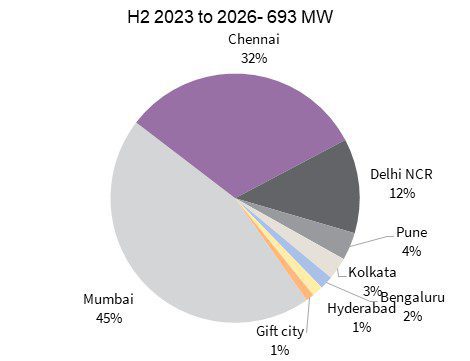

October 5, 2023: Increasing digital growth, Digital Public Infrastructure, 5G rollout and new applications of Artificial Intelligence (AI) like Machine Learning (ML) coupled with data protection laws and state incentives are expected to drive the Indian data centre industry growth with 693 MW capacity addition during H2 2023 to 2026, according to a report by JLL. This growth of the data centre industry is expected to create a real estate demand of 8.8 million square foot (msf) by 2026.

The capacity expansion would create demand opportunities across the value chain in real estate construction, hardware infrastructure, renewable energy, fibre connectivity, power infrastructure and skilled resources. Data centre infrastructure and real estate construction would require investments of $ 4.4 billion until 2026, said the report.

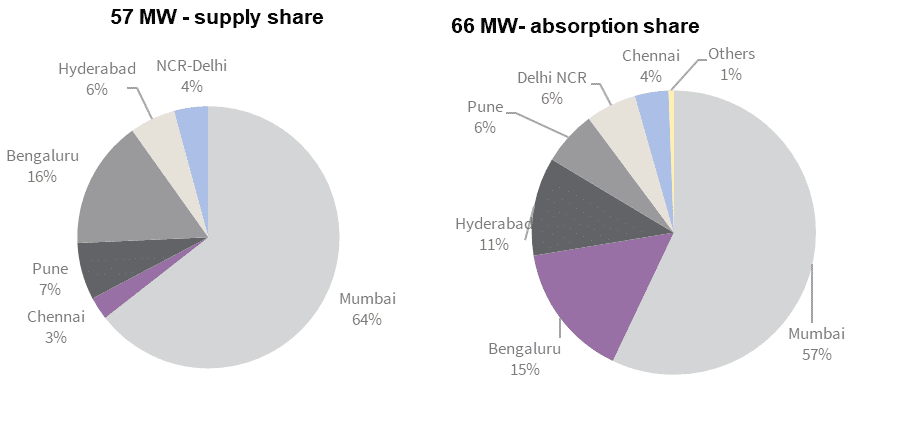

The Indian data centre industry added 57 MW during H1 2023, which is 34% lower than 86 MW added in H1 2023. The pandemic-related spurt in demand and delays in deliveries led to higher deliveries in H1 2022, while the first half of 2023 witnessed steady supply.

Source: JLL

Hyperscale Cloud Service Providers (CSP), the key segment for DC demand witnessed a breather in growth as compared to 2022 due to overall economic headwinds. However, they continued to absorb the pre-committed space due to expected ramp-up in public cloud services demand due to new technological growth trends. The shift in demand due to captive DCs by CSPs is yet to manifest and is expected to have a marginal impact on data centres.

H1 2023 witnessed an absorption of 66 MW as compared to 89 MW in H1 2022, a 26% decline due to demand moderation for public cloud services. However, the BFSI segment witnessed higher growth to align with regulatory requirements. Similarly, enterprise demand increased to save on capex costs. The advent of AI and ML applications, the rollout of 5G and the increasing usage of Internet-of-things devices signal a fresh set of demand emerging for the data centre industry.

Rachit Mohan, APAC lead- data centre leasing and head- data centre advisory, India, JLL, said, “India’s digital ecosystem has been at the threshold of a high growth phase with data centres being its foundation. The convergence of Digital Public Infrastructure, 5G rollout, AI-driven ML applications, IoT devices, edge computing, data protection laws, new cable landings, localisation of hardware and startup-led innovations will propel India’s digital growth. The recent technological and hardware partnership developments among leading players signal the huge growth potential. The potential demand from generative AI is gaining credence and is expected to grow substantially over the next 12-18 months driving demand for DCs”.

“The Indian data centre industry will undergo a transformation in terms of technological advancement and exponential demand growth. Data centre operators, existing and new entrants have been vying for this opportunity and are well-funded to meet this growth. The self-build facilities by cloud service providers will gain a foothold and support the country’s digital growth,” he added.

India’s 77% of new supply will come up in Mumbai and Chennai. India’s availability of renewable energy, skilled manpower, competitive costs and digital infrastructure make it an emerging global data centre hub. The interest evinced by the global players to establish a long-term presence in the Indian market on the technological and hardware front corroborates its potential. Indian data centre industry being the enabler of India’s digital transformation is expected to witness secular growth in the long term.

Source: JLL

Samantak Das, chief economist and head of research & REIS, India, JLL, said, “The first half of 2023 has been a period of calibration as the DC industry gears up for the next level of growth. The operational capacity of the Indian DC industry is expected to grow to 1,481 MW in 2026 from 778 MW as of H1 2023. Mumbai is expected to account for a 45% share of capacity addition followed by Chennai at 32%. This would require 8.8 msf of real estate space with investments of $4.4 billion for real estate constriction and DC infrastructure.”