UAN (universal account number) is a 12-digit identity proof allotted by the Employees’ Provident Fund Organisation (EPFO) to every employee with an Employee Provident Fund (EPF) account in India. You can use the UAN to know the details and perform an action concerning each EPF account.

How to get your UAN offline?

If you have recently joined work and your employer has opened your PF account, you can find out your UAN by the following methods:

Ask your employer

You can simply go to the HR department and ask them for the UAN. They will share it with you as soon as it is generated by the EPFO.

Check your salary slip

You will be able to track your UAN at the top of your salary slip. Along with other details like PAN and PF ID, your UAN will also be mentioned.

Can an employee generate UAN?

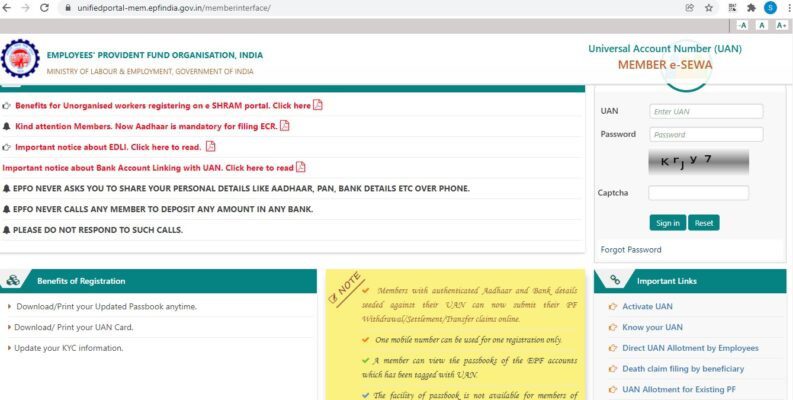

Yes, an employee can generate his UAN by visiting the unified member portal, https://unifiedportal-mem.epfindia.gov.in/memberinterface, and by clicking on Direct UANAllotment by Employees option. A valid Aadhaar number with registered mobile is pre-requisite to avail of this facility. The employee has to provide employment details to obtain the UAN.

How to get your UAN online?

Step 1: Visit the official UAN portal.

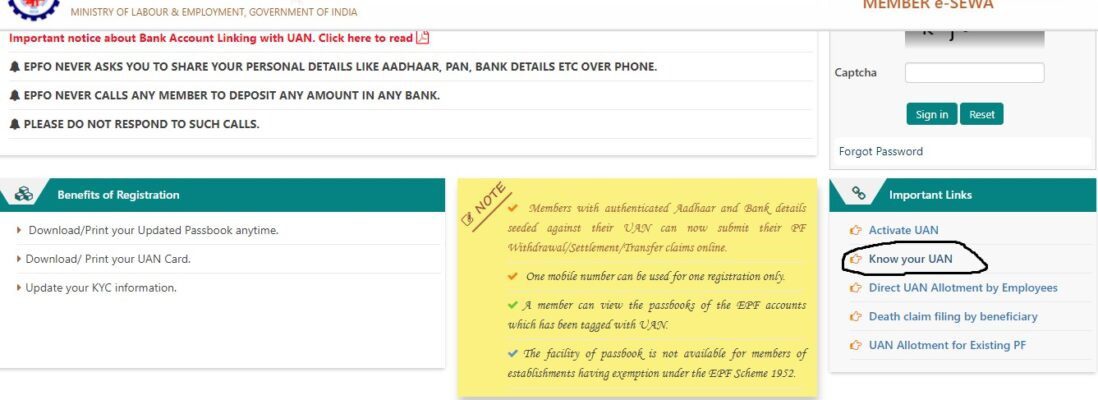

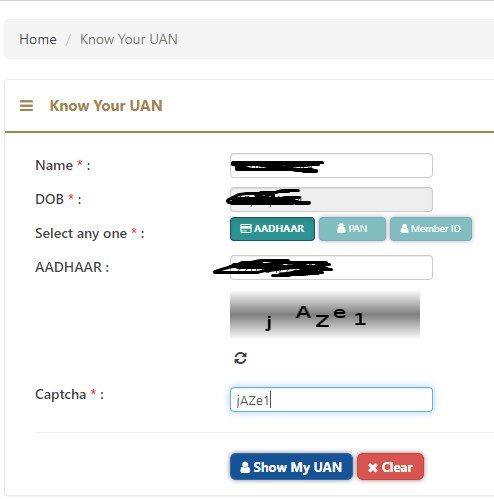

Step 2: Under ‘Important Links’, click on the ‘Know your UAN’ option.

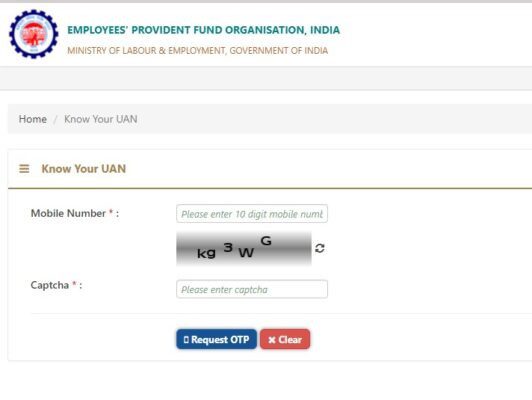

Step 3: Enter your mobile number and Captcha code for verification. Click on the ‘Request OTP’ button.

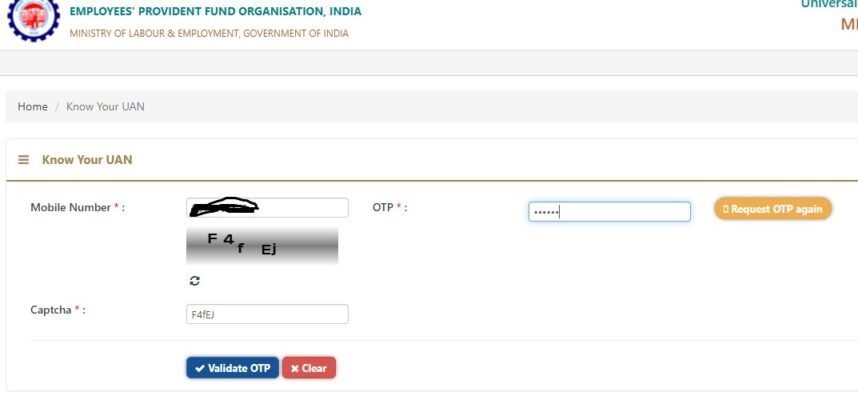

Step 4: Enter the 6-digit OTP that you receive on your mobile number and click on the ‘Validate OTP’ option.

Step 5: Once the OTP validation is successful, click on ‘OK’.

Step 6: Enter all the required details and the Captcha code. Click the ‘Show UAN’ button. In place of Aadhaar, you can also use your PAN or member ID to know your UAN.

Step 7: Your UAN will now be visible on the screen.

Those who know their UAN and have activated it can use the UAN login feature to track every detail of their PF accounts.

Check our guide on UAN activation to know how to activate UAN number

Documents needed to get UAN

- Identity proof

- Address proof

- Aadhaar Card copy

- Pan Card copy

- Bank account number

- Bank account branch name

- Bank account IFSC code

Difference between UAN and PF number

The following example will help you understand the difference between your UAN and PF ID:

PF number sample

MABAN00000640000000125

UAN sample

100904319456

Also read: UAN card download

What to do if two UANs are allotted to you?

An EPFO member might be allotted two UAN in case your previous employer fails to mention the ‘Date of Exit’ in the ECR form. This could also happen if the member applies for transfer of service in his current company. A member with two UANs will not be able to carry out any withdrawals unless one UANs is made inoperative. To do so, report the matter to your current employer. Also send a mail to the EPFO on the email ID: uanepf@epfindia.gov.in. Mention both your UANs in the email and request for cancellation of one. Following this, the EPFO will make the first UAN inoperative.

FAQs

Who allots the UAN?

Universal Account Number or UAN is allotted by the Employees’ Provident Fund Organization (EPFO).

How does the employer get your UAN?

Employers have to download the UAN list from the UAN Menu on the Online Transfer Claim Portal meant for employers.

Who is responsible for providing UAN to an EPF member?

The employers must share the UAN numbers with their employees.

How to activate UAN via offline mode?

UAN registration and activation are exclusively done online.

In which format should I create my UAN password?

The UAN password should be alphanumeric and contain at least one special character. The password length should be between 8 and 25 characters. Special characters allowed are: !@#$%^&*()

Do I have to replace my father's name with my husband's name in UAN after marrige?

While doing so is not mandatory, if the husband's name is provided in other records, doing so in UAN records is recommended.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |