Property owners in Mormugao, Goa, have to pay an annual property tax, irrespective of self-occupancy or renting out to a tenant and residence type. The Mormugao Property Tax is collected by the Mormugao City Municipal Corporation and is used for the upkeep of its amenities, infrastructure and sanitation.

One can pay the property tax in Mormugao online through the Directorate of Municipal Administration (DMA) website or offline. If the property tax is not paid on time, one may incur late payment penalties. If it remains unpaid, the owner may lose the property. In this guide, we detail how to pay Mormugao Property Tax online and offline.

Factors on which the Mormugao Property Tax is based

- Title deed of the property

- Permission for the building to be developed

- District

- Locality name

- ULB

- Street name

- Zone

- Total plot area

- Number of floors

- Building usage

- Type of building

- Plinth area

- Type of occupant

- Age of building

- Annual rental value (ARV)

How is the Mormugao Property Tax calculated?

Annual rental value (ARV) = (Area x zone rate x factor indicator x building usage rate) x 12

How to pay Mormugao Property Tax online?

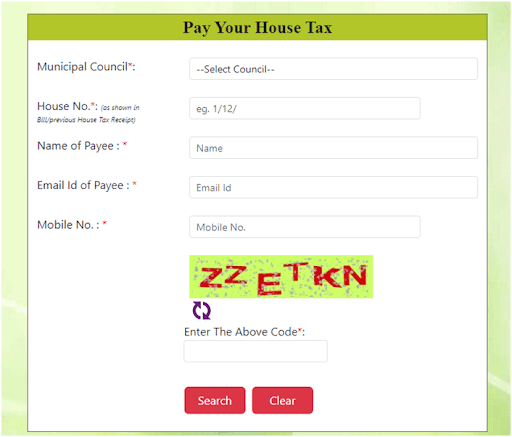

- Click on ‘Pay House Tax’ under ‘Payment of Taxes’ listed under ‘Online Services’.

- You will be redirected to the following page.

- Select municipal council from the dropdown.

- Enter all the details and the captcha and click on ‘Search’.

- You will get all the information related to Mormugao property tax. Once verified, click on ‘Make online payment’ and proceed.

- On the same page, click on ‘View Payment History’ to see previous payments.

How to pay Mormugao Property Tax offline?

- Visit the ward office of Mormugao Municipal Corporation.

- Fill out the property tax payment form and attach the supporting documents.

- Once the taxation clerk verifies the amount, pay the Mormugao House Tax and collect the receipt.

What is the last date to pay the Mormugao Property Tax?

You can pay the property tax in Mormugao by May 31 every year. Payment of property tax after this date attracts penalties.

Mormugao Property Tax: Mutation process

- You can change the name of the property owner by collecting the mutation form from the municipal office.

- Fill out the form, add supporting documents and submit.

- Once the documents are verified, it will take around 30 days for the name to be changed.

Mormugao City Municipal Corporation: Contact information

Jayant Tari, chief officer, 9822135285

Housing.com POV

Property tax is a vital component paid annually by a property owner. Collected by the municipal body in Mormugao, the revenue helps develop the infrastructure in Mormugao. However, it is an offence to default on property taxes and one will be liable to punishment, including attachment and auction of property, if house tax is not paid on time.

FAQs

Who collects the Mormugao Property Tax?

The Mormugao Municipal Council collects the Mormugao Property Tax.

What is the penalty for late payment of the Mormugao Property Tax?

A penalty decided by the Mormugao City Council (between 1-2%) on the pending amount has to be paid for late payment.

What are the ways to pay property tax in Mormugao?

One can pay the Mormugao Property Tax online or at the nearest ward office.

Are there any charges for paying property tax online in Mormugao?

No, there are no charges for paying property tax online in Mormugao.

When is the last date to pay the property tax in Mormugao?

The property tax in Mormugao must be paid by May 31 every year.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |