Bangalore is a well-established IT hub and attracts several working professionals. Hence, the city is also a coveted property destination. The Bangalore Development Authority (BDA) is responsible for developing the city and creating quality infrastructure. If you are looking to invest in a residential or commercial property, you must know that you need to pay a BDA property tax. The Bruhat Bangalore Mahanagara Palike (BBMP) is the municipal corporation, which utilises the taxes paid by citizens for developing the local infrastructure. Now, a homeowner in Bangalore can pay the BDA property tax by visiting the authority’s official website.

BDA property tax: Residential zones

| Zone | In Rs per square foot (sq ft) rate for self-occupied residential property | In Rs per sq ft rate for rented residential property | In Rs per sq ft rate for self-occupied commercial property | In Rs per sq ft rate for commercial, residential property | In Rs per sq ft rate for vacant land |

| A | 2.5 | 5 | 10 | 20 | 0.5 |

| B | 2 | 4 | 7 | 14 | 0.4 |

| C | 1.8 | 3.6 | 5 | 10 | 0.3 |

| D | 1.6 | 3.2 | 4 | 8 | 0.25 |

| E | 1.2 | 2.4 | 3 | 6 | 0.2 |

| F | 1 | 2 | 1.5 | 3 | 0.12 |

As a property owner, it is important to check the property falls under the jurisdiction of which authority. Moreover, if you have rented out the property, you are required to pay the property tax and not the tenant.

BDA property tax: How is it calculated?

Every municipal authority has a system for calculating the property tax. In Bangalore, property tax is calculated for vacant, commercial, and residential properties using the Unit Area Value system.

BDA calculates the property tax based on the following formula:

BDA property tax (K) = (G – I) X 20%

Where,

I is the depreciation amount

G is the Gross Unit Area, which equals X + Y + Z

X is tenanted property area X per sq ft property rate X 10 months

Y is self-occupied property area X per sq ft property rate X 10 months

Z is the parking area per sq ft property rate of parking area X 10 months

I = G x H (depreciation rate in percentage, determined by the property’s age) / 100

How to pay BDA property tax online?

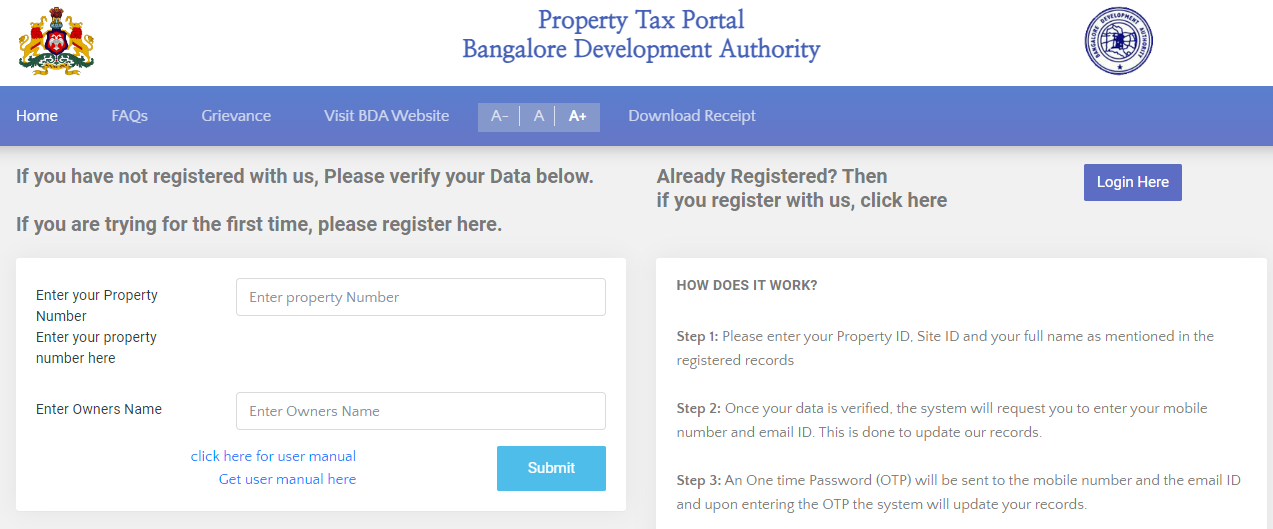

- Visit the BDA official website https://eng.bdabangalore.org/ and click on ‘Property Tax’ under E-services https://propertytax.bdabangalore.org/.

- You will be directed to the BDA property tax page.

- Log into the website. Submit the property ID number, site ID, and complete name to proceed.

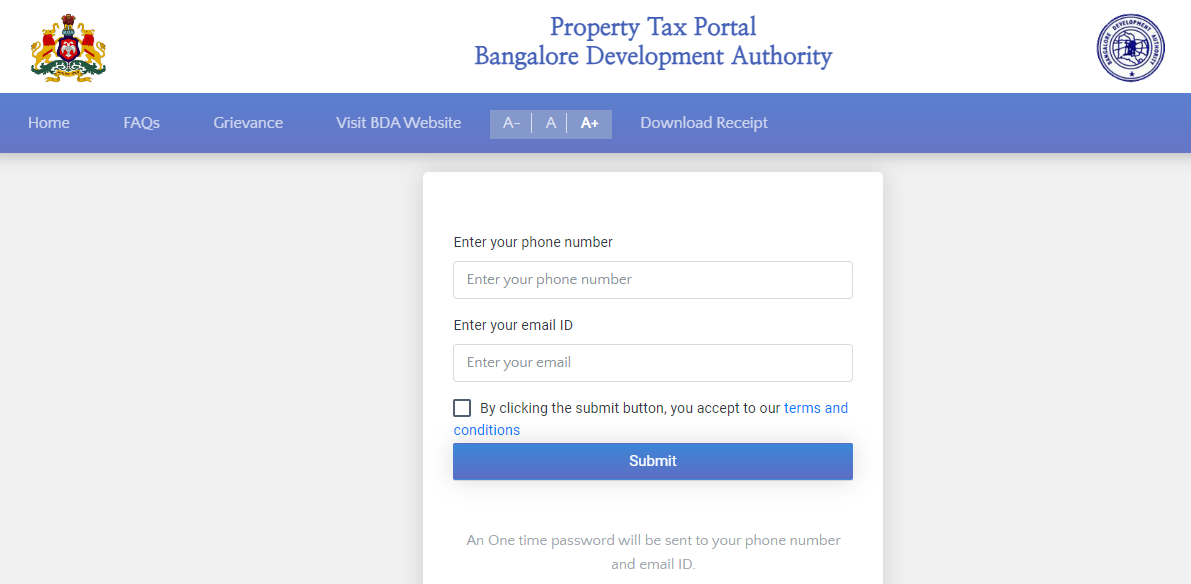

- In the next step, enter your mobile number after the verification is done.

- An OTP will be sent. Enter the OTP to complete the login.

- The page will display information on your bill, including outstanding dues.

- Click on the ‘Pay’ button. Make the BDA property tax online payment through net banking, debit card or credit card.

- An e-receipt will be generated. Save the receipt for future reference.

How to pay BDA property tax offline?

Property owners in Bangalore can pay their BDA property tax offline by visiting the Assistant Revenue Officer (ARO) office or Bangalore One Centre.

Banks that are authorised to accept BDA property tax payment:

- IDBI Bank

- HDFC Bank

- Indian Overseas Bank

- ING Vysya Bank

- Kotak Mahindra Bank

- Yes Bank

- Canara Bank

- IndusInd Bank

- Corporation Bank

BDA property tax depreciation rate

| Age of the building (in years) | Depreciation rate in percentage on taxable annual value |

| Less than 3 years | 3 |

| 3 to 6 years | 6 |

| 6 to 9 years | 9 |

| 9 to 12 years | 12 |

| 12 to 15 years | 15 |

| 15 to 18 years | 18 |

| 18 to 21 years | 21 |

| 21 to 24 years | 24 |

| 24 to 27 years | 27 |

| 27 to 30 years | 30 |

| 30 to 33 years | 33 |

| 33 to 36 years | 36 |

| 36 to 39 years | 39 |

| 39 to 42 years | 42 |

| 42 to 45 years | 45 |

| 45 to 48 years | 48 |

| 48 to 51 years | 51 |

| 51 to 54 | 54 |

| 54 to 57 | 57 |

| 57 to 60 years | 60 |

| More than 60 years | 70 |

FAQs

What is BDA property tax rebate?

In Bangalore, property owners must pay the entire yearly property tax bill by May 30th to avail of a 5% rebate.

What is the BDA property tax penalty?

If property owners fail to make the BDA property tax payment on time, a penalty of 2% per month or 14% annually is applied to the net payable amount.

Can I pay BDA property tax online?

A property owner can pay his/her BDA property tax online by visiting the official website of the Bangalore Development Authority (BDA).

How do I find my BDA property number?

BDA property number is the application number mentioned on the property tax receipt. You can approach the revenue office to find the BDA property number.

How do I register for BDA property tax?

You can register it by visiting the official BDA website of the Bangalore Development Authority (BDA).

Can BDA collect property tax?

Property tax in Bangalore is collected by the Bruhat Bengaluru Mahanagara Palike (BBMP).

What is the BDA property tax discount?

There is a rebate of 5% on property tax in Bangalore if the entire tax due is paid by May 30.

What happens when you do not pay property taxes?

You will be required to pay a penalty if the tax is not paid on time.

How to find property ID and site ID for BDA property tax?

The property ID and site ID are mentioned on the BDA property tax bill or the previous year's property tax receipt.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.