Panjim or Panaji is the capital of Goa. The Directorate of Municipal Administration (DMA), Goa, is responsible for providing various civic services and collecting property tax from property owners in the city. Panjim house tax payment can be done online or offline. The municipal authority provides an online portal that allows property owners to pay their taxes with ease.

See also: Stamp duty, registration charges in Goa 2024

What is the Panjim house tax?

Panjim house tax is the annual tax that owners of all residential properties have to pay to the authority. The tax rates are determined based on the property type. The collected amount forms a significant proportion of the authority’s revenue, which is utilised for infrastructure development and other services.

How to pay Panjim property tax online?

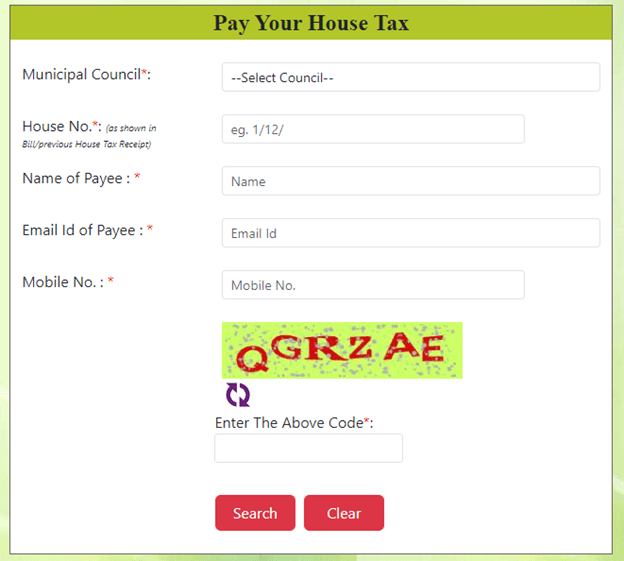

- Go to the official website of the DMA at https://goaulbservice.gov.in/

- Click on ‘Pay House Tax’ under ‘Services’.

- Choose ‘Municipal Council’ from the dropdown. Enter the house number, name, email ID and mobile number of the payee.

- Click on ‘Search’ to proceed with the payment.

How to pay Panjim House tax offline?

Property owners in Panjim can pay their property taxes offline by visiting the local municipal office. They must approach the concerned official with the relevant documents. The official with verify the documents and the tax register. The tax will be collected within 24 hours of the verification process.

Documents required

- Property assessment slip

- Property owner’s name

- Property address

- Proof of identification (Aadhaar card)

What is the last date to pay Panjim house tax online?

The last date to pay house tax in Panjim without penalties is between April and May of every financial year. Late fee is levied in case of delayed payment.

What is property mutation in Panjim?

Property tax mutation is the process of updating the property owner’s name in the municipal records after a change in ownership. For this, you must apply in the prescribed format along with copies of supporting documents. After notifying the relevant authority, the chief officer will verify all the documents and approve the application. The mutation process is completed within 30 days.

Housing.com News Viewpoint

The online facility provided by the DMA, Goa, has simplified the Panjim house tax payment process. To avoid penalties, you should keep track of the tax payment deadline and have the property details handy.

FAQs

What documents are required to transfer house tax in Goa?

To complete the transfer of house tax in Goa, one should provide documents, such as a sale deed and an Aadhaar card.

Who collects the online house tax payment in Panjim?

The Directorate of Municipal Administration, Goa (DMA) collects the house taxes in Panjim.

Who is eligible to pay house tax in Panjim?

All residential property owners in Panjim have to pay house tax.

How do I pay house tax in Panjim online?

To pay house tax in Panjim online, one should have a valid house number and supporting property documents.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |