If you are planning to buy or sell a property in Rajasthan, it’s important to start with the basics—by understanding the District Level Committee (DLC) Rate. This is the minimum rate below which stamp duty cannot be paid for any land or property transaction. The DLC Rate in Rajasthan varies based on factors such as the property’s location, type etc. This guide outlines in detail about the DLC Rate Rajasthan, its importance, how to check it online and offline, how to calculate the property value on the basis of the DLC Rate. Also, check the district wise DLC Rate table and DLC Rate in Rajasthan vs other states.

What is DLC Rate Rajasthan 2025?

The DLC Rate Rajasthan is the minimum value below which land in Rajasthan cannot be registered at the time of transfer of ownership of property. This prevents undervaluation of property in the state. The DLC Rate differs for different types of properties in Rajasthan — residential, commercial and industrial. This plays an important role in collection of stamp duty, property tax and also when applying for home loan in the state. The DLC Rates are fixed by the municipal corporation of that city- for instance the DLC Rate Jaipur is fixed by the Jaipur Nagar Nigam.

What is exterior and interior DLC rate?

The DLC Rate is divided into two categories namely exterior DLC Rate and interior DLC Rate. These categories apply to residential, commercial, industrial and institutional categories.

Exterior DLC Rate: If the property or land is next to the main road, the exterior DLC Rate is applicable.

Interior DLC Rate: If the property or land is not beside the main road, the interior DLC Rate is applicable on it.

Impact of DLC Rate Rajasthan on stamp duty of property

Mentioned are two scenarios based on which stamp duty for a property in Rajasthan is decided. Note that DLC Rate Rajasthan 2025 plays an important role in this. It’s important to note that when it comes to paying stamp duty, it is calculated based on the higher value between the property’s actual value and the DLC Rate in Rajasthan.

Case 1: When DLC Rate Rajasthan is lower than the actual sale price

Suppose Aarti Khandelwal buys a residential property worth Rs 50 lakh. The DLC Rate of this property is Rs 40 lakh. However, Khandelwal will need to pay stamp duty on the higher value, which is on Rs 50 lakh.

Case 2: When DLC Rate Rajasthan is higher than actual sale price

Suppose Naveen Rathod buys a property worth Rs 60 lakh and the DLC Rate for this property is Rs 65 lakh. Therefore, Rathod will have to pay stamp duty on the higher of the two, which is at Rs 65 lakh.

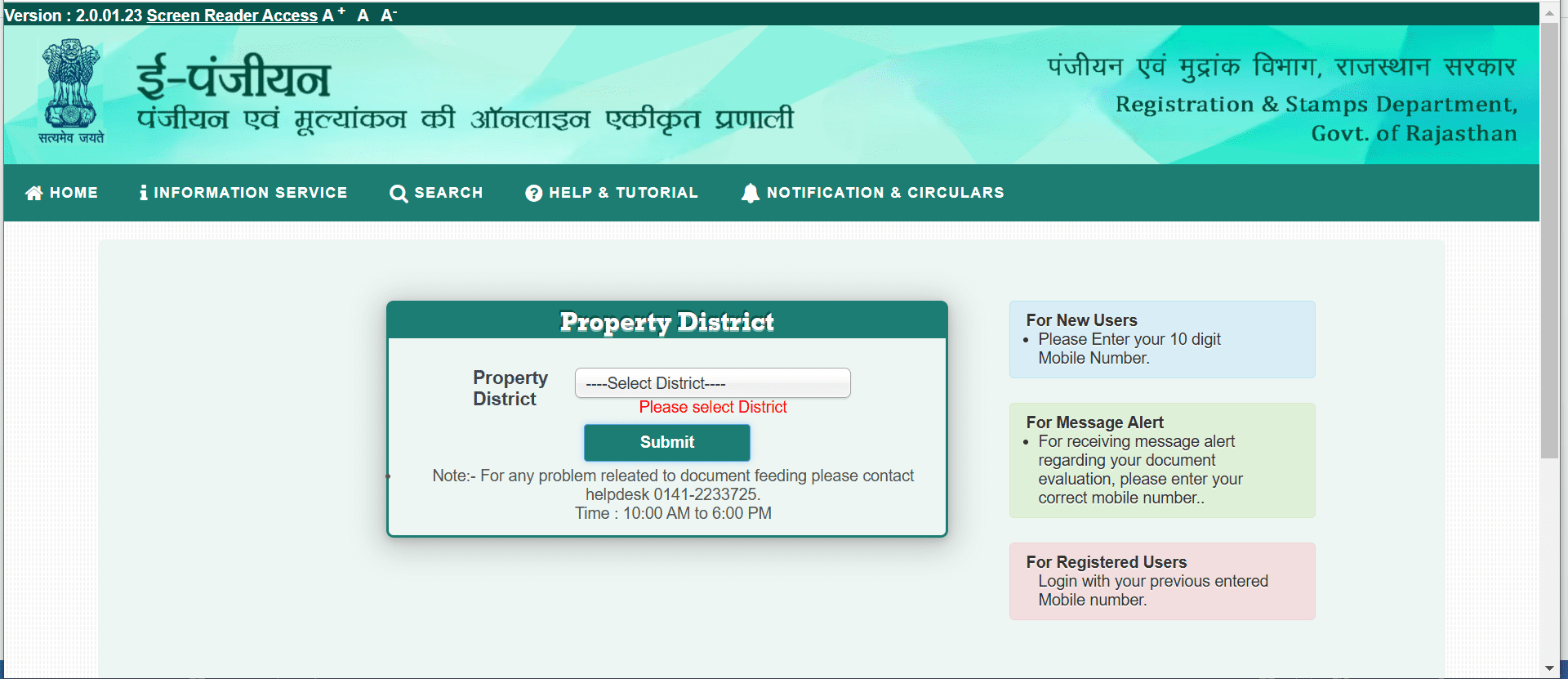

How to check DLC Rate Rajasthan online on E-panjiyan?

You can check the DLC Rate 2025 on the IGRS Rajasthan website.

Step 1: Log on to the IGRS website at https://epanjiyan.rajasthan.gov.in/ and on the homepage, click on e-Value (Online DLC).

Step 2: Select the district and click on submit.

Step 3: Select area and other categories such as SRO, Zone and Colony. Enter Zone name, Captcha and click on show result.

You will see the DLC Rate Jaipur.

See also: Stamp duty and registration charges in Rajasthan

How to check DLC Rate Rajasthan 2025 offline?

If you are unable to access the DLC Rate 2025 online, or need physical documents, you can access the DLC Rate Rajasthan offline by visiting the sub-registrar’s office (SRO).

- Once at the SRO, request for the property valuation rates or the DLC Rate from the authorised official.

- The official will provide you a printed booklet or provide you with a registrar that includes district wise-rates for residential, commercial and agricultural land.

- While checking the DLC Rate Rajasthan offline, you can ask the official about the different rate slabs and how DLC Rate is applicable for different localities in the same district.

- The offline way of checking DLC Rate Rajasthan is useful when the internet connection is not strong or when you want the SRO to verify the property registration.

- You can also check with real estate agents, property consultants and people in the area who have recently bought or sold property. It’s a good idea to double check the DLC Rate Rajasthan before entering into any kind of property transaction.

How to calculate property value using DLC Rate Rajasthan?

To calculate property value using DLC Rate Rajasthan, you first need some details that form the base of the calculation.

Details required to calculate property value using DLC Rate Rajasthan

To calculate property value you need following details:

- Property type

- Property identification details

- Built-up area of property

- Facilities and amenities present in the property

- DLC Rate Rajasthan of that locality

To determine the value of a property based on the DLC (District Land Committee) rate in Rajasthan, you can use the following formula:

Value of property = DLC Rate x Built-up Area of the Property (in square metres)

For instance, if the DLC rate is Rs 5,000 per square metre and the property’s built-up area is 750 square metre, you can calculate the property’s value as follows:

Value of property = 5000 x 750 = Rs 37,50,000

It’s important to note that when it comes to paying stamp duty, it is calculated based on the higher value between the property’s actual value and the DLC rate in Rajasthan.

DLC rates in popular cities in Rajasthan

| Residential DLC rate | Commercial DLC rate | |

| Kota | Rs 4,000 | Rs 8,000 |

| Jodhpur | Rs 4,600 | Rs 9,600 |

| Udaipur | Rs 5,000 | Rs 10,0000 |

| Jaipur | Rs 90,000 to Rs 1,25,000 | Rs 90,000 to Rs 1,25,000 |

DLC Rajasthan Rates 2025 have been updated on the e-Panjiyan website.

How to find value of property in Rajasthan online?

On the Epanjiyan website, under information service, click on Property Valuation for Citizen.

Select district and click on submit.

Enter district, mobile number and verification code and click on fresh valuation or modify valuation as per choice.

DLC rate: Other names by which it is known in India

While DLC rate is a term largely used in Rajasthan, it is known by other names in the rest of the country.

| State | Term |

| Rajasthan | DLC rate |

| Maharashtra | Ready reckoner rate |

| Delhi, Uttar Pradesh, Uttarakhand | Circle rate |

| Haryana, Punjab | Collector rate |

| Karnataka | Guidance value |

| Tamil Nadu | Guideline value |

| Telangana | Unit rate |

| Chhattisgarh, Madhya Pradesh | Market value guideline |

Why is DLC Rate Rajasthan important for property buyers and sellers?

Fair transaction: The DLC Rate Rajasthan sets a standard rate that doesn’t fluctuate based on the market trends. These are changed by the government at equal intervals. Because of the presence of an established base price for property registration, no transaction will be undervalued.

Standardised pricing: DLC Rate Rajasthan offers a standard point of reference for transactions. This is most helpful in places where market data is absent. One can use this DLC Rate as a starting point for property negotiation for buyers and sellers.

Accurate valuation of property: By knowing the DLC Rate Rajasthan, you will know the price of the property that will help avoid property related disputes.

Prevents underreporting: With the DLC Rate Rajasthan, property value cannot be underreported, thus preventing loss to the exchequer of the state.

No penalty: Underreporting property values may lead to penalty that can be avoided.

Calculation of stamp duty: Stamp duty that has to be mandatorily paid is calculated on the basis of the DLC rate or the market value, whosever value is higher.

Important role registration charges: The DLC rate has an impact on the registration charges, which has to be paid by the buyer along with stamp duty to get the property registered in legal book of records.

Home loan: The DLC rate is an important point of consideration for banks and financial institutions when they approve loans.

Difference between DLC rate and market rate

As mentioned in the ePanjiyan official website, to determine appropriate and minimum rates for land and building property registration, various colonies, villages, and areas are divided into separate segments according to their value.

To this end, market value circles are formed by combining colonies, villages, and areas with approximately similar market values and determining uniform rates for similar land categories within them.

DLC rates are essentially the minimum market rates for various land categories, based on which stamp duty and registration fees are determined.

DLC rates for agricultural, residential, and commercial land are determined by the district-level committee, while rates for other land categories are determined by the state government. It is noteworthy that the DLC rates of market value circles are available in three forms on the e-registration portal and app –

1- In the form of an independent list

2- In an automated form with the selection of location in the evaluation process of the entry for registration

3- In an integrated form with the locations with geo-tagging map

The rate of any plot located in the market value circles which have been geo-tagged becomes visible as soon as the cursor is placed on that location.

Why is DLC Rate Rajasthan important for home loan?

DLC Rate Rajasthan plays an important role in documentation and disbursement of home loan. Based on these, the home loan lenders give money to borrowers. Home loan borrowers also have to consider the DLC Rate when they calculate the home loan they are looking at borrowing.

Impact on DLC Rate Rajasthan on real estate market

The DLC Rate Rajasthan impacts the real estate segment in a big way. When the DLC Rate is less, buyers are encouraged to buy properties as corresponding stamp duty and registration fee is less. However, the segment sees a lag when the DLC Rate Rajasthan is high. To ensure fair and transparent transactions that benefit both buyers and the government, the DLC Rate Rajasthan is fixed closer to the market value.

Housing.com POV

It is a good idea to keep a tab of the DLC Rate Rajasthan 2025 if you intend to buy a property here. This will help you calculate the stamp duty to be paid and also help in financial planning. Although the DLC Rate Jaipur has been increased by 10%, the stamp duty rebate announced by the state last year remains as per industry reports. It’s always a good idea if you get to avail the stamp duty rebate before rules change on that front.

FAQs

What is the full form of DLC?

DLC rate stands for district-level committee rate.

What is the stamp duty in Jaipur?

For men in Rajasthan, stamp duty is 6%, while women enjoy a lower stamp duty at 5%.

Where to check DLC Rate Rajasthan 2025?

You can check the DLC rate on the IGRS Rajasthan website or through the epanjiyan website.

Is there an app for DLC Rate calculation?

There is a DLC rates app on the Google Play store that provides DLC rates of Hanumangarh and Ganganagar. The app is completely free of cost and helps individuals in assessing the DLC rates.

Is Jaipur good for property investment?

Jaipur has emerged as a promising destination for real estate investment, particularly after being designated as a smart city. Additionally, the city's growing appeal to IT/ITES companies, bolstered by initiatives like the Start-up India Mission, further enhances its investment potential. Investing in properties in Jaipur offers a range of compelling advantages.

What is the difference between mutation and registry of property?

Property registration is the formal process of legally transferring the ownership of land titles to the buyer. Subsequently, the mutation process follows the registration. Mutation signifies that the registration has been accurately recorded in the revenue documents, confirming the change in ownership.

Is GST applicable on stamp paper?

As per GST law, non-judicial stamp papers are exempt from GST when sold by Government Treasuries or authorised vendors appointed by the Government.rs, when sold by the Government Treasuries or Vendors authorised by the Government.