To have a clear understanding of property rates in localities in Pune, one should have the knowledge of ready reckoner rates. It is the rate based on which a property is valued, and subsequently taxed based on the arrived-at valuation.

See also: Ready reckoner rate in Wagholi, Pune

What is the ready reckoner rate?

Ready reckoner rate is the government-determined rate for properties in Maharashtra. This rate is determined by state governments in India for the purpose of land and property taxations, charged in the form of stamp duty and registration fees. It is changed from time to time to bring it closer to the property’s market rates.

Ready reckoner rate in Koregaon Bhima, 2024

Land department

Survey No. 12/12.0 village rate: Rs 2,100 per sqm

Survey No. 12/12.2 Pune City Road Area: Rs 2,350 per sqm

Survey No. 27/27.1 Sadanika: Rs 2,2370 per sqm

Survey No. 27/27.2 Dukangale: Rs 3,9450

Gaothan land

Villages under Survey No. 12/12.0: Rs 2,100 per sqm

Areas in Pune City Road under Survey No. 12/12.2: Rs 2,350 per sqm

Land under Vadhu-Budruk Industrial Area

Pune Nagar road area under Survey No. 11/1: Rs 1,960 per sqm

Land near developed area on highway under Survey No. 11/11: Rs 1,660 per sqm

Pune City Road area under Survey No. 11/2: Rs 1,660 per sqm

Internal area from Pune City Road under Survey No. 11.3: Rs 1,990 per sqm

Area on Talegaon Road under Survey No. 11.4: Rs 1,210 per sqm

Land with uncultivated potential (बिनशेती संभाव्यता असलेली जमीन)

Pune Nagar road area under Survey No. 11/1: Rs 1,960 per sqm

Land near developed area on highway under Survey No. 11/11: Rs 1,660 per sqm

Pune City Road area under Survey No. 11/2: Rs 1,660 per sqm

Internal area from Pune City Road under Survey No. 11.3: Rs 1,990 per sqm

Area on Talegaon Road under Survey No. 11.4: Rs 1,210 per sqm

Jiyarat land (cultivated)

Developable land on highway under Survey No. 6/6.1: Rs 2,000 per sqm

Developable land on highway under Survey No. 6/6.2: Rs 4,846,000 per ha

Remaining land (per hectare) under Survey No. 6/6.3: 4,672,500 per ha

Land under jungle area

Rs 3,578,000 per hectare

Gairan land

Rs 3,935,500 per hectare

Industrial land

Area near industrial township: Rs 1,920 per sqm

Area near industrial village road: Rs 2,540 per sqm

Pune City Industrial Road Area: Rs 1,920 per sqm

Land under Pune Nagar Road area: Rs 1,180 per sqm

Land under MIDC

Industrial plot: Rs 2,890 per sqm

Residential plot: Rs 3,610 per sqm

Commercial plot: Rs 4,330 per sqm

How to check Koregaon Bhima ready reckoner rate list on official site?

Step 1: Visit the IGR Maharashtra official website at: https://igrmaharashtra.gov.in/Home.

Step 2: On the home page, click on e-ASR.

Step 3: Once you bring your cursor to the e-ASR, you will see several options. Click on e-ASR 2.0.

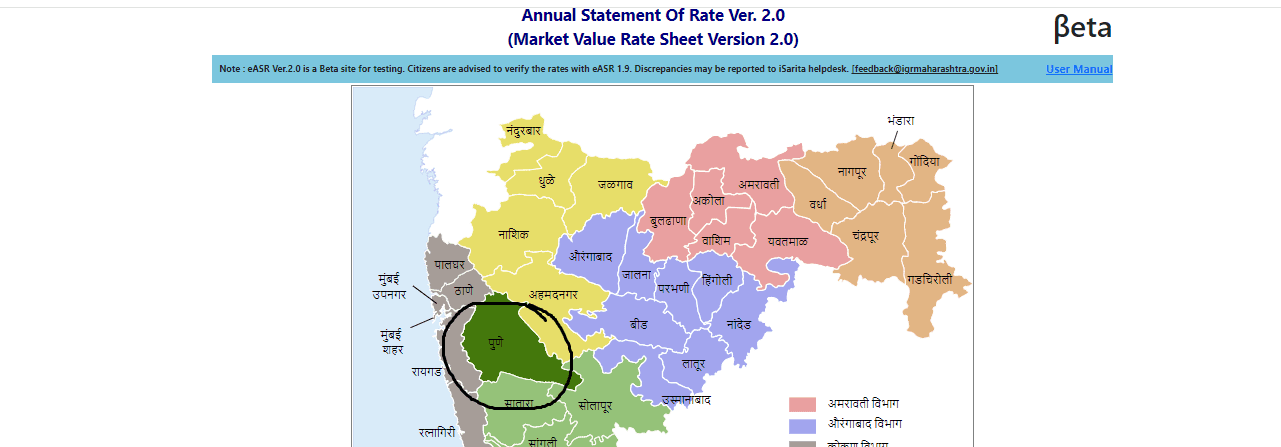

Step 4: You will now see a map of Maharashtra.

Step 5: On this map, select the district under which the area falls. In our case, Koregaon Bhima comes under Pune City. So, select Pune City.

Step 6: Select Shirur as Taluka.

Step 7: Select Mauje: Koregaon Bhima.

Step 8: You will see a detailed list of ready reckoner rates in Koregaon Bhima.

Why invest in Koregaon Bhima?

Located towards the north bank of Bhima River, Koregaon Bhima is a panchayat village under Shirur Taluka in Pune. Considering the low base price, this area has been a mega favourite among builders in the city to launch new projects. Those who want to bet on an emerging area to double their investments may consider this area as a viable option.

FAQs

What is ASR?

ASR stands for Annual Statement of Rates.

Are ready reckoner and circle rates the same?

Yes, ready reckoner rate is same as circle rate. Ready reckoner rate is the term commonly used in Maharashtra.

Are ready reckoner rate and guidance value the same?

Yes, the ready reckoner rate is the same as guidance value. Ready reckoner rate is the term commonly used in Maharashtra while guidance value is used in Karnataka.

Are ready reckoner and collector rates the same?

Yes, the ready reckoner rate is the same as collector rate. Ready reckoner rate is the term commonly used in Maharashtra while collector rate is used mostly in Haryana and Punjab.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |