Under the directive of Maharashtra chief minister Eknath Shinde and the deputy chief minister Devendra Fadnavis, the Maharashtra government launched the stamp duty amnesty scheme-Maharashtra Mudrank Shulk Abhay Yojana 2023 in a cabinet meeting on November 23, 2023.

What is Maharashtra Mudrank Shulkh Abhay Yojana?

According to an order issued by the Maharashtra government, under the Maharashtra Mudrank Shulkh Abhay Yojana, IGR Maharashtra will exempt the entire stamp duty fees and penalty that has been imposed on property documents that are registered or not registered between January 1, 1980 and December 31, 2020. This is also useful for properties under Mhada, Cidco or even the SRA.

Stamp duty amnesty scheme phase-2 gets extension

The phase-2 of the stamp duty amnesty scheme has been extended till June 30, 2024. The phase-2 was to end in March 31, 2024. The Maharashtra state government announced the extension so that the state could rake in more revenue because of this scheme.

Why is the stamp duty amnesty scheme announced?

In all property transactions, a buyer is required to pay a certain amount of tax to the government known as stamp duty and registration charges, under the Maharashtra Stamp Act, 1958. All sale deeds, conveyance deeds that are not stamped are not considered legal in the court of law, under section 34 of the Maharashtra Stamp Act. To regularise these documents, a property owner has to pay the deficit stamp duty and a penalty on the deficit at 2% per month. This money may total to more than 400% of the stamp duty, which will be a huge burden on the property owner. Another disadvantage is that owing to not partial or non-payment of stamp duties by the members, many housing societies are unable to do the deemed conveyance.

The amnesty scheme will regularise the property ownership by providing relief on stamp duty to be paid and the penalty too.

Maharashtra stamp duty amnesty scheme: Eligibility

- Documents that are registered with the sub-registrar of assurances but are not properly stamped.

- Documents that are not registered and where stamp duty has not been paid.

- Note that all documents should have been executed on stamp paper that has been brought from authorised vendors or franking centres. Documents that are executed on fraudulent stamp papers or those bought from Telgi vendors will not be able to avail the benefits of this scheme.

- Any type of instrument or document executed on plain paper without any stamp duty shall not be accepted for any benefit under the amnesty scheme.

- No refund will be granted where stamp duty or penalty on the deficit portion of the duty has already been paid before passing of the order related to amnesty scheme.

- Deficit amount should be paid within seven days of receiving the order by the applicant to take advantage of the scheme. Any delay will result in the applicant losing on benefits of the amnesty scheme.

- For the purpose of assessment, the applicant has to submit proper evidence as per requirements in Annual Statement of Rates

Maharashtra stamp duty amnesty scheme: implementation

| Phase- 1- December to February 29,2024 | ||

| Amount of stamp duty to be paid or payable | Reduction in stamp duty to be paid or payable | Reduction in penalty to be charged on whole stamp duty to be paid or payable |

| For amount of Rs 1 to Rs 1 lakh | 100% | 100% |

| For amount exceeding Rs 1 lakh | 50% | 100% |

| Phase- 2- February 1 to June 30, 2024 | ||

| Amount of stamp duty to be paid or payable | Reduction in stamp duty to be paid or payable | Reduction in penalty to be charged on whole stamp duty to be paid or payable |

| For amount of Rs 1 to Rs 1 lakh | 80% | 80% |

| For amount exceeding Rs 1 lakh | 40% | 70% |

To be rolled out in phases by the IGR Maharashtra, the first phase was from December 1, 2023 to January 31, 2024. Phase-1 of the amnesty scheme got an extension till February 29, 2024. The second phase is from February 1, 2024 to March 31, 2024. This phase got an extension till June 30, 2024.

As per the directive issued by IGR Maharashtra on December 7, 2021, for all properties with stamp duty and penalty amount upto Rs 1 lakh, a full waiver is granted. For all properties with stamp duty and penalty being above Rs 1 lakh, a 50% waiver on stamp duty and a 100% waiver on penalty will be granted.

In phase-2, the Maha government will give a waiver of 80% in both stamp duty and penalties for amounts ranging up to Rs 1 lakh. All stamp duty and penalty amounts exceeding Rs 1 lakh, will get a 40% waiver on stamp duty and a 70% waiver on the penalties.

Properties registered from January 1, 2000 to December 31, 2020 will get a 25% waiver in stamp duty fees for amounts up to Rs 25 crore. The state will offer a 20% waiver on stamp duty aounts more than Rs 25 crore. Also, for penalties below Rs 25 lakh, a 90% rebate will be granted and for penalties above Rs 25 lakh, a penalty of Rs 25 lakh will be charged.

As part of Phase- 2 of the scheme, IGR Maharashtra will offer a 25% waiver in stamp duty fees for amounts up to Rs 25 crore. The state will offer a 20% waiver in stamp duty if the stamp duty fee is more than Rs 25 crore. Also, for penalties below Rs 50 lakh, a 80% rebate will be given and for penalties above Rs 50 lakh, a penalty of Rs 50 lakh has to be paid.

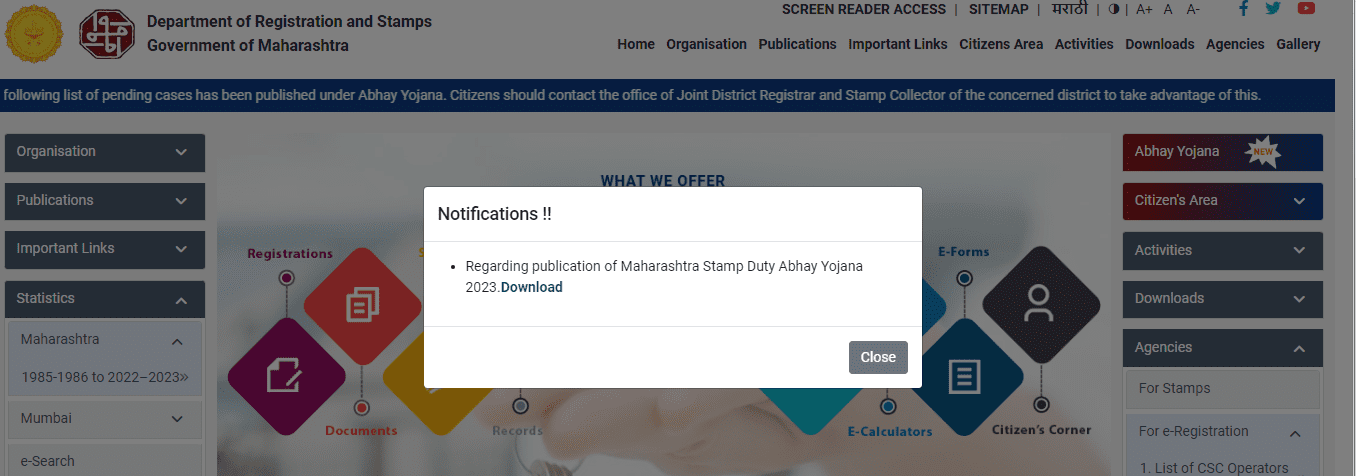

Abhay Yojana information on IGR Maharashtra

On visiting the IGR Maharashtra website, you see a pop-up that leads you to details regarding Abhay Yojana.

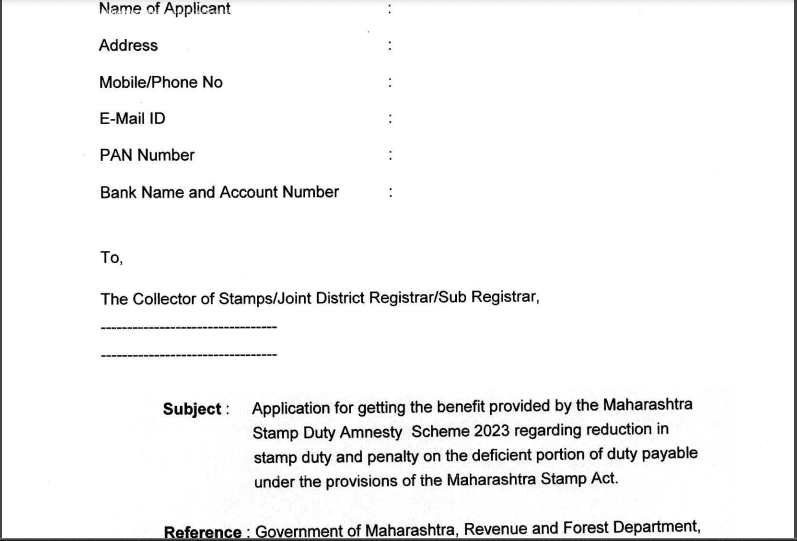

Maharashtra Amnesty Scheme: Application form

You can access the form that has to be filled and submited to take advantage of the amnesty scheme. Click on regarding publication of application form. Shown below is the first page of the application from. You can access the form in both English and Marathi.

