To make rental agreements legally binding, the leave and licence agreement is required to be stamped and registered. They must also pay a stamp duty for licence registration. As stamp duty is a state subject, all states have different rates and laws dealing with stamp duty. In this guide, we will discuss the law applicable on stamp duty and registration of leave and licence transactions in Maharashtra.

What is stamp duty?

Stamp duty is an amount that the parties involved in a transaction have to pay to government bodies (these could be civic or development bodies), in order to get the document registered in the government’s records. Along with the stamp duty, they are also liable to pay a registration charge.

Stamp duty provisions

The basic framework of stamp duty is laid down in the Indian Stamp Act, 1899, which authorises the states to modify the same, as per their needs. Accordingly, the government of Maharashtra passed the Bombay Stamp Act, 1958. The payment of stamp duty on leave and licence agreements, is covered under Article 36A of the Bombay Stamp Act, 1958.

What is leave and licence agreement?

Section 52 of The Indian Easements Act, 1882, defines leave and licence agreements. According to this section, “Where one person grants to another, or to a definite number of other persons, a right to do, or continue to do, in or upon the immovable property of the grantor, something which would, in the absence of such right, be unlawful, and such right does not amount to an easement or an interest in the property, the right is called a license.”

See also: Lease vs rent: Main differences

In Maharashtra, leave and licence agreements are required to be stamped, with a flat stamp duty rate of 0.25% of the total rent for the period. In case any non-refundable deposit is also paid to the landlord, stamp duty at the same rate shall be charged on such non-refundable deposits, as well.

In order to reduce the incidence of stamp duty, people used to pay a significant amount as interest-free deposit, along with nominal rent. This lacuna has been plugged and now, in cases where any refundable deposit is collected by the landlord, a notional annual interest of 10 per cent is imputed on such interest-free deposit and you have to pay stamp duty at the same rate, on such interest for each year of the term of the licence agreement.

The rate of stamp duty for leave and licence agreements is the same for residential premises, as well as for commercial premises. The leave and licence agreement can be executed, for a period not exceeding 60 months.

See also: What is Stamp Duty Rates & Charges on Property?

|

Housing.com has launched a fully digital and contactless service, to create rental agreements. If you would like to complete the formalities in a quick and hassle-free manner, all you need to do, is fill out the details, create the Rent Agreement Online, sign the agreement digitally and get it e-stamped in seconds. |

Registered rent agreement cost: Stamp duty payable on a rental agreement

Monthly rental x No of months = A

Advance rent for the period/non-refundable deposit = B

10% x Refundable deposit x No of years of the agreement = C

Total amount subject to stamp duty = D = A+B+C

Stamp duty = E = 0.25% x D

For example, if you enter into a leave and licence agreement for 24 months, with a monthly rent of Rs 25,000 and a refundable deposit of Rs five lakhs, you will have to pay a stamp duty of Rs 1,750 (being 0.25% on rent of Rs six lakhs for two years and interest of Rs one lakh for two years).

The registration fee for a tenancy agreement in Maharashtra, depends on where the property being let out, is located. The registration fees are Rs 1,000, if the property is situated under any municipal corporation area and it is Rs 500, if the same is in a rural area. In the absence of any agreement to the contrary, the cost of stamp duty and registration charges is to be borne by the tenant.

The stamp duty on rent agreement you pay in Mumbai is governed by the Bombay Stamp Act, 1958. The stamp duty on the lease agreements is applicable across all cities in Maharashtra. The leave and license agreements should be stamped with a stamp duty charge of 0.25% of the total rent for the period. The rent agreement registration charges, that is the rate of stamp duty is the same for residential properties and commercial properties for a period up to 60 months.

Online rent agreement registration in Maharashtra

Here is how to register the rent agreement online. Before registering rent agreement online in Maharashtra, the individual has to create a profile on the official website.

*Go to the e-filing (https://efilingigr.maharashtra.gov.in/ereg/) website.

*Select “District of Property” as ‘Pune’.

*Click “New” to create your profile registered under the e-filing website’s database.

Property details page

*Post successful creation of the profile, the site redirects you to “Property Details Page”

*Enter details of property like Taluka, Village, Property type, Unit Area, Address and other details as available on the e-filing website’s “Property Detail Page”.

*Save the furnished details.

*Upon successful completion, a token number will be generated. Applicants needs to use this token number as your user ID for next login.

In the next step, you need to enter ‘party details’

*Fill in the information required-

*Save the details added.

*Fill second party details by clicking ‘Add : Party Details’ and save the changes

*Click Next: Rent & Other Terms

Rent & Other Terms

Enter owner and if applicable, tenant details.

Stamp duty

The applicant can pay the stamp duty charges and fees online by generating an online challan receipt. Stamp duty calculation is generally derived basis a few particulars that need to be mentioned while registering a property:

*Complete address of the property

*Name of the landlord, occupant, and if applicable, the previous occupant/owner.

*If the property has already been included in a city survey, include the CTS number.

*If said property is in the outside town or a land parcel then name of the geographical area where same is located, like Revenue village or name of Taluka.

See also: All about Mahabhulekh 7/12 Satbara utara

Schedule an appointment

Post successful payment of necessary fees, the applicant needs to book an appointment with the sub-registrar. Arriving at the sub registrar’s with the necessary documents in print ensures that successful registration of the applicant’s property is conducted swiftly.

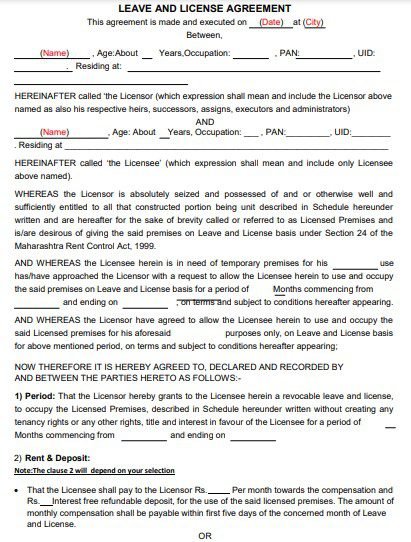

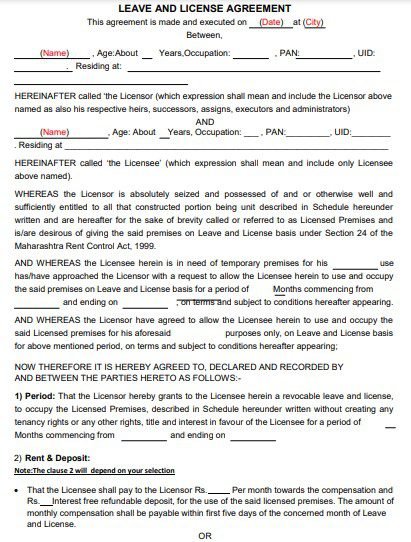

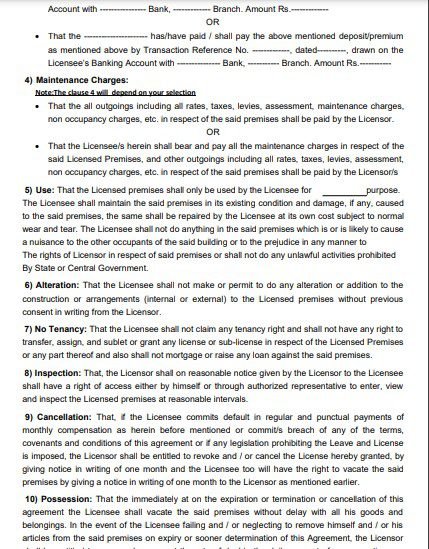

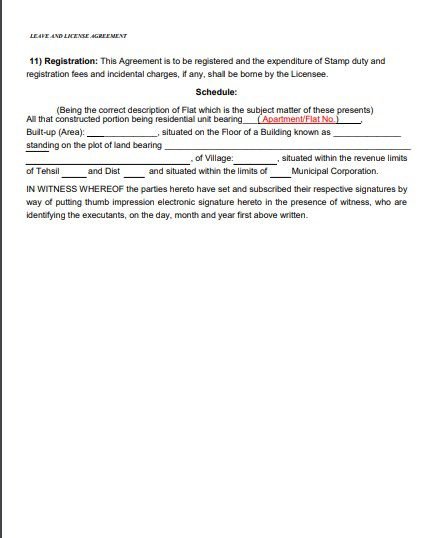

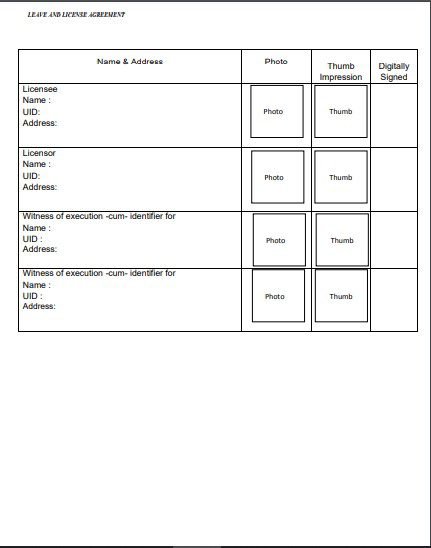

Maharashtra: Leave and license agreement form

Stamp duty in Maharashtra: Ways to pay

Stamp duty in Maharashtra can be paid by three methods- e-stamping, non-judicial stamp paper and franking.

The non-judicial stamp paper procedure has all details regarding leave and license that has to be signed by the executants and registered with the SRO within 4 months.

In case of franking, one has to print an agreement on plain paper and submit to the bank. Next, the bank will process documents with the help of franking machine.

However, note that not paying stamp duty is not an option. If you are found to not having paid the stamp duty, heavy penalty will be charged.

Registration provisions for rental agreements

As per Section 17 of the Indian Registration Act, which applies to the whole of India, every agreement for leases of immovable property from year to year, or for any term exceeding one year, are required to be registered mandatorily. So, unless the state laws provide otherwise, each and every leave and licence agreement for a period of 12 months or more, has to be registered.

However, for Maharashtra, the law has been made more stringent and as per the provisions of Section 55 of the Maharashtra Rent Control Act, 1999, every agreement of a tenancy or leave and license has to be in writing and the same also needs to be mandatorily registered, irrespective of the period of tenancy.

It is the responsibility of the landlord to ensure registration of the rental agreement, failing which, the landlord may have to pay a penalty of Rs 5,000, as well subject himself to imprisonment upto three months. In case the agreement for leave and licence is not registered and any dispute arises between the landlord and the tenant, the terms and conditions of the agreement as contended by the tenant shall be taken as the true and correct conditions on which the immovable property has been given on rent, unless it is proven otherwise.

For registration of the agreement, you will need some basic documents of the tenant, landlord and the witnesses, such as a passport-size photograph, a photocopy of identity proof (e.g., PAN card) and electricity bill or property document like Index II or tax receipt of the property being let out.

Is rent agreement mandatory in Maharashtra?

Rent agreements are critical for solving disputes that arise between landlords and tenants. Usually, in Maharashtra, the rent agreement is made for a period of up to 11 months, as it is necessary by law to register a rent agreement if the agreement period is more than 12 months. If you are looking for a home on rent in Maharashtra, it is essential to know the applicable stamp duty and registration charges for rent agreement in Mumbai, Pune and different cities. You can also make use of facilities with respect to rent agreement creation provided by Housing.com, which is quick and not cumbersome.

Is registration of rent agreement compulsory in Maharashtra?

As per Section 17 of the Indian Registration Act, which applies to the whole of India, every agreement for leases of immovable property from year to year, or for any term exceeding one year, are required to be registered mandatorily.

Draft Model Tenancy Act

States may soon start enforcing the provisions of the Model Tenancy Act 2019, as the centre aims to provide a more binding stature to the policy by way of turning it into a law. The draft has been put in public domain and suggestions have been invited on the policy till October 31, 2020. After this period, the model policy may be the vision document, based on which states will come up with their own tenancy laws. If that happens, Maharashtra’s rental market will also undergo significant changes. The move will, in fact, unlock a large number of homes in the rental housing market.

On November 25, 2020, Durga Shanker Mishra, secretary, Ministry of Housing and Urban Affairs, said that the new Act, once implemented across states, would release over one crore vacant houses locked in the clutches of the old Act and promote investments into the real estate sector.

How is stamp paper value to be paid for rent agreement decided?

Stamp paper value is decided on the property’s location and agreement duration. Also, annual rent of the property also is used to determine the rent agreement.

Word of caution for tenants and landlords

While the state has simplified online payment for various facilities, all parties involved in a deal must make sure they do not involve unauthorised third-parties while completing digital transactions. Try and complete the online transaction either with the help of a trusted family member or friend or under the guidance of your lawyer or financial advisor.

Most importantly, entering into tenancies without giving the agreement a legal validity through the execution of a lease agreement, would be a bad idea, especially keeping in view the instances of wrongdoings in Mumbai’s rental real estate market.

FAQs

How to calculate stamp duty on rental agreement?

The formula to calculate stamp duty on rental agreement is 0.25% x D, where D is (Monthly rental x No of months) + (Advance rent for the period/non-refundable deposit)+ (10% x Refundable deposit x No of years of the agreement).

What is the cost of registered rent agreement?

The registration fee for a tenancy agreement in Maharashtra, depends on where the property being let out, is located. The registration fees are Rs 1,000, if the property is situated under any municipal corporation area and it is Rs 500, if the same is in a rural area.

What are the documents required for registering rent agreement?

For registration of the agreement, you will need some basic documents of the tenant, landlord and the witnesses, such as a passport-size photograph, a photocopy of identity proof (e.g., PAN card) and electricity bill or property document like Index II or tax receipt of the property being let out.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]