Buying property in Himachal Pradesh is not like buying property in other parts of India. If you’re an outsider, you need to follow specific laws that protect local land and the people who live here. These rules can be tricky to understand, which is why this guide will walk you through the process and help you safely own a home in the hills.

Why Himachal is different: The golden rule of section 118

To understand property buying in Himachal, you first have to understand the ‘why’ behind its most important law: Section 118. This rule wasn’t created simply to be a hurdle. Its core purpose is to protect the state’s limited, fertile farmland from being rapidly bought up for commercial construction. The government’s intent is to preserve the agricultural economy and the livelihoods of local communities. This is why the law creates such a major distinction between buying a house in a town versus buying a plot of farmland, which the state treats as a protected asset.

Who can buy what? A breakdown for different buyers

The rules on property ownership change based on who you are. Indian citizens from other states can buy apartments and non-farm properties with little fuss, but to purchase agricultural land, you’ll need special approval. NRIs & OCIs face a similar situation—homes and commercial buildings are generally fine, but farming land is off-limits unless it’s inherited. Foreign nationals have an extra hurdle: they must get clearance from the Reserve Bank of India (RBI). Himachali locals are the only group that can freely purchase any type of land.

Alternative strategies & red flags

Resale properties

For most outsiders, the safest and fastest route is to buy a resale property within town limits. This strategy works because it sidesteps the main legal challenge: properties inside towns are generally not classified as agricultural, meaning you bypass the complex approval process of Section 118. It’s a more certain path because you avoid the risk of a government denial after months of waiting. The paperwork is also often cleaner, as properties from reputable developers are frequently RERA-registered, which provides a layer of consumer protection and ensures titles are clear.

Expert Tip: Make sure you hire a lawyer who is based in Himachal. Many buyers think their family lawyer from a big city will be enough, but a local lawyer knows the area inside out. They are familiar with the Tehsildar’s office, understand how land records are handled here, and spot things that outsiders often miss. Having someone on the ground can prevent costly mistakes and make the whole process much smoother.

Other strategies include:

- Long-term Lease: You can opt for a 30-99 year lease, which provides long-term control over a property without the legal complexities of a direct purchase. The lease must be properly recorded at the sub-registrar’s office.

- Joint Ownership: Co-owning a property with a Himachali domicile is legally possible but requires an “airtight” and comprehensive legal agreement to protect the interests of both parties.

Best Locations & What to Expect

Shimla: The capital. It’s busy, accessible, and has all the modern comforts, but it’s also the most expensive market.

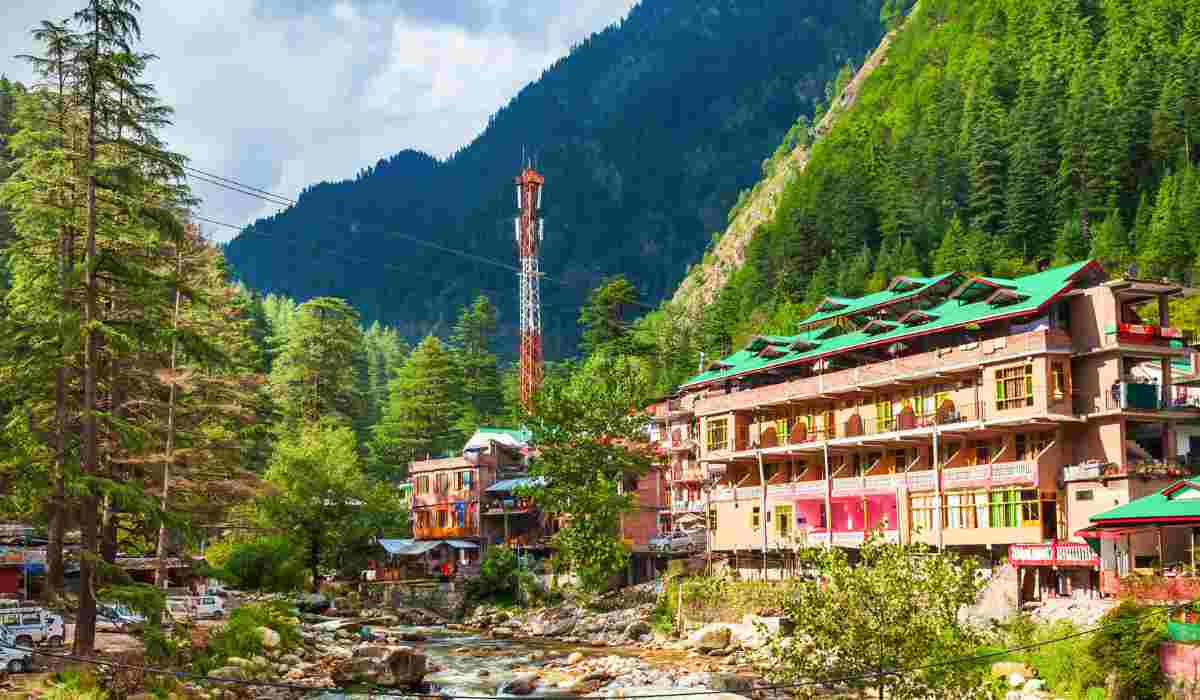

Kullu-Manali: A tourist magnet. Great for a homestay or rental investment that could bring in high returns, but you’ll have to deal with the tourist rush.

Kangra (Dharamshala/Palampur): Much quieter. This area is perfect for a peaceful lifestyle or for attracting long-term renters.

Solan: Close to the plains and Chandigarh. It’s a practical spot for residential or commercial investment due to its industries and colleges.

Property Valuation and Estimated ROI

Below are the estimated property valuations and expected ROI for major districts:

| District | Property Type | Approx. Valuation (per sq. ft.) | Estimated Annual ROI |

| Shimla | Apartment (in town) | ₹7,000 – ₹12,000 | 4% – 7% |

| Manali | Cottage / Homestay | ₹6,000 – ₹10,000 | 8% – 15% |

| Dharamshala | Residential Plot | ₹3,000 – ₹6,000 | 5% – 9% |

| Solan | Apartment / Flat | ₹4,000 – ₹7,000 | 6% – 10% |

Financials: Stamp Duty & Other Costs

Buying property comes with several extra costs:

- Stamp Duty: About 5%

- Registration Fee: 1–2%

Check current rates at the local sub-registrar, as they can change.

Other costs include:

- Agreed sale price

- TDS: 1% if the property is ₹50 lakh or more

- Legal and due diligence fees

- Escrow charges

- Mutation fees

Planning for these costs early helps avoid surprises.

Buying for rental Income: Airbnb & homestays

Thinking about renting your place out? Smart move, but do your homework first.

- Check the local panchayat or municipal rules about rentals and homestays.

- Register your place with the tourism department.

- Figure out if GST applies to your rental income, which usually depends on how much you make in a year.

Document checklist

A thorough check is non-negotiable because it protects you from future legal and financial trouble.

The Paper Trail: Your lawyer will need a complete history to ensure the seller has a clear title. This involves checking the original sale deed and all prior deeds for the last 30 years. They’ll also pull an Encumbrance Certificate (EC) to make sure there are no outstanding loans or legal claims against the property.

On-the-Ground Checks: You must visit the property to verify what’s on paper matches reality. Check the road access yourself, thinking ahead to the winter months.

Approvals and Compliance: Ensure the building is legal. This means checking for RERA registration on new projects and verifying that the building plan was approved by the correct authorities.

Full step-by-step buying process :

Here’s a rough timeline of how it usually goes:

- Find a Property & Do a Quick Check: Once you’ve found a place you like, ask the seller for a copy of the sale deed, the latest tax receipts, and the land records (Jamabandi/RTC).

- Visit the Site: Go see it in person. Check the actual boundaries, the road access (especially for winter), and the water and power situation.

- Hire a Local Lawyer: This is non-negotiable. A good local lawyer will do a full title search going back 30 years and check for any lawsuits or loans against the property.

- Draft a Strong Sale Agreement: Make sure your agreement has protective clauses, like making the sale conditional on getting any required government approvals and setting clear payment timelines.

- Register the Deed: Pay the stamp duty and registration fees, and get the sale deed officially registered in your name at the sub-registrar’s office.

- Get the Mutation Done: After registration, you must apply to the Tehsildar to have your name updated in the official revenue records. This is called mutation, and it’s the final step to securing your legal ownership.

How can Himbhoomi help your property search?

Before you get serious about any property, use the Himbhoomi portal. It’s the government’s official online land record database, and it lets you do some quick detective work. You can confirm the seller is the real owner, check if the land is classified as agricultural or not, and even look at its past transaction history. Using this site first is a simple way to spot lies and avoid getting scammed.

Your Due-Diligence Checklist

Before you buy, you or your lawyer need to check off a few key things:

The Paper Trail and Legal Title

To ensure the seller has a clear and legal title, your lawyer will need a complete paper trail. This includes the original sale deed, certified copies of prior deeds going back 30 years, and an Encumbrance Certificate (EC) for that entire period. You’ll also need the latest land records, known as the Jamabandi or RTC, along with mutation certificates and proof of recent tax payments. A court search to check for any pending lawsuits is also a wise step.

Approvals and On-the-Ground Checks

Beyond the title, you must verify the building’s compliance. If it’s a newer project, check for its RERA registration. Your lawyer should also confirm the building plan was approved by the correct authority (like the municipality) and that it has a completion certificate. It’s crucial to also check that the property does not fall within a protected forest or a notified landslide zone. Finally, visit the site to confirm practical things like road access in winter and the reliability of the water and power supply.

Pros and Cons of Buying Property in Himachal Pradesh

Pros:

- Calm mountain lifestyle with fresh air and beautiful views.

- Potential rental income from homestays in tourist towns.

- Buying inside town limits is usually simple and safe.

Cons:

- Section 118 limits outsiders from buying farmland.

- Beware of scams like forged papers or cash-only deals.

- Hilly terrain can cause landslides and tricky roads, especially in winter.

Full glossary

- Agricultural land: Land classified by revenue records as used for farming, orchards, or plantations.

- Circle Rate: Government-notified minimum valuation per area for stamp duty/registration.

- Encumbrance Certificate (EC): Official certificate showing whether a property has any mortgage, lien, or charge.

- Jamabandi / RoR / RTC: A revenue record showing ownership, cultivation, and liabilities.

- Khasra / Survey Number: A unique plot number in the cadastral survey.

- Mutation: The administrative process to record a new owner in revenue records after registration.

- RERA (Real Estate Regulatory Authority): A regulator of real estate projects.

- Section 118 (Himachal Tenancy & Land Reforms Act): A legal provision that restricts the alienation of agricultural land to non-agriculturists and outsiders in Himachal.

- Stamp Duty: A state tax for stamping the sale deed.

- Tatima: A map extract showing plot boundaries in Himachal.

Housing.com Pov

While the Himachal real estate market offers a unique opportunity, its special legal framework must be respected. For an informed buyer, the path to ownership is clear: the safest and most transparent route is to focus on ready-to-move-in properties within town limits. A buyer can confidently navigate the process by leveraging digital tools like Himbhoomi for verification and engaging local legal experts. Ultimately, securing a valuable and legally sound asset in the Himalayas comes down to meticulous due diligence.

FAQs

What is Section 118?

It restricts outsiders from buying agricultural land in Himachal. Special government permission is needed otherwise.

Can NRIs buy farmhouses or agricultural land?

Generally no. NRIs/OCIs can buy residential or commercial property, not farmland, except by inheritance.

Safest way for an outsider to buy property?

Buy a ready resale flat or built-up house in towns like Shimla, Dharamshala, or Solan.

What is mutation and is it necessary?

Mutation records the new owner in government land records. It is essential for legal ownership and taxes.

What is the Himbhoomi portal?

Official land records portal to check owner, area, classification, and past transactions before buying.

What is TDS and who handles it?

If property ≥ ₹50 lakh, the buyer deducts 1% as TDS and provides Form-16B to the seller.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |