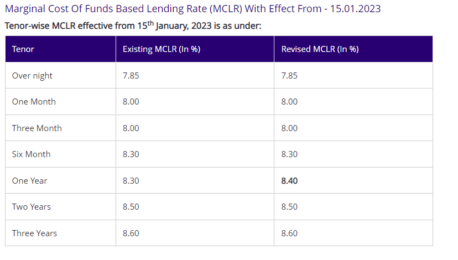

Public lender State Bank of India (SBI) on January 14, 2023, increased its marginal cost of funds-based lending rates (MCLR) by an average 10 basis points across various tenors. To come into effect from January 15, 2023, the hike by SBI will increase the EMI for the bank’s existing customers who are servicing loans linked with the MCLR.

After a 10-basis-point increase, SBI’s 1-year MCLR stands hiked at 8.40% from the earlier rate of 8.30%. Most SBI loans such as home and auto loans are linked with its 1-year MCLR.

Recall here that MCLR is an internal lending benchmark which is no more in use after the RBI mandated banks in India to link loan with external lending benchmarks starting October 2019. However, customers who have not yet applied for their loans to be linked with the new lending benchmarks are still serving their loans at MCLR.