Having life insurance may help protect your loved ones financially. However, the premium on a standard life insurance policy may be too high for some people to manage. Is there anything more reasonably priced? This article will explain the Pradhan Mantri Jeevan Jyoti Bima Yojana, why it is important, and the process for the PMJJBY certificate download.

What is PMJJBY?

PMJJBY is a program initiated by the government that provides life insurance at an annual premium that is inexpensive. It was first introduced in 2015. The government of India devised the PMJJBY program to make it possible for people of any income level to get life insurance.

PMJJBY certificate download

There may be some variation in how each bank handles the download of a PMJJBY policy certificate. Generally, the steps download the PMBJJY certificate are as follows.

- Users must have the internet banking service available on their accounts.

- Log into your online banking profile on your bank’s website.

- Choose “social security plans” from the insurance menu. Choose the Pradhan Mantri Jeevan Jyoti Bima Yojana option under it.

- Select the type of transaction you want to make. Choose UID, then input your Aadhaar number to verify your identity. Users will be required to provide details such as Name, Date of Birth, Nominee, Aadhar Number, Bank Name, Account Number, etc., depending on the bank.

- After that, you’ll be asked to provide some identifying information. Next, choose the “Declaration of Good Health” option.

- After submitting your PMJJBY registration, you will be sent to a website where you may see your policy in detail.

Online PMJJBY registration and settlement

Here is how you may get your hands on the cash benefit if you are a beneficiary in a PMJJBY scheme.

- Visit the website of the policy-linked bank account that the PMJJBY account holder had and upload a copy of their death certificate in the tragic event that the PMJJBY account holder passed away.

- You may either fill out the claim form online or get one from the institution and fill it out there.

- Attach copies of relevant papers, such as the decedent’s death certificate, account information, cancelled checks, etc.

When you make a claim, the bank will check it over and then notify the insurance company that it’s OK to proceed. The insurer will double-check all submitted papers for authenticity. Upon completion of the verification process, the insurance company will deposit most of your payout directly into your account.

PMJJBY features

Since it has several essential features, the PMJJBY policy may be classified as a complete insurance program for lower-income individuals

- If the insured person passes away unexpectedly, the policy’s lump sum death benefit of rupees two lakhs will be granted to the nominee(s) the insured person specifies at the time of purchase.

- This policy’s coverage duration is one year (from June 1 of this year to May 31 of the following year) and is renewable each year (up to 55 years of age).

- The payment will be automatically deducted from the associated bank account from June 1 of this year to May 31 of the following year.

- To verify your identity, they will primarily use your Aadhaar card.

- You can only register for a PMJJBY life policy with one savings account, even if you have more than one.

Pro-rata premium

If you purchase the insurance after May, the payment will be prorated by months left in the duration of the policy. Here’s a look at how the monthly premium changes depending on what time of year you decide to buy insurance.

| Months | Premium payable |

| June, July, and August | Rs. 436 |

| September, October, and November | Rs. 342 |

| December, January, and February | Rs. 228 |

| March, April, and May | Rs. 114 |

PMJBY coverage advantages

The PMJJBY program comes with several advantages, the most important of which are listed below.

- If you purchase PMJJBY insurance, your premium qualifies for tax deductions under Section 80C of the Income Tax Act.

- You may take a break from the program momentarily and then return, provided you have a current health certificate, a linked bank account, and pay the fee.

- In the case of the insured’s death, the policy will pay out a large payment of Rs. 2 lakhs to the beneficiary, with no taxes to be paid on the money. The procedure of making a claim is also simple.

- The policy’s annual premium is just Rs. 436, no matter how old you are.

- The insurance premium will be automatically deducted from your account each year at the renewal date, so you never have to worry about forgetting.

What doesn’t PMJJBY cover?

The PMJJBY plan has several important exceptions, some of which are listed below.

- Intoxication-induced suicide attempt.

- Self-mutilation and/or suicide.

- Contravention of law, whether or not committed intentionally.

PMJJBY eligibility criteria

- Age limit: Applying for this coverage requires your age to be between 18 and 50. Most policies, however, cover people up to age 55.

- Documents: You will need an Aadhaar card and a banking or postal service account to deduct your premiums automatically.

- Bank account: The individual should have an active savings bank account with any of the participating banks. Many private and public sector banks are offering the PMJJBY scheme, which has tied up with insurance companies for the implementation of the scheme.

- One should ensure there is sufficient balance in their bank account, as the premium is paid through the auto-debit facility.

- The scheme does not need any medical examination for enrolment.

PMJJBY enrollment

To submit an online application for a PMJJBY program, please follow the procedures that are mentioned below:

- Several banks are not on board with the PMJJBY program. Check with your financial institution to see whether they provide this service before you even consider applying for it.

- Go to your financial institution’s website and sign in to your account using the PIN for your debit card or the login information for your online banking service (as applicable).

- To enrol in the Pradhan Mantri Jeevan Jyoti Bima Yojana program, go to the tab labelled “insurance,” then “social services programs,” and finally, “Pradhan Mantri Jeevan Jyoti Bima Yojana.”

- Choose the bank account you want to be linked to the PMJJBY policy; the funds from this account will be automatically deducted once a year.

How to check PMJJBY policy status?

By following the steps below, you can check the status of your PMJJBY policy online.

- Log in to your online banking account by going to the main site of your financial institution and signing in there.

- To input your bank account number, go to the PMJJBY section of the website.

- After that, to see the status of your PMJJBY application, enter your registration details and click the submit button.

PMJJBY: What is enrolment period?

The enrolment period is a time set by the government. during which individuals are allowed to apply for the PMJJBY scheme. It typically lasts for a month, from May 1st to May 31st of the year. This ensures a structured approach to the enrollment process.

PMJJBY: Waiting period for the claims

Waiting period refers to the time that must pass before a policyholder is allowed to make a claim. The waiting period for PMJJBY scheme is 45 days from the date of enrolment.

This implies that the nominee is eligible to make a claim for the death benefit only when the policyholder dies after the 45-day waiting period

The waiting period is applicable to all policyholders, irrespective of the cause of death. So, the waiting period is applicable even if the policyholder dies due to natural causes or an accident.

How to check PMJJBY claim status?

A nominee can claim the PMJJBY amount only after the death of the policyholder. One can check with the bank for details about the PMJJBY status.

Action to be taken by the nominee

A nominee can claim the PMJJBY amount only after the death of the policyholder. One must reach out to the bank where the member has the savings bank account and the member’s death certificate. They must obtain a claim form and discharge receipt and submit the duly filled form along with a copy of the cancelled cheque.

Action to be taken by the bank

The bank will verify whether the cover was in effect on the date of the policyholder’s death or not. It will also verify the claim form and the nominee’s details. The bank will then submit documents such as the claim form, death certificate, discharge receipt, and a photocopy of the nominee’s cancelled cheque to the insurance company’s office. The bank will be required to send the claim form to the insurance company within 30 days.

Action to be taken by the insurance company

In the next stage, the insurance company will verify the documents. If the claim is admissible, it will check whether the policy coverage is in force or not. It will forward the same to the bank and obtain the necessary verification.

PMJJBY: How to raise a claim?

- Notify the insurance company: The nominee of the policyholder should notify the insurance company regarding the policyholder’s demise and raise a claim under PMJJBY. This can be done through a phone call or an email to the insurance company’s customer care department.

- Collect documents: Collect the required documents, including the original death certificate, the policy document, and a discharge form duly filled by the nominee or heir.

- Documents required: The documents required to process claim include:

- Policyholder’ death certificate

- Original policy document

- Identity proof of the nominee/ legal heir

- Bank account details of the nominee/ legal heir.

- Fill the discharge form: The nominee or legal heir must sign the discharge form and get the same attested by a gazetted officer or a bank manager.

- Submit the claim: The nominee must submit the discharge form along with the original death certificate and the policy document at the insurance company’s nearest branch. The claim must be submitted within 30 days of the policyholder’s demise.

- Processing of claim: The company will process the claim and verify the documents. The claim amount will be credited to the heir’s bank account if the claim is approved.

SBI PMJJBY certificate download procedure

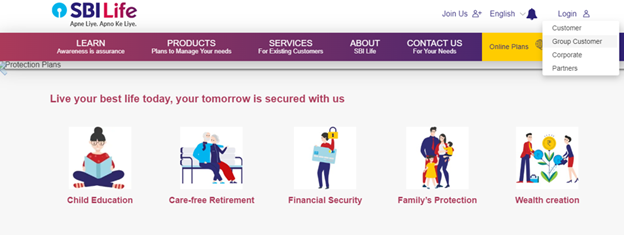

If you have availed of the PMJJBY scheme through State Bank of India (SBI), then visit the official website of SBI Life https://www.sbilife.co.in/

- On the home page, click on Group Customer under the Login tab

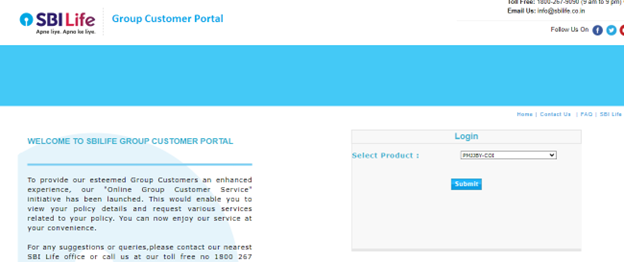

- Click on ‘PMJJBY-COI’ option from the ‘select product’ dropdown

- In the next step, choose bank name State Bank of India and provide details such as account/loan account number, date of birth and enter the text for verification. Click on Submit button.

- Policy details such as customer id and applicant name will be displayed.

- Click on customer id and save and download the PMBJJY Certificate of Insurance.

BOI PMJJBY policy certificate download

Customers of Bank of India can visit the official website https://bankofindia.co.in/ to find the complete details of the PMBJJY scheme. Log into the online banking portal and choose social security schemes. Select the Pradhan Mantri Jeevan Jyoti Bima Yojana option to proceed.

Validity of Pradhan Mantri Jeevan Jyoti Bima Yojana

The PMJJBY life insurance scheme, which offers death coverage for the policyholder, is valid for one year and can be renewed every year.

PMJJBY fax address

Get in touch with the Department of Financial Services for help with enrolling in or claiming benefits under a PMJJBY program. Here are the contact details:

Address:

Department of Financial Services, Ministry of Finance, 3rd Floor, Jeevan Deep Building, Sansad Marg, New Delhi – 110001

Fax Number: 23742207, 23360250 (Banking Division), 23344605 (Ins.)

Cancel policy for PMJJBY

The two ways that you may cancel PMJJBY insurance are outlined in the following paragraphs.

- Pay a visit to the local bank branch associated with the PMJJBY program and ask to have the PMJJBY premium yearly auto-debiting procedure terminated while you are there. If the payments are not paid on time, the coverage will be terminated immediately and without further notice.

- You can also remove all of the money from your connected savings account by transferring it to a different one. In this scenario, the automatic debit won’t go through since there won’t be enough money in the account, and the insurance will therefore be cancelled as a result.

PMJJBY: Latest updates

May 18, 2023: Dr Vivek Joshi, Secretary, Department of Financial Services (DFS), Ministry of Finance, chaired a VC meeting on April 10, 2023, with chief secretaries/ senior officials of all states/ UTs to highlight the salient features of the 3-month-long campaign to boost coverage of micro-insurance schemes such as Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) at gram panchayat level. The campaign would cover all the districts from April to June 2023.

FAQs

Which papers are necessary to submit an application for the PMJJBY program?

When applying for a life insurance policy with PMJJBY, the only piece of documentation that is often needed is an Aadhar card. It is used for the purposes of KYC verification.

Which documentation is required when submitting a claim for a PMJJBY policy?

When filing a claim for PMJJBY, you will often need to provide the documentation listed below. Death certificate Discharge receipt Hardcopy of the cancelled cheque Claims form duly filled

Where can I get the certificate of PMJJBY insurance?

The financial institution where you registered for the program will issue the certificate. Downloading a PMJJBY insurance certificate generally follows the same processes from bank to bank. However, specifics may vary.

Under what conditions may the PMJJBY policy be voluntarily terminated?

When you reach the age of 55 and beyond. The policy-linked account will be closed before the policy renewal. Inadequate money in the associated bank account as of the policy's renewal date.

What is the PMJJBY 436 scheme?

Under the PMJJBY scheme, risk coverage of Rs. 2 lakh is provided in case of death of the insured at the premium is Rs. 436 per annum.

How to enrol for BOB PMJJBY and download certificate?

A Bank of Baroda account holder can enroll for the PMJJBY scheme by visiting the branch or through the BOB World internet banking platform. Login into to the portal, click on the PMJJBY scheme under social security plans and enter relevant details to view and download the certificate.

What is the maturity amount of Pradhan Mantri Jeevan Jyoti Bima Yojana?

PMJJBY provides an accidental death coverage of Rs 2,00,000 to the beneficiary of the policy.

What is policy maturity amount?

In life insurance, maturity benefits refers to the sum assured and bonuses the policyholder is eligible to receive from the insurance provider after the policy completes it term.

What is the premium amount for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

Policyholders are required to pay an annual premium of Rs 436.

Is PMJJBY annual premium paid through ‘auto debit’ facility?

The payment amount is automatically debited from the bank account from June 1 of the year to May 31 of the following year.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.