Under the income tax laws in India, salary is taxed either on a due basis, or a receipt basis, whichever is earlier. But, on certain payments made in the current year that were due in a previous year can attract a high tax rate. This could be due to the jump in the tax slab because of an increase in a taxpayer’s income over the years. However, a taxpayer does not have to pay tax at a higher rate on such income, thanks to Section 89(1) of the income tax law.

What is Section 89 of the Income Tax Act?

According to the income tax department, Section 89 provides relief from the increased tax burden resulting from receiving salary in arrears, relating to earlier years, or receiving an advance salary, which is due in succeeding previous years. “This relief allows the employee to be placed in the same situation as he would have been if such salary had been taxed on an accrual basis instead of being taxed on a receipt basis,” it says.

Payments covered under Section 89

Relief can be claimed under Section 89 on any of the following compensations received during a year:

- Salary received as arrears, or advance

- Premature withdrawal from provident fund

- Gratuity

- Commuted value of pension

- Arrears of family pension

- Compensation on termination of employment

How to calculate relief in case of receipt of advance salary or arrears of salary?

Step 1: Calculate tax on the total income of the current year, including arrears, advance receipts, etc.

Step 2: Calculate tax on the total income of the current year, excluding the above receipts.

Step 3: Calculate tax on the total income of the year to which the above receipts relate after, excluding these receipts.

Step 4: Calculate tax on the total income of the year to which the above receipts relate after, including these receipts.

Step 5: Calculate the difference between (Step 1 minus Step 2) and (Step 4 minus Step 3)

If the result of calculation in Step 5 is positive, the excess amount is allowed as a relief. If the result of Step 5 is negative, no relief shall be allowed to the employee.

How to claim relief under Section 89(1)?

The employee should claim relief in return of income for the year in which the lump-sum payment is received. To do this, the employee must furnish Form Number 10E before filing his Income Tax Return.

The taxpayer can pay tax on such income in the year of accrual or defer it to the year in which it is taxed in the respective country on withdrawal.

Also note, Form 10EE must be filled only online on or before the due date for furnishing of return of income. Once this option is exercised, it will apply to all subsequent previous years and cannot be withdrawn.

Form 10E

Understanding Form 10E

Form 10E has seven parts:

- Personal information: PAN and Contact Details

- Annexure I (Arrears): Salary/Family Pension received in arrears

- Annexure I (Advance): Salary/Family Pension received in advance

- Annexure II & IIA (Gratuity): Payment in nature of Gratuity with respect to past services

- Annexure III (Compensation): Payment in nature of compensation from the employer or previous employer at or in connection with termination of employment after continuous service of not more than three years or where the unexpired portion of term of employment is also not less than three years.

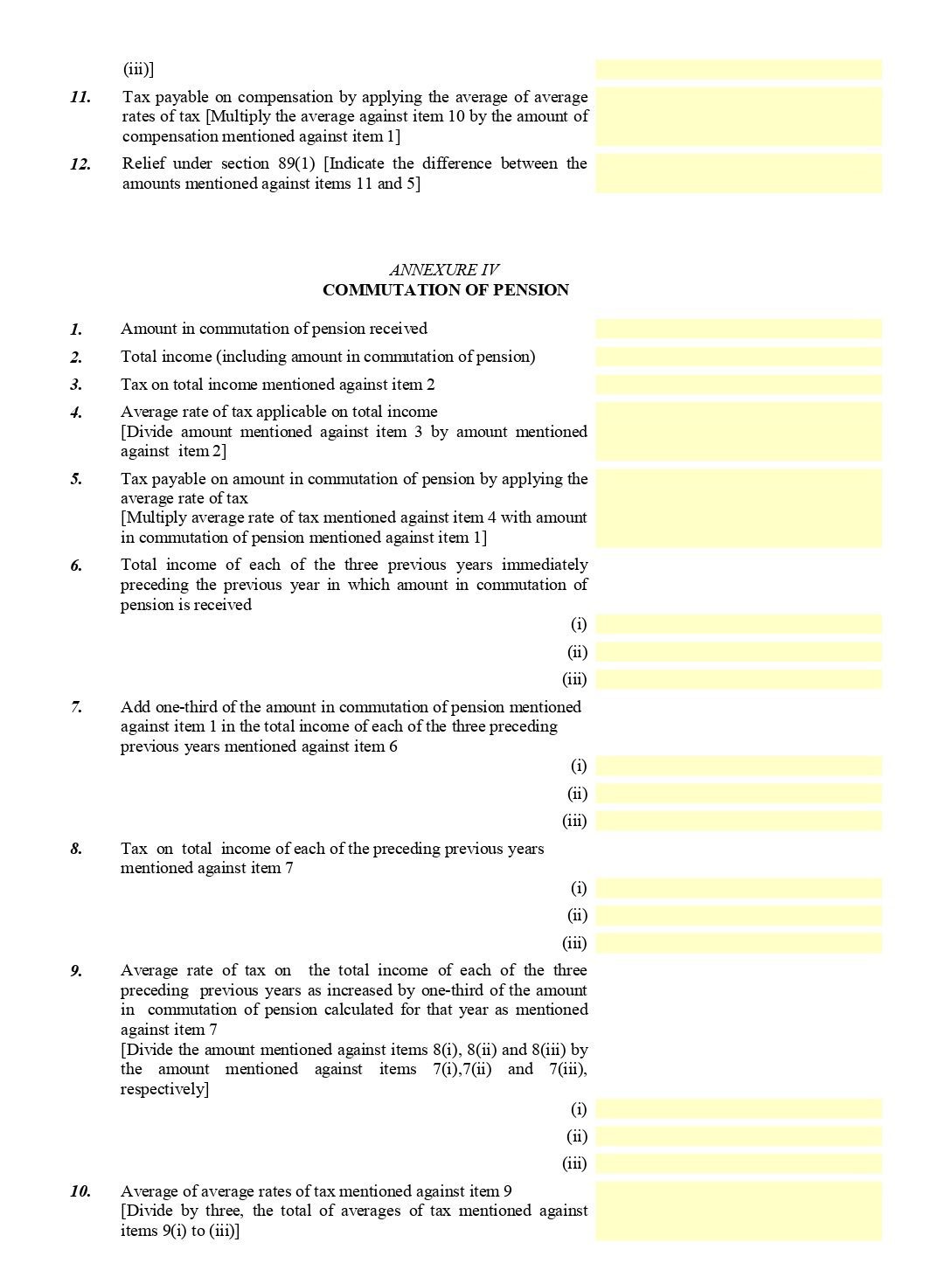

- Annexure IV (Pension): Payment in commutation of pension

- Declaration

How to fill Form 10E?

You can fill and submit Form 10E by the following method:

Step 1: Login to the e-filing portal using your user ID and password.

Step 2: On your dashboard, click e-File > Income tax forms > File income tax forms.

Step 3: On the File Income Tax Forms page, select Form 10E. Alternatively, enter Form 10E in the search box to file the form.

Step 4: Choose the Assessment Year (AY) and click on ‘Continue’.

Step 5: On the Instructions page, click Let’s Get Started.

Step 6: Choose the required sections to be filled in and click on ‘Continue’.

Step 7: Once all the details are filled, click ‘Preview’.

Step 8: On the Preview page, click ‘Proceed’ to e-Verify.

Step 9: You will be taken to the e-Verify page.

Step 10: After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number. An email confirming the same is sent to the email ID and mobile number registered with the e-Filing portal.

FAQs

Who can claim relief under Section 89A?

Only a person resident of India can claim relief under Section 89A.

Tax relief under Section 89 on gratuity is allowed after how many years of service?

Tax relief from gratuity is allowed only if an employee has completed five years of service.

Which form must be filled in to claim relief under Section 89?

To claim relief under Section 89, an employee must furnish Form 10E before filing his Income Tax Return.

Can I submit Form 10E offline?

No, Form 10E can be submitted only through online mode.

What are the prerequisites to submit Form 10E online?

A taxpayer must be a registered user on the e-Filing portal with a valid user ID and password to submit Form 10E online.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |