Under the Indian income tax laws, people making specific payments are liable to deduct tax from the payment amount at the source. Under Section 194J of the Income Tax Act, people are liable to deduct and pay TDS if they are paying fees to residents people for specified services. An example of a TDS deduction is an employer deducting TDS before issuing the salary. Income tax laws make it incumbent on the people deducting the TDS to issue a TDS certificate to the person from whom the TDS has been deducted.

The TDS certificate acts as proof of tax payment. Using this TDS certificate, the person, from whom the tax is deducted, can claim tax deductions.

TDS certificate types

TDS certificates can be of four types – Form 16, Form 16A, Form 16B and Form 16C.

TDS certificate types

| Form type | Transaction type | Frequency | Due date |

| Form 16 | TDS on salary payment | Annual | May 31 |

| Form 16 A | TDS on non-salary payment | Quarterly | 15 days from the due date of filing the return |

| Form 16 B | TDS on property sale | For each TDS deduction | 15 days from the due date of filing the return |

| Form 16 C | TDS on rent | For each TDS deduction | 15 days from the due date of filing the return |

As mentioned above, the deducted TDS must be submitted to the income tax authorities within the deadline. Failure to meet the deadline attracts a penalty of Rs 100 per day.

See also: TDS rate chart

TDS certificate: Form 16 sample

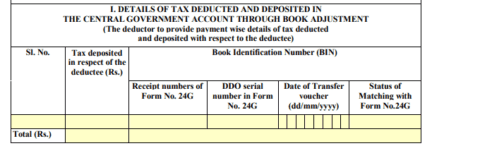

TDS certificate: Form 16A sample

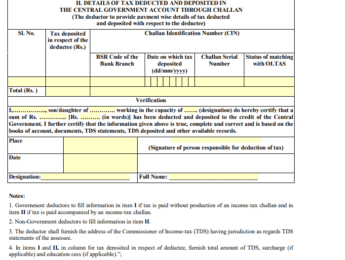

TDS certificate: Form 16B sample

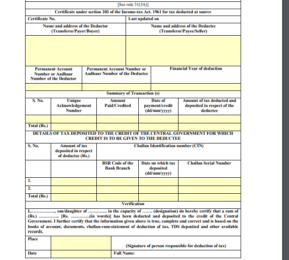

TDS certificate: Form 16C sample

Not received the TDS certificate from the deductor? What can you do?

The TDS credit is reflected in your Form 26AS. In case you find any discrepancy in the tax deducted and the tax credit in Form 26AS, speak to the deductor and get the corrections made.

FAQs

What is the full form of TDS?

The full form of TDS is - tax deducted at source.

On what kind of payments is TDS deducted?

TDS is deducted on payments, such as interest, salary, rent, commission, sale proceeds, etc.

How many types of TDS certificates are there?

There are four types of TDS certificates – Form 16, Form 16(A), Form 16(B) and Form 16(C).

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]