The NagarSewa Uttarakhand administers property tax collection in Haridwar for all residents. They have launched a user-friendly platform for this purpose, facilitating easy payment of property tax. Timely payment entitles you to rebates and discounts. Discover how to pay property tax in Haridwar online or offline, including details on the last date, mutation, and more.

See also: Stamp duty, registration fee in Uttarakhand in 2024

How is property tax Haridwar calculated?

Property tax in Haridwar is calculated based on several factorsspecific to your property. These factors are crucial in assessing the property’s value and determining the tax amount. Key considerations include the unit’s usage type, occupancy status, building type, construction year, plot size and number of floors. Each of these elements contributes to the overall property tax assessment process.

How to pay Haridwar property tax online?

To pay property tax online in Haridwar through the official NagarSewa Uttarakhand portal, follow these steps:

- Visit the official NagarSewa Uttarakhand website. On the homepage, locate and click on ‘Pay Property Tax’ tab.

- If you pay using the property ID, input your ULB/city, software code/ULB property ID, or the last six digits of the property unique ID. Then, click ‘Search’ button.

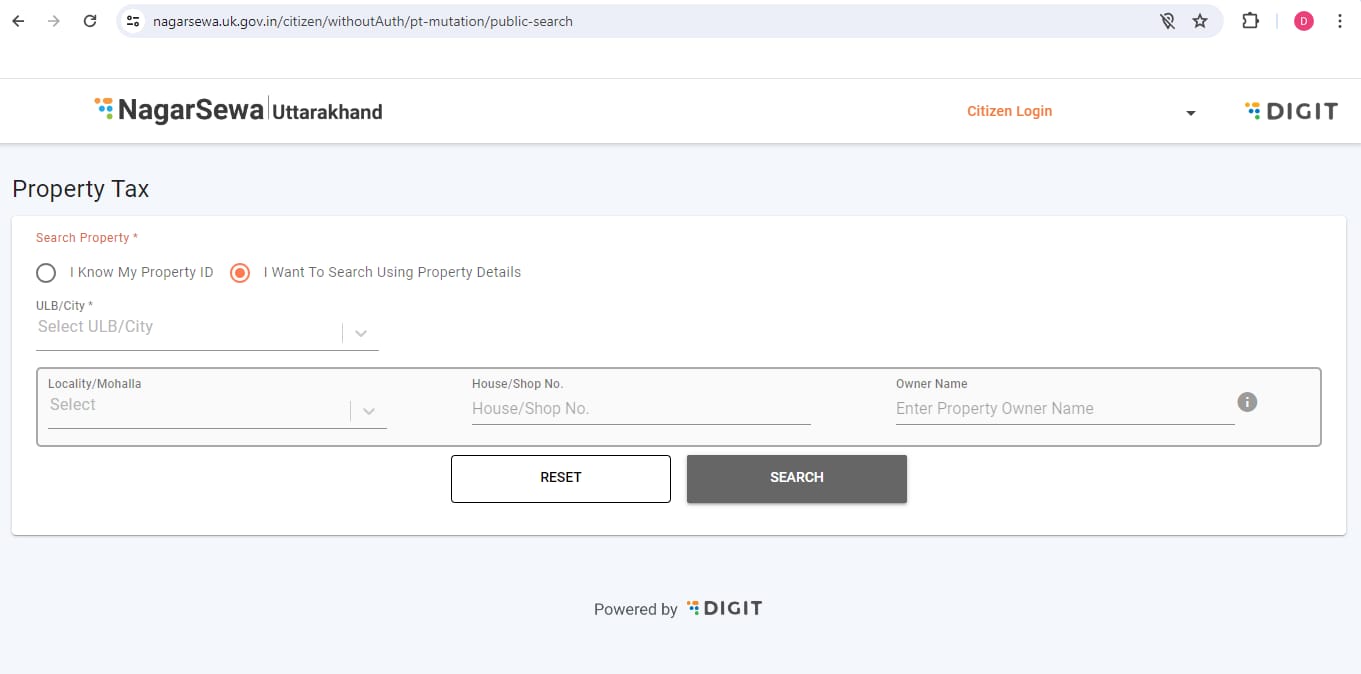

- If paying via property details, enter your ULB/city, locality/mohalla, house/shop number, and owner’s name. Afterward, click on ‘Search’ button to proceed with the property tax payment.

How to pay Haridwar property tax offline?

Citizens can visit the municipal office for detailed instructions on the offline property tax payment process in Haridwar. If necessary, they should gather all required forms to complete the payment in person. The contact details for NagarSewa Uttarakhand are provided below:

- Address: Urban Development Directorate, 31/62 Rajpur Road, Dehradun, Uttarakhand – 248001

- Phone: +91 (0135) 274 1541

- E-mail: enagarsewauk@gmail.com

Last date for property tax Haridwar payment

The last date for paying property tax in Haridwar is typically around March 31 of the financial year, without incurring any penalties.

Housing.com POV

Paying property tax in Haridwar is streamlined through NagarSewa Uttarakhand’s user-friendly online platform, offering convenience and the potential for rebates. Accurate assessment based on property-specific factors ensures fair taxation. For those preferring offline methods, the municipal office provides necessary support. Timely payment, typically due by March 31, helps avoid penalties and maintain financial benefits.

FAQs

How can I pay my property tax in Haridwar online?

You can pay your property tax online by visiting the official NagarSewa Uttarakhand website. On the homepage, click on ‘Pay Property Tax’ tab. Enter your Property ID or property details, then follow the instructions to complete the payment process.

What factors are considered for calculating property tax in Haridwar?

Property tax in Haridwar is calculated based on several factors, including the unit's usage type, building type, occupancy status, construction year, plot size, and number of floors. These factors help determine the property's value and the corresponding tax amount.

Where can I find my Property ID for online tax payment?

Your Property ID can be found on your old payment receipts. If you do not have this information, you can search for your property on the NagarSewa Uttarakhand portal to retrieve your unique Property ID.

What should I do if I prefer to pay my property tax offline?

If you prefer to pay your property tax offline, you can visit the municipal office for detailed instructions and required forms.

When is the last date to pay property tax in Haridwar to avoid penalties?

The last date for paying property tax in Haridwar is typically around March 31 of the financial year. Paying by this date ensures you avoid any penalties and can benefit from potential rebates.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |