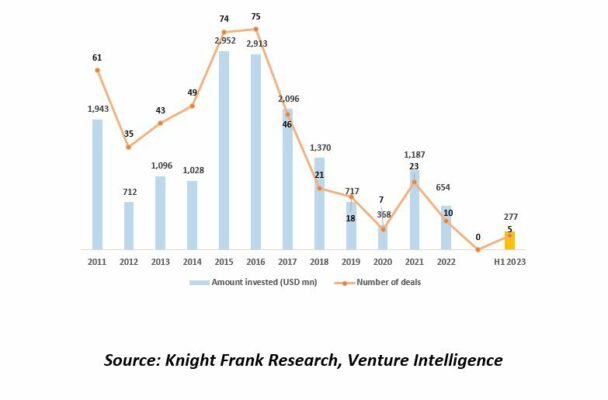

June 29, 2023: The Indian realty sector has received $2.6 billion in private equity (PE) investments across office, warehousing and residential sectors in the first half of 2023, cited the Trends in Private Equity Investment in India – H1 2023 Knight Frank India report.

According to the report, this is down 20% from H1 2022 as PE investors adopted a measured approach in H1 2023, resulting in a conservative shift in investment strategies. A rebound is expected in the second half of 2023. Overall, the PE investments in the Indian realty sector is estimated to touch $5.6 bn in 2023, a 5.3% YoY growth.

The office sector, at 68%, accounted for the largest share of all PE investments, followed by warehousing sector at 21% and residential sector at 11% share. Mumbai received the highest investments accounting for 48%, NCR stood second at 32% and Bangalore at 13%. Nearly 75% of investments came from Asian countries in H1 2023, in contrast to 86% investment received from Canada and the US in H1 2022.

Trends in PE investments in office assets

The office sector received $1.8 billion in investments during H1 2023. The trend of office assets maintaining their lead continued in H1 2023, accounting for a 68% share of total investments. PE investments in the office sector experienced a YoY increase of 24% in H1 2023. This growth was largely driven by a substantial deal worth $1.4 billion between GIC and Brookfield India Real Estate Trust REIT. Around 80% of the investments in H1 2023 were in ready assets, while 20% were allocated to new and under-construction developments, reflecting investor aversion to risks. Mumbai, NCR and Bangalore emerged as leading investment destinations for office investments in H1 2023.

Trends in PE investments in residential sector

Residential sector attracted $277 million in investments during H1 2023. All PE investments in the residential sector were focused on under-construction projects, aiming for investments at an early stage for better returns. Foreign PE players accounted for 82% of the private equity investments in the residential sector. NCR and Bangalore emerged as the leading investment destinations, driven by development stage transactions involving prominent global players.

Investments considered till June 25, 2023

Investor interest in retail moving beyond metros

| Cities | Amount invested (USD mn) | Number of deals |

| Mumbai | 1,664 | 9 |

| Bangalore | 512 | 2 |

| Pune | 483 | 5 |

| Chandigarh | 267 | 2 |

| Hyderabad | 197 | 2 |

| NCR | 192 | 2 |

| Ahmedabad | 123 | 1 |

| Lucknow | 115 | 1 |

| Chennai | 106 | 2 |

| Nagpur, Amritsar | 100 | 1 |

| Indore | 61 | 2 |

| Bhubaneshwar | 46 | 1 |

| Kolkata | 77 | 1 |

| Grand Total | 3,944 | 31 |

Source: Knight Frank Research

Retail sector did not witness any deal in H1 2023. However, the investor interest in the retail sector has expanded beyond major metros during the last decade. As per the report, apart from the metros or the key eight markets, the traction is also seen in markets like Chandigarh attracting investment of $267 million, Nagpur and Amritsar $100 million each, Indore $61 million and Bhubaneshwar $46 million.

Trends in PE investments in warehousing sector

Investment in the warehousing segment experienced a contraction in H1 2023, with an amount of $555 million compared to $1.2 billion in H1 2022. The lack of supply of high-quality grade assets contributed to the slowdown in investments in the warehousing sector. As per the KnightFrank report, PE investors are targeting various sub-sectors within the warehousing market, including e-commerce logistics and 3PL (third-party logistics) facilities. Despite the dip in PE investment in warehousing in H1 2023, the report points that the outlook for this asset class remains positive.

Shishir Baijal, chairman and managing director, Knight Frank, said, “Indian economic growth in the last few quarters has been a strong reason for long-term confidence among global investors. However, we have witnessed a decline in the volume of investments over the past year due to the economic challenges faced worldwide, leading some large economies to take drastic fiscal and monetary policy measures. This has further caused investors to re-evaluate their strategies, at least in the short-term. The India office sector continues to attract investors, particularly for ready income-yielding assets. Looking ahead, the office sector is expected to remain a favourite among investors, as it is likely to maintain its momentum in the short to mid-term.”

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |