Flexible workspace operators are likely to lease about three million sq ft of space across the top six Indian cities in 2021, as operators are likely to focus on signing large enterprise-level deals and cut down on speculative centers, shows a report by global property research firm, Colliers International. In 2020, flexible workspace operators leased about 2.9 million sq ft of space, led by technology and banking and financial services (BFSI) enterprises, the report added.

“We are seeing increasing interest from corporate occupiers in flexible workspace leases, which shows that there is adequate confidence in this space, and we expect demand to increase, for well-managed spaces that focus on digital workplace infrastructure and wellness. Over the next two years, the market is likely to see newer models evolving in this space, especially on the managed office front,” said Siddhart Goel, senior director and head of research at Colliers India.

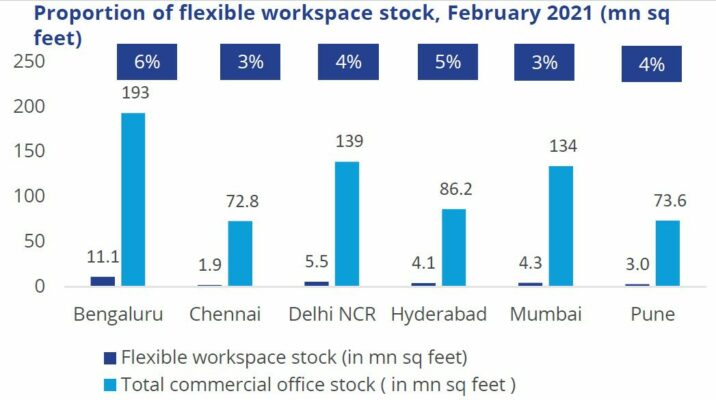

Source: Colliers

Note: The top six Indian cities include Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune.

Key markets

“Though 2020 was muted for the growth of flexible workspaces, markets like Bengaluru, Hyderabad and Chennai continue to drive demand. Enterprises are also driven by the desire to offer locational flexibility to some of their employees and functional departments. They are leasing desks in flexible workspaces closer to the employee’s home,” said Arpit Mehrotra, MD, office services (South India), at Colliers.

Source: Colliers

Despite a large portion of the workforce working from home, as of March 2021, top flexible workspace operators across the top six cities have about 65% of their seats already leased, signalling continued confidence in managed workplaces. As corporate occupiers continue to be uncertain about long-term office leasing plans in 2021 and 2022 and are still re-assessing their office space needs, they are exploring leasing desks in flexible workspaces, to avoid long-term capital expenditures and to get more flexibility on their lease terms.

“For the medium term, corporates are watching the impact of the vaccines closely. Many organisations have opened their offices and the access is left to the personal comfort of the employee. We have seen rising activity in the F&B areas of large office complexes, looking optimistic for sure. Conversations for consolidations and hybrid models continue to pick up and anchor pricing benefits are up for grabs. Leasing will pick up by H2 and it is prudent to evaluate a short-term hybrid model across regions,” said Bhupindra Singh, MD, regional tenant representation (India) at Colliers.

See also: De-densification coupled with expansion, to drive office sector recovery by 2021

The total flexible workspace stock in the top six Indian cities is almost 30 million sq ft, equivalent to 4.3% of total Grade-A and-B commercial office stock.

Bengaluru leads the tally with a 37% share of the total flexible workspace portfolio, followed by Delhi-NCR and Mumbai, with 18% and 14% shares, respectively. By 2022, flexible workspace stock is likely to account for 5.4% of the total office portfolio, led by demand for well-located, high quality and efficient flexible workspaces.

Key operators

The flexible workspace sector remains fragmented and is dominated by operators of various sizes in terms of number of centres and total area occupied. However, the top five operators in India currently operate nearly half of the total area occupied by flexible workspace operators in the Indian market.

Source: Colliers

There is likely to be consolidation in the market, mainly through smaller fragmented operators that are facing acute cash-flow challenges ceasing operations. Over the next three years, flexible workspace operators are also likely to acquire smaller players to ensure they have the geographic range necessary to support their enterprise clients’ distributed workforce.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]