Gone are those days, when credit cards were perceived as instruments that would force you to overspend. Technology has shaped the usage of credit cards in a very helpful way. Now, you can use credit cards to pay bills, acquire cash or even transfer rent to your landlord. For those who face liquidity issues at the end of the month, paying rent through credit cards, can offer substantial relief. Not only will you be able utilise your unused credit limit, you can get other benefits and advantages, as well.

1. Get reward points on your credit card

You must be aware of the deals and discounts that your credit card provider offers. Unlike cash transfer, credit card expenses can earn you additional reward points that can be redeemed, in exchange for flight tickets, shopping vouchers or even travel packages. In addition to this, you can also earn attractive deals, coupons and offers from India’s top retail and online brands on these rent transfer apps, to sweeten your experience further.

2. Boost your credit score

If you have unused credit on your card, your credit score may be affected, because of under-utilisation of your credit line. By using your credit card frequently for large transactions, you not only earn rewards but also keep your credit score high. However, you need to make timely payments, to maintain the high credit score. You can also opt for the EMI moratorium on your credit card payments, offered by your bank under the guidelines issued by the Reserve Bank of India (RBI).

See also: Rental agreements go completely digital with Housing.com

3. Stress-free timely payments

In a situation, where the salary is credited after the rent due date, tenants often find it hard to maintain the funds to make timely transfers. With credit card rent transfer feature, you can use your credit to make timely payments to your landlord and pay the bill on time, as well, using your salary.

This could be understood by following example: Suppose your rent due date is the first of every month but your salary gets credited on the seventh. You may not be able to convince your landlord to wait till the eighth, to transfer the rent. In such cases, you can use your credit card limit to transfer the rent on time. If your credit card bill generation is on 15th and the due date falls on the 4th of the next month, you would effectively be deferring your rent payment by almost a month.

See also: Here’s why you should use your credit card to pay rent

4. Easy bank transfer

Unless you are doing IMPS or UPI payment, bank transfers are time-consuming and involve a lot of hassles. However, apps that facilitate rent payment using credit card transfers the amount immediately, with minimum formalities. You can also automate these payments, for easy transfer every month on a certain date. Once the transfer is completed, you and your landlord will get the notification through SMS.

Check out: What is IFSC code

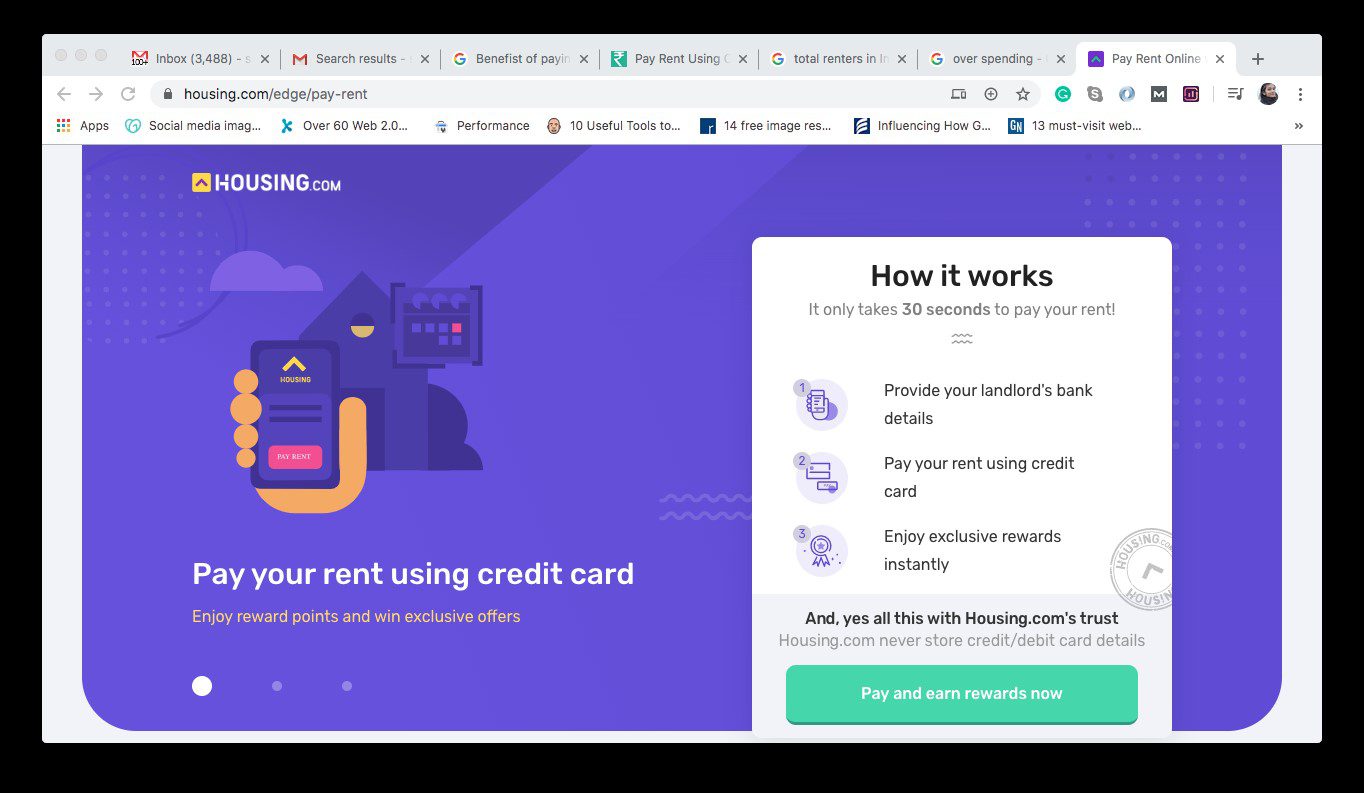

Housing.com Pay Rent

There are many apps available in the market that can enable you to pay rent online, using your credit card limit. One such app is the Housing.com Pay Rent feature that provides instant transfers, along with loads of benefits and offers. With the Pay Rent feature, you can generate rent receipts instantly, for claiming HRA. The Pay Rent feature is available for credit card, debit card and UPI payments. Along with this, you can get a whole range of offers and deals from leading brands, in addition to your credit card reward points. You can try the Housing.com Pay Rent feature here:

FAQs

What are the benefits of rent transfer through credit card?

You can accumulate reward points on payment made through credit cards, to buy deals and vouchers.

Should you pay your rent with a credit card?

Yes, paying rent through credit card can earn you a lot of benefits.

How can I pay my rent with credit card in India?

You can use Housing.com’s Pay Rent Feature to use credit card for rent transfer.

Surbhi is an experienced content marketing expert for over nine years now and has contributed articles and research insights for top real estate portals. She is a journalism graduate and has keen interest in politics, urban development and infrastructure studies. Surbhi is a bookworm and delves into historical fiction and inspiring biographies when she is not sleeping.

Facebook: https://www.facebook.com/surbhi.gupta2406/

Twitter: https://twitter.com/surbhi2406

Linkedin: https://www.linkedin.com/in/surbhi-gupta-82159b63/

Quora: https://www.quora.com/profile/Surbhi-Gupta-17

about.me: about.me/surbhi.gupta/