In Maharashtra, stamp duty is a tax levied on every legal property transaction. It is controlled by the Indian Stamp Act of 1899 and the Maharashtra Stamp Act of 1958. The buyer must pay stamp duty on the sale agreement when a property is sold. However, buyers don’t have to buy the stamp paper to pay the stamp duty physically. Maharashtra is among the states which has e-stamping facility. What does this mean? This means you can buy digital copies of stamp paper to pay stamp duty in Maharashtra.

What is e-stamping?

The process of paying stamp duty to the government online is e-stamping. To make this convenient, the government changed the old stamp paper and franking method of stamping and introduced a digital strategy of payment which is time-efficient and safe in 2013. At present, 22 states in India are offering this service. Maharashtra has its personal stamp duty payment procedure.

How to get e-stamp paper in Maharashtra?

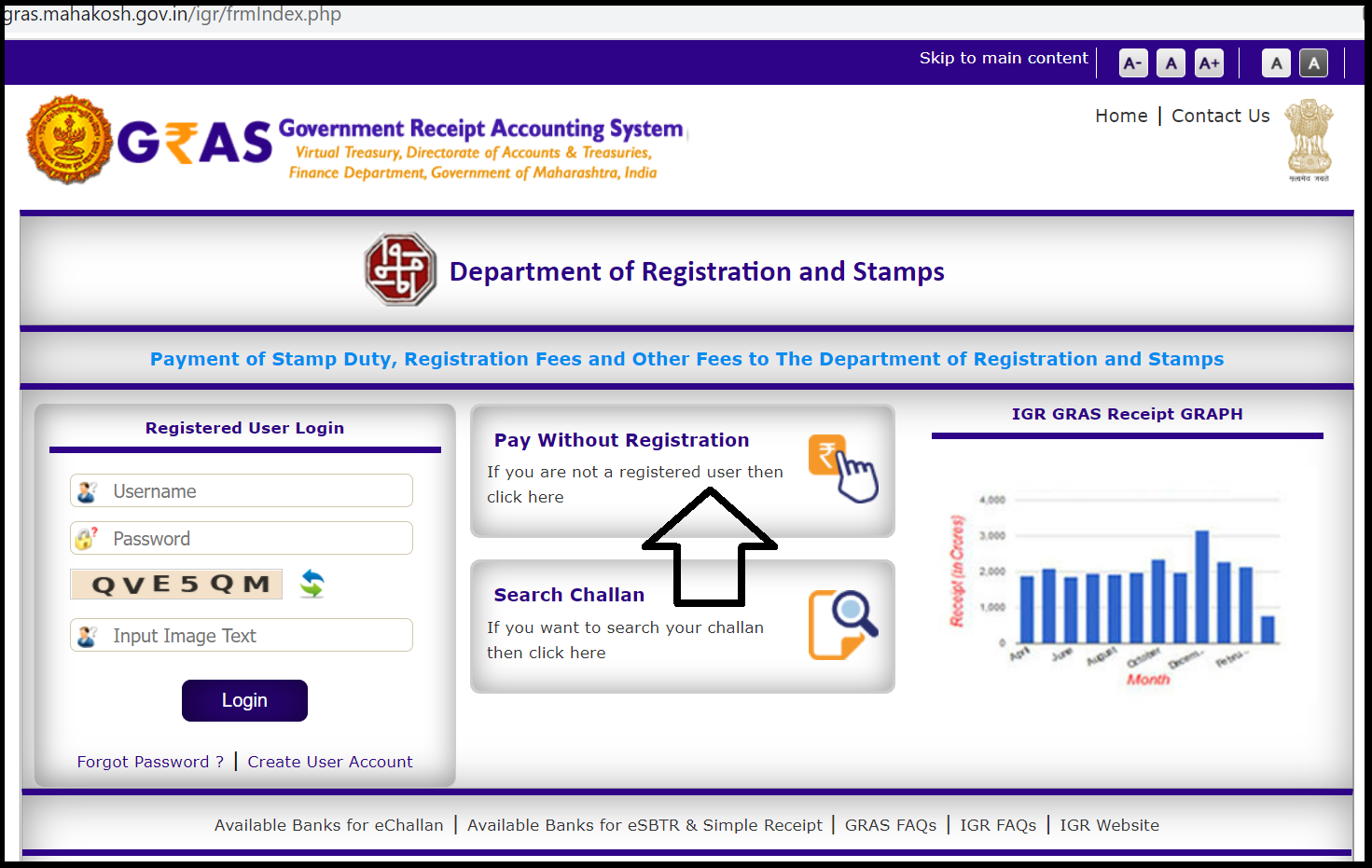

- Click on this page’s ‘Pay Without Registration’ tab.

- Click on the ‘Make payment to Register your documents’. Here, you can pay the stamp duty and registration charges jointly or choose only to pay the stamp duty/registration charges.

- After that, you will have to fill in the details such as district, name of the payer, PAN number, property details, etc., and proceed with payment.

- Choose the payment method and generate the challan. The challan will be required at the time of execution of the deed.

Eligibility for e-stamping in Maharashtra

To proceed with the e-stamping process, you must have a valid email address and mobile number. Additionally, you must be a citizen of India and possess an individual Permanent Account Number (PAN).

Documents required for e-stamping in Maharashtra

To e-stamp, you need to fill in an application form. The following documents have to be submitted:

- Photo ID Proof (passport or driving licence)

- Address Proof (including building plans and maps)

- One’s bank statement should have been issued within 90 days by their bank.

Stamp duty and registration charges in Maharashtra in 2024

| Cities | Stamp duty rates applicable for men | Stamp duty rates applicable for women | Registration charges |

| Mumbai | 6% (includes 1% metro cess) | 5% (includes 1% metro cess) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh

|

| Pune | 7% (includes 1% metro cess, metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Thane | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Navi Mumbai | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Pimpri-Chinchwad | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Nagpur | 7% (includes 1% metro cess local body tax and transport surcharge) | 6% (includes 1% metro cess local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

Factors affecting stamp duty and registration in Maharashtra

In Maharashtra, some of the factors that can affect the stamp duty and registration charges on a property transaction include:

- Type of property: The stamp duty and registration charges on a property transaction may vary depending on the type of property. For example, the stamp duty on a residential property may differ from that on a commercial property.

- Location of the property: The stamp duty and registration charges on a property may vary depending on the location of the property. Different areas within Maharashtra may have different stamp duty rates and rules.

- Value of the property: The stamp duty and registration charges on a property transaction may be based on the property’s value. For example, the stamp duty on a property sale may be a percentage of the property’s sale price.

- Type of ownership: The stamp duty and registration charges on a property may vary depending on the type of ownership. For example, the stamp duty on a property owned by a company may be higher than the stamp duty on a property owned by an individual.

FAQs

What is the Maharashtra stamp duty?

The Maharashtra stamp duty is a tax levied on every legal property transaction. It is controlled by the Indian Stamp Act of 1899 and the Maharashtra Stamp Act of 1958. The buyer must pay stamp duty on the sale agreement when a property is sold.

What is e-stamping?

The process of paying stamp duty to the Government online is e-stamping.

What is the stamp duty on a residential property in Maharashtra?

There is a stamp duty of 2% on the value of residential property in Maharashtra.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]