If you have paid excess amount of tax than your actual tax liability, you can claim an income tax refund. The Income Tax (I-T) Department will verify the returns and process the ITR refund. The amount will electronically get transferred to your bank account linked with Permanent Account Number (PAN), with effect from March 1, 2019. It is important to note that you can only select a pre-validated bank account to receive an income tax refund. You can pre-validate your bank account online when filing your returns through the official e-filing portal of the I-T department. Here is a complete guide.

See also: How to raise a request for an income tax refund reissue?

Why should you pre-validate your bank account?

As per the I-T department, a tax assessee must choose only a pre-validated bank account to receive income tax refund. Moreover, a pre-validated bank account can be used by the taxpayer to enable Electronic Verification Code (EVC) for e-verification. An e-verification is required for income tax returns and other forms, ITR refund reissue, e-proceedings, resetting the password and secured login into e-filing account.

How to pre-validate a bank account online?

You will get an income tax refund only if the bank account is linked with your PAN. Therefore, it is essential that you pre-validate your bank account. This can be done by signing into the e-filing website and updating bank account details, as explained in the steps below.

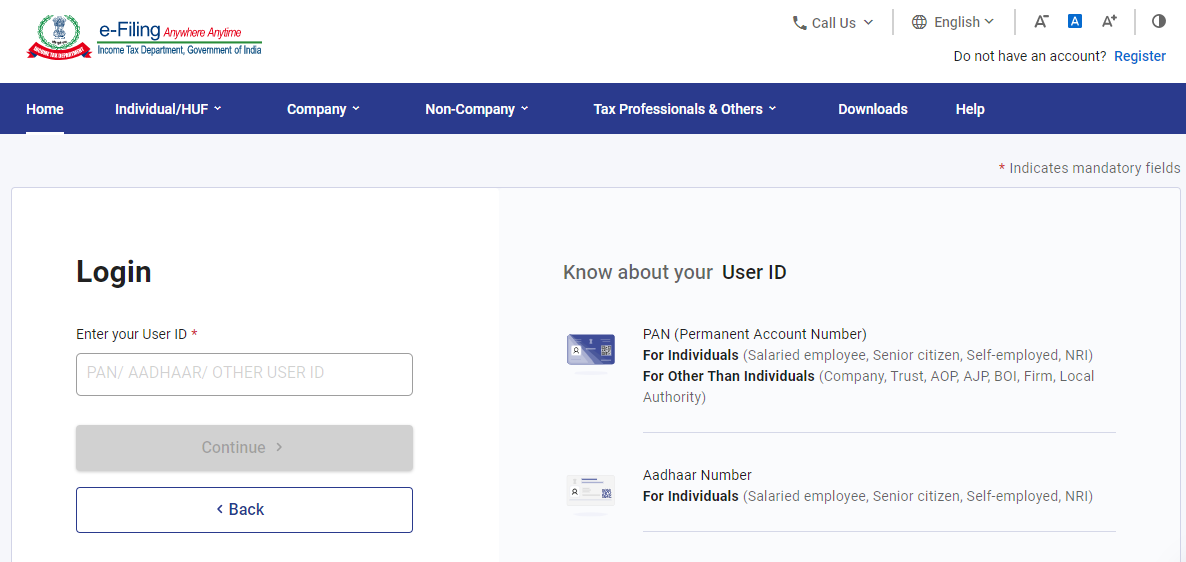

- Visit the income tax e-filing portal at https://www.incometax.gov.in/iec/foportal/.

- Sign into the portal using your user ID (PAN or Aadhaar number) and password.

- After successfully logging into the portal, go to ‘My profile’ section. Click on ‘My Bank Account’ option given on the top left corner.

- Choose ‘Add Bank Account’ option.

- In the next step, enter your bank account details, including bank account number, account type, account holder type, bank name, IFSC code and bank branch.

To successfully pre-validate, ensure that the PAN, individual’s name, mobile number, and email ID provided to the bank account should match your bank account details. Hence, getting the PAN linked or updated with your bank is crucial before proceeding to pre-validate your bank account details through the e-filing portal.

- Click on ‘Validate’ to submit your request for validating the bank account.

What should you do if pre-validation is unsuccessful?

You will get the status of your validation request on your mobile number and email address registered with the official e-filing portal. If the validation of the bank account fails, the details will appear under the ‘Failed Bank Accounts’ tab under ‘My Bank Account’ section in your profile.

In case of failed bank pre-validation, you can re-submit the failed bank accounts for validation.

- Go to Failed Bank Accounts section.

- Click on Re-Validate for the bank and the account with the status ‘Validation’ in progress.

How to check the status of your request to pre-validate your bank account?

- Log into the official e-filing portal to view the status of your request to pre-validate your bank account.

- When you click on ‘Pre-validate’ option, a screen will appear with the message ‘Your request for pre-validating bank account is submitted. The validation process is in progress and the status will be updated shortly.’

- Click on ‘My Bank Account’ under ‘Profile Settings’. The status of the request will appear on the screen.

- In case the bank account validation has failed, the status will be displayed. You can add or remove the bank account after 24 hours. Note that you cannot change the mobile number or email address without revalidation from the bank.

FAQs

Can an individual taxpayer validate and select multiple bank accounts for ITR refund?

An individual tax assessee is allowed to pre-validate multiple bank accounts. He can select more than one bank account for an income tax refund.

Can non-individual taxpayers use EVC for e-verification?

Enabling or disabling the EVC is valid only for individual taxpayers. Taxpayers of other categories cannot use their pre-validated bank account for generating EVC to e-verify income tax returns and forms.

How long will it take to pre-validate bank account after submitting details?

The pre-validation of bank account takes place automatically. The request submitted by you will be sent to your bank. The validation status will be updated in your account within 10 to 12 working days.

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.