Policybazaar’s Consumer Insights team conducted a recent study on home insurance buying behaviour that uncovered a significant gap between awareness and actual adoption.

As per the report, India’s home insurance gap is 41% driven by calamities, 31% by loans yet 27% were confused, 23% unmoved and there was an 18% drop off.

Key insights of the report are detailed below.

- Natural disasters (41%) emerge as the leading consideration for buying home insurance, followed closely by home loans & theft.

- Around 39% of respondents purchased home insurance, with owners more likely to buy than renters.

- Around 23% of respondents felt that home insurance was not necessary and a significant 27% of respondents cited confusion around policy selection.

Note that insights of the report are based on respondents who explored home insurance options in the past six months.

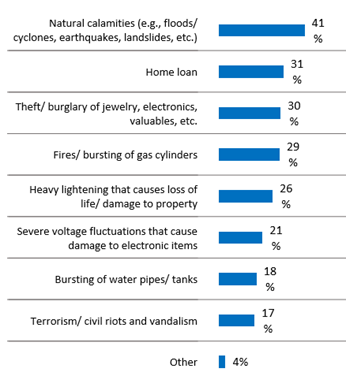

Drivers for considering home insurance

The primary triggers encourage people to consider home insurance, regardless of whether they live in independent houses or societies, and whether they own or rent.

- Natural calamities (41%) top the list, reflecting risks such as floods, earthquakes, and storms driving people to see home insurance as essential protection against unpredictable events.

- Ongoing home loans (31%) are another major motivator. Homeowners with active loans often see insurance as a financial safeguard, ensuring they do not suffer major losses while still repaying their EMIs.

- Theft or Burglary (30%) is the third key concern, especially in urban or semi-urban areas, where securing household belongings and valuables is top of mind.

Apart from these, fire, gas cylinder bursts, lightning damage, voltage fluctuations, water leakage, and threats like terrorism or riots are other drivers for considering home insurance.

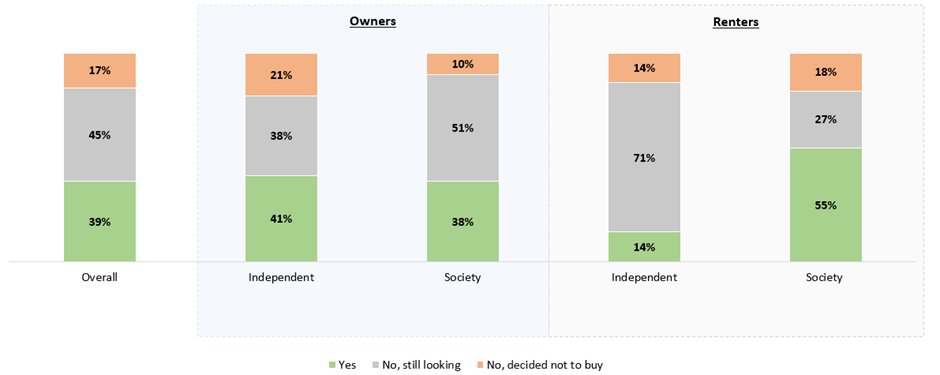

Home insurance purchase behaviour

In the last few months, 39% of those who had shown interest in home insurance, made the purchase—primarily homeowners in standalone houses or societies. Around ~62% were still exploring options or remained undecided to purchase home insurance.

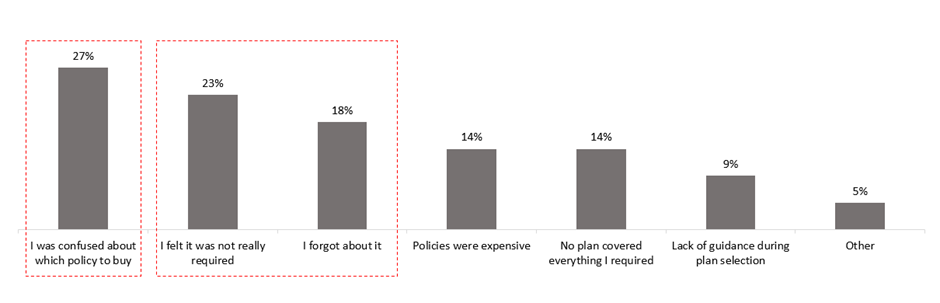

Barriers to home insurance purchase

- Confusion over policy selection –Around 27% respondents find it difficult to understand and compare policies that lead difficulty in policy selection.

- Perceived lack of necessity– 23% of respondents surveyed still believe home insurance is not essential, especially as they have not experienced loss or damage.

- Lack of urgency, among interested buyers – 18% respondents who were even interested buyers often drop off due to lack of priority or clarity.

Many respondents were confused about which policy to buy. This highlights a clear need for better guidance, simplified choices, and consumer education to help potential buyers.

According to Ashwini Dubey, business head – Home Insurance at Policybazaar.com, “Home insurance penetration in India remains low. However, the findings of this survey clearly indicate a growing intent towards buying home insurance—driven largely by increasing climate-related risks and financial liabilities. Certainly, many consumers are still hesitant due to limited awareness and lack of clarity. There’s a pressing need to simplify insurance offerings, improve awareness, and provide proactive support to help potential buyers make informed decisions while simultaneously ensuring an easy and effective claims process”

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |