The government has launched several mega schemes in the past decade to empower the weaker sections of the society. The PM SVANidhi scheme is one of the social programmes.

What is PM SVANidhi?

The PM Street Vendor’s Atmanirbhar Nidhi (PM SVANidhi) is a micro credit scheme launched by the government for street vendors. The PM SVANidhi scheme has helped promote ‘inclusive entrepreneurship’ and proven to be a gender equaliser. This central government scheme helps street vendors to access affordable working capital loan for resuming their livelihoods activities, after easing of the pandemic-induced lockdown.

PM SVANidhi tenure

The scheme was launched on June 1, 2020. During the initial phase, the scheme was active only till March 2022. However, PM SVANidhi 2.0 extended the scope of the scheme beyond December 2024.

Loan under PM SVANidhi scheme

The scheme was launched during the Covid-19 pandemic on June 1, 2020, by the Ministry of Housing and Urban Affairs. Under the scheme, the central government provides collateral free loan up to Rs 50,000 to eligible street vendors in incremental tranches. It provides loans in three tranches:

- Rs 10,000 in first tranche

- Rs 20,000 in second tranche

- Rs 50,000 in third tranche if the loan of the first and second tranche is repaid.

The loan is provided for a tenure of one year and repaid in monthly instalments. For this loan, no collateral will be taken by the lending institutions. On timely or early repayment, the vendors will be eligible for the next cycle of working capital loan with an enhanced limit. No prepayment penalty will be charged from vendors for the repayment before the scheduled date.

Rate of interest on loan under PM SVANidhi scheme

In case of scheduled banks, regional rural banks, small finance banks, and cooperative banks, the rates will be as per their prevailing rates of interest. In case of NBFC, NBFC-MFIs, etc., interest rates will be as per the RBI guidelines for respective lender category. With respect to MFIs (non NBFC) other lender categories not covered under the RBI guidelines, interest rates under the scheme would be applicable as per the extant RBI guidelines for NBFC-MFIs.

Implementing partner for PM SVANidhi: SIDBI

The Small Industries Development Bank of India (SIDBI) is the implementing partner for the scheme. It has launched a portal and developed a mobile app for banks. This has helped lending institutions manage the large number of applications for the scheme.

PM SVANidhi scheme: Eligibility

The scheme is available to all street vendors engaged in vending in urban areas. The eligible vendors will be identified as per the following criteria.

- Street vendors in possession of certificate of vending/identity card issued by the Urban Local Bodies (ULBs).

- The vendors who have been identified in the survey but have not been issued certificate of vending/identity card.

Provisional certificate of vending would be generated for such vendors through an IT-based platform. ULBs are encouraged to issue such vendors the permanent CoV and identification card immediately and positively within a period of one month.

(iii) Street vendors, left out of the ULB-led identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB/town vending committee (TVC); and

(iv) The vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the ULBs and have been issued LoR to that effect by the ULB/TVC.

*Identification of beneficiaries left out of the survey or belonging to the surrounding rural areas

While identifying the vendors belonging to category 4 (iii) and (iv), the ULB/ TVC may consider any of the following documents to issue Letters of Recommendation:

(i) The list of vendors, prepared by certain states/UTs, for providing one-time assistance during the period of lockdown, Or

(ii) A system generated request sent to ULBs/TVCs for issue of LoR based on the recommendation of the lender after verifying the credentials of the applicant, Or

- The membership details with the vendors associations including National Association of Street Vendors of India (NASVI)/National Hawkers Federation (NHF)/Self-Employed Women’s Association (SEWA) etc., Or

- The documents in possession of the vendor buttressing his claim of vending, Or

- Report of local enquiry conducted by ULB/TVC involving Self-Help Groups (SHGs), Community Based Organizations (CBOs), etc. ULB shall complete the verification and issuance of LoR within 15 days of the submission of application.

Further, ULBs may adopt any other alternate way for identifying such vendors with a view to ensure that all the eligible vendors are positively covered.

Vendors who have gone back to their native places due to Covid-19: These vendors, whether from rural/peri-urban areas or city dwellers will be eligible for loan on their return as per eligibility criteria for identification of beneficiaries.

Documents needed to apply for PM SVANidhi loan

For first loan

For Category-A and B vendors:

- Certificate of vending

- Identity Card

For Category-C and D vendors:

- Letter of Recommendation

- KYC documents required in addition to CoV/ID/LoR

- Aadhaar Card

- Voter Identity Card

- Driving Licence

- MNREGA Card

- PAN Card

For Letter of Recommendation:

- Copy of Account Statement/Passbook

- Copy of Membership Card/any other proof of membership

- Any other documents to substantiate the claim as a vendor

- Request letter to ULB

For Second Loan

- Loan closure documents

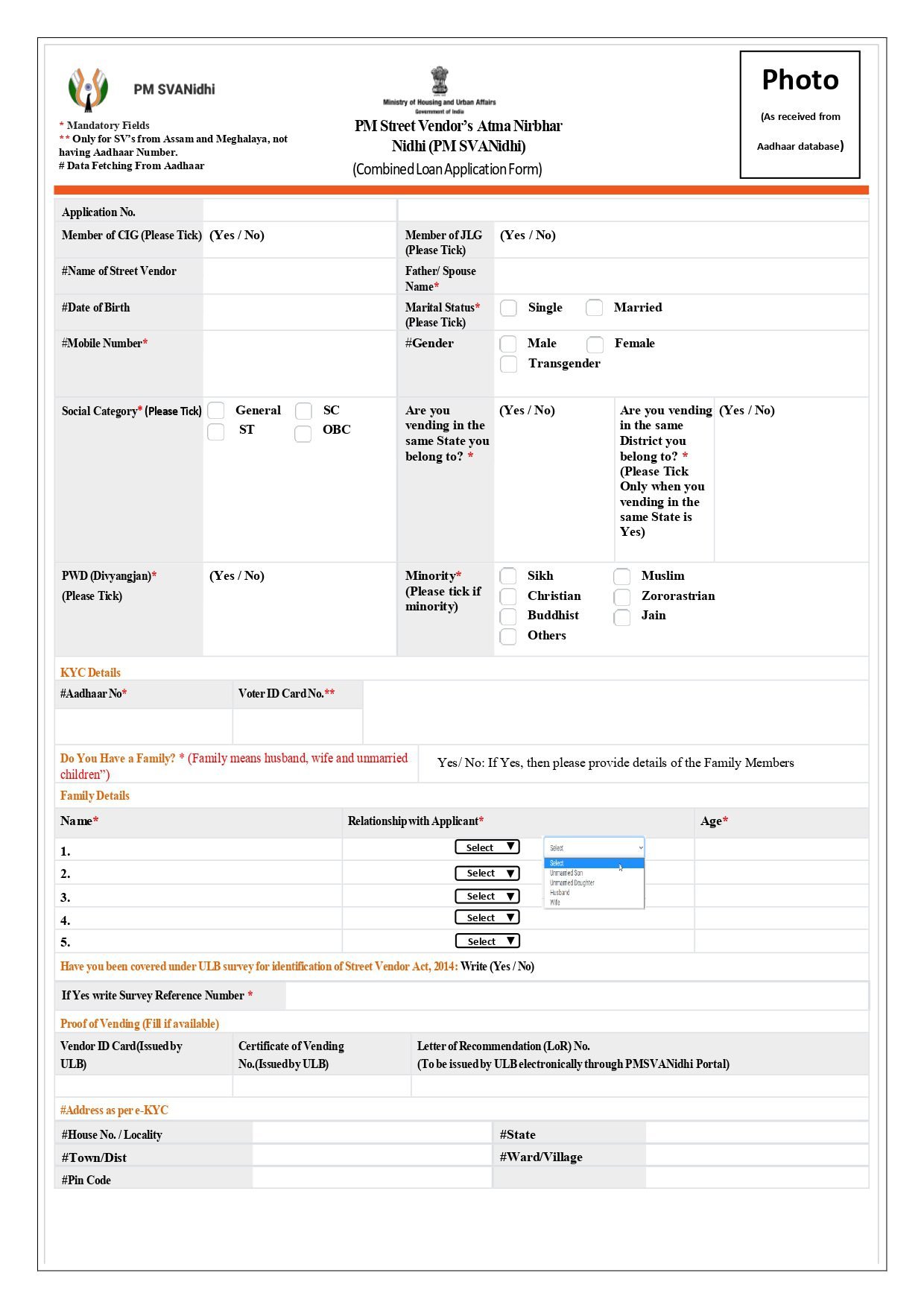

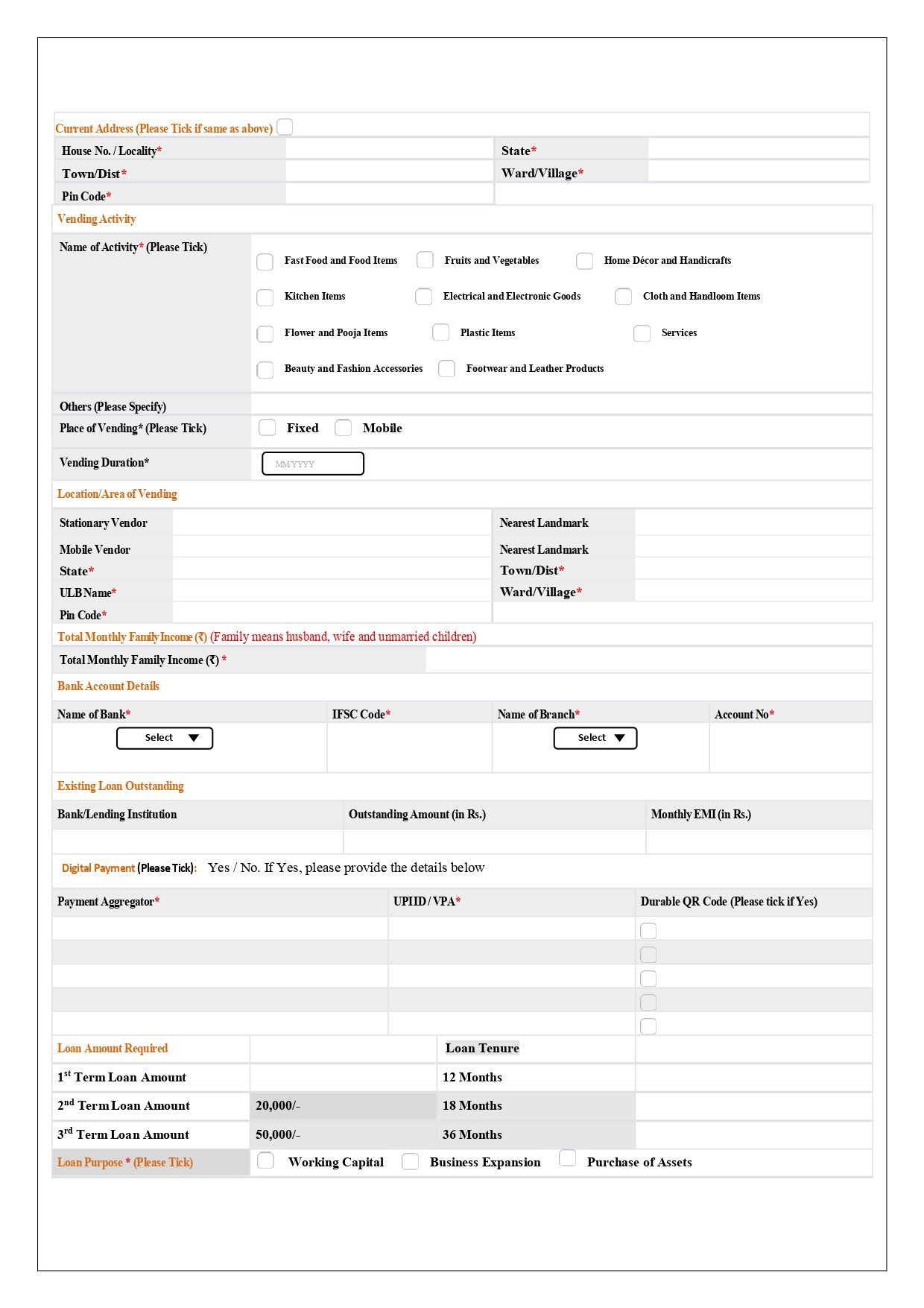

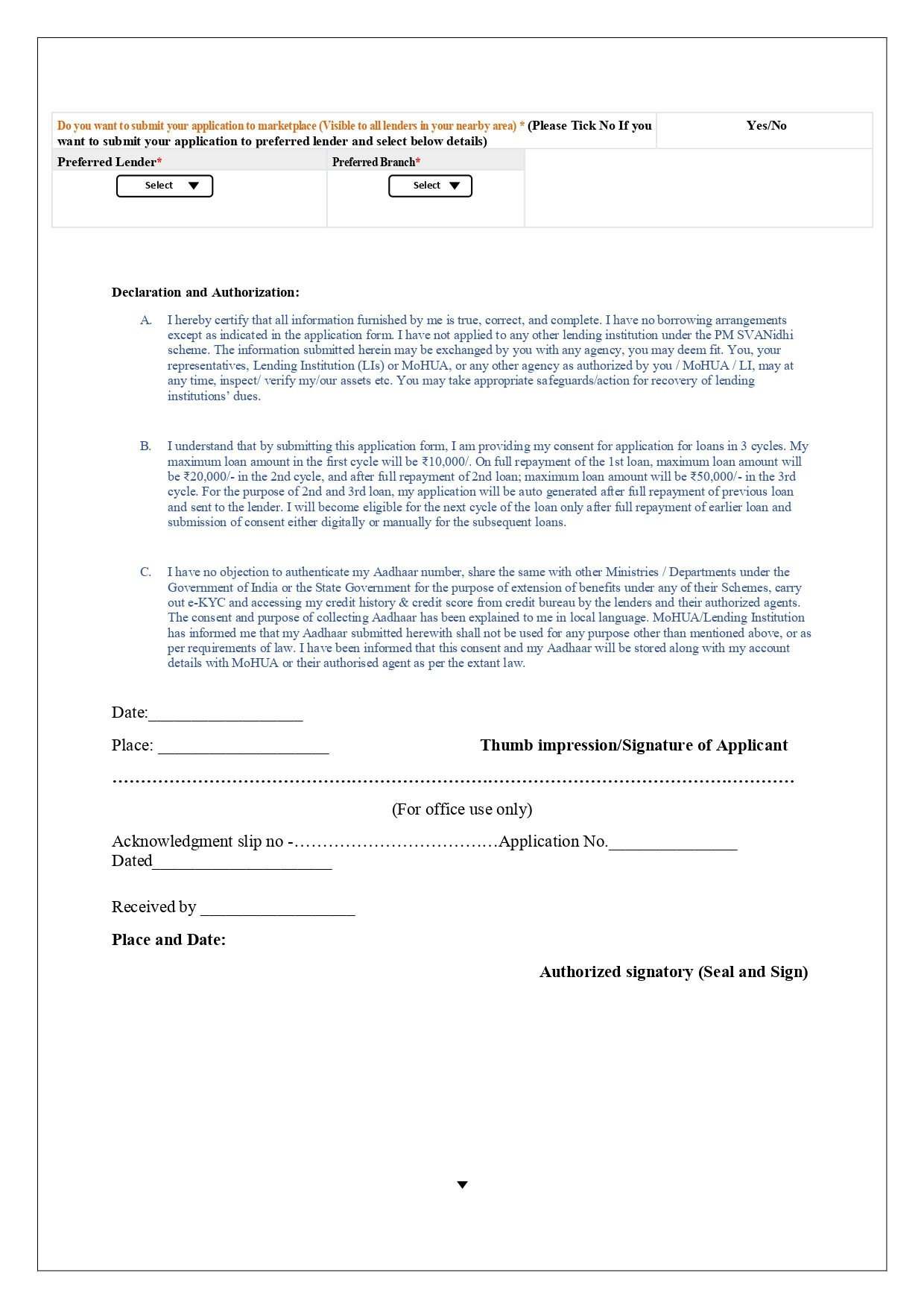

PM SVANidhi loan application form

Click here to download the pdf

How to apply for loan under PM SVANidhi Yojana?

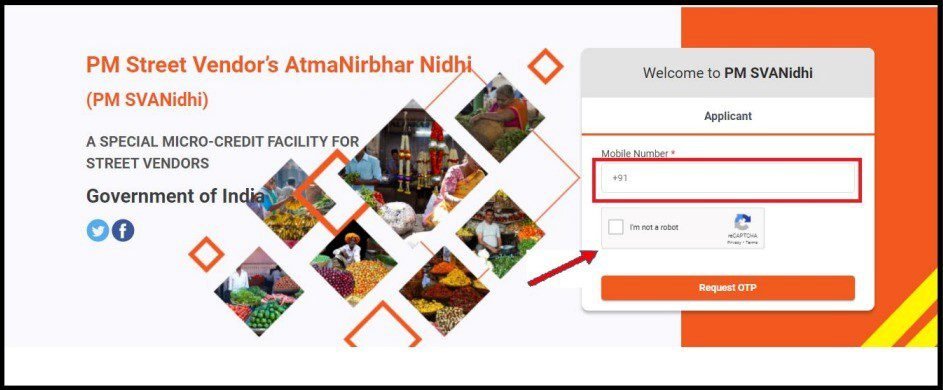

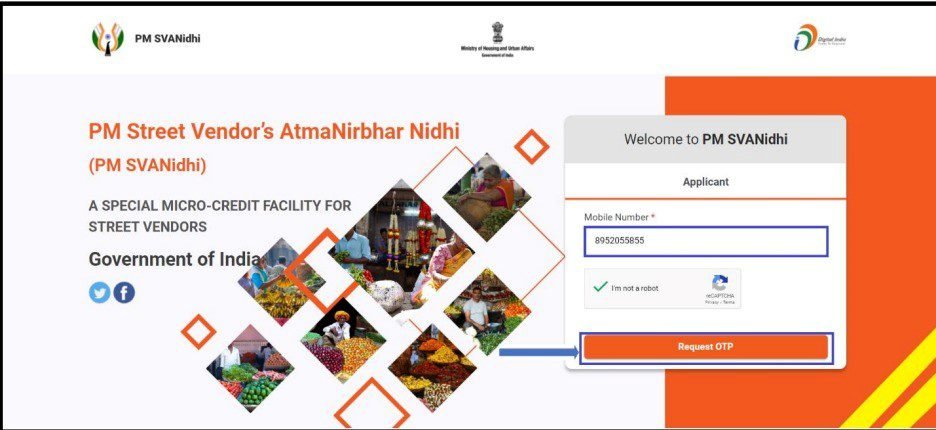

Step 1: Visit the official website: https://pmsvanidhi.mohua.gov.in/.

Step 2: Enter ‘Mobile Number’ of street vendor. Select the check box of ‘I am not a robot’ and click on ‘Request OTP’.

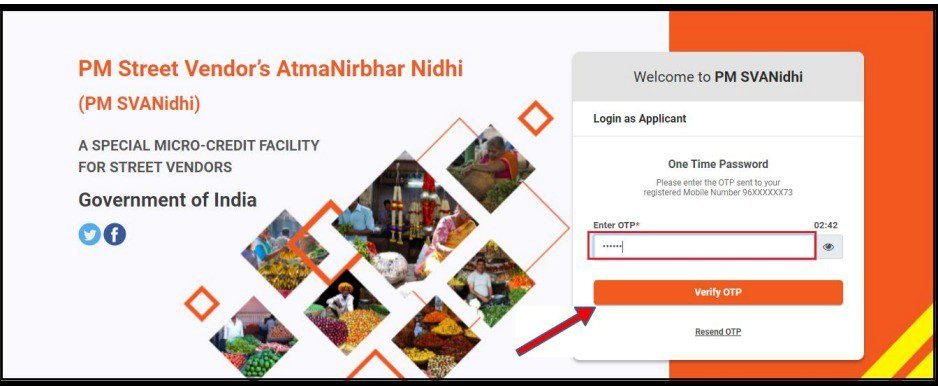

Step 3: Enter six digits OTP received on street vendor Mobile Number and click on ‘Verify OTP’. Upon verification of OTP, the user will successfully login.

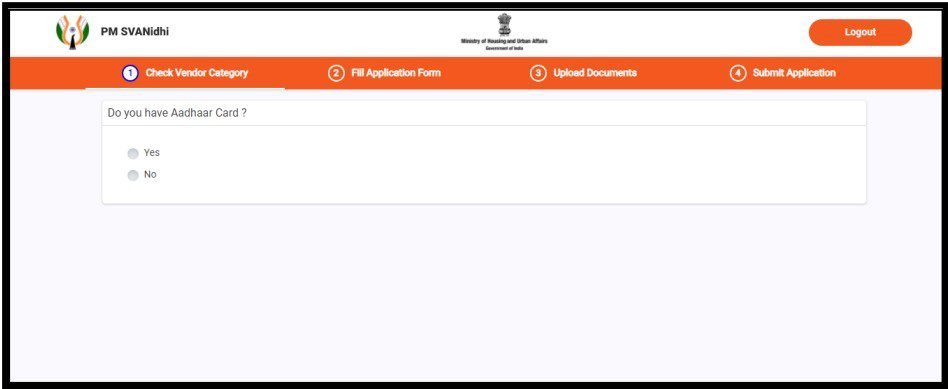

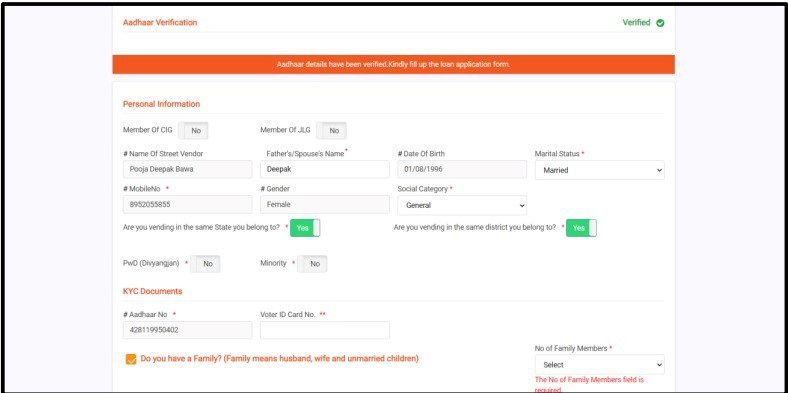

Step 4: Do you have Aadhaar Card? Select option as ‘Yes or No’.

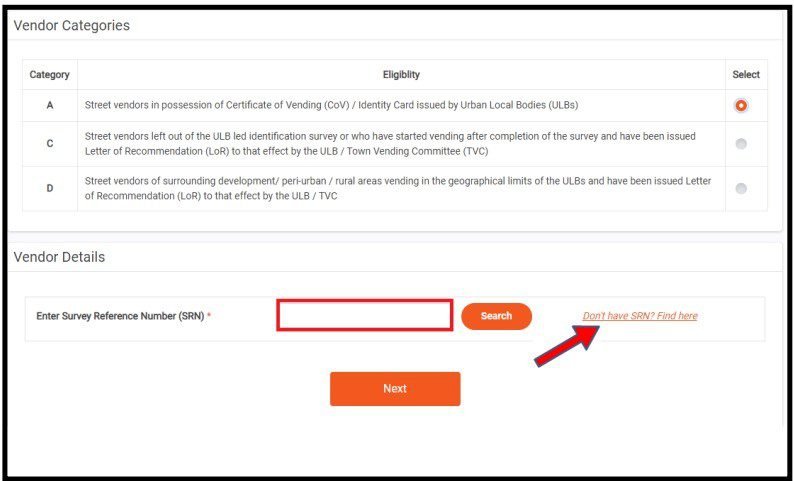

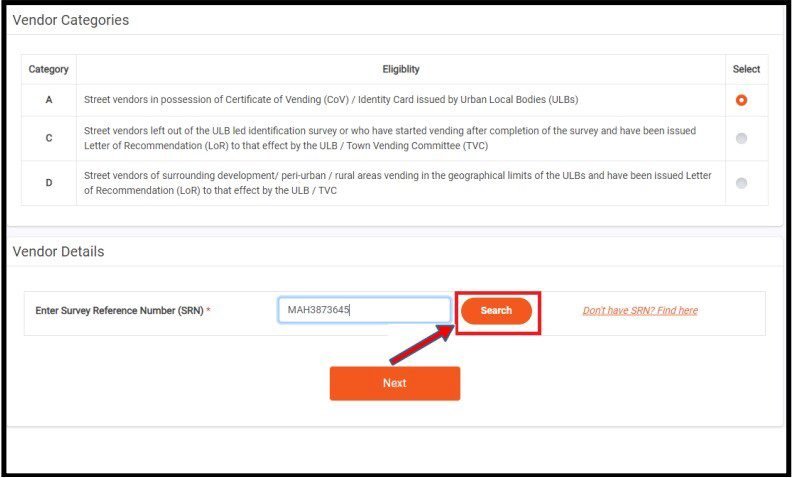

Step 5: Select the category of the street vendor.

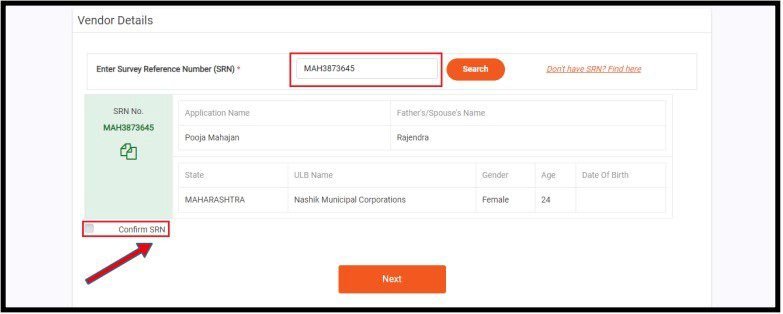

Step 6: If the street vendor selects category as A, then SRN number will be asked. If SRN is not known, click on the link ‘Don’t have SRN? Find here’. A link for searching SRN will open in a new tab.

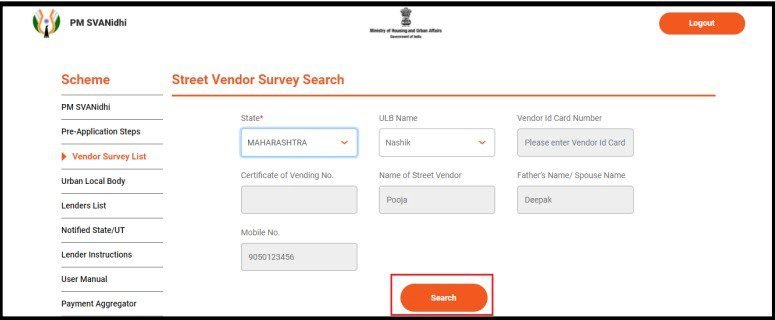

Step 7: To find SRN, choose state, enter the mobile number of the street vendor, and click on ‘Search’. (Mobile number should be as per the data sent to GoI i.e., updated in the portal.)

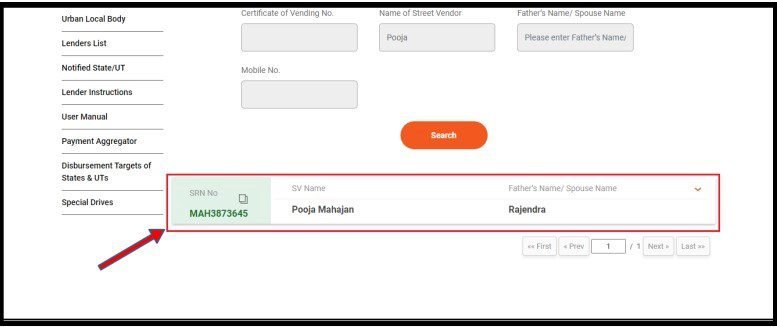

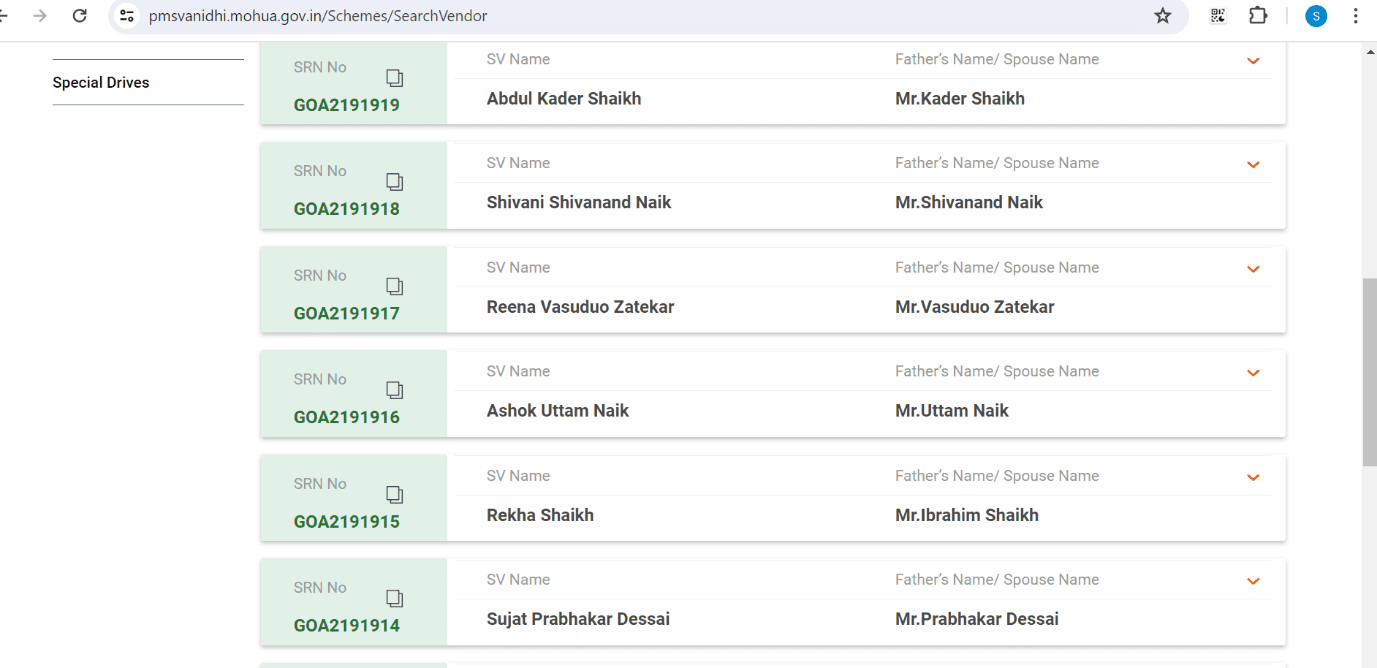

Step 8: SRN number with green colour will be displayed. Copy ‘SRN Number’.

Step 9: In the previous tab enter the ‘SRN’ number and click on ‘Search’.

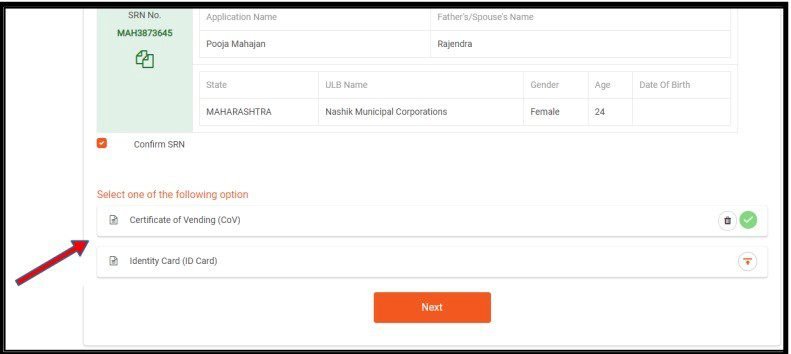

Step 10: SRN number along with street vendor details will be displayed. Confirm the SRN number by selecting the check box.

Step 11: Upload either ‘ID Card or Certificate of Vending or both’. After clicking on ‘Next’, the user will proceed to the Loan Application Form.

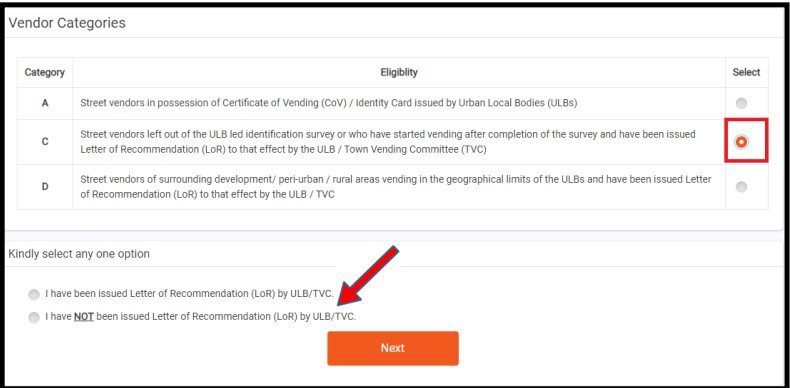

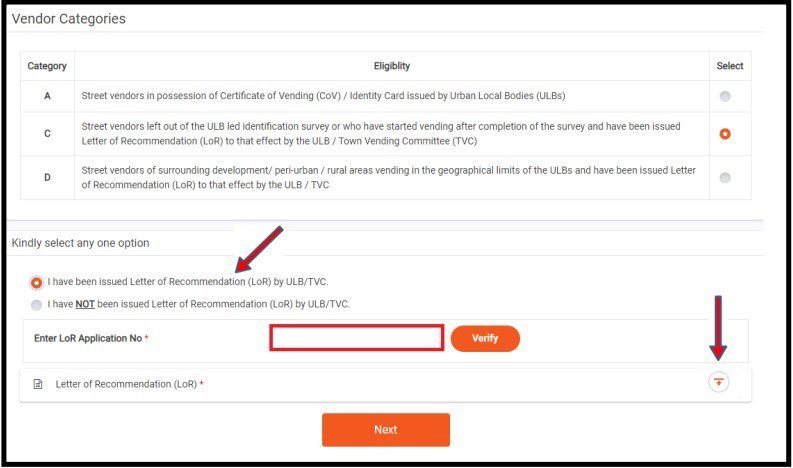

Step 12: If the street vendor selects categories as C or D, then the street vendor will be asked if they have been issued a ‘Letter of Recommendation’ (LoR).

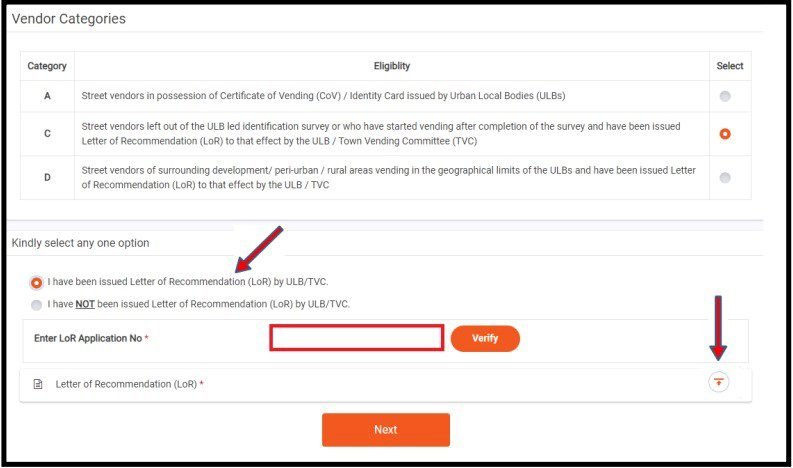

Step 13A (i): If the street vendor has LoR, then select the option ‘I have been issued Letter of Recommendation (LoR) by ULB/TVC’.

Step 14 A (i): Upload the Letter of Recommendation and click on ‘Next’. After clicking on ‘Next’ the user will proceed to the Loan Application Form.

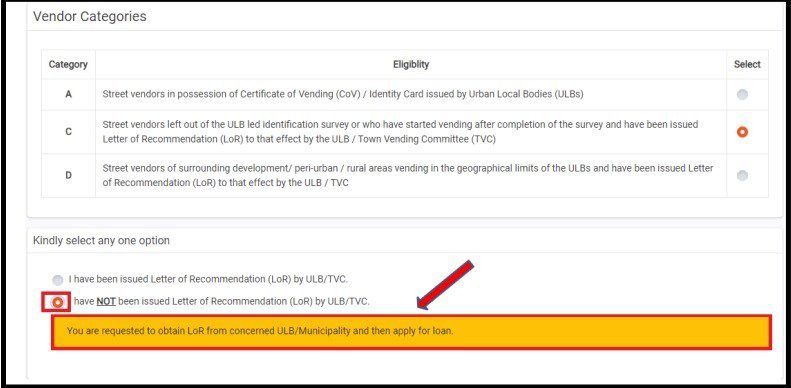

14-B (ii): If the street vendor does not have an LoR, select the option ‘I have NOT been issued Letter of Recommendation (LoR) by ULB/ TVC’. The message box will appear as ‘You are requested to obtain LoR from concerned ULB/Municipality and then apply for loan’.

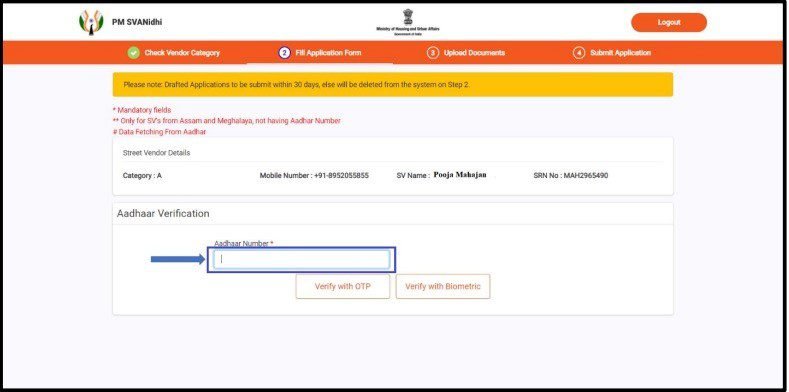

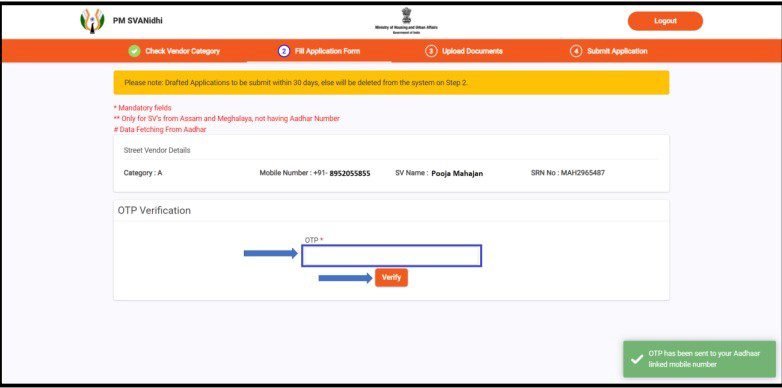

Step 15: Enter the Aadhaar Number of street vendor and click on ‘I am not Robot’ and click on ‘Verify with OTP’.

Step 16: Street vendor can verify Aadhar with OTP.

Step 17: Fill in the personal information and click on ‘Save’.

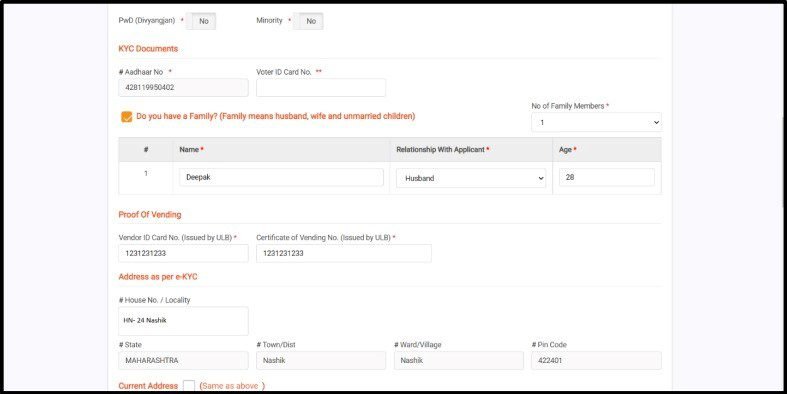

Step 18: Fill in the family details only when your marital status is ‘Married’, also enter ‘Vendor ID Card Number’ and ‘Certificate of Vending Number’ issued by ULBs.

Step 19: Enter the address and vending details.

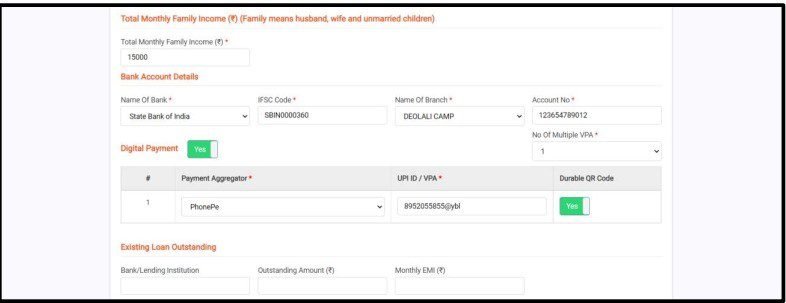

Step 20: Enter the bank account details and enter the Digital Payment details if the vendor is having, if not, then click ‘No’. After filling in the application form click on ‘Save’.

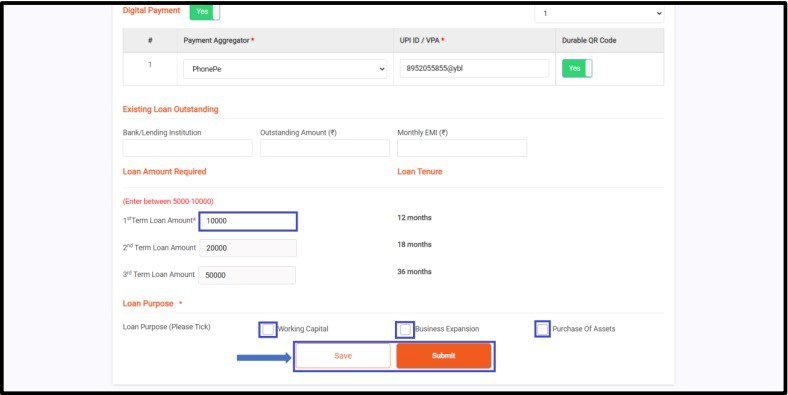

Step 21: Enter the first term loan amount required, loan amount must be between Rs 5,000 to Rs 10,000 and select the check box for ‘Loan Purpose’ and click on ‘Save’. Click on ‘Submit’.

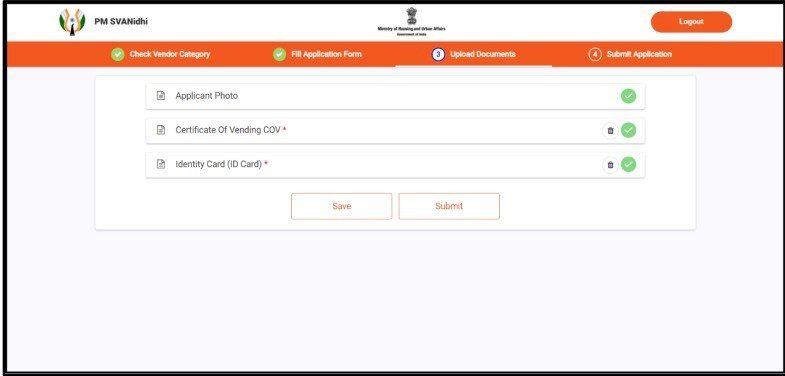

Step 22: The Street vendor will proceed to documentation section. Click on ‘Save’. Click on ‘Submit’.

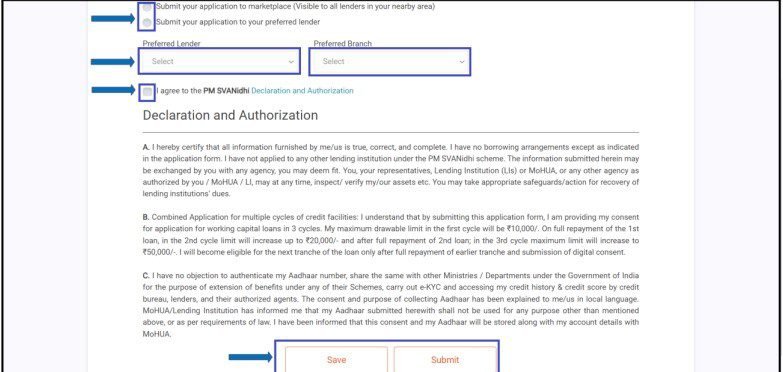

Step 23: Select ‘Bank and Branch’ you want to process the application for releasing loan or submit your application to ‘Marketplace’ and tick ‘PM SVANidhi Declarations and Authorization’. Save and submit the application.

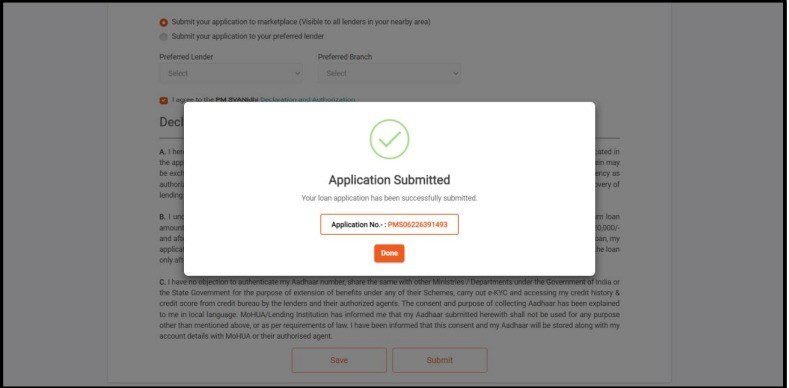

Step 24: You will receive a message as ‘Application Submitted’. Please note the Application Form Number in records for future reference.

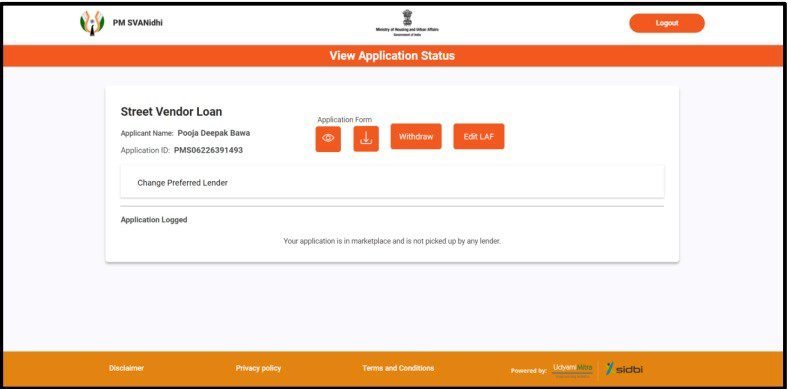

Step 25: Click on ‘Done’, and the application status window will open. Street vendor will be able to see the PMS details.

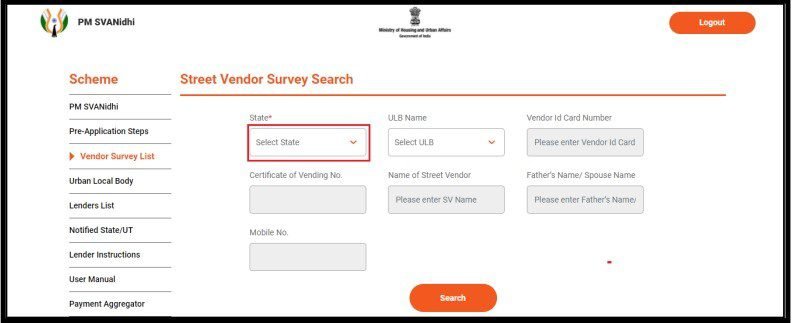

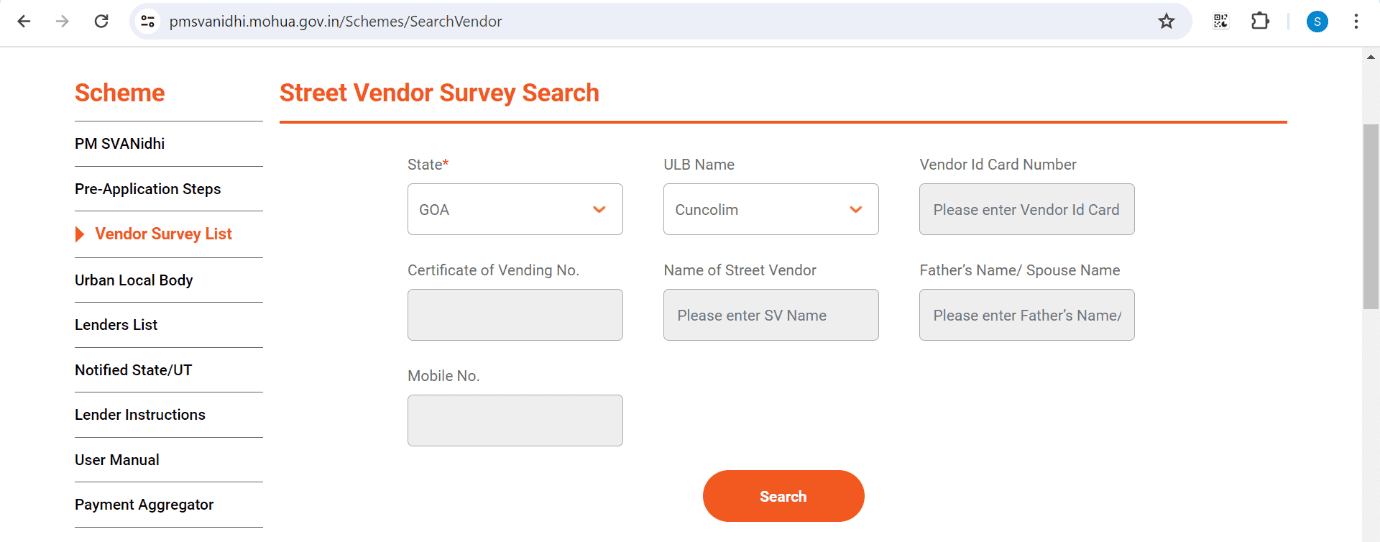

How to check the vendor survey list?

Step 1: Go to the official page: https://pmsvanidhi.mohua.gov.in/Schemes/SearchVendor

Step 2: Select state and ULB.

Step 3: You will be able to see the list of vendors.

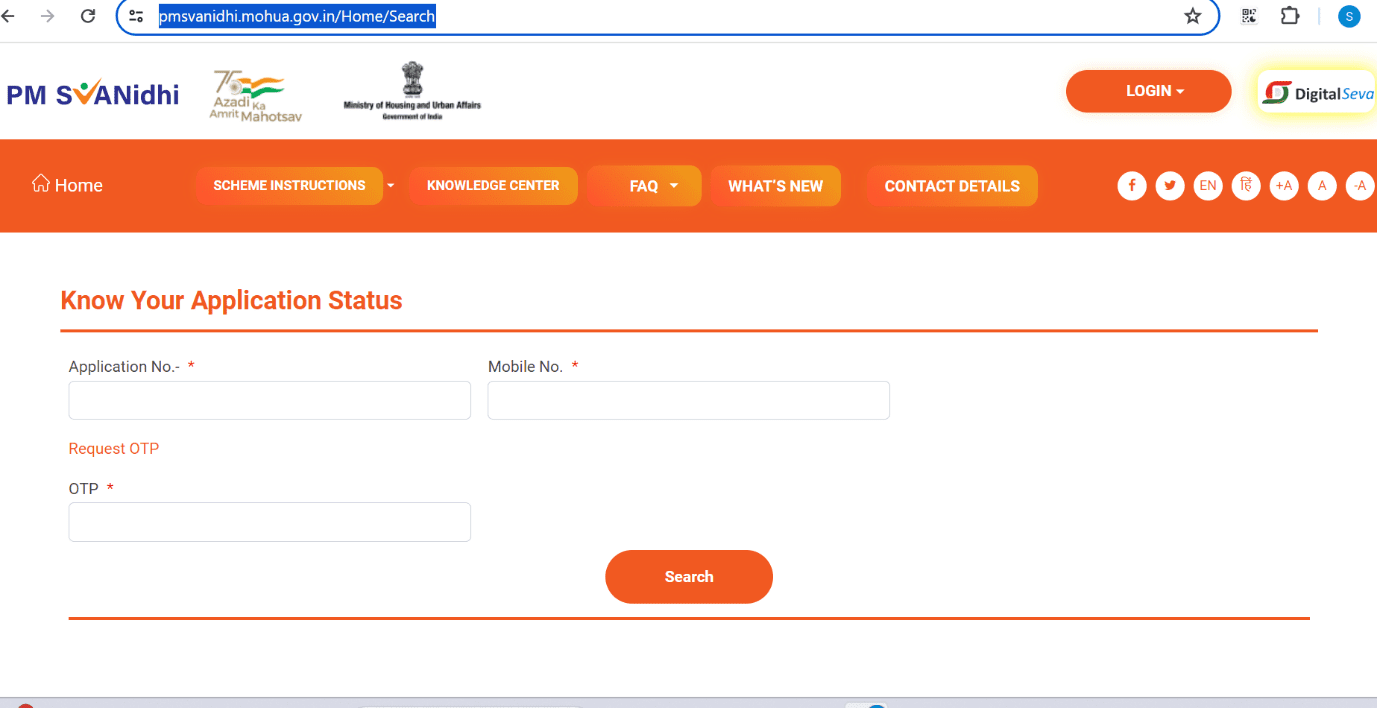

How to know the PM SVANidhi application status?

Step 1: Visit the official page: https://pmsvanidhi.mohua.gov.in/Home/Search

Step 2: Enter your application number and mobile number to request for an OTP. Once you receive an OTP on your mobile, enter it into the required field and click on search.

PM SVANidhi scheme toll-free number

For any query, you can call on the toll-free number 1800 11 1979 between 9.30 AM to 6.00 PM from Monday to Saturday, except national holidays. The helpline service is available in eight languages: Hindi, English, Tamil, Telugu, Kannada, Assamese, Gujarati, and Marathi.

Housing.com Viewpoint

The Ministry of Housing and Urban Affairs recognised the vital role of street vendors in the urban informal economy, ensuring accessibility of goods and services at affordable rates. In response to the challenges posed by the COVID-19 pandemic, the ministry has launched the PM SVANidhi Scheme in June 2020 to support street vendors affected by the lockdown. Keeping in view the importance of the scheme, it has now been extended till December 2024. The scheme has been extended over 80.42 Lakh loans to 60.94 Lakh street vendors amounting to Rs 10,678 Cr till January 2024.

LATEST NEWS

SVANidhi Yojna has proved to be lifeline for street vendors: PM Modi

March 14, 2024: Prime Minister Narendra Modi on March 14 praised the PM SVANidhi scheme as a vital support for impoverished street vendors who previously struggled to get loan due to their inability to provide collateral and afford high interest rates, often facing humiliation when unable to repay on time.

PM SVANidhi scheme benefits 60.94 Lakh street vendors across country: Hardeep S Puri

February 16, 2024: Hardeep Singh Puri, Minister of Housing & Urban Affairs and Minister of Petroleum & Natural Gas, said that the PM SVANidhi scheme has been extended to more than 80.42 Lakh loans to 60.94 Lakh street vendors amounting to Rs 10,678 Cr. He said the scheme has not only resulted into financial inclusion of street vendors but has also led to their respect and dignity. “The aim of the SVANidhi Yojana was to restore the Swarozgar, Svavlamban, Swabhimaan of Street Vendors,” he said.

FAQs

What is the full form of PM SVANidhi scheme?

The full form of PM SVANidhi scheme is the PM Street Vendor’s AtmaNirbhar Nidhi.

What is the PM SVANidhi scheme?

The PM SVANidhi is a Central Sector Scheme to facilitate street vendors to access affordable working capital loan for resuming their livelihoods activities, after easing of the lockdown.

What is the rationale of the PM SVANidhi scheme?

Street vendors usually work with a small capital base. Therefore, credit for working capital to them will be helpful to resume livelihoods.

What are the objectives of the scheme?

The objectives of the scheme are given below. (i) To facilitate working capital loan up to Rs 10,000 at subsidised rate of interest; (ii) To incentivise regular repayment of loan; (iii) To reward digital transactions.

What are the salient features of the scheme?

(i) Initial working capital of up to Rs 10,000 (ii) Interest subsidy on timely/early repayment at 7% (iii) Monthly cashback incentive on digital transactions (iv) Higher loan eligibility on timely repayment of the first loan

Who is the target beneficiary of the scheme?

Street vendors/hawkers vending in urban areas, as on or before March 24, 2020, including the vendors of surrounding peri-urban and rural areas are the beneficiary of the scheme.

Who is a street vendor/hawker?

Any person engaged in vending of articles, goods, wares, food items, or merchandise of daily use, or offering services to the public in a street, footpath, pavement etc., from a temporary built-up structure or by moving from place-to-place is street vendor/hawker. The goods supplied by them include vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, apparel, artisan products, books/stationary, etc., and the services include barber shops, cobblers, pan shops, laundry services, etc.

Which lending institutions will provide credit?

Scheduled commercial banks, regional rural banks, small finance banks, cooperative banks, non-banking financial companies, micro-finance institutions, and SHG banks will provide the credit.

I have an identity card/certificate for vending. How can I apply for the loan?

You can approach a Banking Correspondent (BC)/Agent of Micro Finance Institution (MFI) in your area (ULBs will have the list of these persons). They will help you in filling up the application and upload documents in a mobile app/portal.

How will I know that I am in the surveyed list?

You can access this information from the website of PM SVANidhi (pmsvanidhi.mohua.gov.in).

My name is in the list of surveyed vendors, but I neither have the identity card or the Certificate of Vending? Can I get the loan? If yes, what is the process?

Yes, you can still get the scheme benefits. A Provisional Certificate of Vending would be issued to vendors through an IT based platform. The BC/Agent will help you in filling up the application and upload documents in a mobile app/portal.

I am a vendor from the city but not included in the survey. How can I avail the benefits of the scheme?

The scheme is available to vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the cities/towns and those left out of the survey. If you belong to this category, you should produce one of the following documents to obtain the Letter of Recommendation from ULB/TVC. (i) Proof of availing one-time assistance, provided by certain states/UTs, during the period of lockdown; or (ii) Documents of past loan taken from a bank/NBFC/MFI for the purpose of vending; or (iii) The membership details with vendors associations; or (iv) Any other documents to prove that you are a vendor You can also request ULB through a simple application on white paper to conduct local enquiry to ascertain the genuineness of your claim. After receipt of LoR, you may approach BC/Agent to apply for loan.

What are the KYC documents required in addition to CoV/ID/LoR?

I. Aadhaar Card: Mandatory II. Voter Identity Card: Mandatory III. Driving Licence IV. MNREGA Card V. PAN Card

What is the rate and amount of interest subsidy?

The rate of interest subsidy is 7%. The interest subsidy amount will be credited directly to your account on quarterly basis. In case of early payment, the admissible amount of subsidy will be credited in one go. For a loan of Rs 10,000, if you pay all the 12 EMIs on time, you will get approximately Rs 400 as interest subsidy amount.

Do I need to give any collateral to avail this loan?

No collateral security is required.

What is the cashback for digital transactions?

The on-boarded vendors would be provided with a monthly cashback in the range of Rs 50 or Rs 100 as per the following criteria. (i) On executing 50 eligible transactions: Rs 50 (ii) On executing the next 50 eligible transactions: Additional Rs 25 (iii) On executing the next 100 eligible transactions: Additional Rs 25

I am not familiar with digital transactions. Will there be any capacity building for doing so?

An agent from MFI/payment aggregator will approach you to onboard and help in conducting sample transactions. You will also be provided with a debit card and a QR code.

Is there any incentive for timely/early repayment of loan?

Yes, on timely/early repayment of loan of initial working capital, a vendor becomes eligible to avail a higher tranche of loan in the next cycle.

Is there any penalty for repayment of loan before the scheduled date?

There is no penalty for pre-closure of the loan.

How can I enhance my chances of availing this loan?

You may become a part of Common Interest Group (CIG) formed by ULB or Joint Liability Group (JLG) formed by a lending institution.

Who all can I approach to avail the facility?

You may meet a member of SHG, or ALF, or CLF, or call toll-free number.

Will I get an identity card for use?

Yes, you will be issued a provisional identity card on approval of loan and permanent CoV/ID will be issued within 30 days.

How long will it take to get the loan approved?

The complete process will be automated through a mobile app and web portal. You will be able to check the real time status of your application. The whole process, if paper/information is completed, may take less than 30 days.

Whom should I contact for grievances?

In case of any grievance, you may contact the following officer: Director (NULM), Room number 334-C, Ministry of Housing & Urban Affairs, Nirman Bhawan, Maulana Azad Road, New Delhi – 110011 e-Mail: neeraj.kumar3@gov.in Tel: 011-23062850. Website: mohua.gov.in • Email: dir-nulm@gov.in

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com