Property owners in Avadi have to pay an annual property tax, irrespective of self-occupancy or renting out to a tenant and residence type. The Avadi Property Tax is collected by the Avadi City Municipal Corporation (ACMC). The revenue collected is used for the upkeep of the city by maintaining its amenities, infrastructure and sanitation.

One can pay the property tax in Avadi online or offline. If the property tax is not paid on time, one may incur late payment penalties. If it remains unpaid, the owner may lose the property. In this guide, we detail how to pay Avadi property tax online and offline.

Avadi Property Tax 2025: Quick facts

| Authority | Avadi City Municipal Corporation (ACMC) |

| Last date to pay Avadi Property Tax | April 30 for first half and October 31 for second half of every year |

| Properties that have to pay Avadi Property Tax | Industrial, institutional, residential, commercial, vacant land, mixed-use, government |

| Mode of payment | Online payment through debit card, RTGS, UPI etc.

Offline payment through the KMC offices, authorised banks, Common Service Centers(CSCs) |

| Rebates | If the property tax is paid within the due date, a certain amount of rebate is received.

Available for categories such as senior citizens, physically challenged individuals. |

Which zone Avadi comes under?

A western suburb of Chennai, Avadi is located within the Thiruvallur district, Tamil Nadu. The Avadi City Municipal Corporation promotes use of digital medium and so one can easily pay the Avadi Property Tax online by logging on to the tnurbantree epay website.

What are the factors based on which the Avadi Property Tax is calculated?

- Title deed of the property

- Permission for the building to be developed

- District

- Municipality/ Corporation name

- Locality name

- ULB

- Street name

- Zone

- Zone rate

- Total plot area

- Number of floors

- Building usage

- Type of building

- Plinth area

- Type of occupant

- Age of building

- Approved area

- Annual rental value (ARV)

How is the Avadi Property Tax calculated?

The Avadi Property Tax is calculated on the basis of annual rent value.

Annual rental value (ARV) = (Area x zone rate x factor indicator x building usage rate) x 12

You can use the property tax calculator available on the Tamil Nadu official website to calculate the approximate tax amount to be paid. To calculate the Avadi Property Tax, one has to enter the property address, building approval details, floor details and other such details asked.

How to pay Avadi Property Tax online?

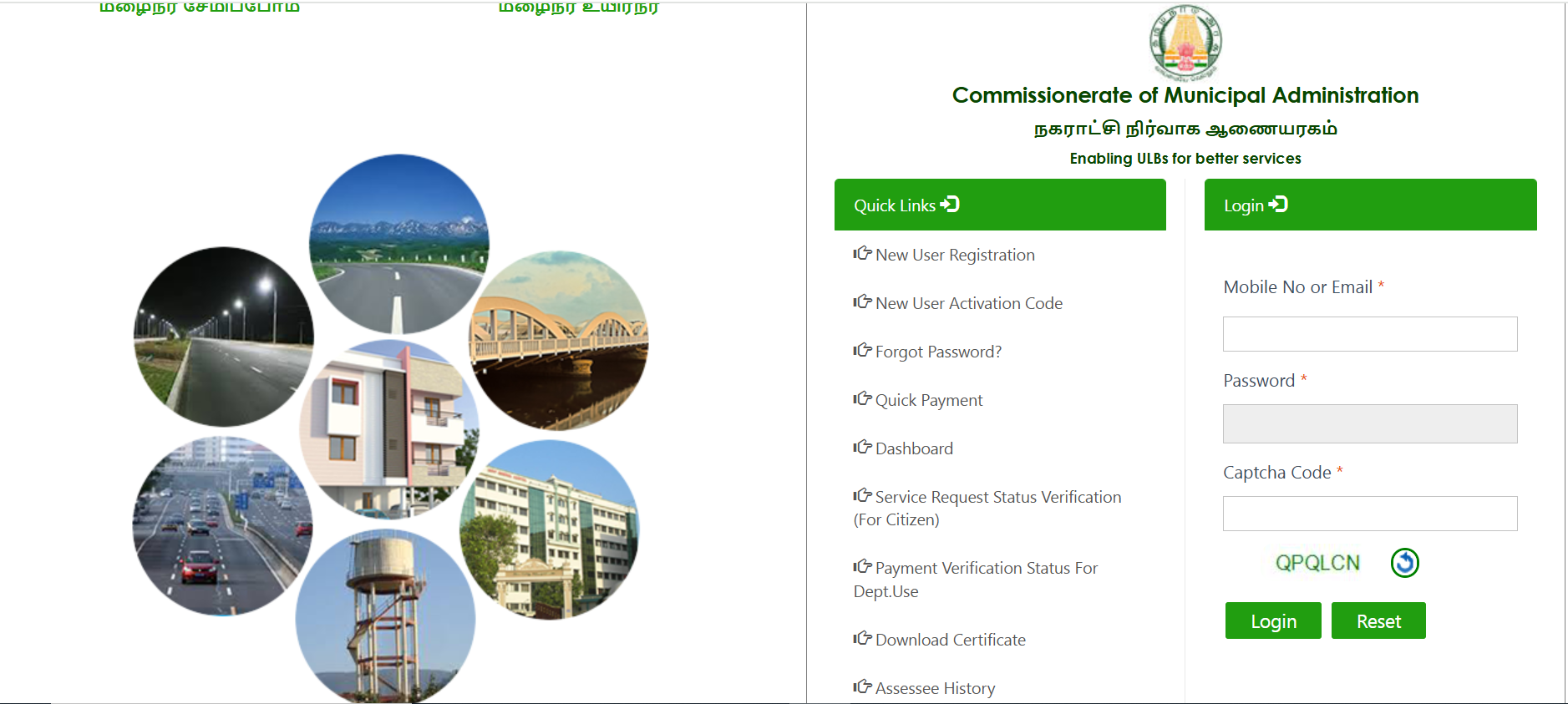

- Visit https://www.tnurbantree.tn.gov.in/avadi/

- Click on ‘ePay’.

- You will be redirected to https://tnurbanepay.tn.gov.in/

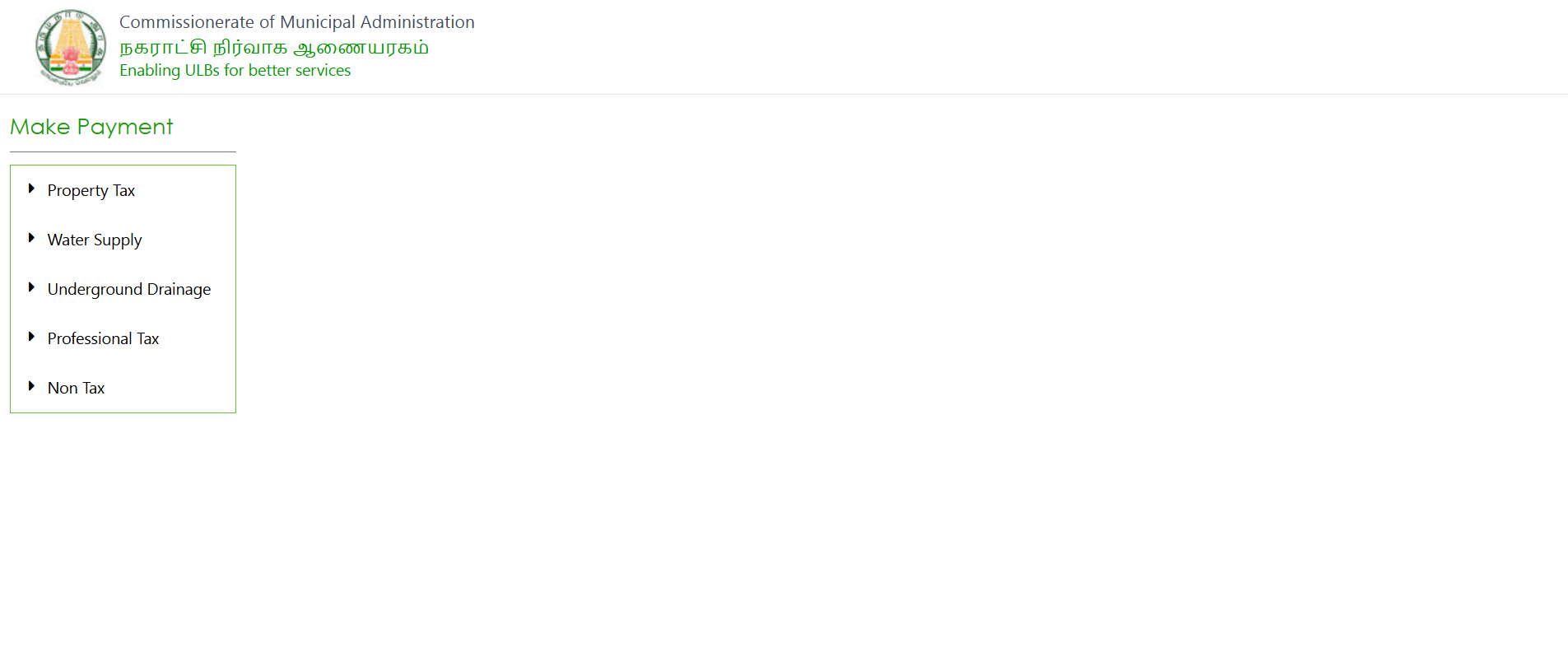

- Click on ‘Quick Payment’.

- You will reach

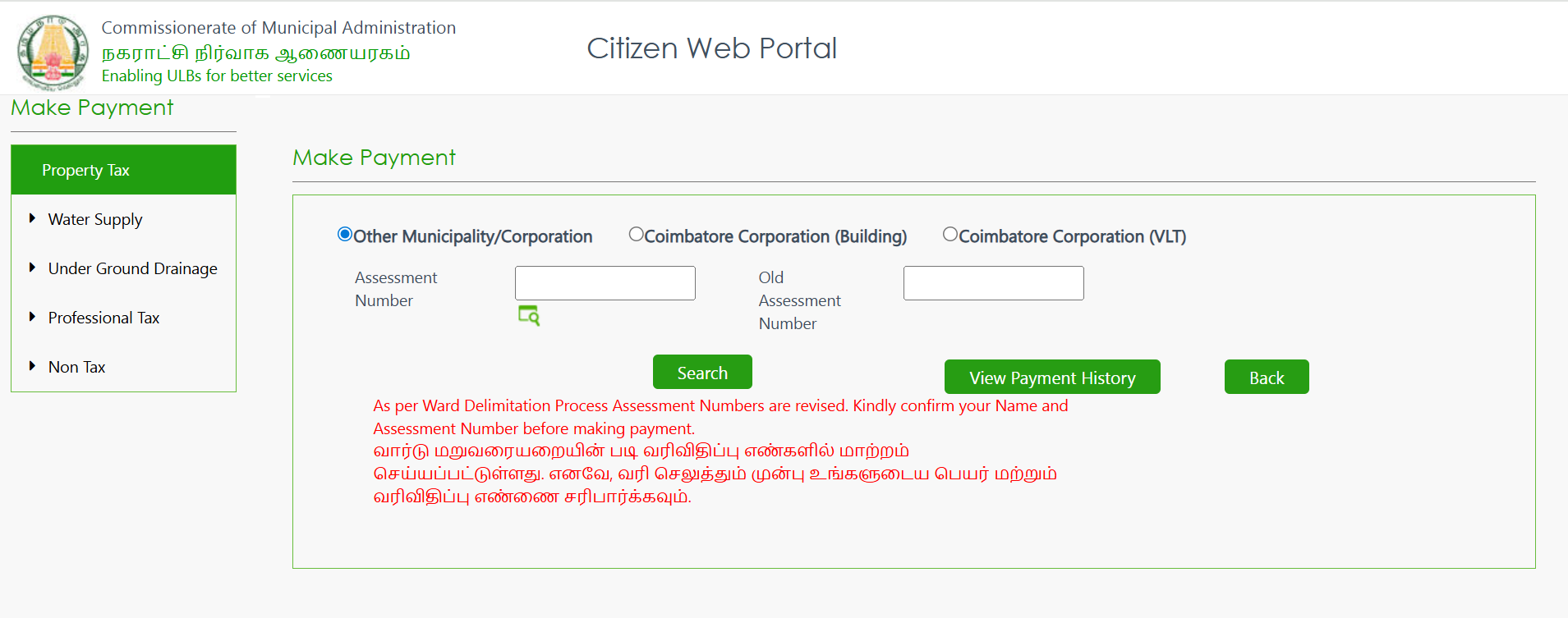

- Click on ‘Property Tax’ to reach the following page.

- Choose another municipality/corporation from the options, enter the details asked- assessment number, old assessment number and click on ‘Search’.

- You will get all the details related to your Avadi Property Tax. Check and proceed with bill payment.

- On the same page, click on ‘View Payment History’ to see previous payments done towards the Avadi Property Tax.

How to search property online to pay the Avadi Property Tax?

- Log on to https://tnurbanepay.tn.gov.in/PT_CPPaymentDetails.aspx#

- Click on the icon below the assessment number- a box with a magnifying glass.

- You will see a pop up page as shown below.

- Select municipality from the dropdown box. Enter assessment number, old assessment number, ward, street, owner name, door no., properties group and properties sub group and click on search.

- You will get all property details.

How to pay Avadi Property Tax offline?

Paying the Avadi Property Tax offline means physically visiting the office during working hours. You should carry a copy of all the supporting property documents that may be asked for property tax payment.

- Visit the ward office of Avadi City Municipal Corporation.

- Fill out the property tax payment form and attach the supporting documents.

- Pay the Avadi House Tax and collect the receipt.

What is the last date to pay the Avadi Property Tax?

The last date to pay property tax in Avadi is April 30 of every year. Failure to pay within this time will result in penalties. Most civic bodies charge around 1-2% as penalty for the time period that the property tax was not paid.

Why is necessary to follow mutation process?

By following the mutation process, the name of new owner comes into the records of the Avadi City Municipal Corporation. This is important because the owner will be sent the bill for payment of property tax, utility services such as electricity, water etc.

How to pay Avadi Property Tax using mobile app?

To pay the Avadi Property Tax using mobile app, download the Tnurban E-pay app, the official app of the Government of Tamil Nadu. This can be accessed from Google Play Store. You can pay the

- Property tax

- Water supply charges

- Building plan tax

- Underground drainage charges

- Professional tax

- Non-tax payments

- Trade renewal and license fees

- Water and UGD deposit tax (in some areas)

The app has many payment options such as credit card, debit card, net banking, UPI etc.

Avadi Property Tax: Mutation process

- One can change the name of the property owner by collecting the mutation form from the municipal office.

- Fill out the form, add supporting documents and submit.

- The name transfer order will be received within 20 days of the application.

- You can get the application receipt and annual rental value (ARV) certificate from the ACMC office within 3 days of application.

What are the common challenges in Avadi Property Tax and how to overcome them?

Incomplete documentation: Ensure that there is no problem in the documents. Ensure timely documentation is done so that there is no problem while paying the property tax.

Discrepancies in records: Check the property tax record details in advance so that there is no mismatch in the records.

Delay in verification: Check with the office on a regular basis so that verification is done on time.

Ownership disputes: Settle all disputes before transfer of ownership of property.

Lack of awareness: It is recommended to be aware about all details about property tax Avadi. You can use experts like lawyers etc. for more clarity.

Avadi City Municipal Corporation: Contact information

Thiru S Sheik Abdul Rahaman, IAS

Corporation Commissioner

Avadi Corporation Office

N M Road Avadi – Tamil Nadu 600054

Housing.com POV

As a property owner, you would want your vicinity to be developed with the best of infrastructure and amenities. These are developed by the local body using the revenue generated by property tax. With the development of the area, the property prices and the rental yield surge, which works in favour of the property owner. Defaulting on tax is a punishable offence in India. Always pay the annual tax on time online or offline and benefit from the rebate offered by the Avadi City Municipal Corporation.

FAQs

Who collects the Avadi Property Tax?

The Avadi City Municipal Corporation collects the Avadi Property Tax.

What is the penalty for late payment of the Avadi Property Tax?

A penalty decided by the Avadi City Municipal Corporation (around 2%) on the pending amount has to be paid for late payment.

What are the ways to pay property tax in Avadi?

One can pay the Avadi Property Tax online or at the nearest ward office.

Are there any charges for paying property tax online in Avadi?

No, there are no charges for paying property tax online in Avadi.

When is the last date to pay the property tax in Avadi?

The property tax in Avadi has to be paid by April 30.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |