July 25, 2023: India’s operational flex stock will reach 106 million square foot (msf), doubling again over the next five years, says a joint report by JLL-Smartworks.

According to the report titled India’s Flex Space Market – The brightest star in the CRE galaxy, the country’s operational flex stock has risen to 53 msf ft across the top seven cities, occupying around 839,250 seats. This equates to an overall office stock penetration level of around 4.7%, making it among the fastest-growing flex markets globally.

“Enterprises cutting across origin, scale and industry segments are looking to integrate flex in their portfolios, from housing their flagship offices to high-end R&D teams and business functions. Notably, the space taken up by enterprises (converted to per seat basis) in flex has risen by 3.2X from FY21 to FY 23, to a record-high number. Further, the enterprise seat take-up recorded in FY 2023 is higher compared to the combined FY 2021 & FY 2022 numbers. Bengaluru, Pune, and Delhi NCR have been the three biggest markets during the past three financial years, combining for a ~ 60% share of all enterprise seats taken up during that period,” says the report.

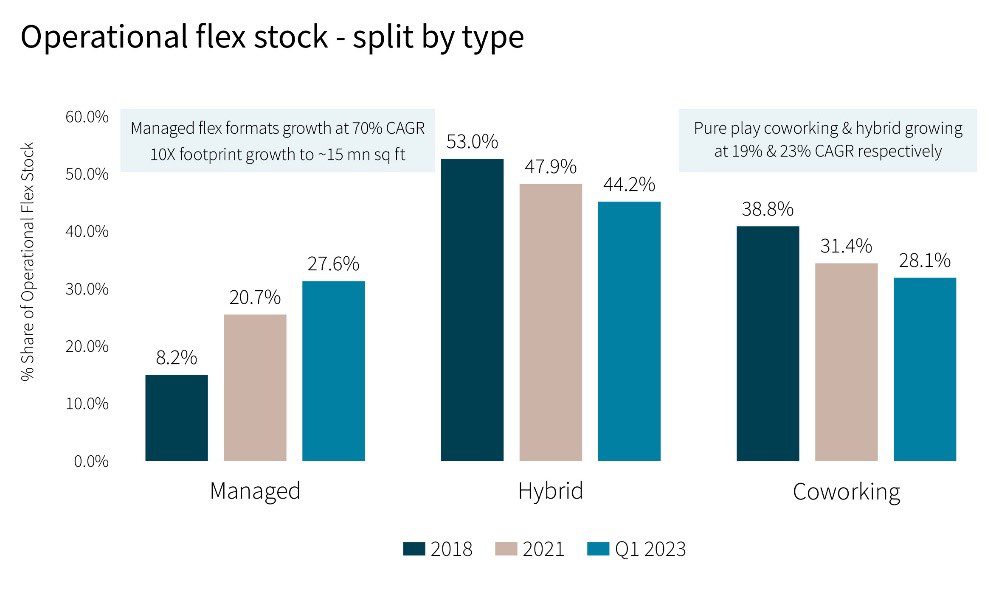

Pure-play managed space providers have been the drivers of the flex resurgence post-Covid, seeing their share grow by 3.4X over the same period. The managed space operators have seen their operational footprint grow by 10X to 15 msg ft till March 2023 compared to 2018. However, hybrid players still hold the largest share, accounting for a substantial 44.2% of the operational flex stock.

Bangalore leads the overall operational flex stock, accounting for a 39% share on average since 2018, followed by Delhi-NCR with an average share of 17%. Over the same period, Hyderabad and Pune have displaced Mumbai in terms of the next highest flex stock across the top 7 cities. Pune has witnessed the highest CAGR growth of 49% since 2018 followed by Hyderabad (40%), Chennai, and Delhi-NCR. (30%)

Agile start-ups make a beeline for flex

Indian start-ups have leased more flex seats over FY21-FY23 compared to any other sector except technology. Their share has risen to a high of 31% in FY 2023, the second highest for the last two financial years. The Indian start-up ecosystem is embracing flex as it offers them just the right amount of cost, location, and tenure flexibility while creating flagship, modern workplaces for their employees. Start-ups across diverse categories including manufacturing / industrial, BFSI and consulting are now adopting flexible office formats to a greater extent.

Flex story in tier-2 cities

The flex story in tier-2 cities is gaining definite momentum. Business continuity has emerged as the biggest driver for respondents looking at tier-2 cities as part of their growth and geographic diversification plans. Lower operational costs, workforce mobility, and talent retention are top parameters to explore opportunities for flex spaces in tier-2 cities.

As sustainability becomes imperative for space selection, occupiers want to imbibe green building certifications as a part of their ESG goals. The share of space leased in green-certified buildings by flex operators rose to 51% in the 2021-Q1 2023 period compared to just 28% in the preceding period of 2019-2020.

The report suggests that flex operators can help support building investors and landlords in layering services that deliver a personal and memorable experience which aids in tenant management, better revenues and higher occupancy, and in turn better valuation.

Samantak Das, chief economist and head of research and REIS, India, JLL, said, “We expect the sector to continue its growth journey and is poised to double its footprint over the next five years, crossing the 100-msf mark across the top seven cities. Additionally, organisations are looking to tap into the opportunities offered by the tier-2 and tier-3 markets in terms of talent accessibility and mobility of their workforce. This does not mean that the demand for conventional office has been cannibalised.”

Neetish Sarda, founder, Smartworks, said, “From FY21 to FY23, the extraordinary three-fold increase in the adoption of enterprise seats closely aligns with the widespread acceptance and adoption of the managed spaces and the overall flex model.”

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: editor@housing.com