To make sure a homebuyer is investing in a property that is free from any legal or financial charges, they must check the encumbrance certificate (EC). With several states in India launching virtual facility to check EC online, accessing this document has become quite easy. This guide will touch upon every aspect of this legal document that provides buyers and investors clarity on property title and associated legal/financial matters. Will will also explain the process to access EC certificate online.

What is an encumbrance certificate?

An encumbrance certificate is a legal document stating whether a property is free or not free from any legal or financial liabilities. A property on which the owner is currently paying a home loan, for example, has a financial encumbrance. If you apply for an encumbrance certificate for this property, you will find the details of this financial encumbrance. Similarly, for a property that is caught in a legal dispute, the municipal body will issue an encumbrance certificate, stating the liabilities.

Nil-encumbrance certificate versus encumbrance certificate

A nil-encumbrance certificate is issued by the sub-registrar’s office for a property which has not seen any transaction in the period for which an encumbrance certificate has been sought by the applicant. A nil-encumbrance certificate is issued in Form 16.

Why is encumbrance certificate important?

An encumbrance certificate clarifies whether a particular property is free from legal or financial burdens. An encumbrance certificate would, for instance, show you if it has been pledged by the owner to a bank. An encumbrance certificate also helps you know if you are dealing with a genuine seller and the property is not in any bind, legally or financially.

By clearly stating the position of the property from a legal and monetary point of view, an encumbrance certificate provides answers to the following queries:

- Is the property you are buying pledged by the owner to a bank?

- Is the person selling the property actually its legal owner?

- How many hands the property has changed since its construction?

- Is the property is free of debts?

- Has the previous owner taken a debt against the property?

- Has someone else has acquired this property without the knowledge of the owner?

What details can be found in an encumbrance certificate?

An encumbrance certificate issued by the sub-registrar’s office has all the details of the property, its owner, transfer of ownership, mortgages, etc. An encumbrance certificate is prepared for a specific timeframe. The EC provides a list of all registered transactions related to the property in the stated period. These transactions could include the following details:

- The number of times the property changed hands during this period.

- If any loans were taken against the property during this period.

- If any loans were paid off the property during this period.

- Record of any legal claims that might have been made over the property during this period.

Types of encumbrance certificate and use

EC for flats

When you are buying a property, an encumbrance certificate is a must document to ensure you are dealing with the real owner, and there are no pending loans against the property.

EC for home loans

When you are taking a home loan to buy a property, banks typically ask for the encumbrance certificate before accepting your home loan application.

EC for PF withdrawal

When you withdraw money from your provident fund to buy a house, your employer would ask for the EC.

EC for mutation

After buying a property, the owner has to get the ownership transfer recorded in the government record by way of property mutation.

EC for flat sale

When you are selling a property, the seller has to apply and get the document out from the government record to show it to the buyer.

Who issues encumbrance certificate?

The sub-registrar in whose jurisdiction the property exists issues the encumbrance certificate. This is the office where a property is registered at the time of the purchase by the current and previous owners.

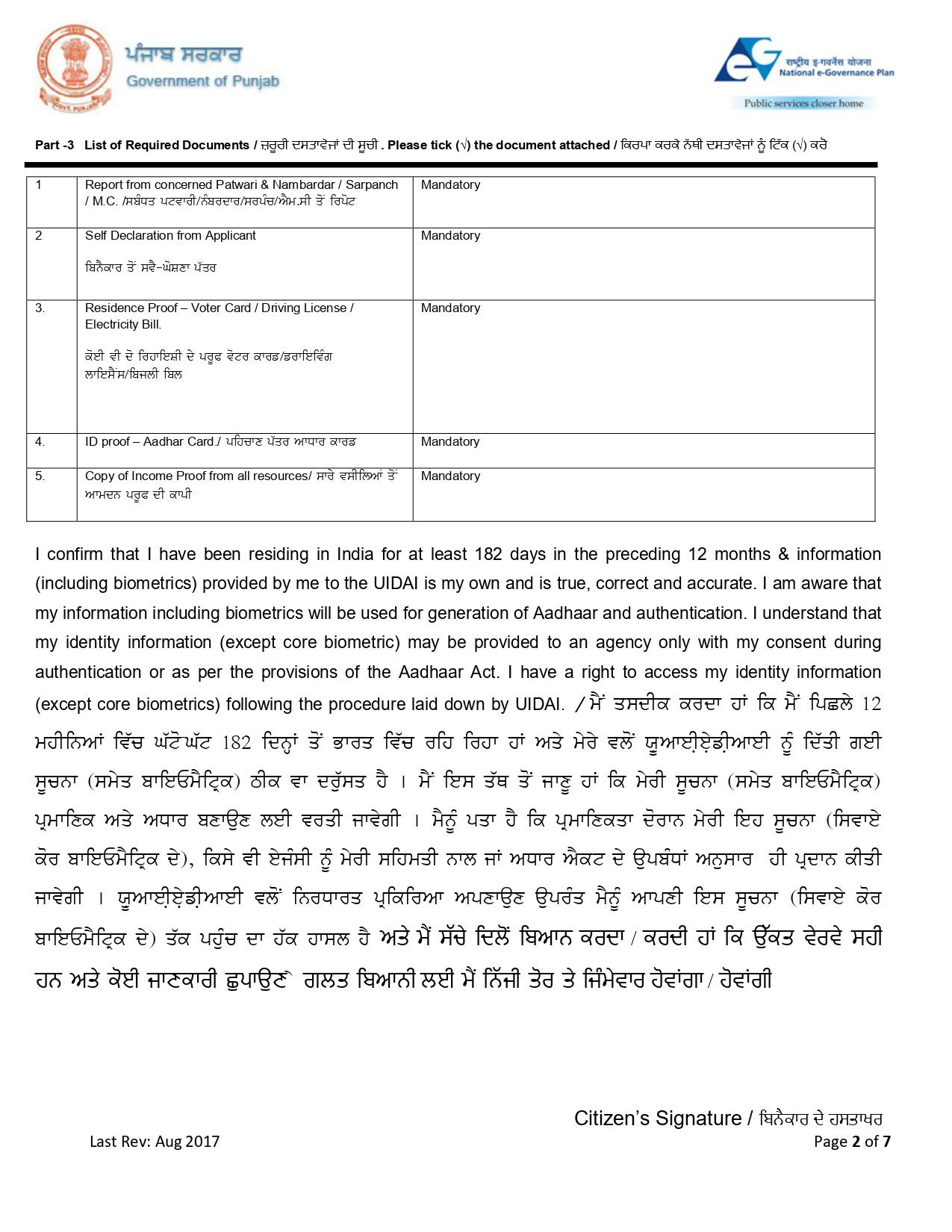

Documents needed to apply for encumbrance certificate

An applicant will have to provide the documents below to apply for an EC:

- Address proof: Aadhaar, Voter ID, driving licence, ration card, etc.

- Identity card: Aadhaar, PAN, ration cards, Voter ID, driving licence

- Property details

4. Copy of the sale deed

5. Purpose of application

6. EC requirement period

7. Copy of power of attorney, if applicable

Encumbrance certificate forms

Encumbrance certificates come in two forms:

Encumbrance certificates Form 15

If a property has any encumbrances during the period for which the applicant has sought a certificate, the sub-registrar’s office issues an encumbrance certificate on Form 15. Typically, Forms 15 will contain each piece of information pertaining to inheritance, sale, purchase, lease, mortgage, gifting, relinquishment, partition of the property in question.

Encumbrance certificates Form 16

If a property has not registered any encumbrances during the period for which the applicant has sought a certificate, the sub-registrar’s office issues a nil-encumbrance certificate on Form 16.

Modes of EC application

Depending on the state where you live, you can apply for an encumbrance certificate either online or offline.

List of states where you can apply for encumbrance certificate online

In many states, one can apply for an EC online. Listed below are the websites addressed of those states that provide EC online.

- Apply online for encumbrance certificate in Andhra Pradesh

- Apply online for encumbrance certificate in Odisha

- Apply online for encumbrance certificate in Kerala

- Apply online for encumbrance certificate in Puducherry

- Apply online for encumbrance certificate in Tamil Nadu

- Apply online for encumbrance certificate in Telangana

- Apply online for encumbrance certificate in Uttar Pradesh

- Apply online for encumbrance certificate in Jharkhand

- Apply online for encumbrance certificate in Haryana

- Apply online for encumbrance certificate in Bihar

- Apply online for encumbrance certificate in Punjab

- Apply online for encumbrance certificate in Gujarat

- Apply online for encumbrance certificate in West Bengal

How to apply for EC online?

To get online encumbrance certificates, the applicant follow this step-by step guide. Do note here that the service is available only in a few states. For a clearer understanding, you will show here how to apply online for EC in Telangana.

Step 1: Go to the official website Meeseva portal.

Step 2: Click on the 3rd tab that appears on top of the page, Government Forms.

Step 3: Scroll down the page that appears. You will find the Application form of Encumbrance Certificate under the head Stamps and Registration. Download the form and fill the required information. Attach the necessary documents along with the form.

Step 4: Find out the nearest Meeseva centre, and submit your application there along with the required fee.

Step 5: After the submission, you will be issued an acknowledgement slip.

Step 6: After verification, you application will be sent to the sub-registrar’s office, which is responsible to carry out a physical inspection of the property before issuing an encumbrance certificate.

Step 7: While you would get updates on the progress of your application through SMSs from the Meeseva portal, you could also track the status on this portal.

Step 8: It takes 6 working days for the sub-registrar’s office to issue the EC.

Telangana Government created a portal to enable citizens to access property-related services, such as encumbrance certificates or EC Telangana, EC search Telangana, stamp duty payment, registration fee payment and others.

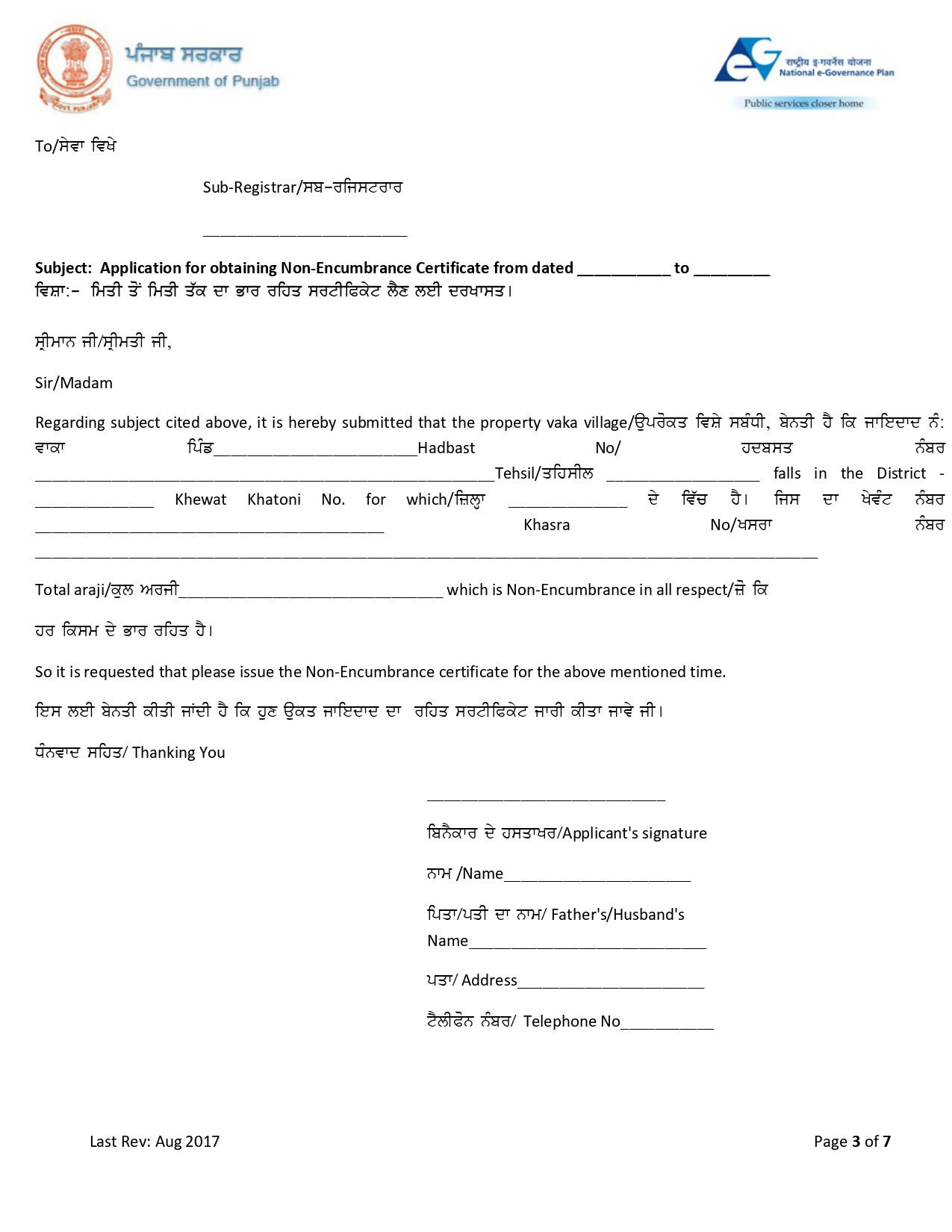

How to apply for encumbrance certificate offline?

- In states where ECs are not issued online, the applicant will have to visit the sub-registrar’s office where the property in question is registered.

- Write an application on a plain paper, clearly mentioning the information you seek.

- Submit the application along with duly filled Form 22.

- You will have to pay a nominal fee along with your application to get the EC. The fee would vary, depending on the period for which the EC is sought.

Fee for encumbrance certificate

There is only a nominal fee – charges vary from state to state and may range between Rs 200 and Rs 500 – that an applicant has to pay to get an EC. Charges might, however, vary depending on the period for which you are seeking information.

Encumbrance certificate fee in some states

| Delhi | Rs 200 |

| Andhra Pradesh | Rs 300 |

| Telangana | Rs 200-500 |

| Tamil Nadu | Rs 1-5 |

| Kerala | Rs 10 |

| Maharashtra | Rs 200-500 |

Modes of payment for encumbrance certificate

When you apply online for an encumbrance certificate you can use various mediums to make the payment. These include payment from debit or credit cards, e-wallets, internet banking, NEFT and RGTS, etc.

How much time does it take to get encumbrance certificate?

While it might take between 15 and 30 days to get an EC offline, the document is issued in matter of 6 to 7 days in states where the certificate is issued online. In Delhi, for instance, it takes 21 days to get an EC offline.

What is the period for which encumbrance certificate can be taken?

An encumbrance certificate could be taken for a period ranking between 12 and 30 years.

Why taking an encumbrance certificate is important?

The encumbrance certificate is among the many documents that establish that a property is or is not free from legal/monetary hassles. Buyers must demand the sellers show this document before they make a decision to purchase a property.

Is EC enough to make sure property is hassle-free?

While an EC is a crucial document that helps buyers get the information they need with regard to a property’s legal/financial position, a buyer must be mindful of the fact that not all the information and change of hand of a property might be registered in government records. This is to say, the government will be able to provide though EC only that information which it has received from the owner by way of registration. If a transaction is not carried out personally without proper registration, the EC issued by the Sub-Registrar’s Office would obviously not reflect that information.

Aside from making sure that the EC is made available by the seller, the buyer must also apply due diligence and make personal checks to ensure that the said property is free from any encumbrance. While the documentary proof does act as a safety net, land-related frauds, especially in plot sales in rural areas, are quite common. Unfortunately, such buyers are also not able to move the RERA as these transactions do not fall under the purview of the Real Estate Regulatory Authority.

Difference in encumbrance certificate, occupancy certificate and completion certificate

These the three documents—the encumbrance certificate, the occupancy certificate (OC) and the completion certificate (CC)–are crucial for property purchase and serve different purposes.

The OC certifies that a building is for habitation by the residents. The CC is an official statement that the structure has been created in compliance with the rules. While a CC is issued by the local authority to a builder after the completion of a building in compliance with the building plan and other regulations. The local authority issues an OC stating they have no objection in allowing the possession of the project.

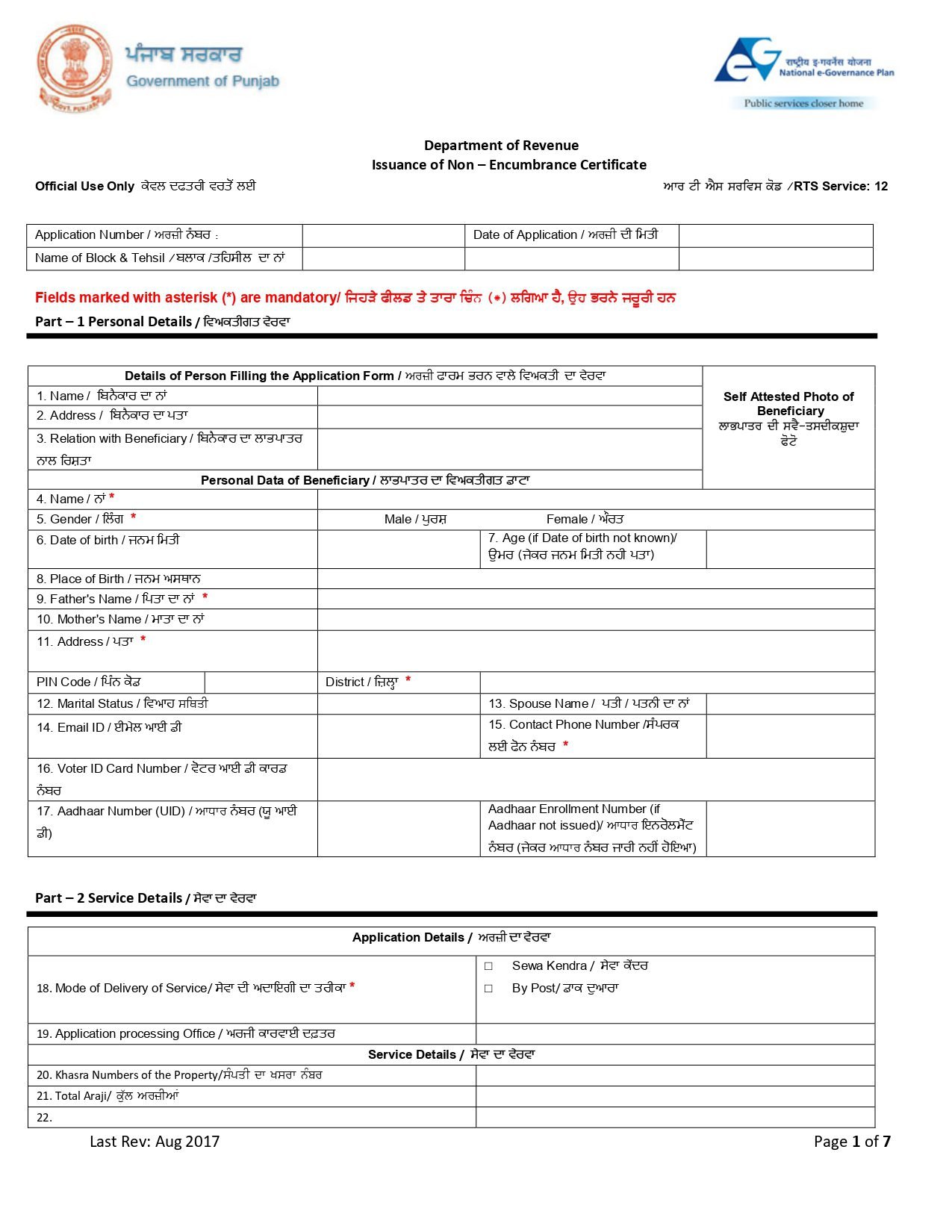

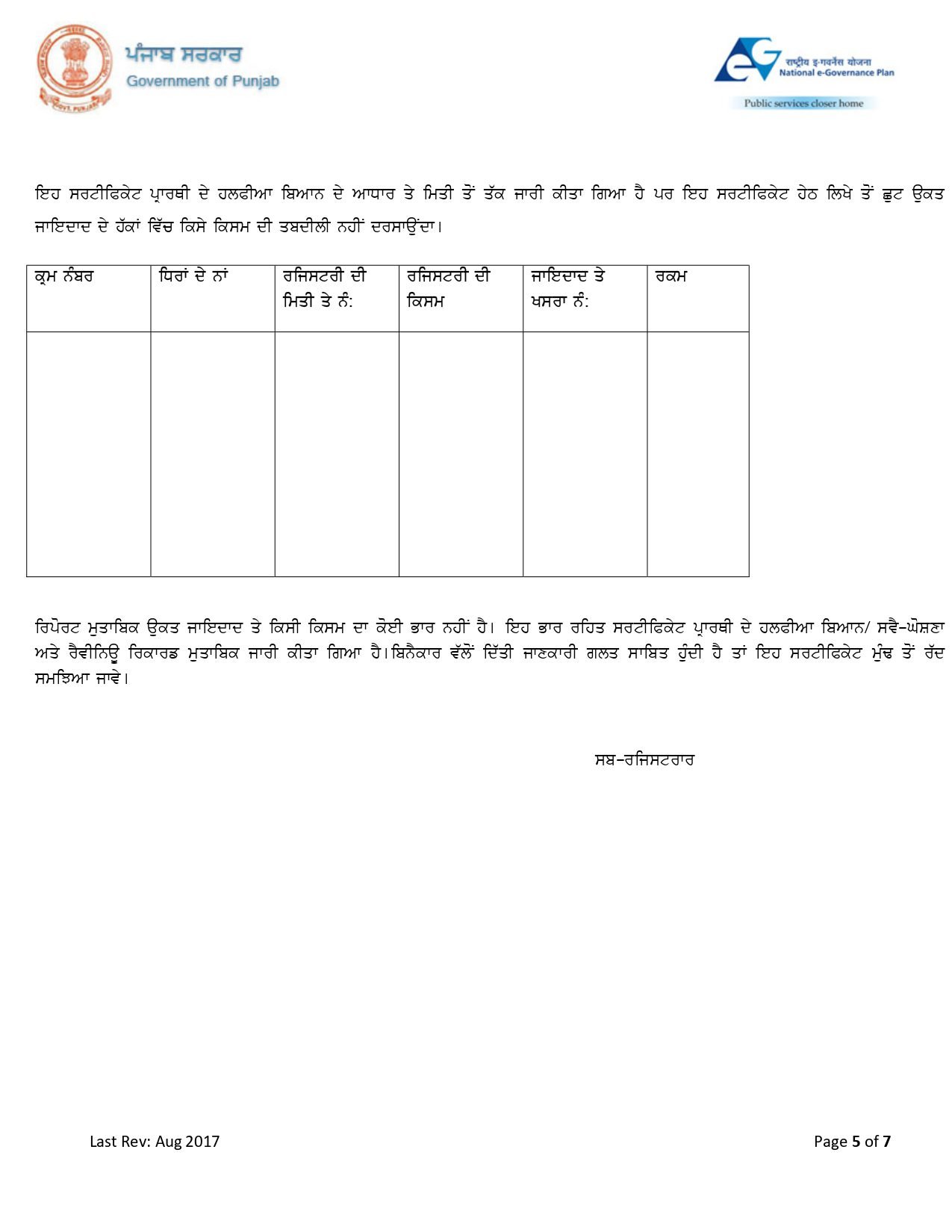

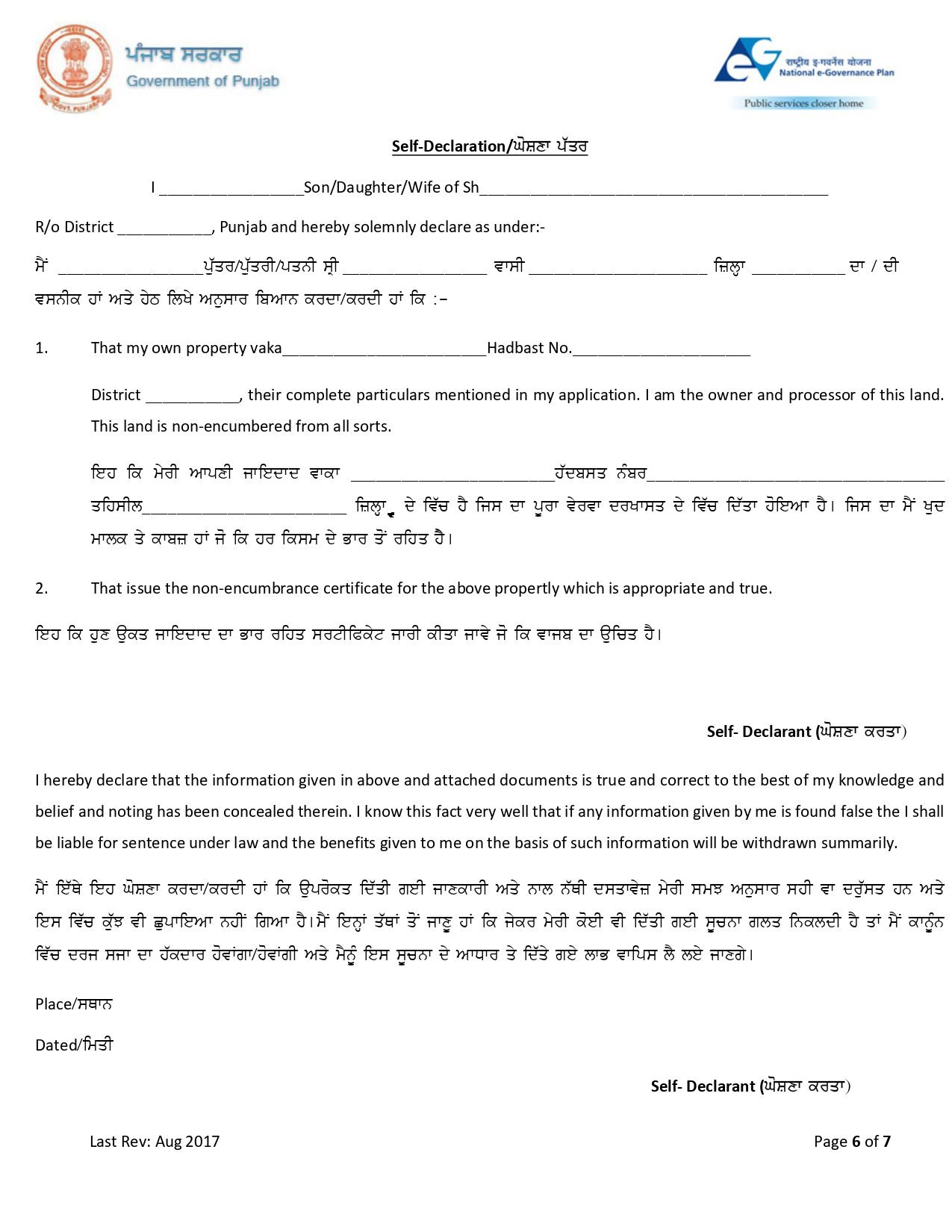

Format for owners to apply for EC

Property owners have to follow a standard Performa while applying for an EC. If you are a property owner applying for an EC in Delhi, for instance, click here to find the encumbrance certificate application format.

APPLICATION FOR ENCUMBRANCE CERTIFICATE/CERTIFIED COPY.

| 1.Name of the Applicant | |

| 2. Address & Telephone No. (if any) |

Details of Property

| 1.Name of the Village | ||||||||

| 2. Name of the street | ||||||||

| 3.Old Survey No/Sub.Div.No | New survey No/Sub divn.No. | Block No. | Ward No. | T.S.No | ||||

| 4.Old Door No. | New Door No. | Plot No. | Flat No/Flat

Name |

|||||

| 5.(a) Extent of the site | Total Extent | Conveyed extent | Undivided share | |||||

| 5(b)Built up area | ||||||||

| 6.Boundaries (North) | ||||||||

| (South) | ||||||||

| (East) | ||||||||

| (West) | ||||||||

| 7.Name of the declared owner

Father name |

||||||||

| 8.period of search – No of

years |

Period

from |

To | ||||||

In the case of certified copy furnish the following partic ulars also

| 9.Name of the executant | |||||||

| 10.Name of the claimant | |||||||

| 11.Doc.

No |

Year | Book &

Vol. No |

Page No | ||||

Note I: As against column survey No. the Resurvey No.(R.S.No.) or the ground Survey No.(G.R.No) shall be entered. Block and ward refers only Survey Block and Ward. In the case of properties affected in partition Deed details from Column 3 to 8 to be given separately. In the case of Town surveyed properties the corresponding previous O.S.No. /G.R.No. shall also be furnished in the relevant column.

Note II: In the case of Copies of wills and Authorities to adopt, copies can be issued only to the executant or in the case of death executant, to any person against the proof of the death of the executant.

Note III: In the case of documents filed in Book IV such of powers of Attorney etc., the copies can be issued only to the person executing or claiming through the documents.

Date: Signature

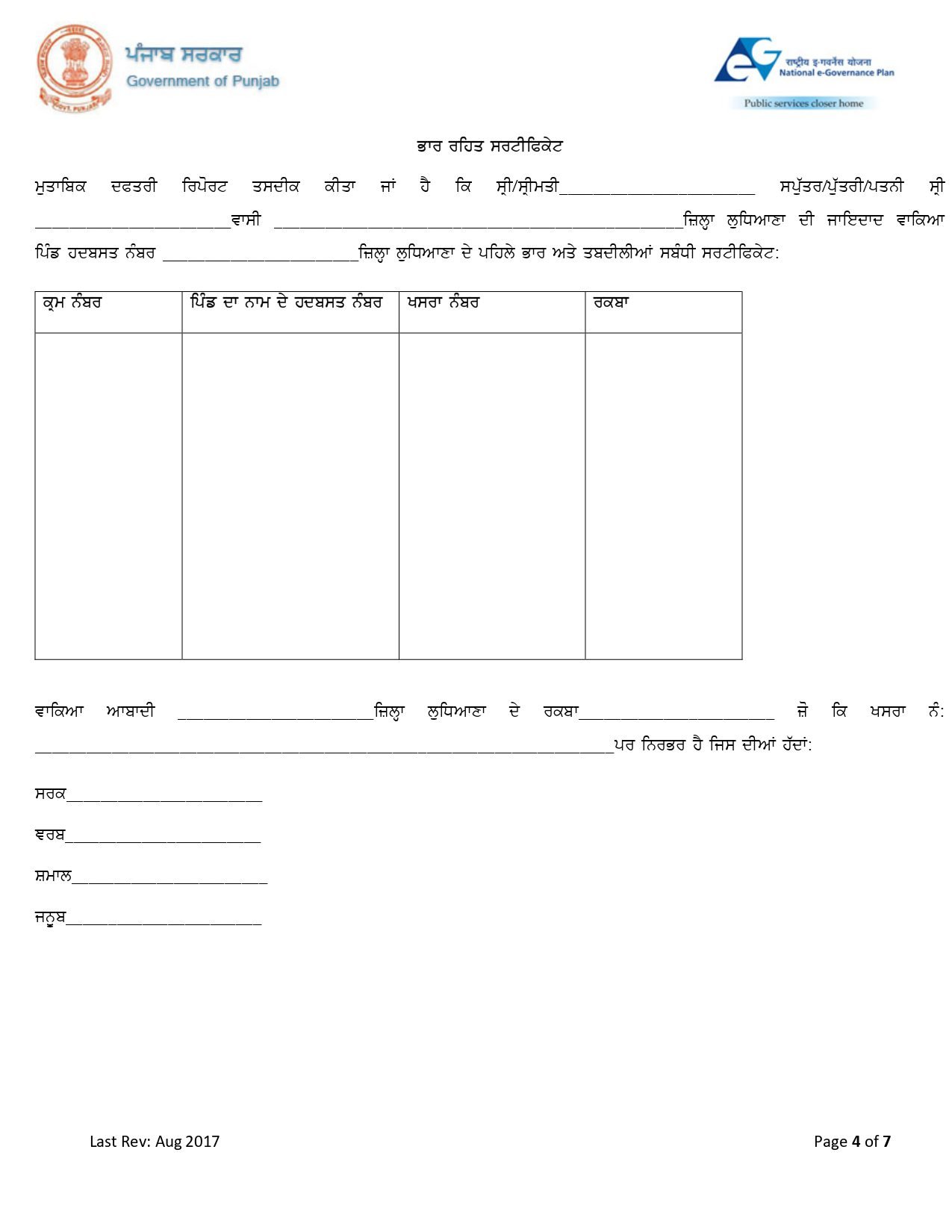

Encumbrance certificate sample 1

Encumbrance certificate sample 2

FORM-6A

NON-ENCUMBRANCE CERTIFICATE

[See rule 13(10)]

No. of

This is to certify that the Land allotted under Land Settlement Certificate No.

of which is to be mortgaged by the allottee is free from encumbrance as far as the records maintained in this office would indicate.

Dated:

Place:

Signature of Issuing Officer

FAQs

Do I need EC for plot purchase?

Yes, a buyer should seek encumbrance certificate whether he is buying a plot of a residential building such as flat, apartment, etc.

Do I need EC for flat purchase?

Yes, a buyer should seek encumbrance certificate whether he is buying a plot of a residential building such as flat, apartment, etc.

What is Form 22?

Form 22 is the standard performa used to apply for an encumbrance certificate.

How can I get encumbrance certificate online?

In majority of states, applicants have to visit the sub-registrar’s office.

Which states issue encumbrance certificate online?

Barring a few states, encumbrance certificates in India are mostly issued offline. States that issue encumbrance certificates online are Andhra Pradesh, Odisha, Kerala, Puducherry, Tamil Nadu, Telangana and Uttar Pradesh.

Is an encumbrance certificate needed for inherited property?

Yes, an encumbrance certificate is needed for inheriting property.

Is an encumbrance certificate needed for gifted property?

Yes, an encumbrance certificate is needed for gifting property.

How long will it take to get an encumbrance certificate?

It takes 15 to 30 days to get an encumbrance certificate.

How many types of encumbrance certificates are there?

There are two types of encumbrance certificates: Form 15 and 16. Form 15 is issued for property with encumbrances. Form 15 is issued for property without encumbrances.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]