A lot is at stake, as India’s residential real estate sector entered the festive season of 2021 on October 7, the first day of the nine-day Navratri festival, a period considered to be highly auspicious for new beginnings.

According to Anjana Sastri, director of marketing, Sterling Developers, the festive season is historically the period that witnesses highest sales in the real estate industry, as it is considered auspicious for home buying. Buying a home during the festive season is believed to bring good luck and opulence. This is why people wait for this time of the year to make property investments.

Should you buy property during the festive season 2021?

While the centre has extended the timelines of its government-sponsored schemes to incentivise property investments, states have tweaked circle rates and stamp duty rates to lower the burden on buyers, after the COVID-19 pandemic. On its part, the banking system has made property investment affordable by bringing down mortgage rates to a 10-year low.

The stressed state of their monetary affairs in general notwithstanding, builders have also planned to offer mega discounts to property buyers, to lure them and make the most out of festive season 2021.

These decisions are pegged to have a positive impact on consumer sentiment in India’s real estate sector, the second-largest employment generator after agriculture.

See also: Festive season 2021: Factors that could boost India’s COVID-hit realty market

What type of projects will buyers prefer during festive season 2021?

After one-and-a-half years of forced restraint and unpredictability, following the Coronavirus pandemic, home buyers in India may be ready to invest in property, made confident by an economic turnaround in the recent past. Those who were forced to live in confinement in their small homes in big cities, may now be keen on investing in big villas along cities’ outskirts, while those who were left stranded in their rented accommodations during the lockdown may be keen on having a home of their own.

“With people being confined to homes in the new normal for a long period, the demand for homes with ultra-modern amenities will undoubtedly catapult in the upcoming festive season,” says Pankaj Bansal, director, M3M. To cash-in on the festive spirit and ramp up sales, his company has planned low-rise condominium homes for home buyers.

“Buyers are keen to have their own holiday homes as they look for social distancing, health, hygiene, safety and comfort under one roof. This can be attributed to the pent-up demand due to the lockdown, the evolution of real estate as a preferred investment class and the need for bigger spaces,” says Lincoln Bennet Rodrigues, chairman and founder, The Bennet and Bernard Company, which sells luxury holiday homes in Goa.

Home loan interest rates during festive season 2021

The fact that one can currently get a home loan at 6.50% annual interest and enjoy income tax rebates on home loan of up to Rs 5 lakhs over the repayment of the loan, only helps to boost the market.

“The upcoming festive season is going to be a gala event for home loan borrowers, with interest at an all-time low and top banks competing with one another, to offer attractive interest rates,” says Atul Monga, co-founder and CEO, BASIC Home Loan.

Monga also points out that this is the right time for a first-time borrower to invest, as low interest rates have increased the eligibility of the consumer.

To understand it simply, till now, the monthly EMI was Rs 50,000 for an eligible loan amount of Rs 60 lakhs, at an interest rate of 8%. Today, at the same EMI, the loan eligibility has increased to Rs 66 lakhs with an interest rate of 6.7% – the rate at which leading banks in India, including SBI, HDFC, ICICI Bank, are offering home loans, anticipating that buyers on the fence will make the decision to purchase during festive season 2021.

See also: Home loan interest rates and EMI in top 15 banks

Even as monetary worries continue to persist for mid-scale builders in the country, they are not shying away from launching discount offers, in the hope of an uptick in sales numbers. Industry estimates already peg home sales to see substantial increase during the three-month period between October and December 2021. This period covers festivals such as Diwali and Christmas and is considered the best time to sell anything in India, be it fast moving consumer goods or residences.

Karan Kumar, CMO, DLF, believes that there has been a remarkable change in the psyche of the Indian buyer, who is now more cautious, smarter than before and plans strategically before investing.

However, this is true for individuals who now feel secure about their income prospects. For those with dwindling incomes or uncertain growth prospects, housing remains a distant dream, despite India becoming the top market offering housing affordability. The lurking fears of a third wave of the Coronavirus pandemic only deepens their insecurities despite the overall upbeat festive sentiments.

FAQs

What festive offers are there in the real estate market in 2021?

Builders are offering flexible payment plans and several other freebies that are typical of their festive offer marketing pitch.

Are builders offering any price cut on property purchases in 2021?

While there has not been any significant decline in property prices, developers may offer GST and stamp duty waivers, to lower the cost of buying for buyers in 2021.

Will 2020’s festive season bring cheer to India’s COVID-19-hit housing market?

Will 2020’s festive period be the catalyst for change for India’s residential real estate that has been deeply impacted by the Coronavirus pandemic

October 16, 2020: Developers consider the period between October and December, as the most auspicious time of the year. This is when India’s much-anticipated festive season kicks-in, starting with Navratra, Diwali, Christmas and finally the New Year.

From a religious viewpoint, this period is considered as an opportune time for making new moves. Investments made during this auspicious period are believed to yield better returns. From an economic standpoint, making purchases during this period is prudent as one can avail of discounts and freebies that businesses offer, as they try to woo consumers.

For most businesses, nearly 70% of their full-year sales come in the third quarter of the financial year alone. “Sales performance during the festive quarter from October to December has always been 30% higher, in comparison to sales during non-festive quarters,” says Prashin Jhobalia, vice-president, marketing strategy, House of Hiranandani. Corporates, therefore, spend the bulk of their marketing budgets on creating awareness about their new products and discounts during this three-month period.

This year’s festive season kicks off on October 17, 2020, with the nine-day Navratra festivities. In spite of the general mood of gloom in the economy, owing to the Coronavirus pandemic, builders across the country are busy launching festive offers to attract buyers. The uncertainties of the pandemic have also highlighted the value of home ownership. “We are expecting the same this year, as conversions are likely to take place from the pent-up demand. Festive offers will also play a critical role in maintaining the sales momentum,” adds Jhobalia.

Will the Coronavirus impact real estate during the festive season?

“In India, we celebrate various festivals and each has its own importance. In the past years, the realty market has seen a significant uptick, during such festivals. Although Indian realty has witnessed some challenges due to the COVID-19 outbreak, the signs of revival have already begun to show,” says JC Sharma, VC and MD, Sobha Limited. In the residential space, enquiry levels are almost coming back to pre-COVID-19 levels, says Sharma, adding, “We expect the second half of the calendar year to show better results than the first.”

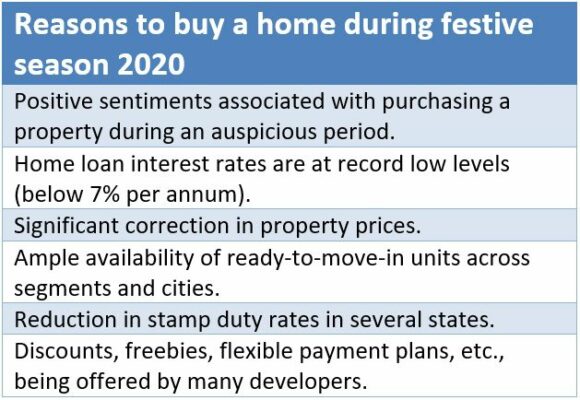

Should you buy property during the festive season 2020?

Monetary calculations indicate that this could be an ideal time to invest in property. Home loans are available at sub-7% annual interest rates and banks are also offering certain waivers, to cut down on the additional expenses in home loans. Even if developers are not conceding it, property rates have undergone a significant correction, especially in cities where builders are sitting on huge unsold stock. The market currently has ready-to-move-in stock across categories. Housing.com data show that there were over 7.23 lakh unsold housing units of all sizes, categories and price tags, across India’s eight prime residential markets as on September 30, 2020.

Some states have also tweaked stamp duty rates amid depleting revenue collections, to encourage buyers. In Maharashtra, Karnataka and Madhya Pradesh, registering a property would cost a buyer much less than it did before the COVID-19 crisis.

Builders have also come up with discounts, to tap the festive mood. This time around, most of these are crafted to suit the buyers’ payment needs, considering that many may be under considerable stress, because of the ongoing economic crisis.

See also: Why is this the perfect opportunity for property investment in India?

Festive season 2020: What are developers offering?

According to Bhasker Jain, head – sales, marketing and CRM, The Wadhwa Group, sales are likely to improve despite suffering a setback due to the pandemic in the previous quarters. “The residential segment looks very promising in the current scenario as many people, including those from the young generation, are now looking to own a house, rather than depending on rental accommodation. Owing to the pandemic, customers have now realised the importance of a well-planned, well-designed and well-ventilated home. These factors will help drive demand and boost sales in festive season 2020 and will be a key in ridding the sector of the ills caused by the virus,” says Jain, whose company has launched ‘Post-Paid Homes’ and ‘High-Rise Pay Wise’ plans, to attract home buyers in Mumbai, this festive season. “We understand that times are uncertain and customers are also facing liquidity issues. One would also want to have some funds for emergencies in such times. Thus, our offerings are explicitly designed to address these concerns,” says Jain.

While acknowledging that the pandemic has battered the economy, severely affecting demand, Ram Naik, executive director of Mumbai-headquartered The Guardians Real Estate Advisory, says his brokerage firm is experiencing burgeoning demand for projects across categories. “The realty sector, which was expected to suffer immensely and amid talks of a steep 20% price correction, has surprisingly shown signs of a revival,” he says.

On the Maharashtra government’s move to temporarily reduce stamp duty to 2%, Rajan Bandelkar, president, NAREDCO – west and convener of HousingForAll.com, says this unprecedented move will bring a new wave of home buying in the short run and change the demand-supply dynamics positively. Stating that the industry body has decided to completely waive the stamp duty on purchases to encourage investments, Bandelkar adds that it will result in substantial savings and a reduction in transaction costs for the end-users.

Naik concurs. “The Maharashtra stamp duty reduction has come as a shot in the arm for this sector. It has encouraged many customers to finalise their purchase. Developers on the other hand are offering better prices against early and increased payments,” says Naik.

According to Amit Jain, MD of Mahagun Group, while the lockdown period constrained project constructions, business activities started coming back to normal since the start of the unlock phase. The group has also launched various payment plans, waivers and freebies, to boost home sales in its various Noida-based projects. Ashok Gupta, CMD, Ajnara India, expresses similar views. “Due to an uncertainty in the market, multiple investment options became increasingly volatile. This further strengthened realty as a future asset,” says Gupta, adding that the festive season has always been an auspicious time for Indian buyers. To ‘leverage this renewed trust towards owning a property’, his company has also introduced various flexible payment plans to make home purchases lucrative. Developers in southern markets like Chennai are also offering discounts. Chennai-based builder Casagrand, for example, has launched discounts to offer more affordable homes to buyers in the Tamil Nadu capital.

According to Sharma, people have realised the importance of owning a home of their own, with the work-from-home concept becoming the new normal for many. This means that even though the external environment is still challenging, developers who can work within this framework and also look at opportunities to be tapped, rather than challenges alone, will benefit, he says.

What type of projects will buyers prefer, post COVID-19?

Developers who have ample ready stock, may be able to ring in higher value than those with under-construction properties. “We expect projects that are ready-to-move-in to outperform under-construction projects during the auspicious days of Navratri and Diwali. Developers of under-construction projects should look at offering subvention schemes, to attract demand from home buyers,” opines Naik.

How are builders facilitating sales during COVID-19?

Digital integration and virtual tours have been a boon for the real estate sector, says Harvinder Sikka, MD, Sikka Group. According to him, instead of coming to a complete halt, sales activities continued via social media, webinars and virtual meetings (during the Coronavirus-induced lockdowns). These exercises have also been instrumental in providing valuable insights into home buyers’ preferences, he says.

At the Wadhwa Group, clients are being provided with virtual guided tours, to examine properties. While stating that clients are quite comfortable with getting initial information and project walk-throughs online, Jain says, “We are also carrying out site visits with prior appointments, to regulate social distancing and ensure the safety and well-being of our customers and team members.”

Prospects for affordable and mid-segment housing

Despite an increase in inquiries, chances of real transactions from mid-segment buyers are low. “Salary cuts and job losses have impacted the mid-income home category, which is largely dependent on the service class. This segment is witnessing good inquiries but buyers here are troubled by reduced loan eligibility and approvals. The lockdown and its economic impact have forced banks to tighten their eligibility criteria and this has affected demand on ground,” says Naik.

Even though first-time home buyers purchasing affordable properties (priced up to Rs 50 lakhs) enjoy higher tax benefits under Section 80EEA of the income-tax law, this segment, which includes people employed in various organised sectors of the economy, has been among the worst affected, as millions of jobs have been lost amid challenges posed by the world’s biggest medical emergency in a century.

How can the real estate sector recover from the Coronavirus pandemic?

Sharma opines that the government needs to work closely with the realty sector and address key concerns. “This will help in reviving the economy. Realty players seek governmental support, in terms of reduced interest and GST rates, lower taxes on construction/raw materials, etc., so that they can pass the benefits to home buyers and thus boost the market sentiments,” Sharma says. “Developers also need funding at lower interest rates, so that the overall cost of the product remains low. Additionally, standardisation of stamp duty and ready reckoner rates across states, will also immensely help, in the current situation,” he adds.

Tips for buyers, for investing during the festive season

Buyers having the means to make purchases, must be mindful of certain facts before investing in property during this festive season. Jain advises that buyers should take into account the developer’s reputation and execution capability, as well as the project’s connectivity, accessibility, planning and design and amenities being offered.

“There are various enticing offers and discounts that are being doled out by developers to push demand during the festive season. Several reports and past experiences have shown that there is always an increase in the number of enquiries during this period. It helps if appropriate research is done about the developer, price on offer, previous delivered projects, timelines met and quality of product, without getting carried away by unrealistic discounts alone,” says Sharma.

- While virtual tools help buyers to narrow down their choices, it is highly recommended that a buyer makes a physical visit to the property before finalising a decision.

- In case the property is under-construction, ensure that it is a RERA-registered project.

- While selecting lenders, buyers should not simply pick the one that offers the lowest interest rate. Instead, choose a bank that has traditionally been more forthcoming in passing on rate-cuts and other benefits to the end-user.

- The customer must also be watchful about the fringe costs that lenders impose.

- In the prevalent situation of uncertainty, keep the loan to its minimum in order to keep your liabilities within manageable limits.

Never underestimate the power of communication as a tool to guard your interest. Extremely difficult market conditions have ensured that both, builders and lenders, have warmed-up to the idea of sitting across the table and negotiating the rules of the transaction with a more open-minded approach. You would be surprised with the outcome of such negotiations, says Brajesh Mishra, a Gurgaon-based lawyer.

Festive offers available to home buyers in 2020 |

| Ajnara India |

| Easy payment plans: 10:90 payment plan for those booking a unit at Ajnara Daffodil; 30:40:30 payment plans for buyers at Ajnara Ambrosia; 20:20:20:20:20 payment plan for Ajnara Fragrance. |

| Bhutani Group |

| Assured returns: 50:25:25 plan on all its commercial projects in Noida. Buyers can deduct the annual return of three years from the down payment amount. |

| House of Hiranandani |

| Free rentals: Rentals of two years for any apartment purchased in Bengaluru. |

| Free consumer durables: Consumer durables and home furnishings are among other festive offerings for its project in Chennai. |

| Wadhwa Group |

| Post-paid homes: Buyers can book ready-to-move-in properties at four Mumbai-based projects of the company by paying 10% of the property cost. They do not have to make any payment till July 2021. |

| High-rise, pay wise: Buyers can book under-construction homes at three Mumbai-based projects of the company by paying just 10% and can avail of a payment holiday for one. |

| Siddha Group |

| EMI holiday: Across its five projects in Kolkata’s BT Road, Rajarhat, Khardah and Madhyamgram, Siddha Group is offering ready-to-move-in homes for a booking amount of 20%. Buyers do not have to pay any EMI for the house till April 2021. |

| Gaur Group |

| Mauke pe chauka: Payment plan with 10% down-payment within 30 days, 40% in one year and the rest at the time of delivery. |

| Freebies: Book flats at Gaur Siddhartham and Gaur City and get free laptops, washing machines, mobile phones, microwaves, video doorbells, refrigerators, chimneys, etc. |

| Migsun Group |

| Possession-proof homes: Book homes at the company’s Ghaziabad and Greater Noida projects at 10% and pay 90% on possession; 1% assured penalty per month in case of delayed possession. |

| Sikka Group |

| Easy payment plan: At Sikka Karnam Greens in Sector 143 B, Noida, the group is offering a 40-60 payment plan, while other charges have been waived off. |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]