In India, income tax is a direct tax levied by the government on the income earned by individuals or entities in a particular financial year. The tax is calculated based on the income tax slab. Taxes are the main source of revenue for the government and are utilised for the development of the country’s infrastructure, healthcare, education, welfare programmes, and other facilities.

Taxpayers are also required to file their Income Tax Returns (ITRs), which involves the submission of an ITR form to the income tax department, which contains details about their income and applicable tax deductions.

Who should pay tax in India?

Individuals and entities must pay taxes if their net taxable income exceeds the prescribed limit:

- Salaried individuals

- Self-employed individuals

- Self-employed professionals

- Hindu Undivided Family (HUF)

- Body of Individuals (BOI)

- Association of Persons (AOP)

- Companies and corporate firms

- Local authorities

- All Artificial Juridical Persons

Who should file Income Tax Returns?

The following individual and entities are required to file income tax.

Income threshold

Individuals below the age of 60 having an annual income above Rs 2.5 Lakh should file Income Tax Returns (ITRs). The threshold for senior citizens (60 years and above) is Rs 3 Lakh, while the limit is Rs 5 Lakh for super senior citizens (aged 80 years and above).

Residential status

Indian residents are required to pay taxes on their global income. Non-Resident Indians (NRIs) must pay taxes only on the income earned in India and file returns if their Indian income exceeds the specified threshold.

Business and profession

Businesses and companies in India have a fixed value of tax calculated based on their taxable profits. Individuals engaged in a business or profession are liable to file ITRs irrespective of their income level. This includes self-employed professionals, freelancers, and entrepreneurs.

Capital gains

Those earning capital gains from the sale of assets, such as property, stocks, or mutual funds must file ITRs, irrespective of their total income.

Foreign assets

Individuals holding foreign assets or having financial interests in entities outside India are required to file ITRs, even if their income falls below the threshold.

Why should you file ITRs?

- ITR serves as a legal document for income proof as well as identity proof

- It enables the taxpayer to claim tax refunds from the government

- ITR is an important document when applying for loan

- Losses (from business or house property) can be carried forward to the next assessment year

- It is essential to file ITR by eligible taxpayers to prevent penalties and punishment

What happens if you do not file income tax returns?

Eligible taxpayers must pay penalties or face punishment if they fail to file their tax returns. The penalty amount depends on the delay in filing and your total income. In addition, the income tax department may impose fines if one fails to file his ITRs within one year from the due date. The amount of fine may vary based on different factors and it is determined by the assessing officer.

Step to file income tax returns

The income tax department has simplified the process of filing ITRs through its online portal. Here’s a step-by-step guide:

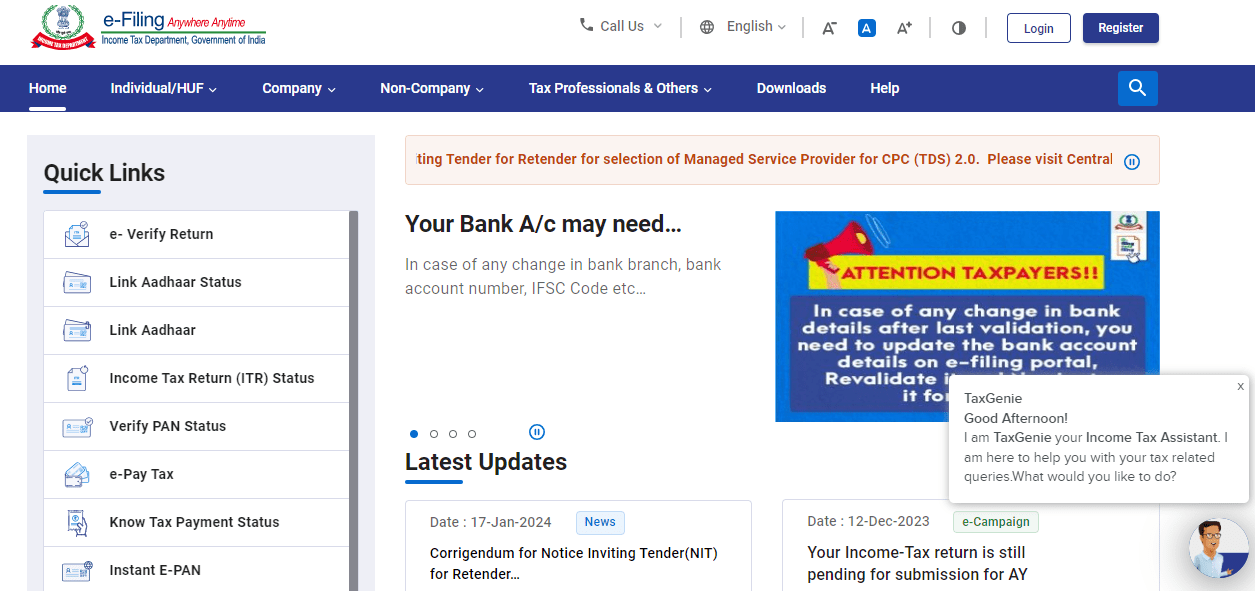

- Go to the Income Tax Department’s e-filing portal https://www.incometax.gov.in/iec/foportal/

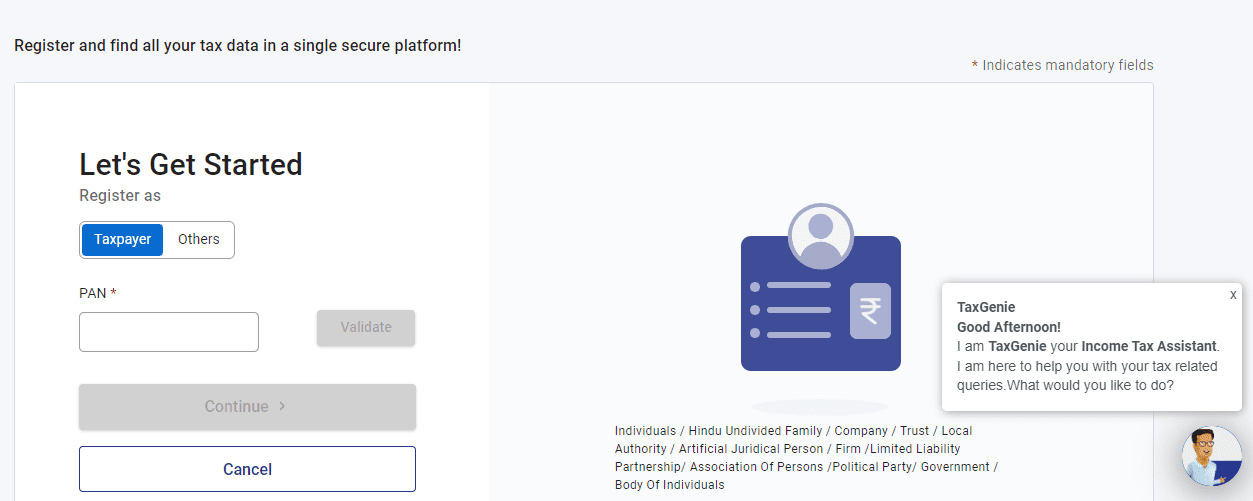

- Click on the ‘Register’ button to register as a new user. Provide details such as PAN, name, date of birth and contact information.

- Keep required documents handy, such as Form 16, salary slips, bank statements, investment proofs and other relevant documents, to compute your taxable income.

- Choose the correct ITR form based on your income sources and category. There are different ITR forms for salaried individuals, self-employed individuals, and businesses.

- Provide personal details, income details, deductions, and exemptions in the respective sections of the ITR form. Verify the details with valid proofs as per the guidelines of the income tax department.

- Compute the applicable tax dues using the income tax calculator on the e-filing portal to know the tax payable or the applicable refund.

- Verify all details in the ITR form and submit the income tax returns online.

- The acknowledgement form (ITR-V) is generated. Save the file for future reference.

- Complete the e-verification of income tax return using Aadhaar OTP or net banking.

Income tax filing for new homebuyers

Those looking to purchase a new home and opting for home loans should understand the tax implications associated with it.

- Home loan interest deduction: According to Section 24(b) of the Income Tax Act, a home loan applicant can claim a deduction of up to Rs 2 Lakh per year on the interest paid on loan.

- Principal repayment deduction: According to Section 80C, one can claim a deduction on the principal repayment of the home loan. The maximum deduction provided is Rs 1.5 Lakh per year.

- Stamp duty and registration charges: The stamp duty and registration charges are eligible for a tax deduction under Section 80C, subject to a maximum limit of Rs 1.5 Lakh. This claim must be made in the year of the transaction.

FAQs

How do I pay my income tax in India?

Visit the income tax department’s e-filing portal and click on ‘e-Pay tax’ to pay tax online.

Can I file ITR myself without CA?

Yes. You can visit the income tax department’s official e-filing portal and file your tax returns online.

What documents do I need to submit for ITR filing?

Some of the important documents required to file ITRs include PAN, Aadhaar card, Form 16, Form 16A/ Form 16B/ Form 16C, Form 26AS, bank statement, home loan statement, rental income, etc.

Who cannot pay income tax?

Those earning below Rs 2.5 Lakh per annum are exempted from paying income tax.

Should I submit any documents when I file the Income Tax Returns?

One is not required to submit any documents when filing ITRs. However, the documents must be provided to tax authorities if requested.

What is the difference between income tax and income tax return?

Income tax is the amount of tax payable on the income earned in a financial year, while an income tax return is a record of earned income, tax liability, tax paid, etc., filed with the income tax department to claim a tax refund.

Who is required to file income tax?

Individuals, AOP, HUF, and BOI must file income tax returns if their income exceeds the threshold limit. It is mandatory for companies and firms to file a tax return.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |