In the realm of property rentals in India, rent receipts serve as a vital payment record between tenants and landlords. They not only act as proof of payment but also play an essential role in resolving any future disputes regarding rent. One question that frequently arises is whether these receipts require a revenue stamp—a small, adhesive paper affixed to legal documents to indicate that the requisite stamp duty has been paid. In this article, we’ll explore revenue stamps, the legal significance of rent receipts, and whether attaching a revenue stamp is mandatory.

What are revenue stamps?

According to the Indian Stamp Act, 1899, a ‘stamp’ means any mark, seal, or endorsement by any agency or person duly authorised by the state government and includes an adhesive or impressed stamp for the purpose of duty chargeable under the Act.

A revenue stamp is a small adhesive label affixed to certain documents to certify that the government’s stamp duty (a type of tax) has been paid on that document. The concept dates back many years and is used worldwide for governments to generate revenue and maintain a formal record of legal transactions. In India, revenue stamps are used on various documents such as agreements, contracts, and certificates to validate their authenticity and legal enforceability.

What is the purpose of revenue stamps?

The government issues revenue stamps for collecting taxes for certain services, such as receipts, tax acknowledgements, and rent receipts. They act as proof that taxes or fees have been paid for legal transactions. A properly stamped receipt holds more legal weight and can serve as primary evidence in a dispute, offering credibility over plain paper receipts.

What is the purpose of revenue stamps?

Revenue stamps are government-issued labels used to collect taxes and fees on various legal documents—like rent receipts, tax payment acknowledgements, and court documents—ensuring that the required revenue is paid; a properly stamped document carries greater legal weight and serves as primary evidence in disputes.

See also: Know about Section 80GG

How to generate rent receipt?

You can use a rent receipt generator to create an acknowledgement for the rent you have paid. The Housing.com rent receipt generator allows you to generate free rent receipts online in seconds by entering just a few details, such as:

- Name of the tenant

- Monthly rent amount

- Landlord’s name

- Property address

- Landlord’s PAN (Optional)

- Rent period

How to generate free rent receipts online?

Follow the below steps to quickly generate an online rent receipt using the Housing.com rent receipt generator:

- Enter the tenant’s name and rent amount.

- Provide your landlord’s name, address, PAN details (optional), and rent period.

- Preview, download, and you’re done!

Can digital rent receipts be printed and stamped later?

If generating rent receipts online, tenants paying in cash should print the receipt and then physically affix a ₹1 revenue stamp before handing it to the landlord for signature.

Is revenue stamp required for rent receipt?

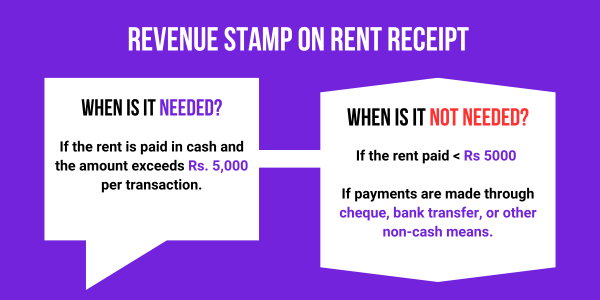

A revenue stamp is often required on receipts to validate financial transactions, including rent payments. However, whether it is needed for a rent receipt depends on multiple factors such as payment amount, mode of payment, and state regulations.

Revenue stamp: When is it needed?

Revenue stamp has to be affixed when there is a receipt, including note, memorandum, or writing such as:

- Receipt of money, a bill of exchange, cheque, or promissory note.

- Acknowledgement of movable property received in satisfaction of a debt.

- Acknowledgment for debt or demand, or any part of a debt or demand that has been satisfied or discharged.

Check out the difference between Leave and license agreement

Revenue stamp on rent receipt: When is it not needed?

Affixing the revenue is not needed if you are paying monthly rent below Rs 5,000. You will also not have to generate a rent receipt and affix a revenue stamp if you have been paying the rent using online channels and provide your bank statement as a proof of the rent payment.

Online payment platforms like Paytm or Google Pay, are considered non-cash payment methods. Therefore, if you pay your rent using these platforms, you are not obligated to affix a revenue stamp on the rent receipt, even if the payment exceeds Rs. 5,000.

| Rent Paid In | Amount > ₹5,000 | Revenue Stamp Required? |

| Cash | Yes | Yes |

| Cash | No | No |

| Online (UPI/Bank Transfer) | Yes/No | No |

| Cheque | Yes/No | No |

State-specific variations in revenue stamp enforcement

In India, the Indian Stamp Act 1899 mandates a ₹1 revenue stamp on rent receipts for cash payments over ₹5,000. While this serves as a baseline, states can set their own stamp duty rules.

For example, Maharashtra’s Stamp Act 1958 requires one stamp if a single receipt is issued annually. Due to such variations, tenants and landlords should check local regulations or seek legal advice for compliance.

Alternative proofs for rent payments

- Bank statements: If rent is paid via bank transfer, a bank statement showing the transaction can serve as valid proof. This method is especially useful for non-cash payments.

- Lease agreements: A formal lease agreement detailing the rental terms, including the amount and payment schedule, can substantiate rent payments.

- Cancelled cheques: Providing a copy of a cancelled cheque from the tenant’s account can verify the payment method and amount.

- Digital payment receipts: For online payments made through platforms like Paytm or Google Pay, transaction receipts or screenshots can act as proof.

- Landlord’s declaration: A written statement from the landlord confirming the receipt of rent payments can be considered, especially when other documents are unavailable.

How to buy revenue stamp for rent receipt?

Revenue stamps can be purchased from the local post offices or authorised stamp vendors. The cost of a revenue stamp is Re 1 for each stamp. Nowadays local shops and some online shopping portals also keep revenue stamps and sell them at a higher price than the post offices. It is advisable to buy it from the post office or authorised stamp vendors to avoid chances of getting fake stamps.

See also: Know all about lease vs rent

Revenue stamp on rent receipt sample

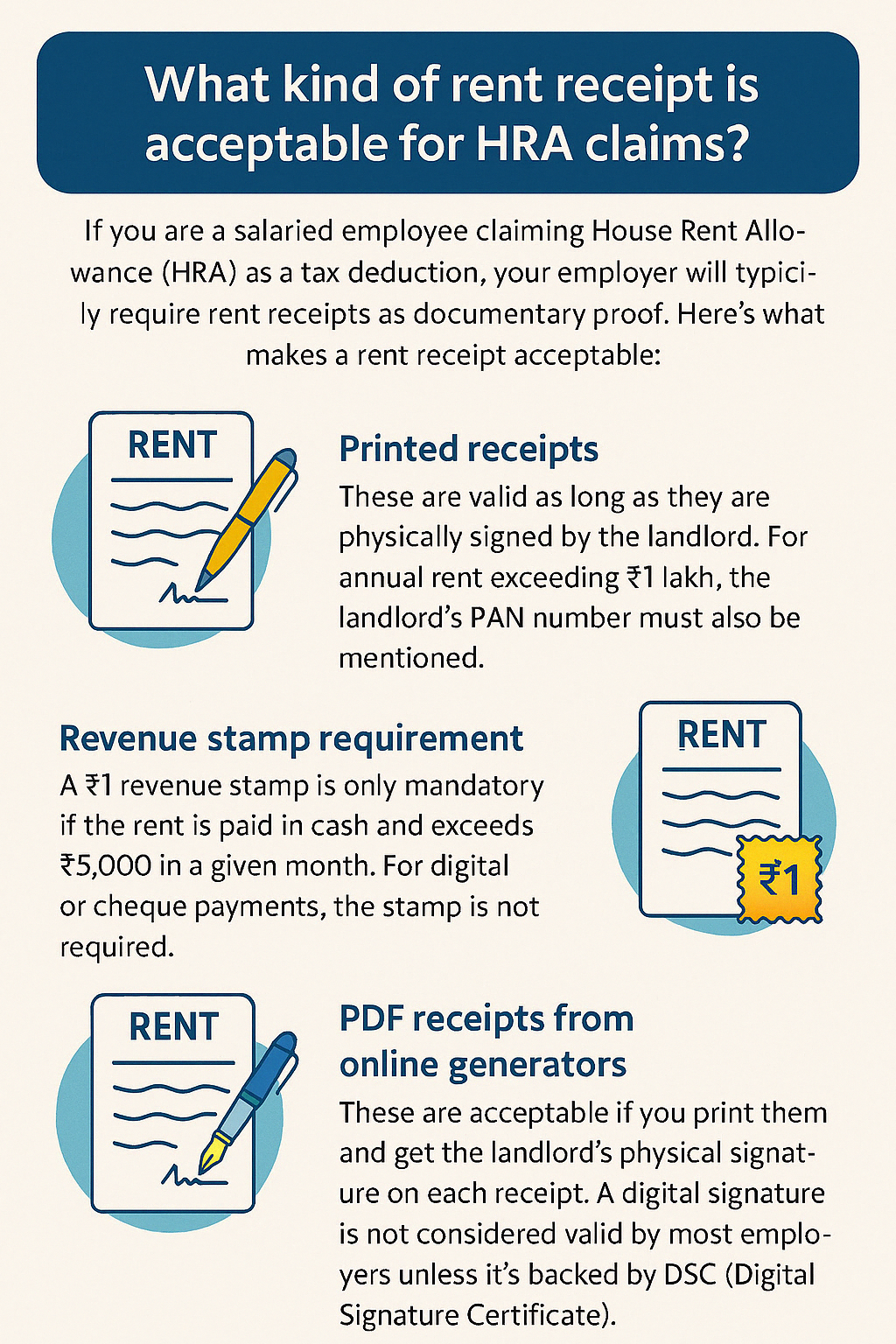

If you want to claim the HRA benefit from your employer, it is mandatory to provide the confirmation of rent payment to the employer. To provide such confirmation, you need to get the rent receipt from the landlord.

There is a prescribed format of the rent receipt, which should be filled properly. The landlord gives the rent receipt only after getting the rent from the tenant. If the rent has made the payment online or through a cheque, then, there is no need for a revenue stamp on the rent receipt. When rent is paid in cash, the rent receipt affixed with a revenue stamp becomes documentary evidence to establish the transaction. If there is a legal dispute between the landlord and the tenant, the rent receipt can be produced as evidence in court.

What kind of rent receipt is acceptable for HRA claims?

When claiming HRA, even a small error in documentation can lead to rejection or tax complications. Understanding the nuances of rent receipt validity—beyond just filling a form—is essential. From payment modes to signature formats, this infographic clarifies what truly counts behind the scenes of an approved HRA claim.

Are electronically signed rent receipts valid for tax return purposes?

In India, electronically signed rent receipts are becoming common with the rise of online rent receipt generators and digital documentation. However, for tax return purposes—particularly when claiming HRA deductions or providing proof to your employer—it is essential to understand the legal and procedural validity:

- Digitally signed receipts using DSC (Digital Signature Certificate): These are legally valid under the Information Technology Act, 2000. If your landlord uses a valid DSC, the rent receipt is accepted by employers and tax authorities.

- Scanned signature or typed name: A rent receipt with a scanned image of a physical signature is generally accepted by employers for HRA, but typed names or unsigned PDFs are not valid.

- Best practice: Even if generated online, the rent receipt should ideally be printed and physically signed by the landlord. This ensures legal acceptability and prevents rejection during scrutiny by employers or tax departments.

📌 Tip: Always keep backup proofs like bank statements, lease agreement, and PAN details, especially when submitting digital receipts.

Value of revenue stamp on rent receipt

According to the amendment of Schedule-I to the Indian Stamp Act, 1899, you have to affix a revenue stamp of Re 1 value in on rent receipt where cash payment exceeds Rs 5,000.

Rent receipt format (filled)

See also: Can I claim HRA for different city?

Can stamps be reused?

No, revenue stamps cannot be reused. To prevent reuse, the person affixing the stamp must cancel it by writing their name or initials and the date across the stamp. If the stamp isn’t properly canceled, the document is considered unstamped, which can lead to penalties.

1 rupee revenue stamp for rent receipt

The 1 rupee revenue stamp is more than just a legal formality; it is a binding acknowledgement of cash rent payments, particularly in disputes between tenants and landlords. While often overlooked, an adequately affixed and signed stamp strengthens the legal validity of a rent receipt, making it a crucial safeguard. Despite the rise of digital transactions, the 1 rs revenue stamp remains relevant in cash-based transactions, especially in states with specific stamp duty laws. To ensure compliance, tenants must use a fresh 1 re revenue stamp and have the landlord sign across it, preventing any legal ambiguity.

What if a landlord refuses to sign a stamped rent receipt?

If a landlord refuses to sign a rent receipt that has been duly stamped with a ₹1 revenue stamp (required for cash rent payments exceeding ₹5,000), the tenant has legal recourse.

According to Section 65 of the Indian Stamp Act, 1899, any person who refuses to provide a stamped receipt for money received is liable to a penalty of ₹100. This provision empowers tenants to demand a valid, signed, and stamped receipt as proof of rent paid—especially important for HRA claims or legal disputes.

What you can do as a tenant:

- Politely inform the landlord about the legal requirement and offer to provide the revenue stamp yourself.

- If the refusal continues, document the rent payment using other proof like bank statements, witness declarations, or a written acknowledgement.

In persistent cases, consider filing a written complaint with the local stamp authority or revenue office citing Section 65 non-compliance.

Component of rent receipt with revenue stamp

A rent receipt for a cash payment of rent becomes valid when affixed with a revenue stamp and consists of the following information:

- Name of the tenant

- Name of the landlord

- Address of the rental property

- Rent amount

- Rental period

- Mode of payment – cash/online/cheque

- Signature of the landlord

- If the rent amount per annum exceeds Rs 1 lakh, then, the PAN number of the landlord should be furnished on the rent receipt.

- Details of other charges such as water bill, electricity charge, etc.

- Revenue stamp should be affixed if cash paid in a rent receipt exceeds Rs 5,000.

Read more about rent agreement format and rent receipt & its role in saving tax

Housing.com Viewpoint

In case you fail to submit your rent receipts with revenue stamps, your employer will not only refuse to accept those as a proof of rent payment, a penalty can also be imposed on your for not doing so. If a payee refuses to give a receipt with a revenue stamp, they can be punished with a fine of Rs 100 under Section 65 of the Stamps Act.

FAQs

Is a revenue stamp required on every rent payment?

No, the revenue stamp is required only when the rent is paid in cash and the rent amount exceeds Rs 5,000. For example, if the rent is paid through cheque or online transfer, then, there is no need to affix the revenue stamp.

What should be the value of the revenue stamp affixed on the rent receipt?

According to the amendment of Schedule I to the Indian Stamp Act 1899, affix a revenue stamp of Re 1 value in the rent receipt wherein cash payment exceeds Rs 5,000.

What is the use of revenue stamps?

Revenue stamps are used to collect fees or revenue for maintaining courts. For every legally permitted transaction, a certain amount of revenue is needed to be given to the government. Stamping of receipts or main documents evidencing giving and taking of money also need such revenue and the revenue stamp is affixed in proof of that. A properly stamped receipt or debt document or note gets a prima facie priority as an acceptable legal proof over a plain paper receipt.

When is Re 1 revenue stamp needed?

Under the Indian Stamp Act, on payments of more than Rs 5,000, revenue stamp of Re 1 is mandatory. Failure to do so attaracts fine of Rs 100 under Section 65.

What are revenue stamps?

Revenue stamps are used to collect fees or revenue for maintaining courts.

Is attaching revenue stamp on rent receipt necessary?

Yes, attaching revenue stamp on rent receipt is necessary if the value of the receipt exceeds Rs 5,000 under the Indian Stamp Act, 1899.

What should be the value of the stamp to be used on rent receipts?

Re 1 revenue stamp should be used on rent receipts.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |