Anantapur, a vibrant city rich in history and full of potential, is an attractive option for investors. If you are a proud homeowner in Anantapur, managing property taxes may seem like a daunting task. This in-depth manual explains the complexities of property tax payments in Anantapur, allowing you to navigate the process with confidence. We’ll go over tax assessment procedures, convenient online payment options, and resources for additional assistance. So, let’s make sure your property tax journey in Anantapur goes as smoothly as possible!

Property tax in Anantapur

Property tax is an annual obligation for all property owners in Anantapur, encompassing both residential and non-residential spaces. This tax contributes to the city’s development and upkeep, managed by the local government or municipal authority. Just like in many Indian cities, Anantapur’s property tax rates are determined by a variety of factors, with the type of property being a key influence.

Property tax rate in Anantapur in 2024

| Tax type | Residential properties | Non-residential properties |

| General tax | 0.0375% | 0.075% |

| Water tax | 0.0105% | 0.021% |

| Drainage tax | 0.0105% | 0.021% |

| Lighting tax | 0.006% | 0.012% |

| Conservancy tax | 0.0105% | 0.021% |

| Total tax | 0.075% | 0.15% |

Source: Property Tax Anantapur

How to pay property tax in Kadapa online?

Property tax payments in Anantapur are now straightforward thanks to the CDMA official portal. If the right assessment number, owner name, and door number are provided, citizens can pay the property tax in Anantapur with ease. To easily pay property tax in Anantapur, take the actions listed below:

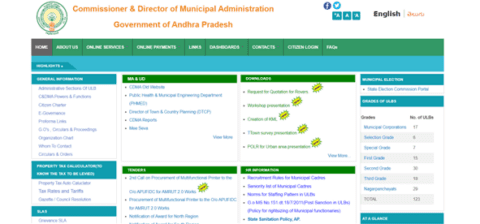

Step 1: Go to the official website of CDMA, Andhra Pradesh

Step 2: On the home screen, select the “Online Payments” tab.

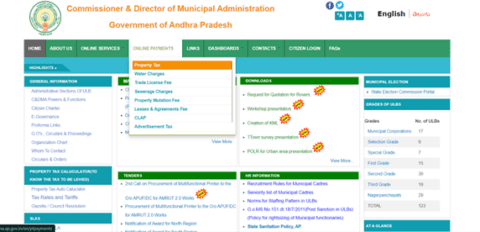

Step 3: Select “Property tax” from the menu that drops down.

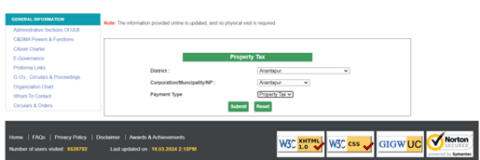

Step 4: Select the district, payment type, and corporation, municipality, or NP at this point. Press the “Submit” button.

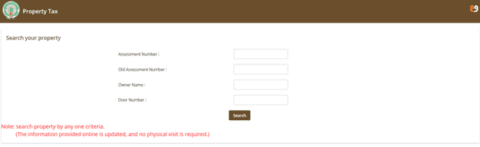

Step 5: Enter the owner’s name, door type, assessment number, and previous assessment number in the following step. After selecting the “Search” option, use the approved payment methods to pay the Anantapur property tax.

What is the last date to pay property tax in Anantapur?

April 30, 2024, is the deadline for Anantapur property tax payments. Recall that discounts or rebates are frequently obtained with prompt payment.

What is the property tax rebate in Anantapur?

If you pay your property tax by April 30th, 2024, you will receive a 5% property tax rebate in Anantapur. Utilising this rebate can assist in lowering your tax liability.

Property tax calculator in Anantapur

To calculate your property tax in Anantapur for the year 2024, you can follow these simple steps:

- Visit the official website of CDMA, Andhra Pradesh.

- Look for the ‘Online Services’ tab on the homepage and click on it.

- From the dropdown menu, select ‘Property tax.’

- Next, click on the link labeled ‘Property Tax Auto Calculator.’

- Choose the district as Anantapur and select the appropriate option for corporation, municipality, or NP (Nagar Panchayat).

- Click on the ‘Submit’ button to proceed.

- In the subsequent step, you’ll need to provide the following details:

- Category of ownership (such as residential or non-residential)

- Extent of the site in square yards

- Land area underneath the building in square yards

- Details about the apartment or complex, if applicable

- IGRS (Integrated Grievance Redressal System) details, if required

Once you’ve entered all the necessary information, the property tax calculator will provide you with an estimate of your property tax for the year 2024.

How to change name in property tax documents in Anantapur?

To update your name in property tax documents in Anantapur, you can follow these steps:

- Visit the official website of CDMA, Andhra Pradesh.

- Navigate to the ‘Online Services’ tab located on the homepage and click on it.

- Under the ‘Property Tax’ section, you’ll find various options. Select the ‘File Your Mutation (Transfer of ownership)’ link.

- This will lead you to a page where you can provide the necessary details for the name change process.

- Fill out the required information accurately and completely. This may include details such as your old name, new name, property details, and contact information.

- Once you’ve filled out the form, review the information carefully to ensure accuracy.

- After verifying the details, submit the form as per the instructions provided on the website.

- Along with your application, make sure to attach attested copies of relevant documents, such as the sale transaction deed or any other legal documents supporting the name change.

- This step is crucial for the processing of your request and ensuring a smooth transition in the property tax documents.

- Once submitted, you may receive a confirmation of receipt and further instructions regarding the status of your application.

By following these steps and providing all necessary documents, you can successfully update your name in the property tax documents in Anantapur.

How to check property tax dues in Anantapur?

To review your property tax dues in Anantapur for the year 2024, follow these steps:

- Go to the official CDMA, Andhra Pradesh website.

- Click on the ‘Online Services’ tab displayed on the homepage.

- Within the ‘Property Tax’ section, choose the ‘File Your Mutation (Transfer of ownership)’ link.

- Provide the required information and proceed with the process to check your property tax dues.

How to pay property tax in Anantapur offline?

To make an offline payment for your property tax in Anantapur, follow these steps:

- Visit the nearest Municipal Corporation office in your city.

- Complete the property tax form provided by the office, ensuring to fill in all the required particulars accurately.

- Choose your preferred payment mode from the options available, which may include cash, Demand Draft (DD), UPI (Unified Payments Interface), net banking, credit card, or debit card.

- Before submitting the form, carefully verify all the details you have provided to ensure accuracy.

- Once you have confirmed that all information is correct, submit the form along with the payment using your chosen payment method.

Documents and details required

When paying your property tax in Anantapur, ensure you have the following documents and details ready:

- Assessment Number: This unique identifier is assigned to your property by the municipal authorities and is crucial for tax purposes.

- Owner Name: Provide your full legal name exactly as it appears on the property records to ensure accurate identification.

- Door Number: Specify the precise door or house number of your property for proper identification.

- Sale Transaction Deed: If there’s a change in ownership or you’re updating details, you may need to present this document as proof.

- Other Relevant Documents: Gather any additional paperwork pertaining to your property, such as occupancy certificates, building plans, etc., depending on the specific requirements.

- Old Assessment Number: If applicable, have the old assessment number on hand for reference or updating purposes.

- Address of the Property: Provide the complete address of the property to ensure accurate tax assessment and record-keeping.

- Aadhaar Card: Your Aadhaar card may be required for identification and verification purposes during the tax payment process.

Housing.com News Viewpoint

Through the official CDMA website, property owners in Anantapur can conveniently pay their property taxes online, doing away with the need to visit any local authority office. Additionally, in order to avoid penalties and to receive the most out of any available rebates, property owners need to make sure that their property taxes are paid.

FAQs

You can usually obtain your property tax assessment document from the local municipal authority office or online portal (if available). This document details your unique property ID and the assessed tax amount.

Late property tax payments typically incur penalty fees. The specific penalty rates are determined by the local authority. It's best to avoid delays to prevent additional charges.

The property tax rates in Anantapur vary based on the type of property. For residential properties, the general tax rate is 0.075%, while for non-residential properties, it’s 0.15%.

Yes, you can make advance payments. Visit the CDMA website for details

Visit the CDMA website and use the ‘Know Your Dues’ feature to check your property tax dues. How do I find my property tax assessment?

What happens if I miss the deadline for property tax payment?

What is the property tax rate in Anantapur in 2024?

Can I make an advance property tax payment in Anantapur?

How can I check my property tax dues in Anantapur?

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

Sanskrati Gupta is an economics major currently pursuing her studies at Delhi University. She likes to explore world topics and share her thoughts and analysis through her writing.