Various factors might have led to value appreciation for India’s housing market, but the sector achieved impressive levels of growth in 2022 amid a change in buyer outlook towards immovable assets in the post-pandemic era, says the Economic Survey 2022-23.

According to the Survey, tabled by Finance Minister Nirmala Sitharaman on January 31, 2023, the sector has witnessed resilient growth in the current year, with sales and launches in second quarter of FY23 surpassing the pre-pandemic level of Q2 FY20. This is despite the rising interest rates on home loans and an increase in property prices.

“The pandemic brought about a change in individual home buyers’ sentiment in favour of owning a house. With the easing of curbs, there was an increase in interest in the residential housing sector and more so in the readily available and affordable segment,” says the Survey penned by Chief Economic Adviser (CEA) V Anantha Nageswaran.

“The Russia-Ukraine conflict has further affected the supply chain resulting in price escalations of steel, cement, finishing materials, imported chemicals, and fuel, thereby increasing the overall construction cost and resulting in a rise in housing prices,” says the Survey.

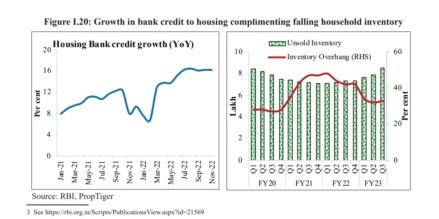

Because of the strong sales momentum, there has been a significant decline in inventory, with overhang dipping to 33 months during Q3 FY23 from 42 months in the same period last year, points out the Survey citing PropTiger data.

A screenshot of the PropTiger data as shown in the PDF format of the

Economic Survey 2022-23

Unsold inventory stood at 8.5 lakh at the end of 2022, with 80% of the stocks under various stages of construction, the Survey says, quoting PropTiger data.

“The improvement in sales in 2022 has been instrumental in lowering the inventory burden for India’s real estate developers. Consequently, inventory overhang — the estimated time builders would take to sell off the existing unsold stock, based on the current sales velocity— has now declined to 33 months as compared to 42 months in 2021. The inventory overhang is the lowest since 2020,” the PropTiger report, released in December 2022, had said.

“The return of migrant workers to cities to work in construction sites leading to a significant decline in housing market inventory,” says the survey, adding that the universalisation of vaccination coverage also has a significant role in lifting the housing market as, in its absence, the migrant workforce could not have returned to construct new dwellings.

The “release of pent-up demand” was reflected in the housing market, says the Survey, as demand for housing loans picked up too.

“Consequently, housing inventories have declined, prices are firming up, and construction of new dwellings is picking up pace and this has stimulated innumerable backward and forward linkages that the construction sector is known to carry,” it says.

Recent government measures such as the reduction in import duties on steel products, iron ore and steel intermediaries will cool off the construction cost and help to check the rise in housing prices, says the survey.

Economic Survey 2022: 23: Key highlights

GDP growth

India to witness GDP growth of 6% to 6.8% in 2023-24, depending on the trajectory of economic and political developments globally. The projection is broadly comparable to the estimates provided by multilateral agencies such as the World Bank, the IMF, the ADB and the RBI.

India is the third-largest economy in the world in PPP terms and the fifth-largest in market exchange rates. As expected of a nation of this size, the Indian economy in FY23 has nearly “recouped” what was lost, “renewed” what had paused, and “re-energised” what had slowed during the pandemic and since the conflict in Europe.

Private consumption

According to the survey, India’s economic growth in FY23 has been principally led by private consumption and capital formation and they have helped generate employment as seen in the declining urban unemployment rate and in the faster net registration in Employee Provident Fund. Moreover, the world’s second-largest vaccination drive involving more than 2 billion doses also served to lift consumer sentiment that may prolong the rebound in consumption.

Housing affordability

The overall affordability in the residential real estate sector was high during the post-pandemic period as reflected by a decline in the weighted average annual interest rate on home loans from 8.6% during January-March 2020 to 7.3% during January-March 2022.

Affordable Housing Fund, other funding options

Under the Affordable Housing Fund, the National Housing Bank has disbursed Rs 34,588 crore for 3.9 lakh dwelling units since its inception.

Under the Special Liquidity Facility of the RBI, the NHB disbursed Rs 13,917 crore and Rs 8,112 crore during the 1st and 2nd waves of the pandemic, respectively, to ensure seamless business as usual in the sector. The NBH also provided liquidity support of Rs 88,400 crore through various refinance schemes since the onset of the pandemic.

PMAY CLSS

The government has released a subsidy amounting to Rs 53,548 crore benefitting approximately 22.87 lakh households through interest subvention under the Pradhan Mantri Awas Yojana-Credit Linked Subsidy Scheme-Urban.

RERA

Real Estate Regulatory Authorities across the country have disposed of more than 1.06 lakh complaints. With 99,262 projects and 71,514 agents already registered under the RERA, the law incentivises more investments into the sector.

Moratorium

The permission by the RBI to lending institutions to grant a total moratorium of 6 months in case of payment failure due between March 1 2020, to August 31, 2020, infusion of Rs 75,000 crore for NBFCs, HFCs and MFIs have contributed to the revival of the real estate sector.

Transparency in real estate

The Survey quotes JLL’s 2022 Global Real Estate Transparency Index, which says India’s real estate market transparency is among the top 10 most improved markets globally, with its composite transparency score improving from 2.82 in 2020 to 2.73 in 2022. This improvement is driven by increased institutional investment and the growing number of Real Estate Investment Trusts (REITs).

Focus on small cities

The hybrid work mode with the privileges of working from anywhere has encouraged first-time home buyers to move away from the conventional metros, leading to pent-up demand in the residential real estate markets of Tier-II and Tier-III cities.

Interest rate

Entrenched inflation may prolong the tightening cycle, and therefore, borrowing costs may stay ‘higher for longer’.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com