Like all other sectors of the Indian economy, cement has been hit hard by the Coronavirus pandemic and has seen the entire supply chain disrupted. Cement dealers across the country expect a significant slackening in sales, elongated credit period to retailers and higher working capital needs, in the wake of the COVID-19 pandemic this fiscal, reveals a survey by CRISIL Research. The survey was conducted with over 100 dealers, spread across tier-1 and tier-2 centres in 13 states, to glean insights on the pandemic’s impact. Trade channels account for nearly 60% of annual cement sales.

Coronavirus’ impact on constructions by individual home builders

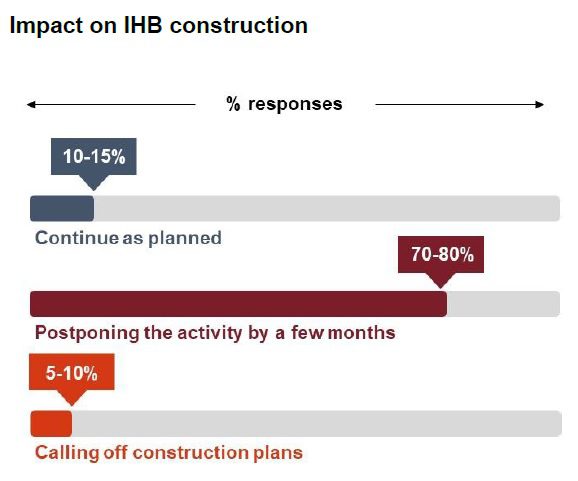

A whopping 93% of the respondents said they expect volumes to shrink by 10%-30% in fiscal 2021, in the base case scenario, i.e., if the lockdown is eased in May 2020. Extension beyond this can worsen these figures. Also, 70%-80% dealers felt individual home builders (IHBs) would delay new constructions, due to the gloomy business outlook, fear of income loss, labour shortage and uncertainty with respect to resumption of normalcy.

How the COVID-19 pandemic will affect cement inventory

Over 60% of dealers are holding low inventories (two to four days), but spoilage concerns persist. Dealers are hopeful of liquidating inventory, by offering discounts as soon as the lockdown eases, to contain spoilage and to get volumes going. On the other side, payment delays from retailers appear inevitable, considering that these players are small and fragmented and most likely to delay payments amid the liquidity crunch, gloomy demand outlook and cement spoilage concerns. This, in turn, would stretch the receivables cycle and negatively impact cash flows of the dealers, as much as 95% of whom offer credit.

Says Rahul Prithiani, director, CRISIL Research, “The cycle of recovery of retailer dues is expected to extend by four to six weeks, over and above the usual four weeks. This will potentially increase the working capital requirement of dealers by 12%-17%, even as they reduce credit exposure, infuse capital, and curb non-essential expenditure.” The elongated working capital cycle could last at least a couple of quarters, and the risk of retailers defaulting on payment dues would aggravate the financial pain. However, the collateral-free MSME loans announced by the government, will come as a big relief, since it will help cement dealers to access working capital debt.

How long will it take for the cement sector to normalise?

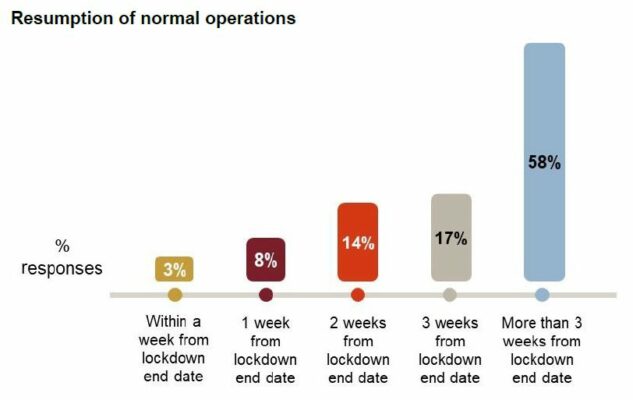

More than 90% of the dealers surveyed are hopeful of manufacturers’ support in terms of better margins/ incentives, or liquidity support to weather the hard times. However, chances of a swift revival after the easing of the lockdown remain bleak, with 58% of the respondents believing it will take over three weeks, for operations to normalise.

Says Guranchal Singh, associate director, CRISIL Research, “An intermittent rise in daily wages, freight cost, and construction material prices, will deter restart of construction activity. Return of labour, freight disruption and dwindling consumer confidence, will weigh on resumption of normalcy in the near term.” Improvement is envisaged in the second half, as demand picks up and receivable days gradually decline.

Impact of the migrant workforce on the cement industry

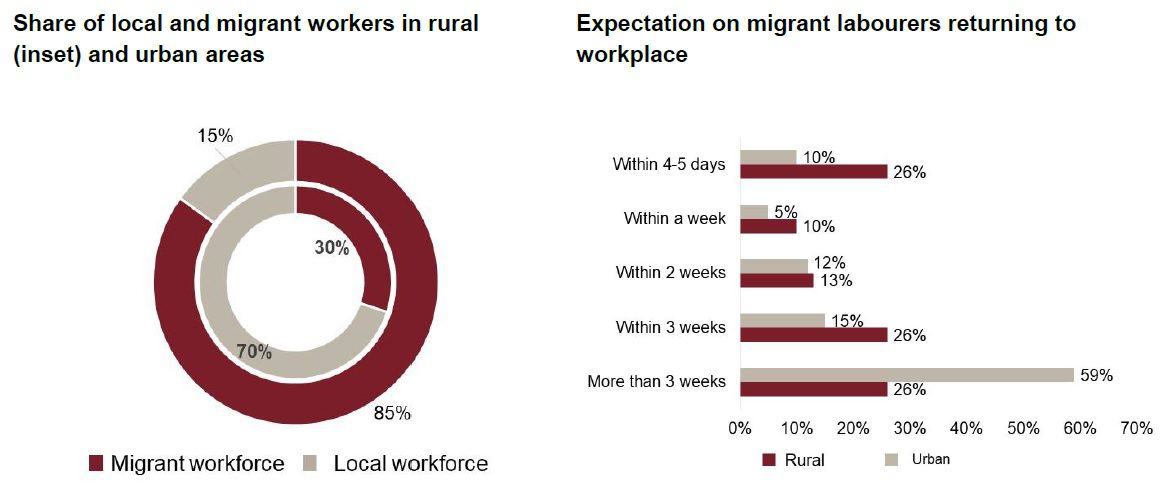

Recovery in urban areas may take longer, due to the extended lockdown, slowdown in real estate construction and higher dependence on migrant workforce.

A few dealers, though, are optimistic that the labourers, who have not been able to earn wages for nearly two months, would return quickly post-kharif sowing, to capitalise on pent-up demand and halted construction activity.

Key takeaways from the survey

- Almost all the dealers foresee a 10%-30% drop in demand in fiscal 2021, due to the delay/freeze in construction activity.

- More than 60% respondents have a minimal inventory of two to four-days but spoilage is a concern, nonetheless.

- The dealers’ credit cycle is likely to get stretched from four weeks to eight weeks, over the next two to three quarters.

- Working capital requirement is expected to increase by 12%-17% in a best case scenario, assuming dealers are able to limit operational expenditure, reduce credit sales and infuse additional capital in their business. A probable risk of retailers defaulting on payment dues, will aggravate the financial pain.

- Traders are hoping for manufacturers’ support, in terms of better margins (higher incentives).

- Chances of swift resumption to normalcy, post the unlocking look bleak, because of delay in return of migrant workers and resumption in freight operations.

- Urban centres are likely to fare worse than rural ones, given their higher dependence on migrant labourers.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]