While it is a well-known fact that housing finance is a boon for modern-day home seekers who face financial limitations, there are various misconceptions attached to these facilities. Before a buyer plans to opt for a home loan to buy a new home, they must be familiar with certain facts about this product.

How much home loan can I get on the property value?

There could be cases where banks would offer you 90% of the property cost, as loan. However, there is no blanket rule about this. The lender would check a variety of factors, including your repayment eligibility, before they agree to grant you that kind of loan.

Can I claim tax benefits for loans from family members?

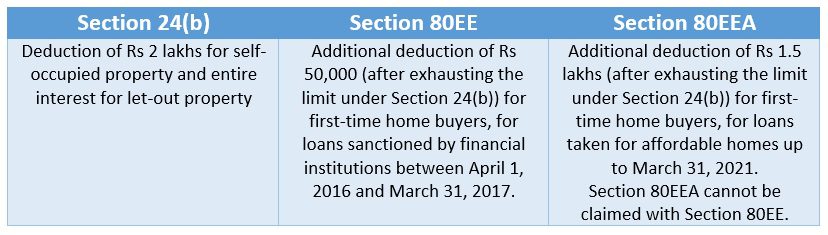

Tax benefits on interest payment under Section 24 of the Income Tax Act, are available to the borrower if he takes a loan from personal channels –friends, family, etc. The borrower must, however, note that they cannot claim deductions under Section 80C on repayment of the principal component. The borrower also cannot claim benefits on interest payment under Section 80EE or Section 80EEA.

See also: Have knowledge about IFSC full form

Can I claim tax benefits on stamp duty and registration?

Under Section 80C, a home buyer can not only claim rebate on the home loan principal repayment but also on stamp duty, registration charges and other additional expenses. However, the limit stands at Rs 1.50 lakhs in a year.

Can I repay a housing loan in cash?

You can repay your home loan taken from any housing finance company (HFC) or non-banking finance company (NBFC) in cash, provided each installment is less than Rs 2 lakhs. According to a notification issued in 2017 by the Finance Ministry, the prohibition of cash payment applies to repayment of a single loan installment in cash and not to the aggregate amount. On the other hand, according to the income tax laws, cash payment of over Rs 2 lakhs is illegal.

Is it mandatory to have a co-borrower for a home loan?

When you apply for a home loan, most banks would encourage you to apply for a joint home loan, enumerating its various benefits. This may lead you into believing that co-applying is mandatory, which is incorrect. While there are several benefits of jointly applying for a home loan, there are disadvantages too. Please read our post Should you opt for a joint home loan? to know more.

How will my credit score affect my loan eligibility?

Among the many factors based on which a bank may or may not approve your home loan request, is your credit score, which is a rating assigned to you by the credit bureaus based on our borrowing history. While a good credit score might get you a cheaper home loan, it is not the only factor that financial institutions consider, while processing your home loan application. More importantly, you could easily improve your credit score, by following some simple methods.

Do all borrowers get the same interest rates?

Banks offer varying rates of interest to different customers. The gender of the applicant also plays a role in deciding the interest rate. Most banks offer lower interest rates to women borrowers. Also, the rate of interest for the salaried class is lower than that for the self-employed, because of the higher risk perception. Similarly, banks offer cheaper rates to people with good credit scores.

Will the bank repossess my home if I default?

This is generally the last resort for banks, as they are not in the business of claiming homes and selling it in the market to make profits. They are in the business of banking where they want to earn benefits by way of regular EMIs. Even in the worst-case scenario, banks would prefer to find an option that is most suited to all parties concerned.

Is home loan insurance compulsory?

Banks often nudge buyers into buying home insurance and home loan insurance as part of a package deal. Buyers often venture into buying such products, without analysing whether it is suited to their individual needs. Unless you are certain about the home loan and home loan insurance product that is being sold by the lender, do not buy them. You can always buy any of these products at a later stage, on completion of due diligence.

Can I transfer my loan more than once?

There is no rule that limits a borrower from transferring his home loan. Consequently, a borrower has the choice to change his lender as and when he thinks it is proper. However, changing your lender comes at a cost – each time you go through the process, you have to pay for expenses such as processing fees, stamp duty, legal charges, etc.

See also: How can I transfer my home loan?

Do I have to pay penalty on prepayment?

The RBI has prohibited banks from charging any penalty, if borrowers pre-pay their housing loans. However, this remains true if the home loan interest is linked with floating rates. In case a home loan is linked with a fixed rate of interest, the bank can charge a penalty on prepayment.

See also: The pros and cons of prepaying a home loan

FAQs

For how many years deduction under Section 80EEA is available?

Deductions can be claimed throughout the loan repayment tenure.

Can I claim deductions under Section 80EEA after I buy my second property?

Yes, deductions under Section 80EEA are available on home loans that are taken when the tax payer has no property. Your future property ownership has no impact on this rebate.