?

Owners have to pay a tax for the ownership of a property, to the civic bodies. Under the specific state laws, the owner has to pay a bi-annual or annual property tax on all his real estate possessions - land, plot or any improvements made on these pieces of land, including buildings, shops, homes, etc.

Can I pay lagan online in Bihar?

Yes, you can pay the land tax online on the Bihar Bhumi portal.

What is the official Website of Bhulekh Bihar?

The official website of Bhulekh Bihar is bhumi jankari Bihar, biharbhumi.bihar.gov.in/Biharbhumi/Default.

Can I view jamabandi Bihar online?

Yes, you can view jamabandi Bihar online at bhumi jankari Bihar portal.

How do I get Bihar bhu naksha online?

To get Bihar bhu naksha online, visit the lrc.bih.nic.in portal, and click on 'View Your Account'. You will have to provide details like district, village, circle name before the Bihar bhu naksha is displayed on the site.

How to check land details online in Bihar?

Visit the Bhumi jankari Bihar portal and search these details by either party name or serial number. You can also get this information on lrc.bih.nic.in website. On this site, click on 'View Your Account' to proceed.

How to check online registry in Bihar?

Visit the bhumi jankari Bihar site to view online register in Bihar.

How to check khasra/khatauni online in Bihar?

On bhumi jankari Bihar portal, you can view khasra/khatauni by clicking on 'View Jamabandi' option.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]