Income Tax (I-T) is levied by the government of India on the income of every person in India. The provisions governing the I-T are covered under the Income-tax Act, 1961. The last date to file I-T for FY 22-23 is July 31, 2023.

According to the I-T rules, if a person pays more than the taxable amount, then the I-T department has to refund the excess amount paid to the person. This is where the income tax return (ITR) comes into prominence, which has to be filed to claim refund. After the ITR is processed, you will get the refund in your registered bank account within 45 days.

When can you claim a tax refund?

- If the tax collected at the source (TCS) or tax deducted at source (TDS) is more than it should be.

- If you pay more tax in the form of self-assessment tax or advance tax.

How does the I-T department refund the excess money paid?

To get a refund from the I-T department, it is mandatory to file the ITR. Once you file the ITR, the I-T department checks all the details you have mentioned and correspondingly transfers the excess money to the bank account mentioned. So, exercise caution while specifying account details.

How to e-verify ITR?

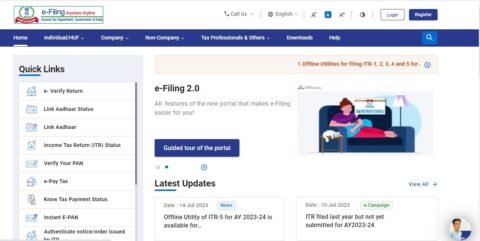

To e-verify ITR, click on e-Verify Return under Quick Links on the Income Tax portal.

You will reach https://eportal.incometax.gov.in/iec/foservices/#/pre-login/eVerifyReturn-bl

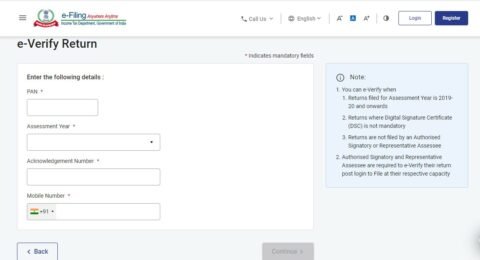

Enter PAN, assessment year, acknowledgement number and mobile number and click on continue to proceed with e-verification of ITR.

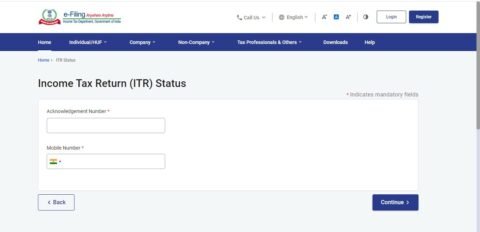

How to check the status of ITR?

On the I-T portal, click on Income Tax Return (ITR) Status. You will reach https://eportal.incometax.gov.in/iec/foservices/#/pre-login/itrStatus

Enter the acknowledgement number, mobile number and click on continue.

Next enter the OTP that you receive on the registered mobile number and click on submit.

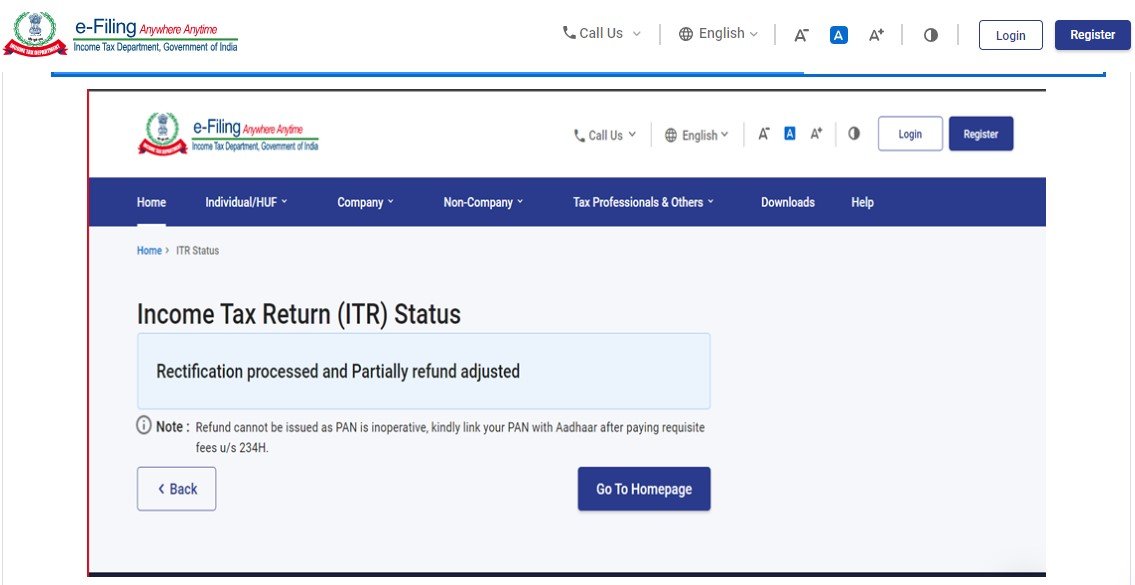

If its a success, you will see this message.

Status of ITR: Inoperative PAN card

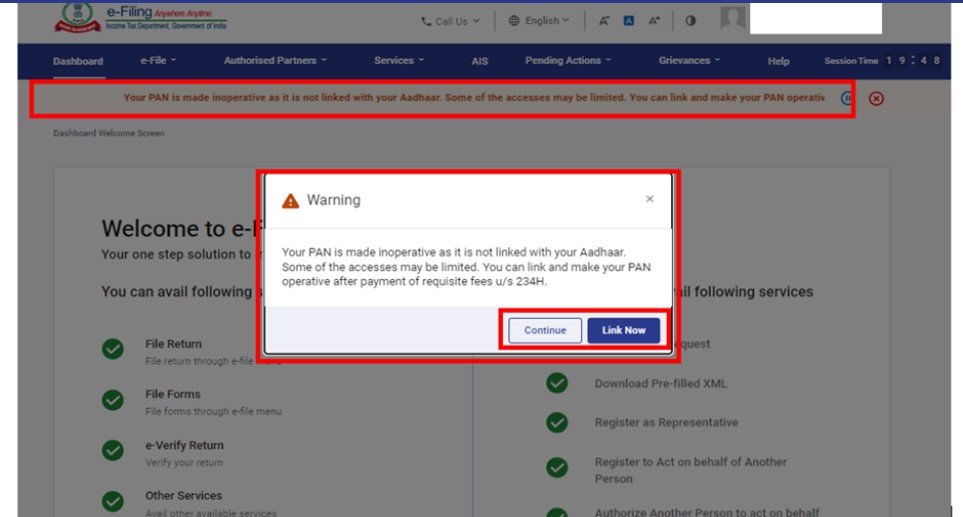

In case the PAN card is not linked with the Aadhaar card, then the PAN card will be made inoperative by the IT department and refund cannot be issued. In such a case, the first step is to link your PAN with Aadhaar after paying requisite fee under section 234H.

On entering all the above mentioned steps, if you get such a message, then click on Link Now and follow the procedure to link PAN Card with Aadhaar Card.

In such a case, the Income Tax Return Status will come with a note as shown in the image below.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]