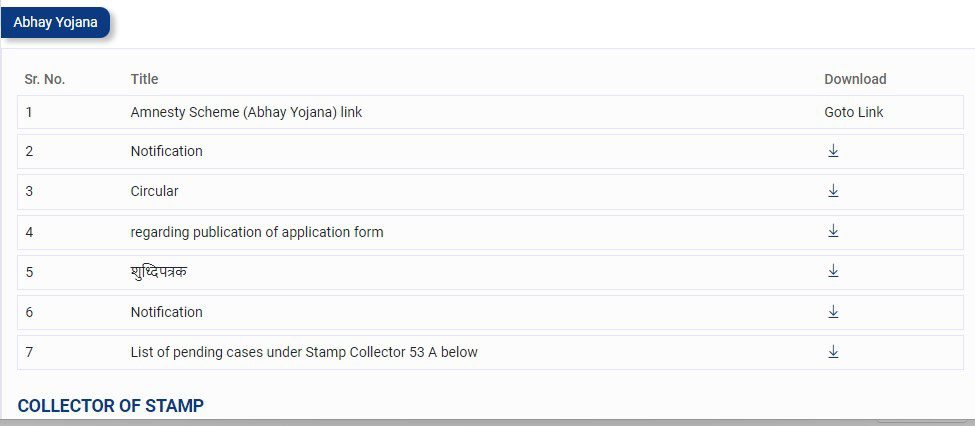

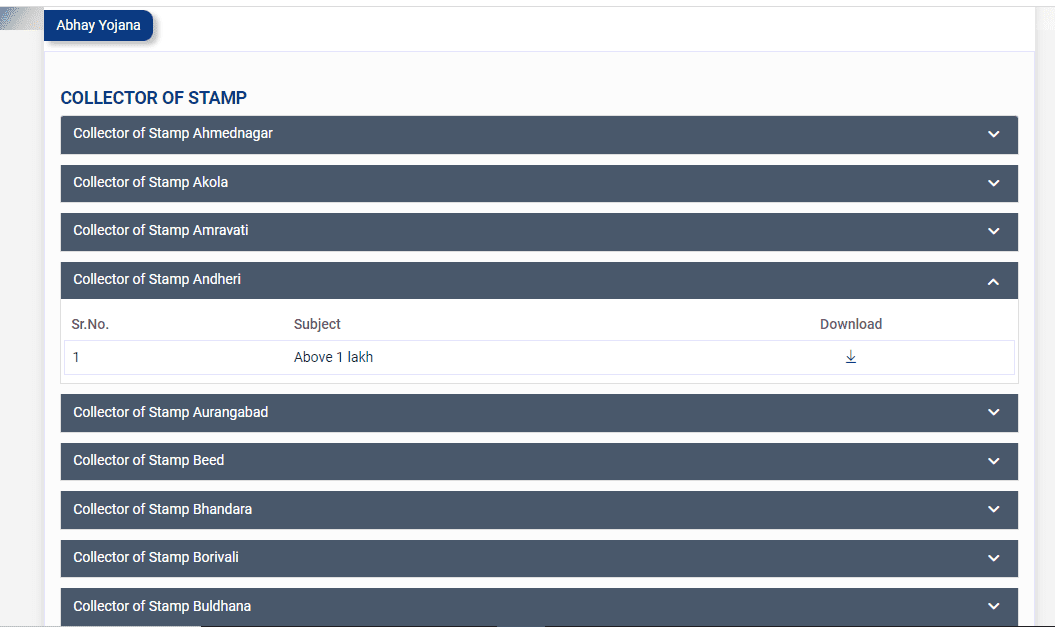

Abhay Yojana: Collector of stamp

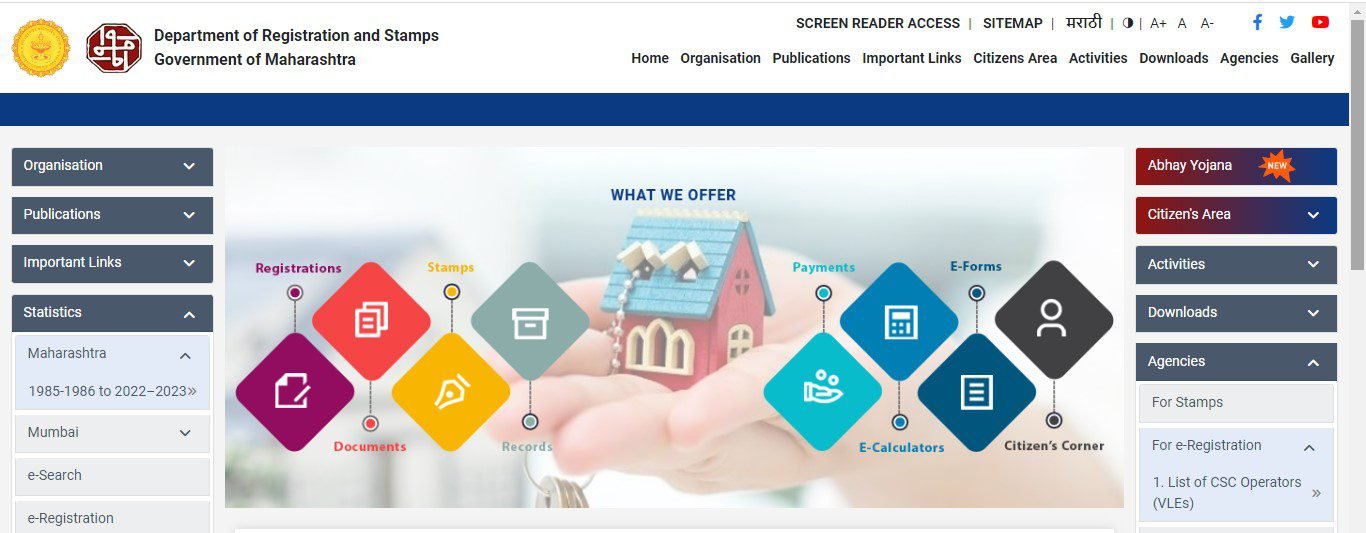

Visit the IGR Maharashtra website and click on Abhay Yojana present on the right side of the page to download details related to regularising the property documents.

You will reach

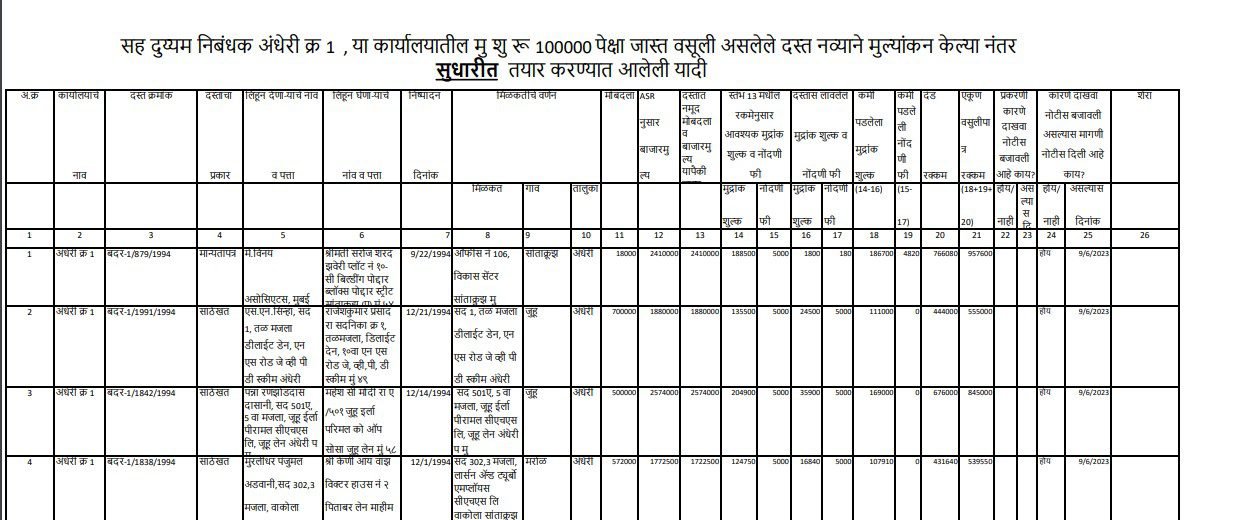

After downloading, you will get all details regarding the rebate offered to you under the amnesty scheme.

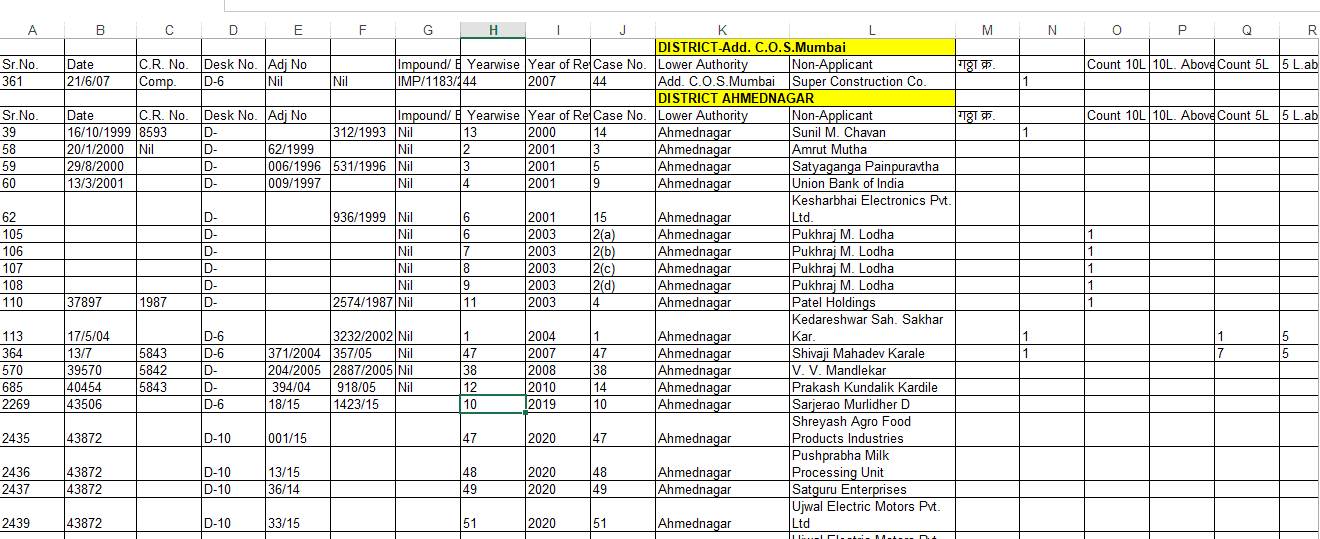

You can also check the list of pending cases under stamp collector 53 A below. Citizens should contact the office of Joint District Registrar and Stamp Collector of the concerned district to take advantage of this.

Pending cases under Stamp Collector 53 A

To check the pending cases under stamp collector 53A, click on ‘List of pending cases under Stamp Collector 53 A below.’ It will be downloaded in your system.

Maharashtra Amnesty Scheme: Helpline

If you have any queries regarding the Maharashtra Amnesty Scheme, you can call on helpline: 8888007777

FAQs

Who can apply for the Mudrank Shulkh Abhay Yojana stamp duty amnesty scheme?

The Mudrank Shulh Abhay Yojana can be applied by the owner, successor or power of attorney (PoA) holder.

Will people who have paid stamp duty and penalty before the scheme was announced get a refund?

There will be no refund given to any property owner if he paid the stamp duty before the amnesty scheme was announced.

When should the people availing the scheme pay the stamp duty and penalty?

Those who are availing the amnesty scheme should pay the deficit amount within seven days of getting the notice from IGR Maharashtra

What is the time period of the first phase of the Maharashtra stamp duty amnesty scheme 2023?

The first phase was initially from December 1, 2023 to January 31, 2024. It has got an extension till February 29, 2024.

What is the time period of the second phase of the Maharashtra stamp duty amnesty scheme 2023?

The second phase is from February 1, 2024 to March 31, 2024.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]