Land tax in Pathanamthitta, Kerala, is an important revenue source for the district and must be paid annually by all property owners. This tax can be conveniently paid online through the Sandes App, Sanchaya portal or Revenue App. These platforms ensure a smooth payment process and assist in calculating property tax. Timely payment of land tax in Pathanamthitta is crucial to avoid penalties and qualify for rebates. Learn when and how to pay land tax in Pathanamthitta.

Pathanamthitta land tax rate for 2024

For municipalities, the land tax rate is Rs 10/R for six cents of land. For land exceeding six cents, the tax rate increases to Rs 15/R. Property owners must pay the half-yearly land tax within 30 days of the start of each half-year. If the tax is not paid by the due date, it will incur a penalty of 2% per month from the due date.

How to calculate land tax in Pathanamthitta?

Follow these steps to calculate Pathanamthitta land tax:

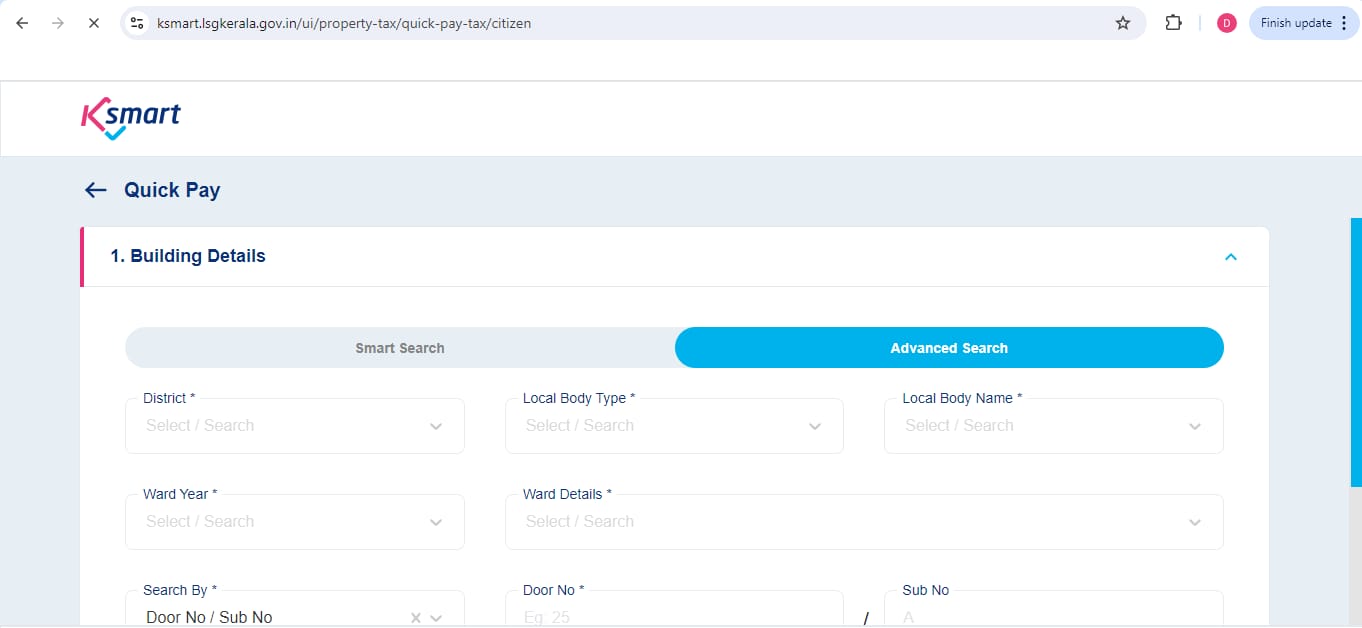

- Visit the official KSmart portal.

- On the homepage, select your district and click on ‘Property Tax’.

- Click on ‘Estimate Tax’ to proceed to the next page.

- Enter all the required details on the dashboard to view the accrued property tax.

- Review the property tax amount and choose a payment method to pay the land tax online in Pathanamthitta.

How to make Pathanamthitta land tax payments online?

Paying land tax online in Pathanamthitta is straightforward and can be done via the Sanchaya Portal, Sandes App or Revenue App.

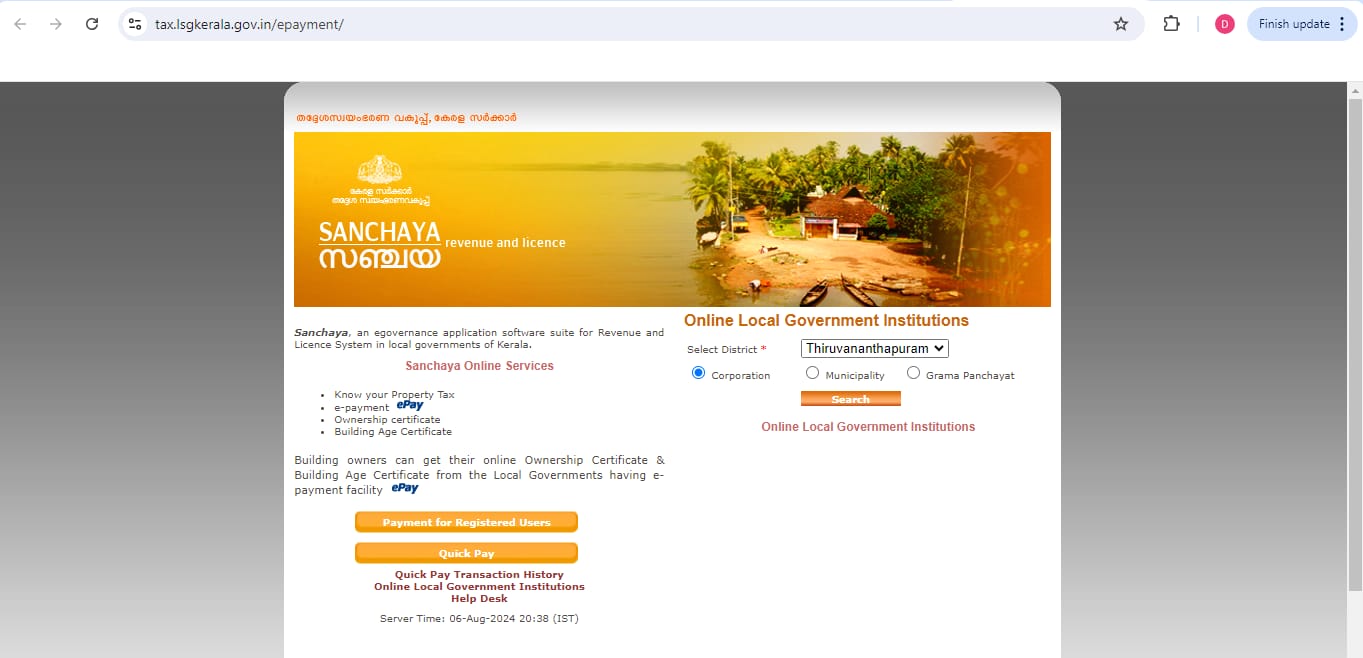

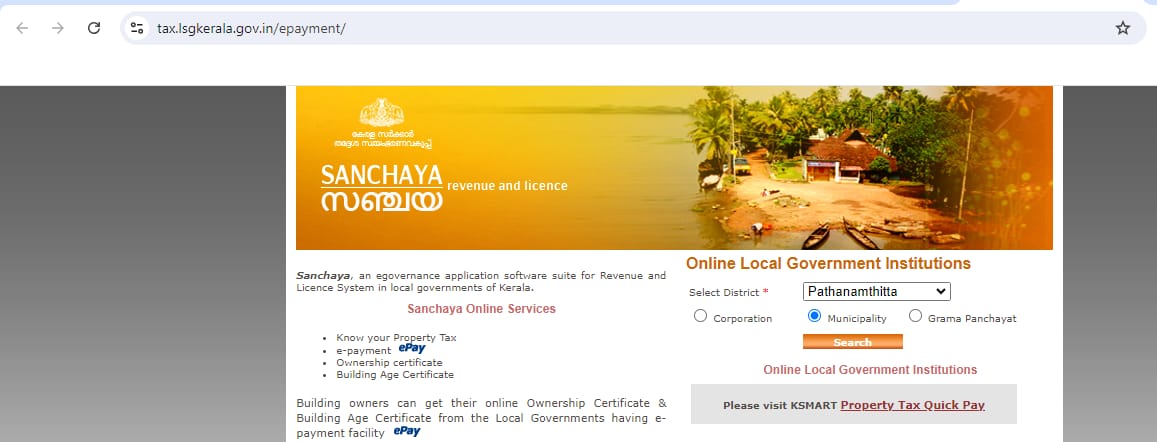

Payment of Pathanamthitta land tax through Sanchaya portal

- Visit the official Sanchaya portal.

- On the homepage, select your district (Pathanamthitta) and choose your municipality. Click on ‘Search’.

- Select ‘Property Tax Quick Pay’ to proceed.

- Enter all the required details and click on ‘Search’.

- Review the property tax amount and choose a payment method to complete the land tax payment online in Pathanamthitta.

Payment of land tax in Pathanamthitta through the Sandes app

- Visit the Google Play Store and search for the Sandes app.

- Open the app and log in with your registered mobile number or enter your details to register.

- Enter the OTP received and proceed to the next page.

- Choose ‘Land Tax’ and enter the taluk, district and village name, followed by the block number.

- Review the accrued property tax and proceed to the payment page.

- Pay the land tax online for Pathanamthitta using any of the available online payment methods.

Pathanamthitta land tax payment through the Revenue App

- Visit the Google Play Store and search for the Revenue eServices Kerala app.

- Open the app and log in with your registered mobile number or enter your details to register.

- Enter the OTP received and proceed to the next page.

- Choose ‘Land Tax’ and enter the taluk, district and village name, followed by the block number.

- Review the accrued property tax for your property and proceed to the payment page.

- Pay the land tax online for Pathanamthitta using any of the available online payment methods.

Last date to pay the Pathanamthitta land tax

The last date to pay the land tax in Pathanamthitta is March 31 and September 30 of each year. Those who fail to pay within the specified timeline face penalties.

Pathanamthitta land tax rebate

Citizens of Pathanamthitta who pay their land tax in advance are eligible for a 5% rebate.

Housing.com POV

Paying land tax in Pathanamthitta, Kerala, is the responsibility of property owners, contributing significantly to the district’s revenue. The tax can be paid online through the Sanchaya Portal, Sandes App or Revenue App. These platforms facilitate an easy calculation and payment process, helping property owners avoid penalties and earn a 5% rebate for early payments. The rates for 2024 vary based on land size, with different rates for properties up to and beyond six cents. Following the outlined steps for each platform ensures a seamless experience in managing land tax obligations in Pathanamthitta.

FAQs

What are the land tax rates in Pathanamthitta for 2024?

For municipalities, the land tax rate is Rs 10/R for up to six cents of land. For land exceeding six cents, the tax rate increases to Rs 15/R.

When is the last date to pay land tax in Pathanamthitta?

The last date for paying land tax in Pathanamthitta is March 31 and September 30 of each year. Failing to pay within this timeframe will result in penalties.

How can I pay my land tax online in Pathanamthitta?

You can pay your land tax online through the Sanchaya Portal, Sandes App or Revenue App. Each platform provides a straightforward process for calculating and paying your tax.

Is there a rebate for early payment of land tax in Pathanamthitta?

Yes, citizens who pay their land tax in advance are eligible for a 5% rebate.

What details are required to calculate land tax in Pathanamthitta?

To calculate land tax, you need to provide details, such as local body type, local body name, building completion date, ward year, zonal office, ward name, nearest road width, building zone, roof type, floor type, building age, functionality and total plinth area

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |