Filing income tax returns is an important financial responsibility for salaried employees. As per the Income Tax Act, 1961, ITR filing is mandatory wherein a taxpayer reports his total income in a financial year and net tax liability and claims tax deductions using an ITR form. The ITR filing process has been simplified by the Income Tax Department through its e-filing portal. In this article, we explain how salaried employees can file their income tax returns online.

See also: Income tax calculator: Know how to calculate income tax for the financial year

Who should file ITR?

People with an annual income of Rs. 2,50,000 and more must file their ITR as per the new tax regime. There are no higher exemption limits for senior citizens and super senior citizens i.e., those above 80 years of age. Under the old tax regime, the exemption limit was Rs 2.5 lakh for individuals below 60 years, Rs 3 lakh for senior citizens between 60 to 80 and Rs 5 lakh for super senior citizens.

The following individuals must file their ITR:

- A person earning income from more than one income source, such as investments, residential properties, capital gains, etc.

- Those with investments or earnings through foreign assets

- Those having over one crore rupees of deposits in current accounts of one or more banks

- If an individual has paid over Rs 1,00,000 as electricity charges in a year

- If one has made a payment of over Rs 2,00,000 on foreign travel for a person who may or may not be a family member

How to file income tax returns online for salaried employee

Here is a step-by-step guide for filing income tax returns online:

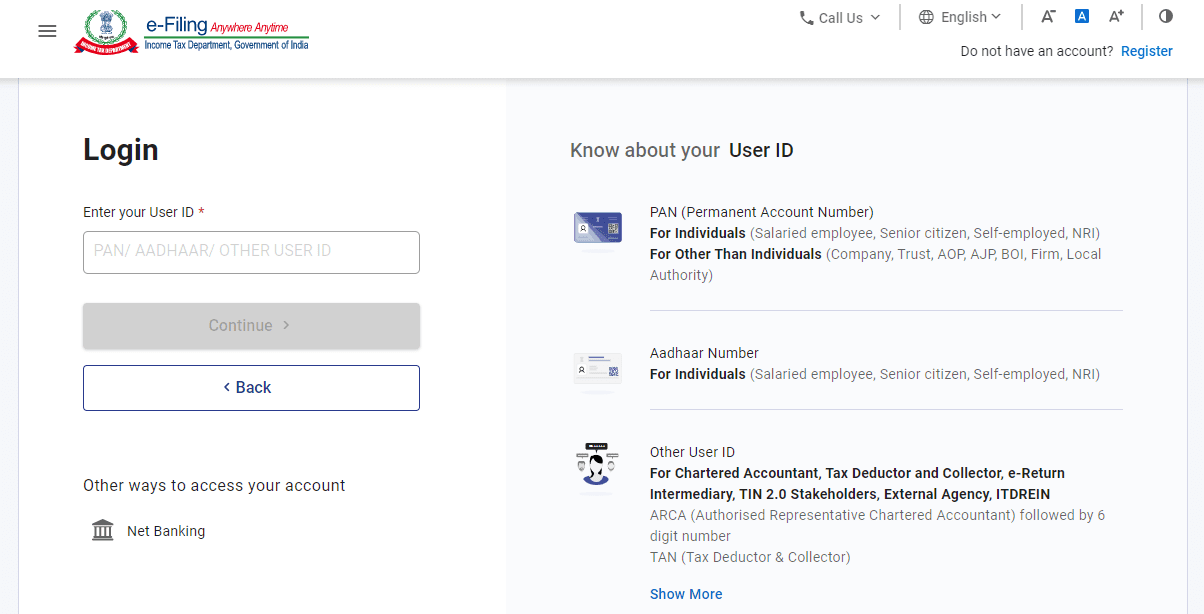

Step 1: Visit the Income Tax Department’s e-filing portal https://eportal.incometax.gov.in/iec/foservices/#/login

Step 2: Sign in to the portal by entering your user ID (PAN No.), password and Captcha code. First time users can register using their Permanent Account Number.

Step 3: Go to ‘Income Tax Returns’ under the ‘e-File’ tab. Click on ‘File Income Tax Return’.

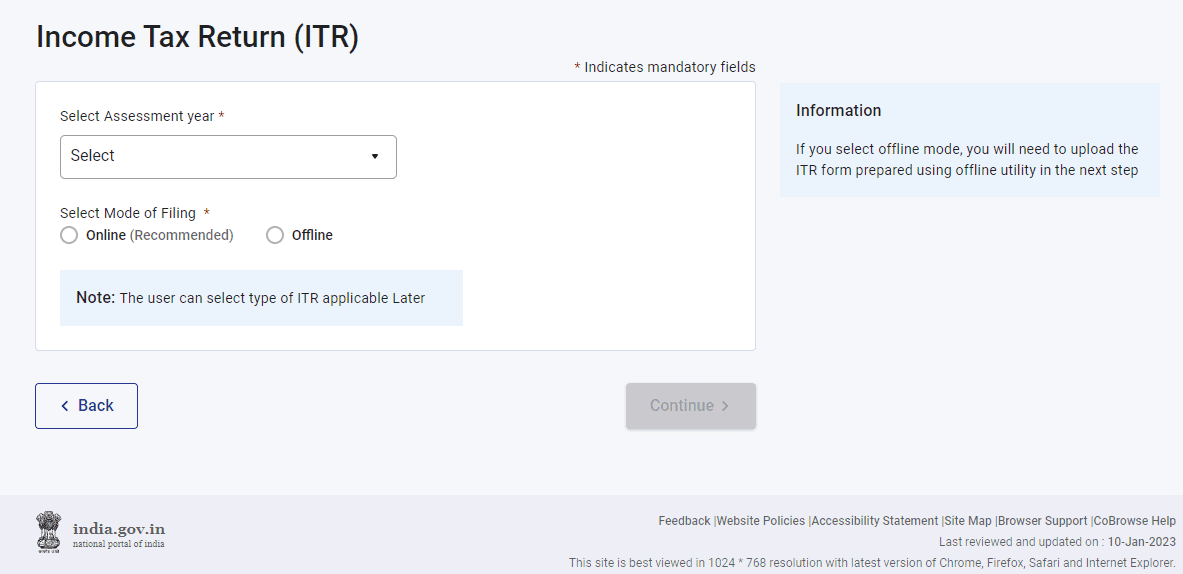

Step 4: Choose the assessment year from the drop-down. Select online as the mode of filing.

Step 5: Choose and download the relevant income tax return (ITR) form. Salaried employees can choose form ITR-1, ITR-2 or ITR-3.

Step 6: Choose the filing type as ‘Original’ if not filing for a revised return.

Step 7: Select the submission mode of ‘Prepare and Submit Online’. Click on ‘Continue’.

Step 8: Provide the relevant details in the ITR form. Add information about tax payments through TDS, TCS and advance tax. Click on ‘Save The Draft’ to keep saving the changes.

Step 9: Calculate the tax payable and pay the tax. Enter challan details in the tax return. If you do not have any tax liability, skip this step.

Step 10: Check and confirm the details provided in the form and submit the form.

A message will be displayed on the screen confirming successful e-filing. An acknowledgement form, ITR-V, will be generated. You can verify the tax return filed through any of the following modes:

- Aadhaar OTP

- Registered mobile number

- Bank account number

- Demat account number

- Net banking

- Bank ATM

- Sending the physical copy of the acknowledgement to the Centralised Processing Centre (CPC) in Bengaluru through the post

ITR forms applicable for salaried employees

If you are a salaried employee, it is essential to be aware of the various ITR forms for filing your tax returns.

ITR – 1 (Sahaj)

ITR-1 or Sahaj is applicable for salaried individuals with a total income of up to Rs 50,00,000. The total income includes earnings under ‘Income from Other Sources’ along with salary. However, the assessee must not have more than one house property. Moreover, the individual’s income from agriculture should not exceed Rs 5,000.

ITR – 2

ITR -2 is applicable for salaried individuals with a total income above Rs 50,00,000. The form is also applicable for those having more than one house property or with income from capital gains and/or other sources but not from profits or gains from business or profession.

ITR – 3

ITR-3 is applicable for individuals or a Hindu Undivided Family generating income from salary, business or profession, one or multiple house properties, capital gains and other sources and are not eligible to file ITR‐1 (Sahaj), ITR‐2 or ITR‐4 (Sugam).

How to file a belated return?

If a salaried employee is unable to file the income tax returns on or before the due date, he can file the ITR after the due date. This is referred to as a belated return. However, one must choose a different ITR form for filing a belated return, known as ‘Return Filed under Section 139(4)’.

What is the penalty for filing ITR after the due date?

| Due date to file ITR | Penalty applicable to individuals with a total income of less than Rs 5,00,000 | Penalty applicable to individuals with total income over Rs 5,00,000 |

| On or before August 31 | No late fee charges | No late fee charges |

| September 1 to December 31 | Rs 1,000 | Rs 5,000 |

| January 1 to March 31 | Rs 1,000 | Rs 10,000 |

A late fee is applicable for filing income tax returns after the due date. You are required to pay late fee charges as per Section 234F of the Income Tax Act. The maximum penalty for filing a belated ITR is Rs 10,000. It is important to note that one must forgo specific deductions and set-offs on carrying forward losses, except for loss from house property, as per Section 139 (1).

Benefits of filing income tax returns for salaried employees

Filing income tax returns is a mandatory exercise for salaried individuals, which is beneficial in many ways.

Claim refunds

If the tax paid in advance based on self-assessment exceeds the tax payable based on regular assessment, you can claim a refund. Filing an ITR for a financial year enables you to claim a refund on the tax deducted. Refunds on TDS on rent payments or fixed deposits are initiated after you file tax returns and claim the tax deduction.

Easy loan application processing

An income tax return serves as an important financial document specifying an individual’s annual income. Hence, banks and financial institutions consider the ITR as proof for granting loans, including home loans. Those who do not have taxable income can also file ITR. This increases their chances of loan approval.

Visa processing

Many foreign embassies may request for ITR receipt of the last two years during visa applications. The document serves as proof of the individual’s source of revenue in India and increases the chances of visa approval.

Adjustment of capital gains or losses

ITR filing is beneficial if an individual has invested in equity or the share market. Based on the ITR submitted for a financial year, the adjusted short-term capital losses would be carried forward for up to eight years.

How to file income tax return online for salaried employees for first time?

Those filing their returns for the first time should register themselves on the official e-filing portal.

- Visit the website https://www.incometax.gov.in/iec/foportal

- Click on ‘Register’

- Click on ‘Taxpayer’

- Submit your PAN details. Now, click on ‘Validate’ and then click on ‘Continue’

- Enter your name, address, gender, etc.

- Provide your email ID and registered mobile number

- Once you have filled the form, click on ‘Continue’

- An OTP will be sent to your mobile number and email ID.

- Enter the OTP. You will be redirected to a new window where you must verify the details.

- If there are any errors, you can edit it. Another OTP will be sent to validate the changes.

- Set up your password and login message.

- Click on ‘Register’. You will receive an acknowledgement message.

- Now, login to the portal and complete the steps for income tax return e-filing.

FAQs

When should salaried employees file ITR?

Salaried employees earning more than Rs 2,50,000 as taxable income must file ITR before the due date of July 31 of the relevant assessment year. For example, the due date for filing ITR for FY 2021-22 is July 31, 2023.

Can a person file ITR without a CA’s help?

An individual can easily file their income tax returns by visiting the official e-filing portal of the Income Tax Department.

Which ITR form is required for salaried employees?

The ITR 1, also known as SAHAJ, is the ITR form that must be filed by a salaried employee (not a businessman or an entrepreneur), who receives pension, earns income from one house property and the total income does not exceed Rs 50 lakh.

Do salaried employees need to file ITR?

Individuals having taxable income or income above the exemption limit must file ITR.

Can I file my ITR myself?

Yes. One can use the pre-filling and filing of ITR-1 service available on the income tax department’s e-filing portal.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |