All homeowners in Gorakhpur, eastern Uttar Pradesh, should pay house tax annually. This guide will provide you everything you should know about the Gorakhpur property tax.

What is house tax?

House tax is an annual tax, which homeowners in India should pay to the local municipal bodies for the maintenance and upkeep of the area. Also known as property tax, the fund generated through this tax is used to maintain and improve the infrastructure in the area under the jurisdiction of the municipality concerned.

How is Nagar Nigam Gorakhpur House Tax evaluated or assessed? What is the rebate offered?

Property tax is calculated considering the following factors.

1) Carpet area of the property

2) Type of property: Residential/non-residential/mixed/miscellaneous/industrial/open land

3) As per ready reckoner rate

4) Type of construction: RCC construction/simple construction/Patra Shed

How to arrive at carpet area?

The carpet area is determined by adding the full internal dimensions of all rooms and covered veranda together with half the dimensions of all balconies, corridors, kitchens, and storage rooms, as well as one-fourth of the internal dimensions of the entire garage.

How to arrive at annual assessment?

To calculate the annual assessment of the building, one multiplies the per square foot rate of tax assessed by the carpet area. Multiplying the monthly rate by 12 will yield the annual assessment.

Rebate on Gorakhpur property tax

Calculating the Gorakhpur house tax involves arriving at the annual assessment of the property. The taxable annual valuation is then computed after applying a discount of either 25 percent, 32.5 percent, or 40 percent, based on the age factor. For buildings up to 10 years, a 25 percent discount is applied; for those between 10 to 20 years, a 32.5 percent discount is applicable. For buildings older than 20 years, a 40 percent discount is granted.

How to view Gorakhpur house tax bill?

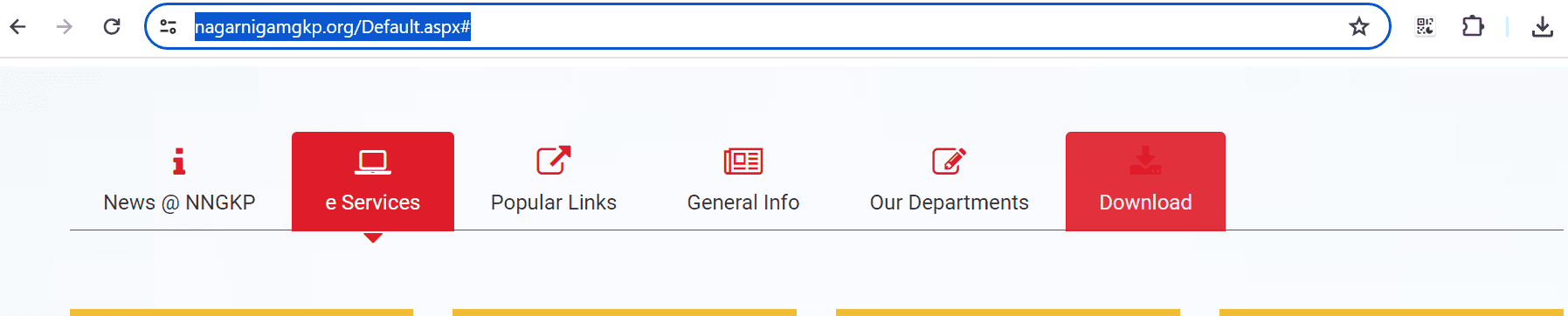

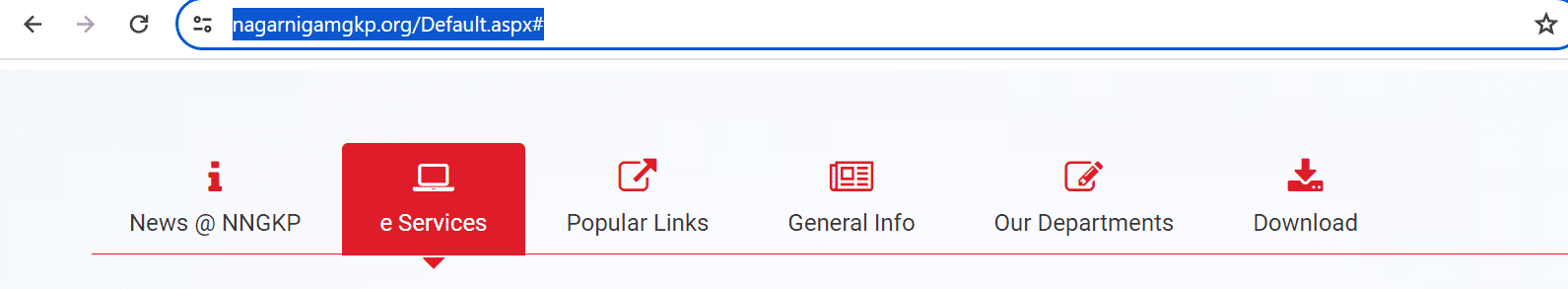

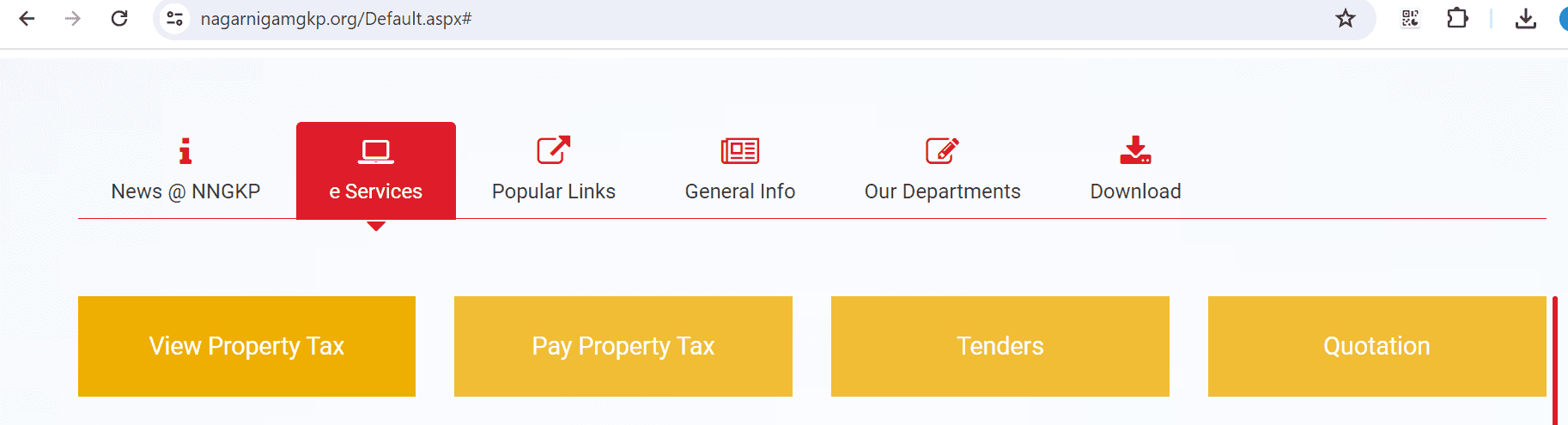

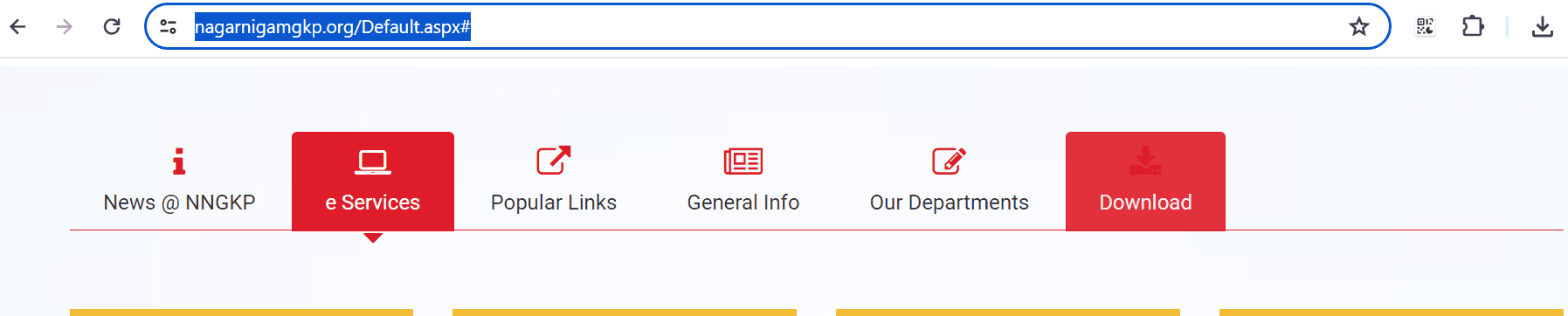

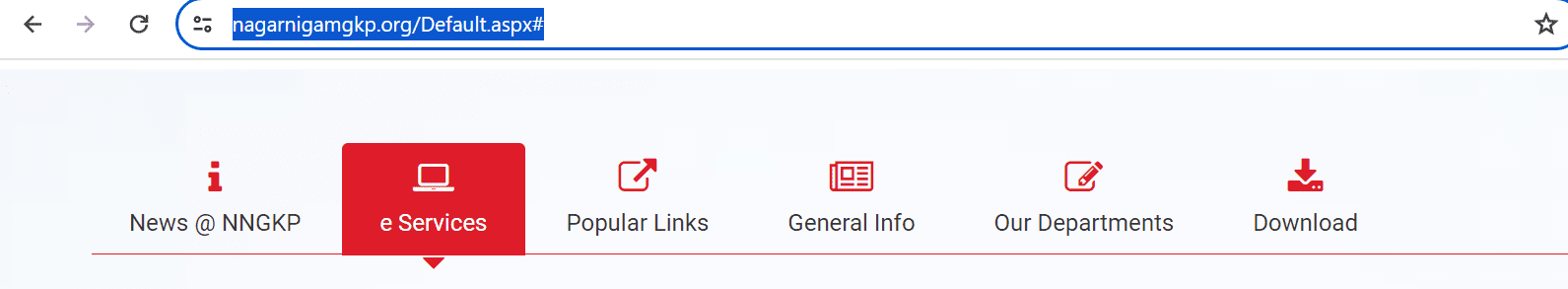

Step 1: Go to the official website https://nagarnigamgkp.org/Default.aspx#.

Step 2: You will see the e-Services option. Click on it.

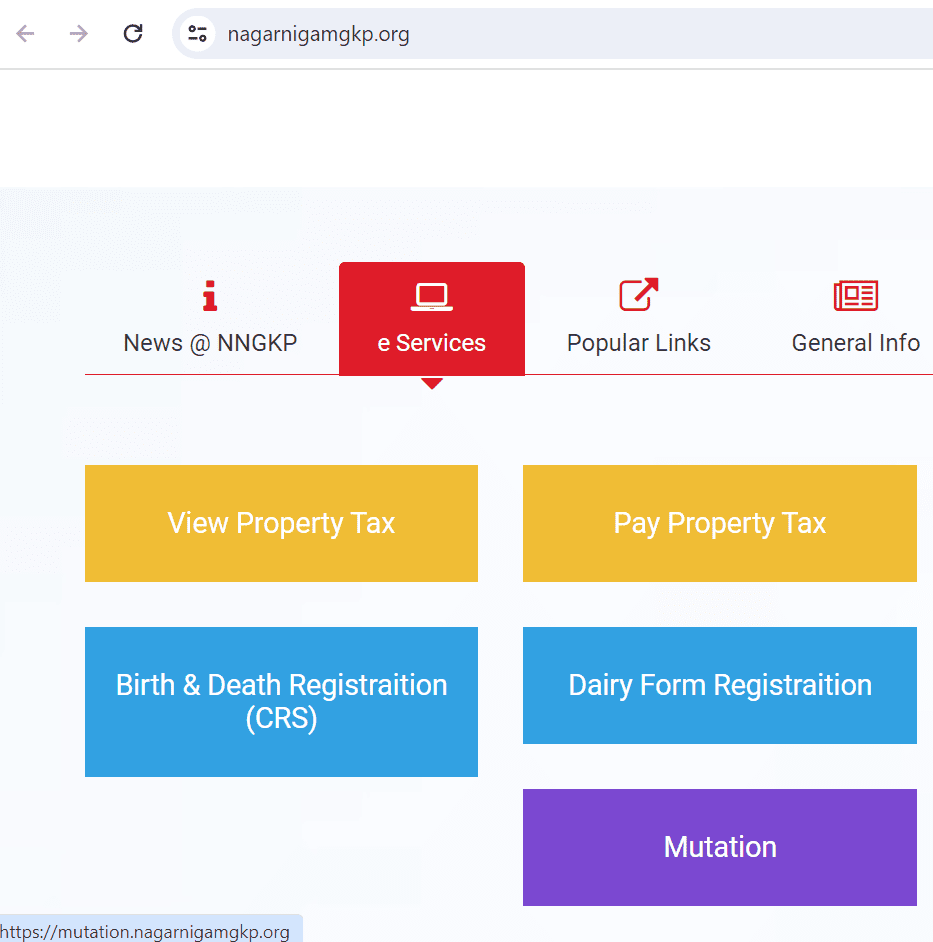

Step 3: You will see ‘View Property Tax’ option. Click on it.

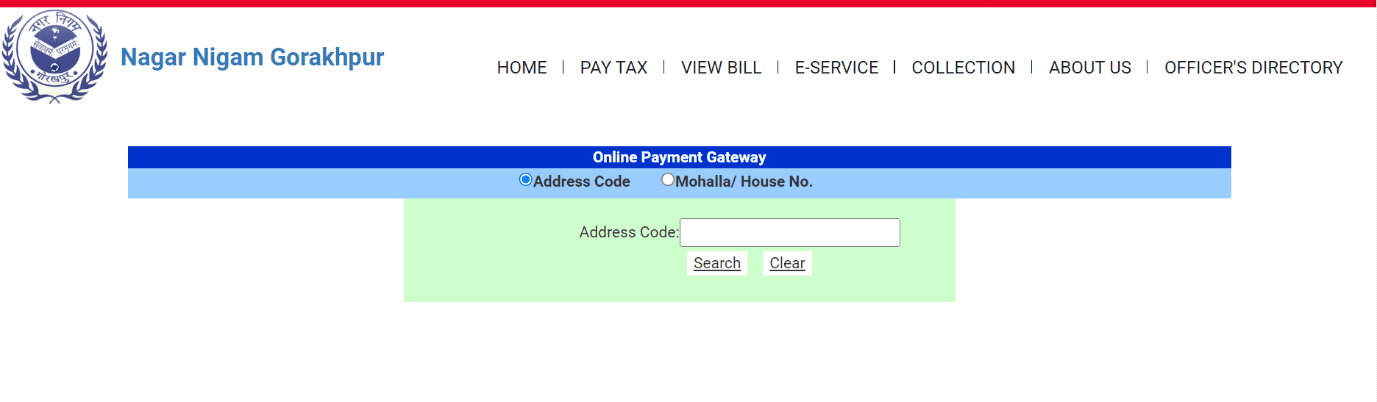

Step 4: You will now be asked to provide address code.

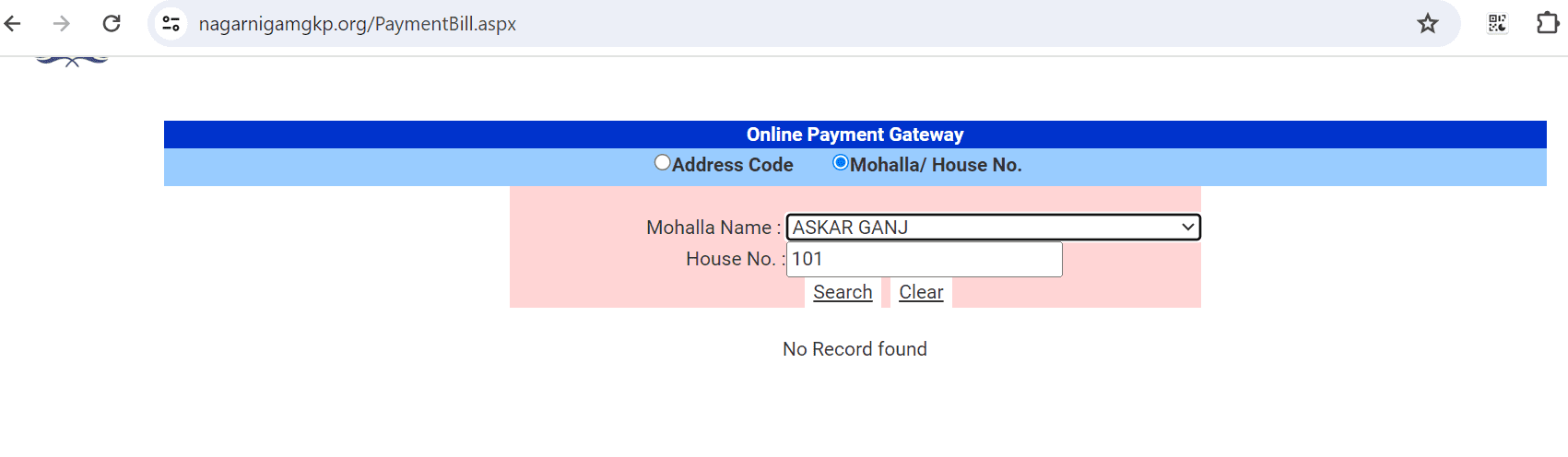

Step 5: You can also proceed with Mohalla/House Number.

Step 6: Once your details are provided, you will be able to see the details of your outstanding Gorakhpur property tax.

How to pay Gorakhpur house tax bill online?

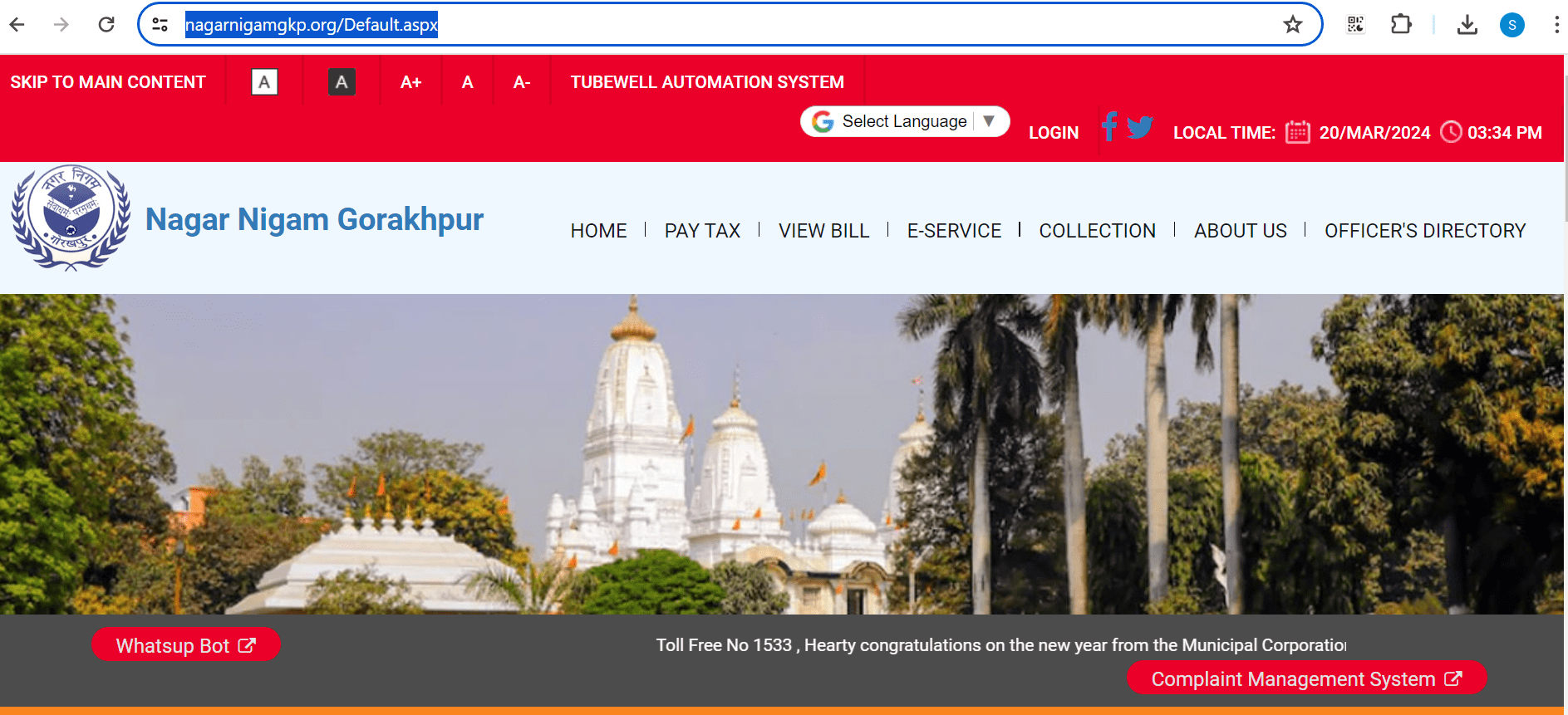

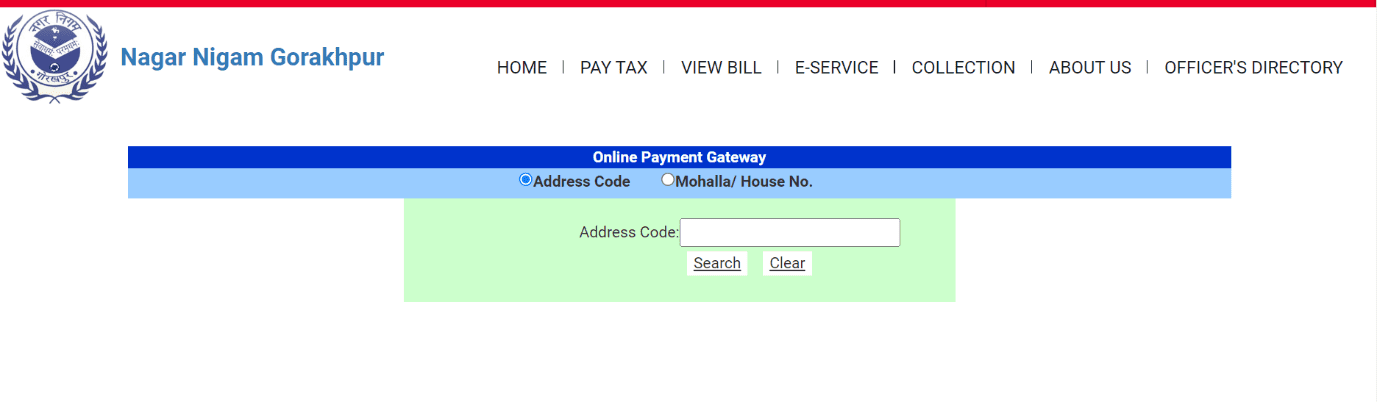

Step 1: Visit the official website: https://nagarnigamgkp.org/Default.aspx.

Step 2: On the home page, click on ‘PAY TAX’.

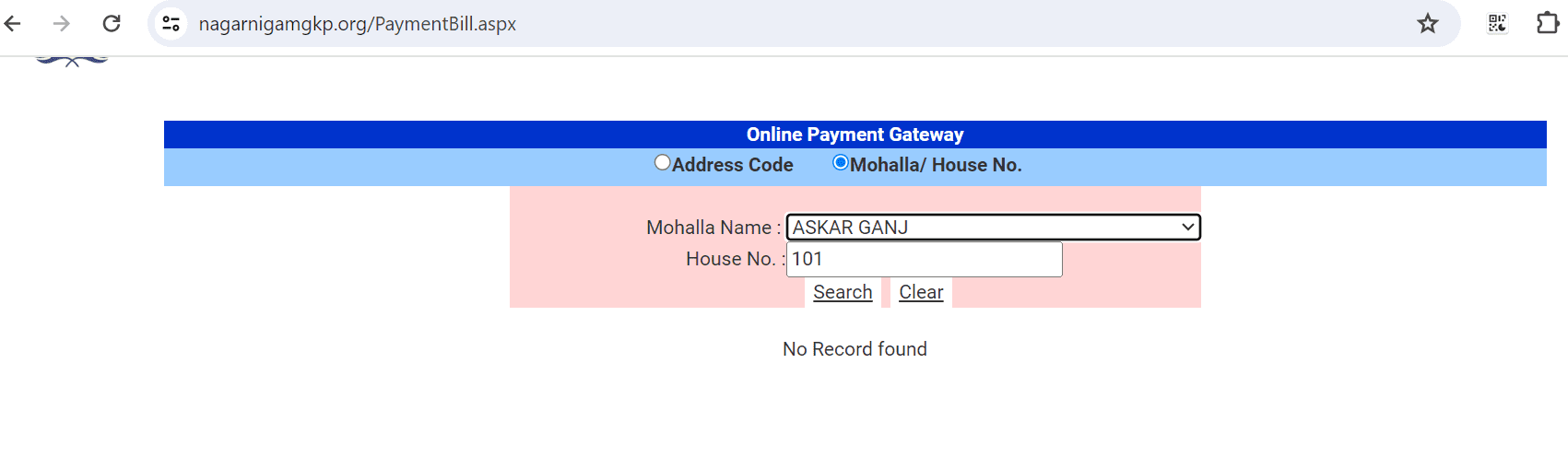

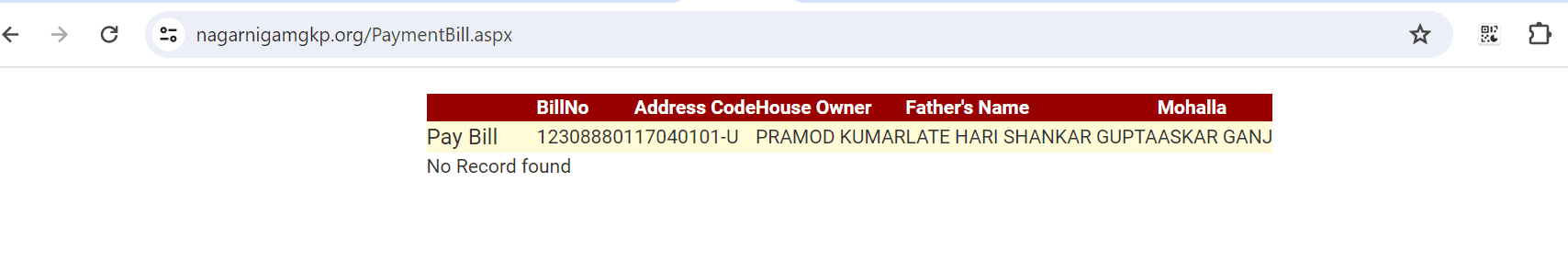

Step 3: You will now be asked to provide address code.

Step 4: You can also proceed with Mohalla/House Number.

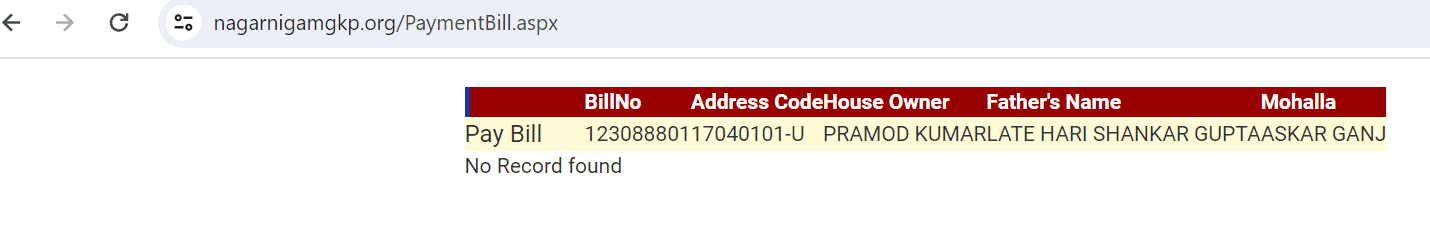

Step 5: The details of your bill, bill number, address code, name of the house owner, their father’s name, and name of mohalla (neighbourhood) will appear on screen.

Step 6: Click on PAY BIL.

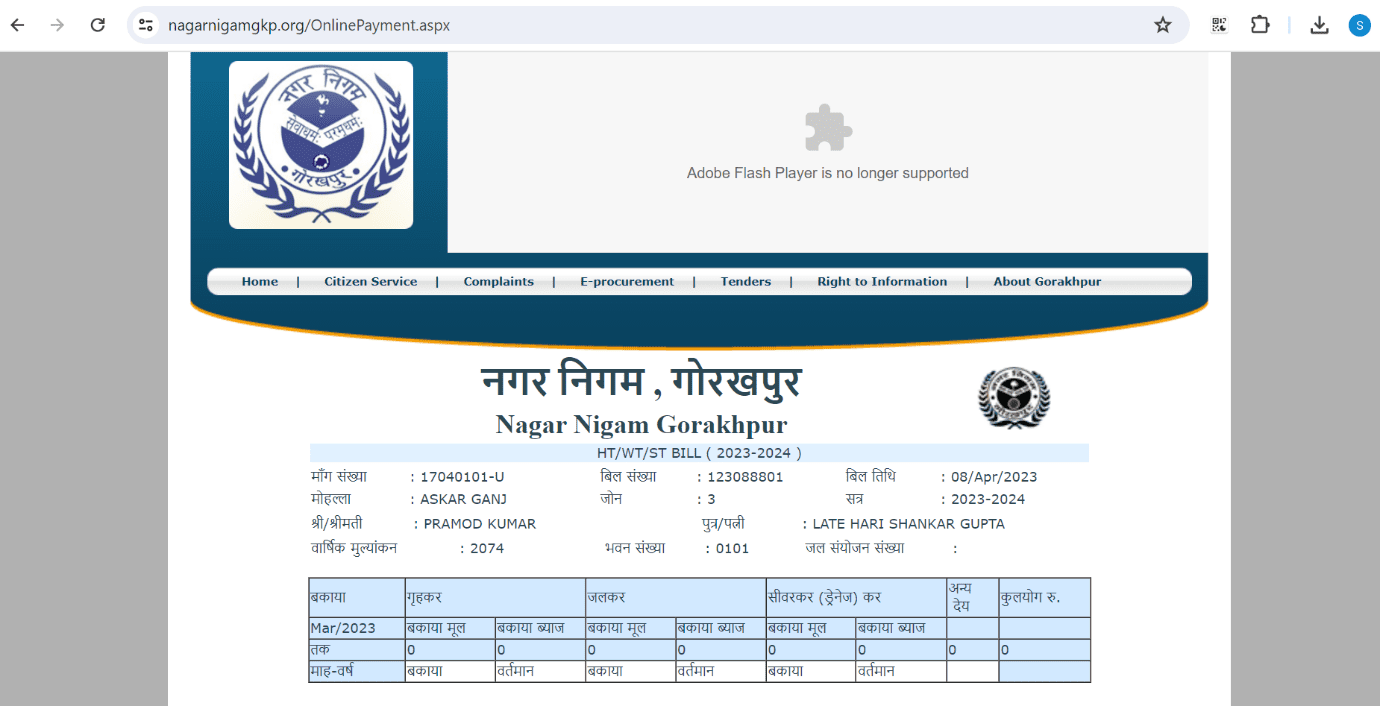

Step 7: A detailed breakup of the bill will appear.

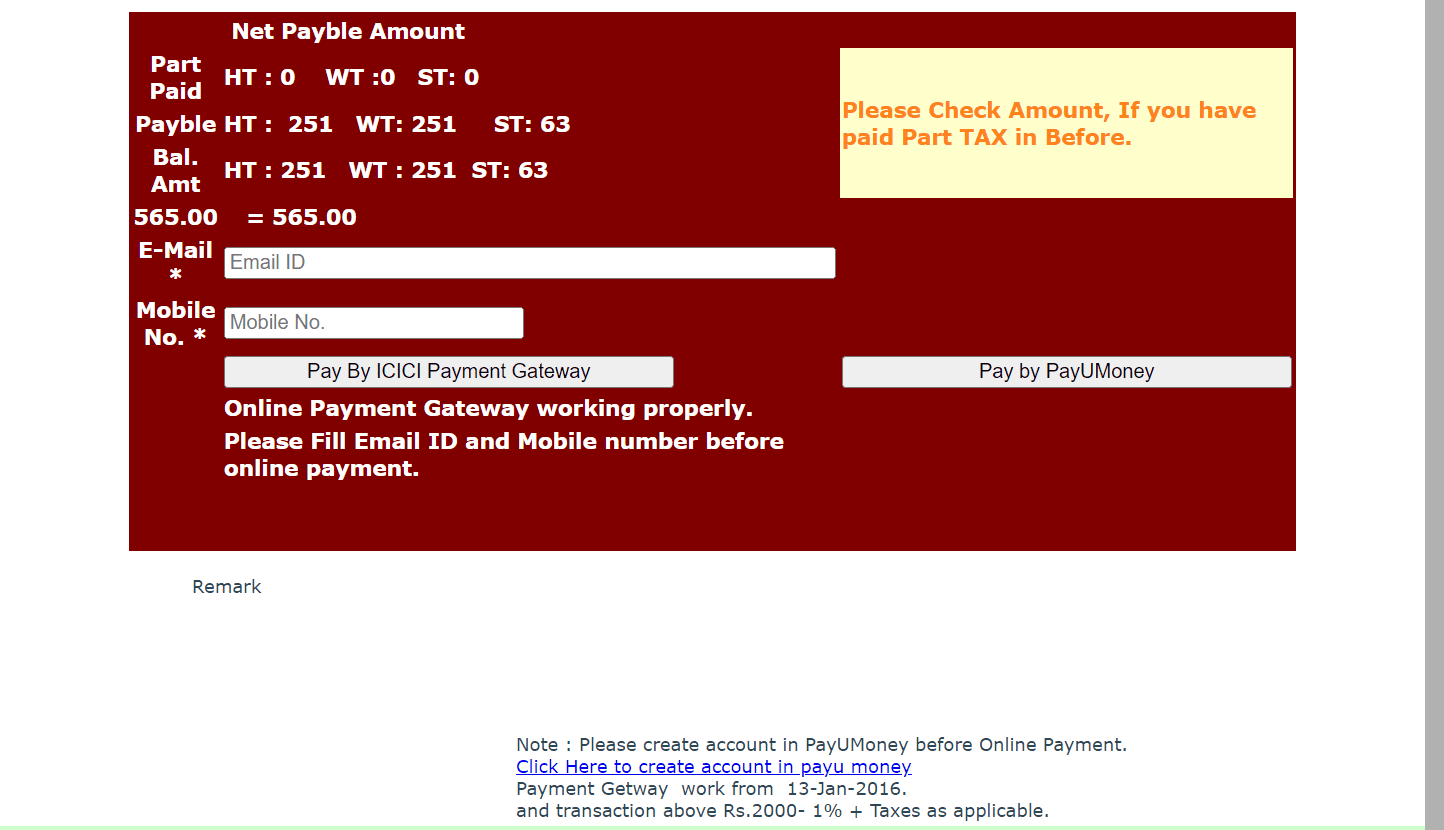

Ways to pay Gorakhpur house tax online

You have two options to pay your Gorakhpur house tax online.

- Using ICICI Bank Payment Gateway

- Using PayUMoney

How to pay Gorakhpur house tax bill offline?

Residents can visit the Gorakhpur Nagar Nigam office during the working hours of any working day to pay their house tax offline. Once the property tax is paid, they will be given a payment receipt. You can make the payment in cash, or cheque.

The Gorakhpur Nagar Nigam also organises camps from time-to-time where citizens can pay their house tax.

Gorakhpur Nagar Nigam: Contact

Address: 1, Towan Hall, Gorakhpur, Uttar Pradesh – 27300, India

Contact no.:+91- 0551- 2333015

Toll free number: 1533

Official website: https://nagarnigamgkp.org

e-mail ID: nngor@nic.in | nagarnigamgkp@gmail.com | Admin@nagarnigamgkp.org

Gorakhpur House Tax late payment penalty

Late payment of the house tax in Gorakhpur might attract an interest at the rate of 5 to 20 percent on the payable sum.

Nagar Nigam Gorakhpur House Tax mutation process

A homebuyer should get name entries changed in revenue records after the purchase of a house. This information is then used to levy local taxes, such as property tax in Gorakhpur. This process is known as property mutation in India. Here is how to get it done.

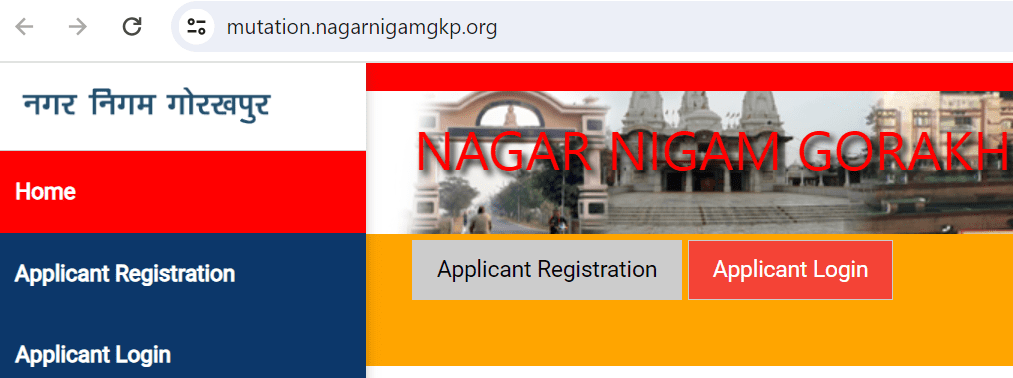

Step 1: Visit the official website of the Municipal Corporation of Gorakhpur at nagarnigamgkp.org.

Step 2: You will see the e-Services option. Click on it.

Step 3: Go to the ‘E-service’ tab on the homepage and select ‘Mutation’.

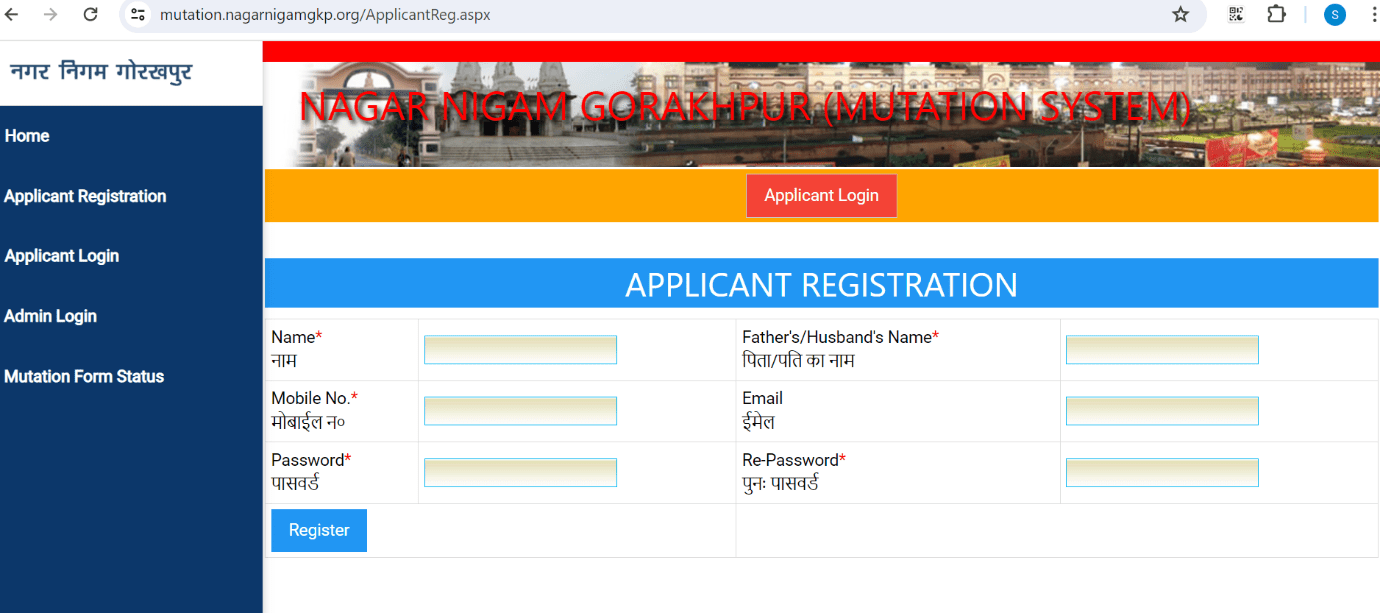

Step 3: Proceed to the ‘Applicant Registration’ section.

Step 4: Provide your name, mobile number, e-mail address, password, and father or husband’s name. Click on ‘Register’ to proceed.

Step 5: After you are registered, access the ‘Applicant Login’ tab, and enter your login ID and password. Upon logging in, fill in the application form and make the necessary payment for mutation fees to finalize the process conveniently.

Housing.com Viewpoint

While the property tax payment has become quite easy with the advent of technology, a homebuyer must take care of the following points to make sure the process is hassle free.

- Keep your property details handy.

- Make sure your net-banking is operative. You can also make the payment using credit or debit cards.

- Don’t save any password on your laptop or phone. That exposes you as a target for online fraud.

FAQs

Where is Gorakhpur?

Gorakhpur is a city in eastern Uttar Pradesh.

What is Gorakhpur Pin Code?

Gorakhpur Pin Code is 273001.

What is property tax?

Property tax is levied on properties based on their annual rental value.

Who should pay property tax?

All property owners within the limits of Gorakhpur Nagar Nigam should pay property tax. Property tax is applicable on all properties and open lands within the municipal corporation limits.

What is the Gorakhpur House Tax rate?

The Gorakhpur House Tax rate is 12 percent of taxable annual assessment.

What is the last date to pay Gorakhpur property tax?

December 31 of every year is the last date to pay the Gorakhpur House Tax.

Who is exempted from paying Gorakhpur House Tax?

In October 2022, the Gorakhpur Nagar Nigam board decided to exempt army personnel who are in service or have retired and are residing in municipal corporation area, from paying house and water tax. Apart from them, the municipal corporation employees have also been exempted from paying house and water taxes.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com