Owners of any residential or non-residential property are required to pay property tax every year to the respective urban local bodies (ULB) in their state. The state government of Andhra Pradesh determines the property tax rates and levies the tax that must be paid to the ULB annually. The tax levied by the authority serves as a major source of revenue utilised for the development of civic amenities and infrastructure in the state. The Andhra Pradesh government, through the official the portal of the Commissioner and Director of Municipal Administration (CDMA) enables taxpayers to access various property tax-related services online and pay their taxes without any delay and penalties.

What is Andhra Pradesh property tax and why is it important?

Property tax is the annual tax levied on property owners by local municipalities in Andhra Pradesh. The property tax in Andhra Pradesh is calculated based on factors such as property size, location, type of usage (residential or commercial), built-up area, etc. Taxpayers can opt for the online mode of property tax payment in AP, which is a quick and hassle-free process. Alternatively, they can choose the offline mode of property tax payment by approaching the local municipal office.

Property tax payment is necessary for the following reasons:

- Serves as proof of property ownership: The property tax receipt is a vital document as it is a proof of the property ownership and can be used for legal transactions such as property resale, transfer or mortgage.

- Ensures legal compliance: Payment of property tax is a legal obligation for all property owners as per the government regulations.

- Prevents penalties: Non-payment of property tax results in legal consequences for the property owner and penalties, including additional interest on outstanding dues.

- Ensures financial transparency: Maintaining records of property tax payments proves useful in case of disputes related to property ownership and taxation.

How to pay property tax in AP?

Citizens in Andhra Pradesh can pay their property tax through the following sources:

- cdma.ap.gov.in –> Online Services –> Property Tax –> Know Your Dues

- ULB Counter

- Meeseva/AP Online

- Puraseva App

How to pay Andhra Pradesh property tax online?

If you own a residential property in the state, you can pay your house tax Andhra Pradesh through the portal of the Commissioner and Director of Municipal Administration, Andhra Pradesh government. The steps are mentioned below:

Step 1: Visit the official CDMA AP government website. Go to the ‘Online Payments’ tab and click on ‘Property Tax’.

Step 2: On the following page, select the district and the respective corporation/municipality and click on ‘Search’.

Step 3: On the next page, submit details such as Assessment number, Old assessment number, Owner name or Door number. You can enter any one field and click on ‘Search’.

Step 4: The next page displays details about your property, including the net payable amount towards Andhra Pradesh property tax. There are two options, namely, ‘Pay Tax’ and ‘View DCB’ – the option to view and print the report for offline payment. Click on ‘Pay Tax’ to proceed with online Andhra Pradesh property tax payment.

Step 5: On the subsequent page, enter the amount in the ‘Balance amount you are likely to pay’ tab. Select the box given next to CFMS Payment Gateway and Terms & Conditions. Click on ‘pay online’.

Step 6: Proceed as the page prompts by clicking on online payment. Choose the preferred payment gateway option like credit or debit cards, net banking, etc. and make the payment.

The Andhra Pradesh property tax receipt will be displayed after the transaction and it can be downloaded and saved for future reference.

See also: All about Andhra Pradesh property and land registration

How to pay house tax Andhra Pradesh through offline method?

Step 1: Property owners who wish to pay their Andhra Pradesh property tax through offline mode must visit their nearest local Urban Local Body (ULB) office or a Citizen Service Centre (Pourasa Kendra) in the municipal office.

Step 2: Taxpayers should carry all relevant documents and information. These include:

-

- Assessment number or property’s unique identification number. It is generally mentioned on the previous property tax receipts. One can also search for the property’s ID number through the CDMA portal.

- Previous property tax receipts: These receipts may be required for property verification and tracking pending dues.

- Identity proof: Taxpayers must carry a valid identity proof, such as an Aadhaar card, when visiting the ULB office or CSCs.

- Property ownership documents: A relevant property ownership document, such as a title deed, can help with verification and a hassle-free property tax payment process.

Step 3: Taxpayers must approach the officer concerned to complete the process. After verification, payment can be made in cash, by cheque, or via online modes such as UPI.

Step 4: A physical receipt will be generated, which must be kept securely for future reference.

Andhra Pradesh property tax app

The Andhra Pradesh government has launched the PuraSeva app, to help citizens access various municipal services, including Andhra Pradesh property tax, in one go. It is the first fully-integrated citizen and employee mobile app, designed by the e-Governments Foundation for the Andhra Pradesh government. Citizens can download the app from Google Playstore. Citizens can pay their house tax in Andhra Pradesh through this app.

How to calculate Andhra Pradesh property tax?

Citizens of Andhra Pradesh can also use the online Andhra Pradesh property tax calculator on the portal to calculate their property tax.

Step 1: Go to the official portal of the CDMA AP government. Scroll down and click on ‘Property Tax Auto Calculator’.

Step 2: A new page will be displayed wherein you must select the district and corporation/municipality. Click ‘Submit’ to proceed.

Step 3: You will be directed to another page. Provide the required details by selecting revenue zone, building classification, nature of usage, floor number, occupancy (owner or tenant), construction date, constructed plinth area and plinth area in building plan. Click on ‘Calculate’.

See also: How to avail of AP registration services on IGRS

Andhra Pradesh property tax rates

The state government has recently introduced a new system for levying property tax Andhra Pradesh, based on the market price of the property.

The government has revised the system and decided to levy tax based on capital value (CV) of the property.

As per the new Andhra Pradesh property tax system, the tax percentage will range between 0.10% and 0.50% of the CV for residential buildings. The rate will range between 0.2% and 2% for non-residential buildings.

The property tax was earlier based on the annual rental value (ARV).

| Range of Annual Rental Value (Residential) | Property Tax Rate |

| Up to Rs 600 | Exemption from payment of property tax |

| Rs 601 to Rs 1200 | 17% |

| Rs 1201 to Rs 2400 | 19% |

| Rs 2401 to Rs 3600 | 22% |

| Above Rs 3600 | 30% |

See also: All about Telangana CDMA property tax

Assessment of property tax in Andhra Pradesh

The properties that fall within the limits of the ULB are assessed for tax, based on which taxes are levied. Information regarding all new constructions, existing constructions and modifications of a property are provided by the Town Planning Department for making required changes to the tax assessment.

The property tax is calculated based on the Annual Rental Value (ARV), which is the estimated annual rent fixed by the municipal authorities. Besides, there are key parameters that are considered when determining property tax in Andhra Pradesh:

- Property type: The property tax rates vary for vacant land, buildings, flats and other structures.

- Property usage: The rates also differ based on usage of the property, such as residential, commercial, industrial or mixed-use properties.

- Property location: Property tax rates in urban areas are higher than the tax rates in rural areas.

- Property age: The tax rates also vary based on whether it is an old property or a newly built one.

- Type of construction: Tax rates also vary based on construction type. RCC structures are taxed at a higher rate than simple brick or thatched buildings.

An official, appointed by the government, will visit the property and assess all parameters, including the size of the property and location. When the property tax is charged for the first time, the property owners will be notified, and an assessment report is generated. The assessment sheet includes the owner’s house tax details in AP such as:

- Property Serial Number

- Ownership details

- Door number

- Locality

- Zone number

- Nature of usage

- Construction type

- Plinth area (in square metres)

- As per Form A notice, the monthly rental charges are set per square metre of plinth space

- Property’s monthly rental value is set

- Half-year split property tax

- Date of the special notice service

- Date on which the revision petition was received

- Date of the hearing

- In summary, the Commissioner’s orders

- Property tax set when the revision petition is resolved

- Commissioner’s initials

How does a hike in AP land-market value impact property taxes?

Property taxes in Andhra Pradesh are calculated based on the prevailing capital values of properties. Capital value is simply the land value + building value. Recently, the Andhra Pradesh government decided to increase the land market values from February 1, 2025. The government proposed to raise land market values by 5 to 10%. So, when land market values increase, the capital value of each property rises. Even if the property has not undergone any major renovations or upgrades, the taxable value can still rise significantly due to revisions in land values. Local authorities are likely to levy a higher tax rate due to the higher capital value. The impact is seen more in urban areas, especially localities with steep land-value increases resulting in proportionate increases in property taxes.

Gram Panchayat House Tax in AP

Citizens of Andhra Pradesh can make the online payment of AP property tax for panchayats through the Andhra Pradesh Panchayat official portal.

- Visit the official portal https://digitalpanchayat.ap.gov.in/

- Click on the citizen login option

- New users must register on the portal by clicking on ‘Sign-up New User’ link

- Log in using your credentials to access the various government services.

Online property tax payment in AP for panchayat

People in villages and towns in Andhra Pradesh can avail of various government services under one roof through the AP Digital Panchayat portal. They can install the official mobile app for AP Digital panchayat on their smartphones. The uses can log in to the app and complete the gram panchayat property tax payment procedure.

How to apply for property mutation in AP?

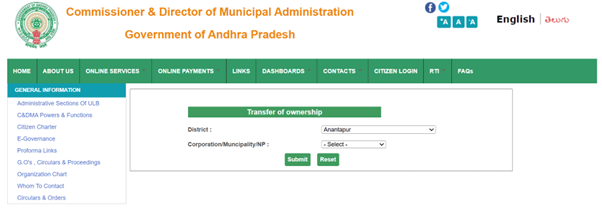

- To apply for property mutation in Andhra Pradesh, which is the process of name change in property tax records, one can visit the CDMA official portal.

- Under ‘Online Services’, go to property tax and click on ‘File your mutation (transfer of ownership)’ option.

- A new page will open. Choose the district and corporation/municipality/NP from the dropdown.

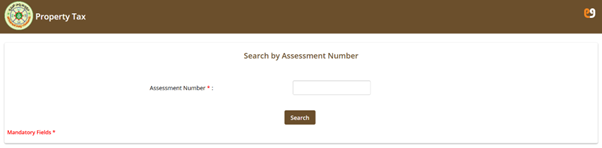

- Provide your assessment number and click on Search.

- Complete the property tax mutation application form by providing relevant information such as address, new owner’s name, etc.

- Upload the scanned copies of supporting documents such as the sale deed, ID proof, etc.

- Pay the relevant fee and submit the form. The property mutation fee can be checked and paid on the CMDA portal under ‘Online Payments’.

Housing News Viewpoint

If you own a house anywhere in Andhra Pradesh, you are required to pay the property tax to the relevant municipal authority. Owing to the CDMA website, the process of property tax payment becomes seamless. The Meeseva/ AP service and Puraseva App are other modes that you can choose for quick tax payment. You can also approach a ULB counter in your area if you want to pay the tax by cheque or cash. Make sure you have calculated the tax dues and have all the relevant documents handy before proceeding for property tax payment.

FAQs

How to get a house tax receipt online in Andhra Pradesh?

Citizens of Andhra Pradesh will receive a soft copy of the property tax receipt after making the tax payment online.

How do I download the PuraSeva app?

One can search and download the PuraSeva mobile app via Google Playstore on their mobiles.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |