The Budget presented by finance minister Nirmala Sitharaman, on February 1, 2020, has proposed a new tax regime for individuals and HUFs, where they are offered lower rates of tax for different slabs, provided they are willing to forgo various exemptions and deductions. Some of the deductions and benefits pertain to staying in rented accommodations or buying a house with a home loan. This tax regime is optional and one can choose to stick with the current tax regime also.

What are the provisions of the new tax regime under Budget 2020

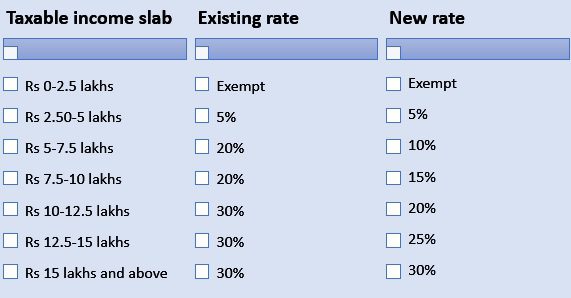

The finance minister proposes to introduce an alternative tax regime, by introducing a new Section 115BAC in the Income Tax Act, which will apply to individuals and Hindu Undivided Families (HUFs). The new tax regime is optional for the tax payers, under which tax at concessional rates shall be levied up to the income of Rs 15 lakhs, under seven progressive tax slabs of 5%, 10%, 15%, 20% and 25% on the income slabs advancing by Rs 2.50 lakhs, starting from the basic exemption of Rs 2.50 lakhs. In case one wishes to avail of the benefits of the reduced tax slab rates, in place of existing tax slabs, one has to forgo various tax deductions and exemptions.

Income tax slab 2020-21

For salaried employees, if one opts for the new scheme, one will not be able to avail of the major benefits like House Rent Allowance (HRA), Standard Deduction or Leave Travel Assistance (LTA). For salaried and self-employed people, deductions under Section 80 C, with respect to home loan repayments, in addition to various other eligible items, will also not be available. The tax payer will also have to forgo the benefit of deduction under Section 24(b), with respect to the interest on home loans, for self-occupied property, deduction with respect to savings bank interest, premiums paid for health insurance for family, as well as parents, etc.

Moreover, a tax payer will not be able to claim carry forward of the losses incurred under the head ‘Income from house property’, which arises in case the loss under this head is more than Rs 2 lakhs for the current year, as loss up to Rs 2 lakhs can only be set off against the current income. Such a situation can arise, when the tax payer either has a let-out property or a self-occupied and let-out property, both financed through home loan. The loss not so set off during the current year is allowed to be carried forward for eight subsequent years. The right to carry forward the loss is akin to a tax credit that is available to you, which can be adjusted against future tax liability.

The cumulative benefit for moving toward the new tax regime is around Rs 75,000, for a person having an income of Rs 15 lakhs. As various combinations and permutations are possible, of exemptions and deductions one can claim and will have to forgo, a general statement cannot be made, on whether the existing regime is better than the alternative offered, or vice-versa. However, looking at the tax benefits one will have to forgo, generally, the benefit of staying with the existing regime, will outweigh the benefit of migrating to the new regime.

See also: Budget 2020: What did the real estate sector gain?

New income tax slabs: How the scheme will work

Let us understand the impact with an example. A salaried person who opts for the new tax regime, will have to forgo the claim of home loan interest, as well as principal repayment, in case the property is bought with a home loan. Moreover, he will also have to forgo the benefit of standard deduction of Rs 50,000. If we only consider the benefit of principal repayment of Rs 1.50 lakhs under Section 80C and Rs 2 lakhs of interest under Section 24(b), he will have to forgo a claim of Rs 4 lakhs, with tax effect of Rs 80,000, if he is in the 20% tax slab, having income between Rs 5 lakhs and Rs 10 lakhs. This is higher than the tax benefit of Rs 62,500 by migrating to the alternative offered, which will accrue for income up to Rs 10 lakhs. For those who are in the 30% slab rate, the tax effect of the benefit forgone at 30%, would be Rs 1.20 lakhs against the benefit of Rs 75,000, which will accrued if the tax payer opts for the new tax regime.

From the example given above, it becomes apparent that for a person who is in the 20% or 30% tax slab, the existing scheme is better if one has a home loan. We can incorporate the benefit of Rs 50,000 under Section 80 CCD(1B) for NPS for easy understanding of the example. Even those who are self-employed and having income of up to Rs 7 lakhs, will have to pay tax of Rs 32,500, if they opt for the new regime. However, if one is able to claim deduction under Section 80 C for Rs 1.50 lakhs and a deduction of Rs 50,000 under Section 80 CCD(1B) for NPS and bring the income below Rs 5 lakhs, one will not have to pay any tax, by availing of the rebate up to Rs 12,500 under Section 87A. So, by investing Rs 2 lakhs, one will be able to save tax of up to Rs 32,500, if one remains under the old regime, instead of migrating to the new regime.

New income tax slabs: How will it affect the real estate sector?

From the examples cited above, it becomes clear that a person who has a home loan, will be better off remaining under the existing schemes under different tax slabs. As it will not make any sense for a majority of the tax payers to migrate to the new scheme, it will not affect the decision of buying a home with a home loan. Moreover, people generally do not base all their financial decisions, only on the basis of availability of tax benefits. People do not buy a house to avail of the tax benefits on home loans but buy their residential house for their needs. The tax benefits on home loans accruing to the tax payers are incidental and not the deciding factor for buying a house. Likewise, people take houses on rent for staying therein and not for availing of the HRA benefits.

In my opinion, as the new tax regime will almost be a non-starter, it will not affect decisions of taking houses on rent or buying one with a home loan. Consequently, this proposal will not have any impact on the real estate industry. People will continue to buy houses, whether the tax benefits are available or not.

FAQs

Who can avail of the new income tax regime proposed in Budget 2020-21?

The new income tax regime proposed by finance minister Nirmala Sitharaman in Budget 2020-21 is applicable to individuals and HUFs.

What deductions will a tax payer have to forego, if he chooses the new tax regime?

Salaried individuals who opt for the new income tax regime, will have to forego deductions including interest on home loans under Section 24(b), principal repayment under Section 80C, House Rent Allowance (HRA), Standard Deduction of Rs 50,000, Leave Travel Assistance (LTA), deduction on savings bank interest, health insurance premiums, etc.

Which income tax scheme should an individual in the 20% or 30% tax slab choose?

An individual who is in the 20% or 30% tax slab, will be better off choosing the existing income tax regime, if he has a housing loan.

(The author is a tax and investment expert, with 35 years’ experience)

Budget 2020: Tax benefits for home buyers

February 1, 2020: Here are some of the top announcements made in Budget 2020-21 that can bring tax relief for home buyers and developers of affordable housing as well

1. The tax holiday for projects under the affordable housing category available under Section 80IBA which was available for the projects which are approved by March 31, 2020 will be available even for the projects which are approved till March 31, 2021.

2. The threshold limit for applying the provision to tax the difference as capital gains or income from other sources in case the stated consideration is lower than the stamp duty valuation, has been increased from the existing 5% to 10%. This will help the home buyer where the actual consideration is lower but the stamp duty valuation continues to be high in cases where the difference does not exceed 10% instead of the existing threshold limit of 5%.

See also: Budget 2020: What did the real estate sector gain?

3. For the purpose of computing the capital gains the tax payers have the option to take the fair market value of the land and building as on April 1, 2001. There were no restrictions earlier on how much the same varied from stamp duty valuations. Now, the budget proposes that the same can not in any case, be higher than the stamp duty valuation.

4. The additional benefit of Rs 1.5 lakh of interest available under Section 80EEA introduced last year, was applicable in case the home loan was sanctioned between April 1, 2019 to March 31, 2020. Now, Budget 2020 announced that the same will be available for home buyers who get their home loan sanctioned between April 1, 2020 and March 31, 2021.

5. The budget also proposes a different concessional tax rate regime for individuals who do not avail various tax benefits. The tax benefit listed include HRA and interest on home loan, deduction under Section 80 C which includes home loan repayment. Due to these benefits being made optional, the proposed tax regime would most likely be a non-starter, and have no major impact in terms of encouraging people to invest in homes, in my opinion.

(The author is a tax and investment expert, with 35 years’ experience)

Budget 2019: Additional tax benefit of Rs 1.5 lakhs under Section 80 EEA explained

The Union Budget 2019-20 has proposed an additional tax benefit of Rs 1.50 lakhs on the interest component of home loans. We look at the eligibility criteria for claiming this benefit and how it differs from Section 24(b)

July 9, 2019: The Union Budget 2019-20, presented by Nirmala Sitharaman, the first full-time woman finance minister, did not have many provisions for home buyers. Nevertheless, in order to give a boost to the ‘Housing for All by 2022’ mission, she offered an additional tax benefit of Rs 1.50 lakhs on the interest component of home loans, taken from specified financial institutions, under a new Section 80 EEA. This is in addition to the existing benefit of Rs 2 lakhs, which is available under Section 24(b), to a person who is buying a residential house for his own occupancy.

Additional tax benefit of Rs 1.5 lakhs: What is the exact benefit that is being proposed?

The additional benefit, is being offered under a proposed new Section 80 EEA, as a deduction from gross total income. There are certain conditions to be fulfilled, for being eligible to claim the proposed additional benefit of interest upto Rs 1.50 lakhs. The first condition, is that the value of the house being bought should not exceed Rs 45 lakhs, as per the stamp duty ready reckoner published by the state government. So, your agreement value is not relevant for this purpose. If you buy a house for an amount which exceeds the threshold limit of Rs 45 lakhs, you will still be able to claim this benefit, as long as the value does not exceed Rs 45 lakhs as per the stamp duty reckoner, which is also referred to as the circle rates.

This benefit is available only for home loans sanctioned between April 1, 2019 and March 31, 2020, irrespective of the date of actual disbursement of the loan or purchase or booking of the home. So, even if you have booked an under construction property prior to April 1, 2019, you can still claim this benefit, provided you get a sanction letter which is issued between these two qualifying dates and provided you satisfy all the other conditions.

The tax benefit of Rs 1.5 lakhs is available if the home loan is taken from a financial intuition. As per the definition of financial institution used for this purpose, only home loans taken from banks will be eligible for this purpose. So, any loan taken from a housing finance company, shall not qualify for this purpose. This seems to be a drafting error and hopefully, should be rectified by the time this bill is passed.

See also: Budget 2019: What did the home buyers and home owners get

In order to claim this deduction, the borrower should not have any house, as on the date of sanction of the home loan. There is no restriction on your other family members owning a residential house, for qualifying for this benefit. Although the finance minister, in her speech, has created an impression that this benefit is available for self-occupied property but the wording used in the proposed section does not convey that impression. So, you can claim this benefit even for a let-out property if you do not own any residential house on the date of sanction of the bank loan, implying thereby that you can still avail of the benefit under this scheme if you buy another residential house, after obtaining the sanction letter. So, you will continue to get the benefit of this provision, if you acquire any number of residential house properties, in the same year or in subsequent years after the sanction of the bank loan.

How is it different from the existing tax benefit available under Section 24(b)?

Presently, you are allowed to claim interest benefit for any money borrowed for purchase, construction, repair or renovation of a house, under Section 24(b). This deduction can be claimed with respect to any property, whether residential or not, without there being any restriction on the value of the house. However, the tax benefit under the proposed section, can only be availed of with respect to a residential house and that too, for a value not exceeding Rs 45 lakhs.

Deduction under the new provision can only be claimed for acquiring a residential house, whereas the benefit under existing provisions are available even for repair or renovation of your existing house property. The new benefit of interest under Section 80 EEA is available, only if the money has been borrowed from banks, whereas the benefit under Section 24(b) can be claimed, for money borrowed from anyone including your friends and relatives. The benefit available under Section 24(b) is available as a deduction under the head ‘Income from House Property’, whereas the new benefit on interest is proposed to be made available, as a deduction against your total taxable income from all sources.

For an under-construction property, the interest under Section 24(b) can be claimed only if the construction of the house property has been completed and possession taken and therefore, cannot be claimed during the construction period. However, the aggregate of interest paid during the construction period, can be claimed in five equal instalments, together with interest for the current year, beginning from the year in which the construction of the house was completed. Against this, the benefit under the proposed Section 80 EEA, can even be claimed during the construction period, as the completion of construction is not a prerequisite for this purpose.

If your total income is not sufficient to claim the tax benefit offered under the new section 80 EEA, even if you are otherwise qualified, your right for that year lapses and you cannot carry forward the same, to a subsequent year. On the other hand, any loss computed under the house property head beyond Rs 2 lakhs, is allowed to be carried forward, for set-off against house property income of the subsequent year.

(The author is a tax and investment expert, with 35 years’ experience)

Interim Budget 2019: 3 main tax benefits for property owners

February 2, 2019: The interim budget 2019 has offered some unexpected benefits for owners of property. We look at the three main announcements that are likely to bring tax relief to home owners

1. Exemption of notional rent on second self-occupied property

Tax payers who own and occupy more than one house have to pay tax on notional rent, which the property might fetch. This used to put many tax payers under undue monetary pressure as these tax payers may have a second house in a native place or one that is used by their parents for which no rent is received. Until now, they had to pay notional rent on the second property, as one can claim only one owned house as self-occupied. Now, tax payers will be able to claim two owned houses as self-occupied, without having to pay any tax on such notional rent, provided the same is/are not let-out.

See also: Budget 2019 highlights: What did home buyers and the real estate sector gain

2. Exemption on long-term capital gains when the same is invested in two houses

Presently, you can claim the tax benefits with respect to long-term capital gains on the sale of residential house, if the indexed long-term capital gains are invested for buying or constructing another one residential house, within the period specified. The interim budget 2019 proposes to expand this benefit to buying or constructing two residential houses, for the purpose of claiming the exemption under Section 54, provided the amount of capital gains does not exceed Rs two crores. Once a tax payer claims the exemption for buying or constructing two house, he cannot claim the exemption for the same year or the subsequent years.

3. Increase in TDS limit for rental income

The third benefit for property owners is by way of increased limit for rent on which the lessee will deduct tax, before paying the rent to the landlord. Against the present limit of Rs 1.80 lakhs, the lessee will now have to deduct TDS, if the annual rent exceeds Rs 2.40 lakhs. The tax is required to be deducted, if the lessee is other than an individual or an HUF. An individual or an HUF lessee will deduct tax while paying you rent, if and only if he is engaged in business or profession and their books of accounts were subjected to tax audits in the previous year.

(The author is a tax and investment expert, with 35 years’ experience)