The Pimpri Chinchwad Municipal Corporation (PCMC) is the municipal body that covers Pimpri, Chinchwad, Akurdi, Nigdi and the north-western part of Pune city. The PCMC looks after the functioning of the areas in this jurisdiction. One of the major revenue generators for the PCMC is the PCMC Property Tax. This money is used to develop the areas by providing them with social infrastructure and amenities. The PCMC was established in 1982 and it is the responsibility of the PCMC to collect property tax from new industrial areas of Pimpri, Bhosari, Chinchwad, Akurdi etc. In this guide, we list key points about the PCMC Property Tax 2025 such as its calculation, online and offline payment and grievance redressal.

What is the PCMC Property Tax?

The PCMC Property Tax is an annual tax that a property owner has to pay to the Pune-Chinchwad Municipal Corporation (PCMC). A very important revenue source for the local body, the PCMC uses this money for providing basic essential services. Property owners need to pay half-yearly PCMC Property Tax to the corporation, which can be easily done online. In fact, the PCMC was one of the first civic bodies to collect PCMC Property Tax digitally. If this tax is not paid, the property owner will be penalised and the property can be attached by the local body too.

Under the Pimpri Chinchwad Municipal Corporation (PCMC) Property Tax jurisdiction, properties that have been purchased between 2006 and 2023 are considered as new properties. The PCMC Property Tax varies between Rs 17.18 per sqft to Rs 31.44 per sqft.

For tax collection purposes, the PCMC administrative regions are divided from A to H with the presence of 4 electoral offices and an Assistant Municipal Corporation Office.

Types of properties covered under Pimpri Chinchwad Municipal Corporation

The properties that have to pay the PCMC Property Tax are:

- Residential properties: These include independent apartments, flats, condominiums etc.

- Commercial properties: These include structures used for business and commercial aspects such as shops, office spaces, retail spaces etc.

- Industrial properties: This include warehouses.

- Vacant land: Even if the vacant land is undeveloped, a property owner has to pay the property tax for this.

PCMC Property Tax 2025: Important facts

| New properties as per PCMC | Properties bought between 2006 and 2023 are considered new |

| Property tax rate varies between | Rs 17.18 per sqft to Rs 31.44 per sqft |

| Property tax to be paid for April 1, 2025 to September 30, 2025 | Due date is May 31, 2025 |

| Property tax to be paid for October 1, 2025 to March 31, 2025 | Due date is December 31, 2025 |

| 10% property tax rebate | PCMC Property Tax should be paid between April 1 and May 31 and the amount should be more than Rs 25,000. |

| 5% property tax rebate | PCMC Property Tax should be paid between April 1 and May 31 and the amount should be less than Rs 25,000. |

| Penalty | 2% per month all the property tax amount that has not been paid. |

| Regions under PCMC | Pimpri, Chinchwad, Akurdi, Nigdi and north-western Pune city. |

| Official website | https://www.pcmcindia.gov.in/index.php |

| Languages offered on PCMC portal | English and Marathi |

| Helpline number | +91 020-67333333 |

How to view PCMC Property Tax Bill 2025?

- Log on to https://www.pcmcindia.gov.in/e-seva.php

- Under Residents tab on the page, click on Property Tax.

- You will reach https://publicptaxpcmc.in/

- Enter registered mobile number or property id and click on search. Note that Property id is a unique 10 digit number attached to your PCMC property. By feeding this number, all details regarding your property can be accessed.

- Once you identify property, enter property details by entering the zone number, Gat number and owner’s name.

- Click on ‘Show’ option, to view your PCMC property tax bill.

- Search for ‘Total Amount to Pay (Amount with Concession-Fajil Amount)’ in the property tax PCMC bill. This is the amount you have to make as PCMC Property Tax payment, for the April-September and October to March period. You can also download the PCMC Property Tax bill.

Self-assessment: How to calculate PCMC Property Tax 2025?

The method used to calculate the PCMC Property Tax includes factors such as property type, location, size, age and usage of the property.

PCMC Property Tax= Built-up area (in sqm) X base unit rate X property type rate X property age factor X property usage factor where

- Built-up area is total built-up area of the property measured in sqm

- Base unit rate depends on type of property and location

- Property type rate which depends on the type of property- commercial, residential or industrial

- Number of years that has passed by after construction of property

- How the property is being used.

Method 1

A capital based valuation technique is used by the PCMC to calculate the PCMC Property Tax that has to be paid for a property. So, basically, the PCMC Property Tax is calculated on the basis of the market value of the property. This method is prevalent in Mumbai.

Method 2

An alternative method is to calculate tax based on per square feet valuation of the property. For example, this method is used in Kolkata.

Method 3

You can calculate the property tax on the basis of the rent the property will fetch.

All properties including vacant land in Pimpri, Chinchwad, Akurdi, Nigdi and north-western Pune city have to pay property tax.

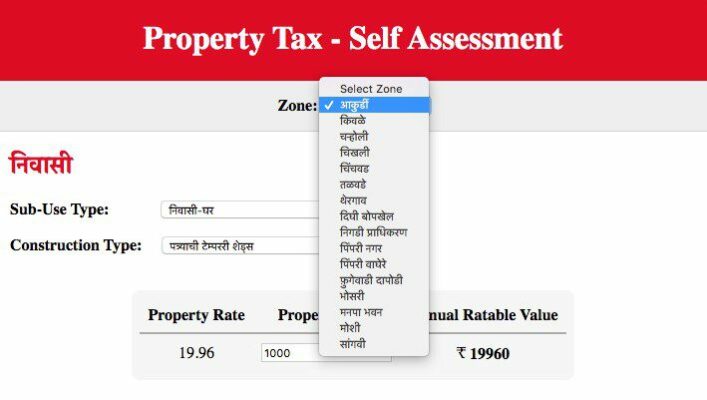

Step 1: Visit the PCMC Property Tax-Self Assessment Portal.

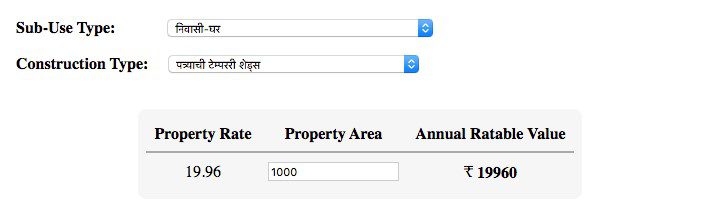

Step 2: Choose the zone and scroll down if you want to calculate property tax as a resident or NRI or for commercial property.

Step 3: Select the sub-use type, construction type and type in the property area.

Step 4: Your property tax amount will be calculated.

What is property id?

Property id is a unique 10 digit number attached to your PCMC property. By feeding this number, all details regarding your property can be accessed.

How to know the status of assessment of the PCMC Property Tax?

To check the assessment status of PCMC online, follow the below mentioned steps.

- Log on to PCMC website

- Click on residents on the PCMC homepage

- Select self-assessment of property

- You will be redirected to another page where you should click on assessment status

- You will reach another page where the application number should be entered

- Click on ‘view application button’ and you can see the application status displayed.

Factors impacting property tax

- Location: The location of the property is a key factor impacting the property tax calculation. Properties located in prime localities have higher property tax rates.

- Property value: The assessed value of the property, which is determined by the local government or tax assessor, is a major factor impacting property tax rates.

- Property type: The type of property, whether residential, commercial or industrial, will determine property tax rates. Property tax rates for commercial and industrial properties are typically higher compared to tax rates on residential properties.

- Property’s age and condition: Older properties are likely to have lower values and lower property tax rates.

How to view PCMC property tax bill?

For PCMC Property Tax bill view online in 2025, visit the PCMC India portal at https://www.pcmcindia.gov.in/e-seva and click on ‘Resident’, from the top menu.

Select ‘Property Tax’ option. You will reach

- Enter property id number or mobile number and click on search

- You will have to enter property details by entering the zone number, Gat number and owner’s name.

- Click on ‘Show’ option, to view your PCMC property tax bill.

- Search for ‘Total Amount to Pay (Amount with Concession-Fajil Amount)’ in the property tax PCMC bill. This is the amount you have to make as PCMC Property Tax payment, for the April-September and October to March period. You can also download the PCMC Property Tax bill.

How to download PCMC property tax receipt (PDF) 2025?

On successful payment of the PCMC Property Tax, the PDF of the e-receipt will be generated online. You need to save this as this will act as proof that you have paid the Property Tax. This will also play a major role in solving legal battles.

In case of any technical glitch while making the payment, you may check the bank account if the money has been debited and you have not got the receipt. In case the money has been debited, you will get the bill or the money will be credited back in 3 days.

How to track PCMC property tax bill status?

Check from the payment gateway

If the PCMC Property Tax has been made using credit card, debit card or net banking, you can track the payment status through its payment gateway or bank account. Check for transactions around the date of payment and you can know if it’s successful or rejected.

Check your PCMC Property Tax bill online

Check the PCMC Property Tax bill online and see if Amount Due is 0 or paid. If it is so, then you have paid the PCMC Property Tax bill.

What are the documents required for paying PCMC Property Tax?

- Proof of property ownership: Documents such as sale deed, property agreement, etc.

- Owner details: Owner name, contact number, address

- Identity proof: A government-issued identification such as Aadhaar card or voter ID, passport.

- Previous property tax receipt: Latest property tax receipt verifying the tax payment history and assessment details.

- Property details: Property ID and property’s description such as property’s location, size and usage (residential or commercial).

- Payment details: Bank payment details or card payment details.

- Encumbrance certificate: This document is required if the property is mortgaged.

- Details of rented property: In case the property is rented, then details of the tenant are required for calculation of property tax.

How to pay PCMC property tax bill online?

-

Log on to https://ptaxservices.pcmcindia.gov.in/onlinepayment

-

If you click on Fast payment, you can pay by scanning QR code or entering UPIC ID/ Mobile number/Old property number. Once done, click on search for property and you will get all details regarding Pimpri Chinchwad Property Tax. Proceed to pay the property tax bill of PCMC.

- If you click on property no., select divisional office from drop down box, group no, property no. and click on search for property.

Once you view your bill, move on to pay the amount using any of the online payment option.

What are the problems you can face while paying PCMC Property Tax online?

Payment failure: This may happen if there is any server error from the bank’s side or if there is insufficient balance in the bank.

Technical failure: Many times you may not be able to proceed with the payment because of technical issues in the PCMC website.

Incorrect information: While paying the PCMC Property Tax, if you feed incorrect property id details or other such mandatory information, the will be a problem with the payment.

What to do if PCMC Property Tax receipt is not generated?

In case the receipt is not generated on the PCMC website due to some technical problem while making PCMC property tax online payment, check your bank account and pay accordingly.

If money is deducted from your bank account and your property tax receipt is not visible, it will take three working days for the PCMC receipt to be available on the PCMC property tax website.

How to pay PCMC Property Tax offline?

- You can make the PCMC Property Tax payment offline by visiting the local ward office that is near the property.

- Fill the application form and attach supporting documents.

- Pay the bill using credit card, debit card, cash, cheque, demand draft or UPI and get the acknowledgement and get the acknowledgement.

How to link property with mobile number?

On https://publicptax.pcmcindia.gov.in/index.php , click on link your property with mobile number. Enter Zone no, Property No, Group no, increased and click on next and proceed.

See also: All about house tax Delhi

What is the last date for PCMC property tax 2025?

The PCMC Property Tax can be made in two instalments. The first one for the period (April to September) has to be paid by May 31 and the second one ( October to March) has to be paid by December 31. The PCMC has applied a late fee of 2% starting October 1 for people who have defaulted on paying the PCMC Property Tax for the April to September period.

What is the discount of PCMC property tax payment?

If the entire property tax is paid by May 31, the following rebates are available:

| Condition | Rebate | Date |

| For residential properties/ non-residential/open plot specifically registered as residential building | 10% discount on general tax, if the annual rateable value is up to Rs 25,000 or

5% discount, if the annual rateable value is more than Rs 25,000 |

April to May 31 |

|

Residential properties with solar, vermiculture and rain-water harvesting |

5%-10% discount, depending upon the number of projects installed. |

April to May 31 |

Note that PCMC also gives rebates on property tax for women property owners and owners who are ex-servicemen.

50% discount for ex-servicemen and freedom fighters: Properties owned by ex-servicemen, freedom fighters, their wives and women can avail this. By way of reducing the tax, the PCMC supports post-service lives of these people who contribute towards national security.

40% rebate for persons with disabilities: People with more than 40% disability can avail a 40% rebate on property tax on properties that are registered in their name. This is to provide financial assistance to people who have challenges already with respect to disability.

The PCMC is also offering a rebate of 2% to all property owners who have paid property tax consecutively for three years without any default. This is applicable in the fourth year and is over and above all rebates offered by the PCMC.

How to avail PCMC property tax concession 2025?

- Go to https://ptaxservices.pcmcindia.gov.in/CitizenLogin and click on property tax concession.

- If your mobile number is not linked to the property then it can be added by clicking on Add mobile number to property.

- Click on Search button to search property using UPIC ID, Mobile Number or Old property number. Enter the OTP that will be sent to the registered mobile number.

- After the property screen opens, click on “Apply for property tax discount

- Check the exemption applicable according to your property type (Individual / Society / Private Educational Building).

What is the penalty for late payment of PCMC Property Tax?

A fine of 2% per month will be charged by PCMC on delay in payment of PCMC Property Tax. If not paid for a year, it can go up to 24%.

PCMC Property Tax 2025: Illegal construction penalty waiver certificate

Click on Illegal construction penalty waiver certificate on https://publicptax.pcmcindia.gov.in/. You will reach http://103.224.247.135:8081/PropertyTaxService/?wicket:bookmarkablePage=:com.pcmc.propertytax.ptaxservices.IllegalShastiNOCLogin

Enter mobile no., email and click on next and proceed.

PCMC 2025: Other property tax services

Property tax services such as property tax concession, property tax NOC, property abstract, self assessment and property transfer are among the many services that can be used on the PCMC website.

How to change name on Property Tax record?

The process of getting your name changed in the official PCMC property tax record is simple and can be done by the applicant if all the necessary documents are in place. Keep these documents handy:

- Latest property tax receipt.

- Attested copy of the sale deed, which should be in the name of the applicant.

- No-objection Certificate from the housing society.

- Application form, which is available from the property tax office

Fill the application form and submit it with above documents to the Commissioner of Revenue at the PCMC office. The application will be verified and the records will be changed in 15-20 working days.

What is the name change fee for PCMC property tax?

If you want to register a property, PCMC collects around 0.5% of the property’s value as registration fees or transfer fees. Next step is the name change for which the fee depends on the location, rules and regulations followed by the PCMC body. It is best to check with the PCMC beforehand on what the exact fee would be.

How to register complaint on about PCMC Property Tax?

All citizens can register their complaints related to the Pimpri-Chinchwad Municipal Corporation on the Suvidha platform. Users need to register themselves, to launch a complaint on the platform. The portal can also be used for tracking the status of complaints. All issues related to property tax, water tax, building plan approval, civil works and public establishment systems can be filed on the Suvidha platform.

See also: All you need to know about PCMC Sarathi

PCMC Property Tax 2025: SUC

Street Waste Management User Charges (SUC) stands in the context for Service User Fee that is levied by municipal bodies on unusual services provided to a property.

The SUC covers value of water supply, sewage treatment, waste management and other municipal services. The SUC is calculated based on the size and type of property- residential, commercial, industrial) and size. It also depends on the municipality and local rules and regulations.

What are the properties which are exempted from paying the PCMC Property Tax?

- Properties for religious worship, public burials or cremation and heritage land.

- Any building that is used for charitable, educational, or agricultural purposes

- Residential structures of less than 500 sqft.

How to apply for PCMC building permission online?

- Go to PCMC website

- Click on e-services

- Click on Building Permissions

- Of the many options on the page, click on Submission of Building Plan for approval and you will be redirected to new page.

- Create username, password and proceed to provide building details such as area, amenities, details of construction. Once this done, your form will be verified and based on it approval will be given.

PCMC contact details

While the PCMC property tax payment process is simple and user-friendly, the payee can reach out to the civic body, in case of problems.

In case of any complaint regarding payment of property tax or for more information (only for property assessed in financial year 2024-25) contact toll free number 1800-833-2700 from Monday to Friday from 10 am to 6 pm (except government holidays)

Email: ptax.survey@pcmcindia.gov.in

Housing.com POV

Property tax is one of the most important revenues for the local municipal body. The PCMC has put in place a very easy and efficient system to make the PCMC Property Tax payment. It is always recommended for property owners to pay the property tax bill before the deadline. This way, they may be able to avail of the rebate (if any) offered by the municipal body. Failure to pay the property tax on time will unnecessarily lead to complexities such penalty for the time period that the property tax has not been paid for. Ignoring payment of the property tax PCMC for a long time will lead to problems such as attachment of property and eventually its auction.

FAQs

How do I fill my PCMC property tax online?

Visit the PCMC website and follow the above given procedure, to pay your property tax.

How to check PCMC property tax bill online?

You can view the property tax bill on the PCMC property tax website.

Is Ravet under PCMC?

Yes, Ravet falls under the PCMC's jurisdiction.

What is meant by PCMC?

PCMC stands for Pimpri-Chinchwad Municipal Corporation.

Is property tax applicable to vacant land?

Property tax is applicable on all kinds of properties, including the vacant land.

In case of joint ownership who is responsible to pay property tax?

All owners of a property are responsible for paying property tax.

How do I find my PCMC property tax?

Go on https://www.pcmcindia.gov.in/ to find the exact property tax that you have to pay for the property that you own in the PCMC jurisdiction.

How do I change my name on my property tax in PCMC?

You can change the name by submitting the following documents along with the filled application form-Paid e-receipt of the latest property tax, copy of sales deed in the applicant’s name that is duly attested by the official department, NOC from the housing society .

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |