Visakhapatnam is a port city on the southeast coast of India and often called The Jewel of the East Coast. The Greater Visakhapatnam Municipal Corporation (GVMC) covers the erstwhile Visakhapatnam Municipal Corporation (VMC) and the Gajuwaka Municipality in addition to 32 other villages. The GVMC came into effect on November 21, 2005. With an area of 540 sqkm under its jurisdiction, the GVMC is an integral part of the planning body of the Visakhapatnam Urban Development Authority (VUDA).

Property owners in Visakhapatnam have to pay the GVMC Property Tax on their residential properties to the Greater Visakhapatnam Municipal Corporation every year. The revenue generated by the GVMC is substantial and contributes to the town’s development. It is the responsibility of each property owner to pay the GVMC Property Tax so that the citizens can benefit from all the facilities and critical services provided by the GVMC.

This article outlines the process of paying the GVMC Property Tax. While both, online and offline methods, are available for paying the GVMC Property Tax, it is advisable to use the online way to save time and effort.

How to use the GVMC Property Tax calculator?

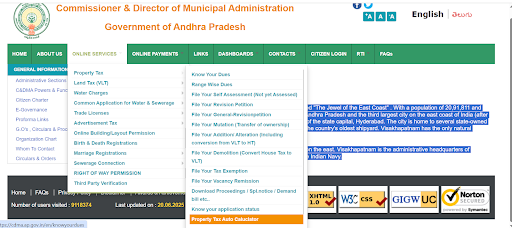

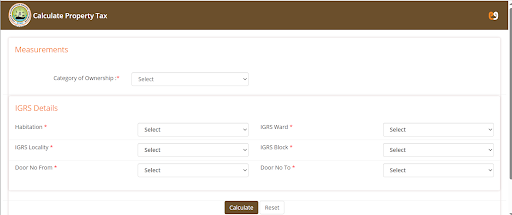

Individuals can calculate the GVMC Property Tax based on factors including whether the property is residential or commercial, the built-up area of the property, base value of the property, age of the property and the type of construction – single or multi-floored and occupancy. The GVMC Property Tax calculator is available on the official website where citizens can calculate and pay the property tax. To access the GVMC Property Tax calculator, go to the official GVMC website. Under online services, select property tax and then select property tax auto calculator.

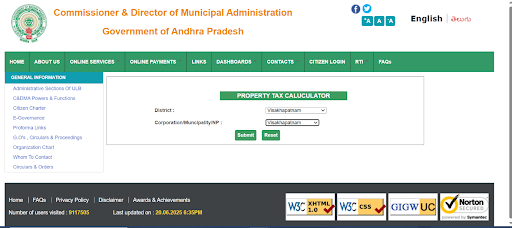

You will reach this page where you have to select district and corporation/municipality/NP as Visakhapatnam and click on submit.

Enter measurement details-category of ownership, and IGRS details such as habitation, IGRS locality, Door no from, IGRS Ward, IGRS Block, Door No To and click on calculate.

How to pay the GVMC Property Tax online?

- To pay the GVMC Property Tax online, visit the official GVMC website and under online services click on property tax.

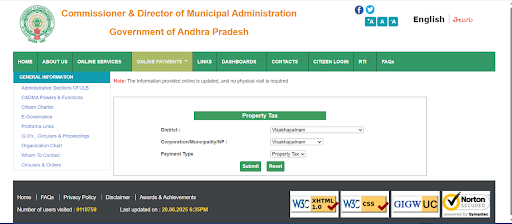

- Select Visakhapatnam as district, corporation/municipality/NP and payment type as property tax and click on submit.

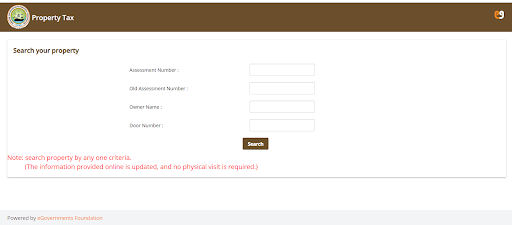

- You will reach the following page.

- Enter assessment number, old assessment number, owner name and door number and click on search.

- You will get details of the property tax that you have to pay, due date, rebate if any and penalty that will be levied in case of payment after due date.

- Once verified, click on make payment and proceed to pay by online options such as UPI, e-wallet, credit card, debit card etc.

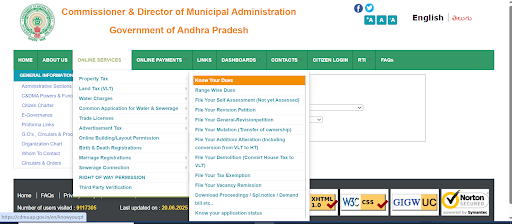

What are the GVMC Property Tax services that can be accessed online?

On the official GVMC website, under online services, select property tax and select the service.

The various services that can be accessed are:

- Know your dues

- Range wise dues

- File your self-assessment

- File your revision petition

- File your mutation

- File your affidavit

- File your tax exemption

- File your vacancy remission

- Download applications

- Know your application status

How to pay GVMC Property Tax offline?

Paying the GVMC Property Tax offline means physically visiting the office during working hours. You should carry a copy of all the supporting property documents that may be asked for property tax payment.

- Visit the ward office of GVMC.

- Fill out the property tax payment form and attach the supporting documents.

- Pay the GVMC House Tax using debit card, credit card, cash, cheque or demand draft and collect the receipt.

What is the last date to pay the GVMC Property Tax?

The last date to pay GVMC Property Tax is April 30 of every year. Failure to pay within this time will result in penalties. Most civic bodies charge around 1-2% as penalty for the time period that the property tax was not paid.

What is the rebate offered for paying GVMC Property Tax on or before time?

The GVMC offers a rebate of 5% if property tax is paid before April 30, 2025.

GVMC introduces property tax records auto update system

Property tax ownership transfers in Visakhapatnam that are registered at SRO will now be processed automatically for all properties having existing GVMC tax assessments. This will be implemented from August 1, 2025. With this new system in place, property owners need not physically visit the GVMC office or submit additional paperwork to update property tax records after registration. The new owner’s name will be updated in the GVMC Property Tax database automatically, once the process is complete.

Why is necessary to follow mutation process?

By following the mutation process, the name of new owner comes into the records of the GVMC. This is important because the owner will be sent the bill for payment of property tax, utility services such as electricity, water etc.

How to change the name on the GVMC Property Tax records?

- To change the property mutation online, visit the official website.

- Under online services, click on property tax and click on file your mutation. Select Visakhapatnam as district and corporation/municipality/NP and click on submit.

Offline property mutation

To change the ownership offline, follow these steps.

- One can change the name of the property owner by collecting the mutation form from the municipal office.

- Fill out the form, add supporting documents and submit.

- The name transfer order will be received once done and you can get the application receipt and annual rental value (ARV) certificate from the GVMC office.

Maximising savings on GVMC Property Tax

You can save on GVMC Property Tax by:

- Taking advantage of the rebates offered to people who pay their property tax before the deadline.

- Most states offer incentives if property tax for entire is paid at once at the beginning of the year.

- Not forgetting to pay the GVMC Property Tax on time or else you will have to pay penalty.

What are the common challenges in GVMC Property Tax and how to overcome them?

Incomplete documentation: Ensure that there is no problem with the documents. Ensure timely documentation is done so that there is no problem while paying the property tax.

Discrepancies in records: Check the property tax record details in advance so that there is no mismatch in the records.

Delay in verification: Check with the office on a regular basis so that verification is done on time.

Ownership disputes: Settle all disputes before transfer of ownership of property.

Lack of awareness: It is recommended to be aware about all details about GVMC property tax. You can use experts like lawyers etc. for more clarity.

How to Register GVMC Property Tax grievances?

You can dial the toll-free number 180042500009 for complaints regarding GVMC tax payment. Complaints regarding property tax Visakhapatnam and property tax payment can also be sent on the WhatsApp number 9666909192.

Housing.com POV

As a property owner, you would want your vicinity to be developed with the best of infrastructure and amenities. These are developed by the local body using the revenue generated by property tax. With the development of the area, the property prices and the rental yield surge, which works in favour of the property owner. Defaulting on tax is a punishable offence in India. Always pay the annual tax on time online or offline and benefit from the rebate offered by the GVMC.

FAQs

How to pay property tax online in GVMC?

You can pay the property tax online in Visakhapatnam by visiting the GVMC Property Tax homepage and click on online payment.

How can I check my property tax in GVMC?

Check the GVMC official website for knowing details about property tax.

How can I change my house tax name in Visakhapatnam?

You can visit the GVMC Property Tax page to change the house tax name in Visakhapatnam.

Why is online payment for property tax recommended?

The online payment service is recommended as it is an end-to-end online service with no physical touch point required. It saves time and removes the need to stand in queues.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |