NMC offers rebate on online property tax payment

NMC is offering the pay online and get 5% rebate on property tax scheme to property owners in Nagpur. The scheme was announced by the Nagpur Municipal Commissioner Radhakrishnan B in Budget FY23-34. According to a ToI report, 4598 people have paid the property tax totaling to Rs 19.89 lakh, thus availing this benefit. Additionally, these people will also get 10% rebate on property tax for payment of property tax before June 30, 2023.

NMC property tax offices open on weekends and government holidays till March 31,2023

Collection Centre and Civil Office Property Tax Collection Centre under Nagpur Municipal headquarters for paying NMC tax for property will be open on all Saturdays, Sundays and government holidays from February 4 to March 31, in order to help Nagpur citizens to pay property tax and collect the target property tax for FY22-23. All the 10 zonal offices under the Nagpur municipality will be open all days except March 7, 2023 which will be a holiday.

Nagpur property tax

Property owners in Nagpur have to pay Nagpur property tax (NMC property tax) year, depending on the location of their property. NMC tax is a major source of revenue for the Nagpur Municipal Corporation. The Nagpur Municipal Corporation is also looking at revising the NMC property tax rates under the MMC ACT in the new financial year 2022-23. Under the MMC Act, a civic body has the powers to increase the property tax rate every year. NMC property tax was last revised in April 2015.

See also: Everything about PCMC property tax bill 2021-22

NMC property tax: Services

Mentioned in this article is the way to proceed with paying your NMC property tax Nagpur online and an elaboration on related information on NMC property tax.

For NMC tax, on the homepage of Nagpur Municipal Corporation, click on the ‘Services’ tab and select ‘Property Tax’ from the drop-down menu to pay property tax bill online. You will be led to a host of options regarding NMC property tax as shown in the picture below.

Alternatively, for NMC tax log on to https://www.nmcnagpur.gov.in/property-tax where you will be led directly to the NMC property tax page.

See also: How to use Chennai property tax calculator

Before proceeding with paying your NMC property tax Nagpur online, there are a host of NMC tax associated details that you may want to view.

See also: AP house tax

NMC property tax Nagpur online: How to pay?

Click on the ‘Pay Tax and Generate Receipt’ tab to pay your Nagpur Property tax.

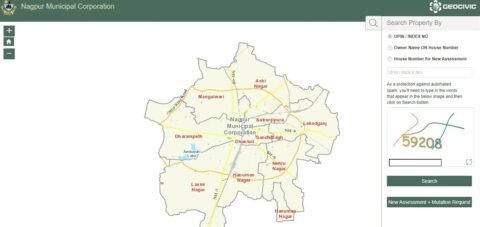

You will be led to another page where you have to enter your NMC property tax index number/UPIN or owner name/house number or house number for new assessment.

After this, you will be directed to a page where all the information of the person who has to pay the NMC property tax will be displayed. On the right-hand side of the NMC property tax Nagpur online page, you will see a tab which has the ‘action’ button. In that, there will be a dropdown box on the ‘Choose’ button. On that click on ’Pay Tax’ to proceed with payment for NMC tax. Then, you will get all information about NMC property tax, including how much money has to be paid as Nagpur property tax, etc.

. Then, you will get all information about NMC property tax, including how much money has to be paid as Nagpur property tax, etc.

See also: Everything about building tax Kerala

Here you will also be able to see an option for paying advance NMC property tax for five years. Note that payment of advance NMC property tax is optional. Citizens can also choose to pay Nagpur property tax or NMC property tax only for the current year.

If you want to avail of NMC property tax rebate offered by the Nagpur Municipal Corporation, click on the box that says ‘full’ and ignore the box that says ‘partial’. (Rebate is offered only on full payment of the NMC property tax.) After this, the final amount to be paid as NMC tax for property, after availing of the rebate, will be displayed on the screen which has to be paid using the NMC property tax Nagpur online payment options.

You can make the NMC property tax Nagpur online payment through UPI facility, credit card or internet banking. Once the NMC property tax Nagpur online payment is done, you will receive a receipt, acknowledging the payment. Please save or take a print of your NMC property tax Nagpur online payment for future reference.

See also: Know how to pay property tax GVMC

NMC property tax demand

To know your NMC property tax Nagpur demand, click on the ‘View Your Property Tax demand’ and you will be led to https://geocivicnmcapp.nmcptax.com/CitizenServices/CitizenTax/index.html .

Here, you have to enter your

- UPIN or index number for NMC tax related to property or

- Owner name or house number or

- House number for new assessment

- Then, enter House number for new assessment

- Select ward

- Enter captcha

- Click on ‘Search’ to get the tax demand.

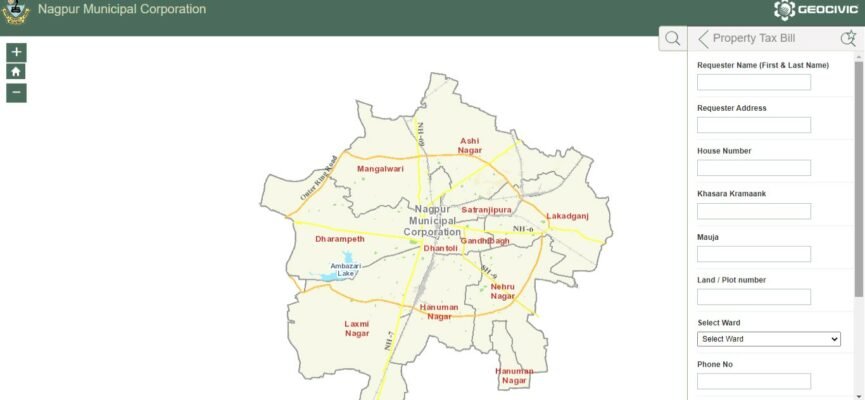

For New assessment + mutation request, click on that box.

Here, enter

- requester name

- requester address

- house number

- khasara kramaank

- mauja

- land/plot number

- select ward

- phone number

- mobile number

- make payment

- Click on ‘ Create Request’

See also: Everything about GVMC water tax online

NMC tax property last receipt

In case you have not saved your last NMC Nagpur property tax receipt, you can check the same by clicking on ‘Check your tax last receipt’. You will be led to a NMC Nagpur property tax page like the one shown below, where you have to enter the index number for property tax Nagpur and press on ‘view receipt’. It will give you all NMC property tax online payment details about your previous property tax Nagpur transaction.

See also: IMC Indore Municipal Corporation property tax and citizen services: All you need to know

NMC property tax: Property verification

To do an online assessment of your NMC property tax, click on the Online-Assessment-Verification-Using-Property-Details tab. You will be led to https://geocivicnmcapp.nmcptax.com/CitizenServices/CitizenTax/ which will open to an NMC property tax page that shows the map of Nagpur and you can search and verify the coordinates.

See also: Mysore city corporation property tax online payment: A step by step guide

You can search the property for paying NMC tax by UPIN/ Index number or owner name/ house number or house number for new assessment for NMC property tax. Enter the captcha and press on search.

all about: UP Road Tax

Property tax Nagpur: Annual Letting Value

To calculate the NMC property tax Annual Letting Value (ALV), click on Calculate your ALV or a small button beside it saying ‘Click Here’. You will be directed to a NMC property tax google spreadsheet where you can enter the values and calculate the annual letting value real time. A sample of the Annual Letting Value calculation on NMC property tax page is shown below.

NMC property tax: How to calculate?

Under the guidance of the Maharashtra government, the Unit Area System is being used by the NMC to calculate the NMC property tax. So, the annual value multiplied by the rate of tax, is equal to the Nagpur property tax.

As it is based on the unit area system, Nagpur property tax depends on location of the property, built-up area, the age of the property, occupancy type and finally the type of the property. So, property tax Nagpur in an area in the outskirts of the city may be less and the tax of properties in the city center may be more. Mentioned below is a sample of the total NMC property tax calculated that includes general tax, sewerage tax, sewerage benefit tax, special cleanup tax, general water tax, water benefit tax, fire service tax, road tax, education tax, tree tax, education cess, EGS cess and big residential building tax that combine to become the total property tax annually.

See also: All about Thane property tax payment

NMC property tax: What happens if you do not pay on time?

Unless there is a relaxation announced by the Nagpur Municipal Corporation (NMC), failure to pay NMC property tax or Nagpur property tax within the due date will attract a penalty of interest of 2% per month, applicable for the entire time period of default in payment.

See also: All about the Nagpur Improvement Trust (NIT)

NMC property tax grievance management

For any NMC grievance redressal that citizens seek, with respect to their Nagpur property tax, they can register their complaints on the Nagpur grievance management system. You have to register yourself first with the system and lodge the NMC property tax complaint. You can then view the status of your Nagpur NMC property tax complaint.

NMC property tax contact details

For all queries related to Nagpur Property Tax or NMC property tax related services, you can contact:

Nagpur Municipal Corporation

Mahanagar Palika Marg,Civil Lines,

Nagpur, Maharashtra,

India- 440 001

Telephone: 0712 2567035

Fax: 0712 2561584

E-mail: [email protected] / [email protected] / [email protected]

Check out: Nagpur Pin code

FAQs

Where can you get your index number for property tax Nagpur from?

Index number for property tax Nagpur can be found in the previous year’s property tax receipts.

Under which department does the NMC property tax fall?

The Nagpur Municipal Corporation is responsible for managing the Nagpur property tax.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]